5 Ways to Calculate Profit/Loss in Excel

Calculating profit and loss is a fundamental task for businesses, investors, and financial analysts to understand financial performance. Microsoft Excel, with its robust computational capabilities, offers numerous methods to perform these calculations efficiently. Whether you are a small business owner, a financial analyst, or just managing personal finances, mastering these techniques can enhance your ability to analyze and forecast financial health. Here are five comprehensive ways to calculate profit and loss in Excel, each tailored for different needs and levels of detail:

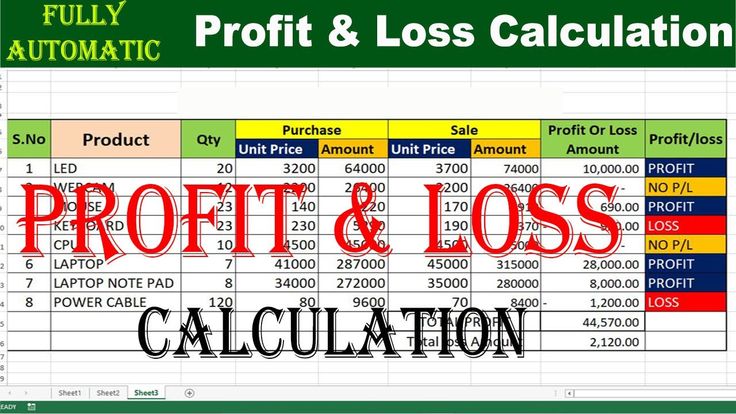

1. Basic Profit/Loss Calculation

At its simplest, profit or loss is determined by subtracting total expenses from total revenue. Here’s how you can do this:

- Enter revenue in cell A1.

- Enter expenses in cell A2.

- Use the formula =A1-A2 in cell A3 to find the profit or loss.

This method is ideal for quick checks or for individuals with straightforward financial tracking.

📘 Note: Ensure all revenue is accounted for when entering figures to avoid skewed results.

2. Monthly Profit/Loss Statement

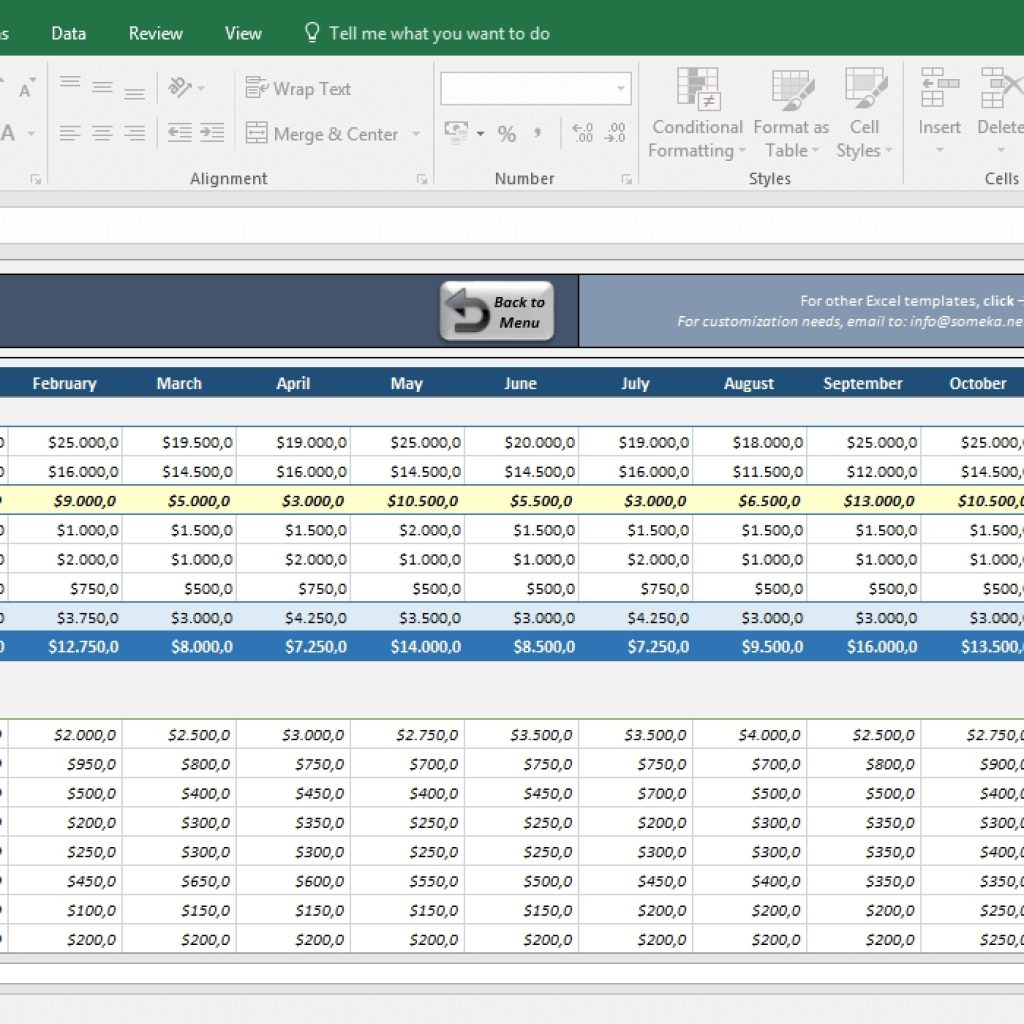

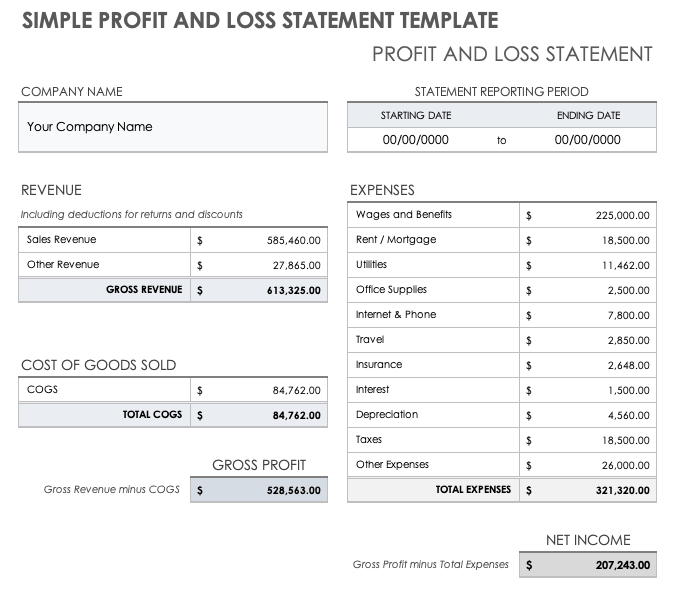

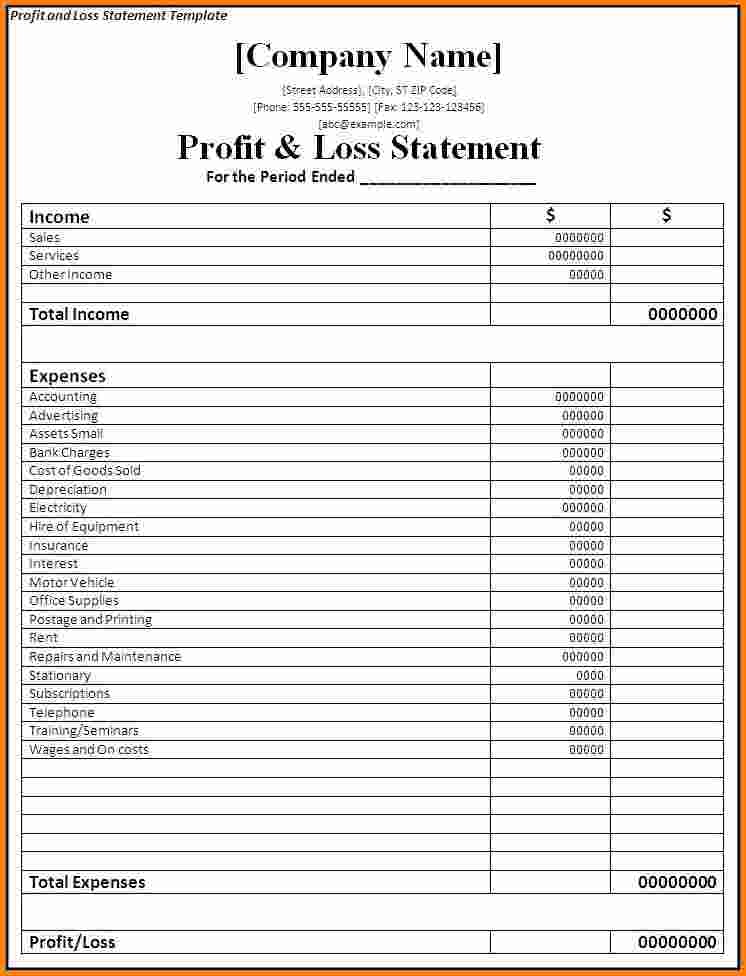

For a more detailed view, setting up a monthly profit and loss statement can be very insightful:

- Create Headers: Use columns for months and rows for Income, Cost of Goods Sold, Operating Expenses, etc.

- Input: Enter monthly figures under each category.

- Formulas: For each month, subtract expenses from revenue in the final row to calculate the profit/loss.

- Summarize: Add a total row to get the yearly overview.

| Category | Jan | Feb | Mar |

|---|---|---|---|

| Income | $10,000 | $12,000 | $15,000 |

| Cost of Goods Sold | $4,000 | $5,000 | $6,000 |

| Expenses | $3,000 | $3,500 | $4,000 |

| Profit/Loss | $3,000 | $3,500 | $5,000 |

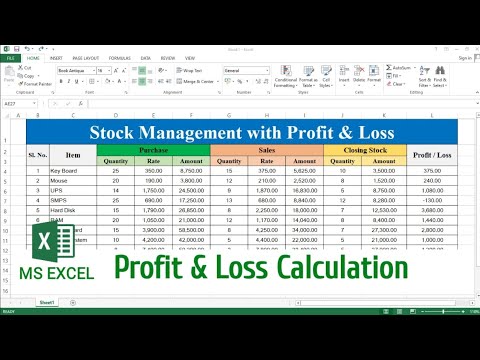

3. Using Pivot Tables for Analysis

Pivot tables are powerful for dynamic data analysis:

- Set up your data with columns for dates, sales, costs, etc.

- Insert a Pivot Table to analyze profit/loss:

- Row Labels: Months or Quarters

- Values: Sum of Revenue, Sum of Costs, and Calculated Field for Profit/Loss

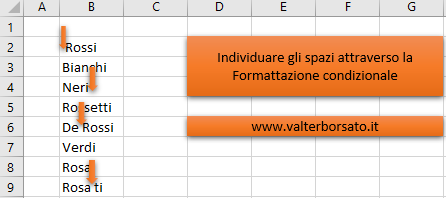

- Use conditional formatting to highlight profit in green and loss in red.

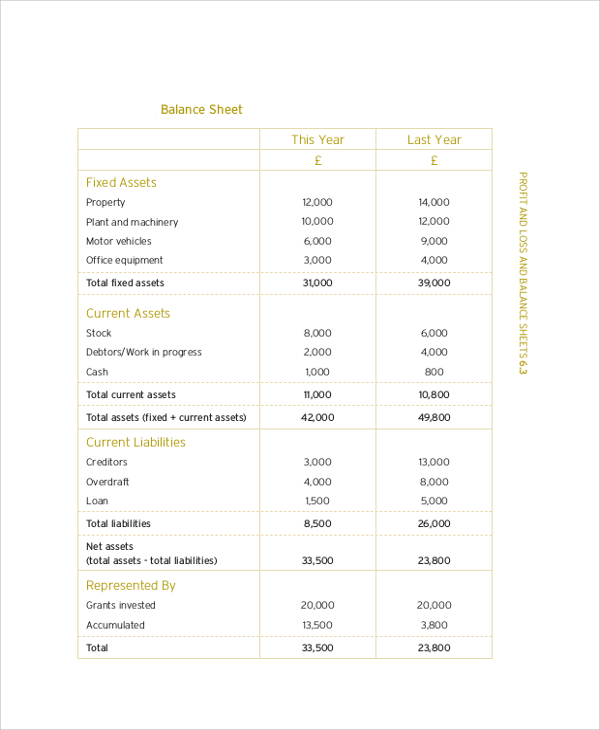

4. Projected Profit/Loss Analysis

For future planning, creating projections can be critical:

- Enter Current Data: Use historical financial data.

- Forecast: Use trend lines or Excel’s forecasting features to estimate future revenue and expenses.

- Project Formulas: Set up formulas to calculate projected profit/loss based on your assumptions.

- Adjust and Test: Change variables to see how different scenarios affect your projections.

5. Advanced Techniques with Functions

For those needing in-depth analysis:

- Financial Functions: Utilize functions like XNPV(), XIRR() for more complex calculations.

- Scenario Manager: Analyze different financial outcomes.

- Data Table: Perform what-if analysis to understand how changes in variables impact profit/loss.

To wrap up, mastering the calculation of profit and loss in Excel empowers users with essential financial tools for better decision-making, planning, and performance review. Each method provides a different level of insight and complexity, allowing you to choose or combine techniques that best suit your financial analysis needs. Whether it's for a quick overview or a detailed strategic analysis, Excel's versatility ensures you're equipped to track and project your financial health effectively.

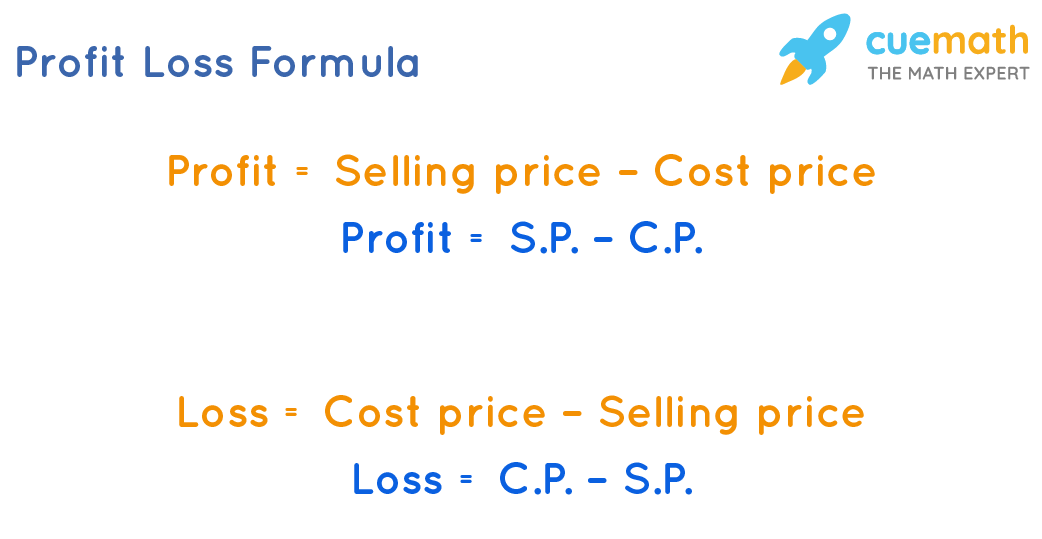

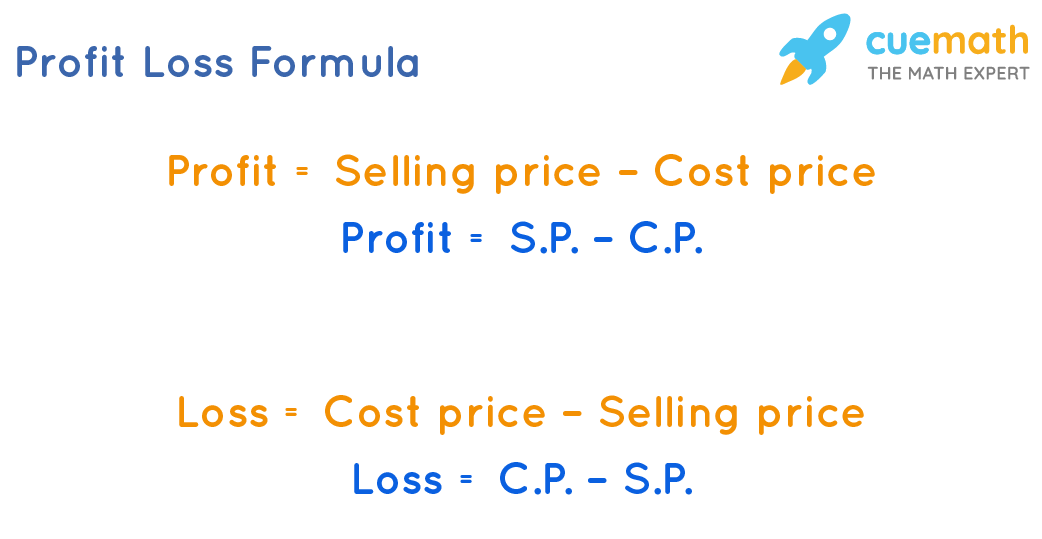

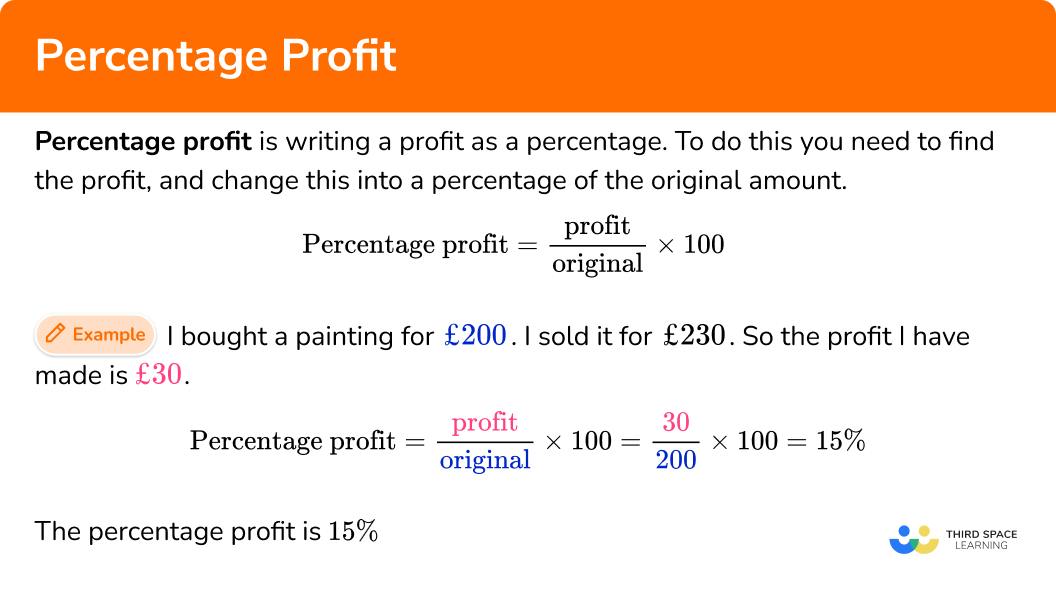

What is the basic formula for calculating profit/loss?

+

The basic formula is: Profit/Loss = Revenue - Expenses. This calculation gives you a snapshot of the financial gain or loss for a specific period.

Can I use Excel for complex financial modeling?

+

Yes, Excel offers advanced features like PivotTables, financial functions (XNPV, XIRR), and what-if analysis tools, which are ideal for complex financial modeling.

How can I visualize profit/loss data in Excel?

+

Excel provides various chart types like line charts, bar charts, and pie charts. For profit/loss, a line chart or a bar chart can effectively illustrate trends over time.

What should I do if my calculations are showing a loss?

+

Analyze each component of your financials, from revenue streams to expenses. Adjusting pricing strategies, reducing costs, or expanding market reach might help turn a loss into a profit.