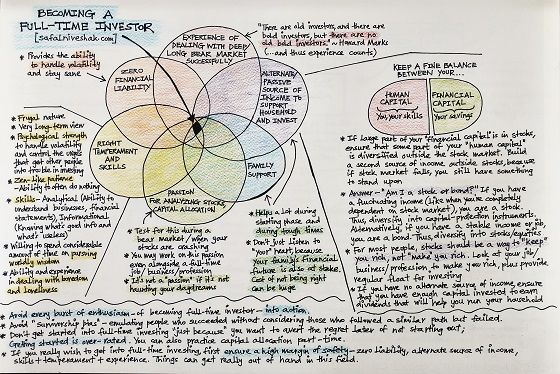

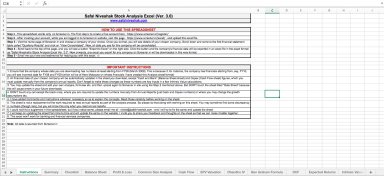

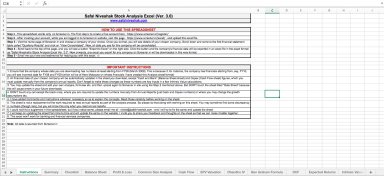

Excel Template for Safal Niveshak: Boost Your Investment Strategy

The world of investing can often feel like navigating a maze in the dark. With countless options, strategies, and financial instruments at your disposal, it's easy to become overwhelmed. However, one of the most effective tools for simplifying and enhancing your investment strategy is a well-crafted Excel template. Here, we delve into how Safal Niveshak can benefit from creating and using Excel templates tailored for investment analysis and tracking.

Why Excel for Investment?

- Versatility: Excel can handle complex financial calculations, organize data, and provide visual representations with charts.

- Accessibility: Excel is widely used and available on multiple devices, ensuring that your investment tools are accessible anywhere, anytime.

- Customization: Tailor the templates to your specific investment needs and strategies, making it a personalized solution.

Creating Your Investment Excel Template

Setting up an Excel template for your investment activities involves several key steps:

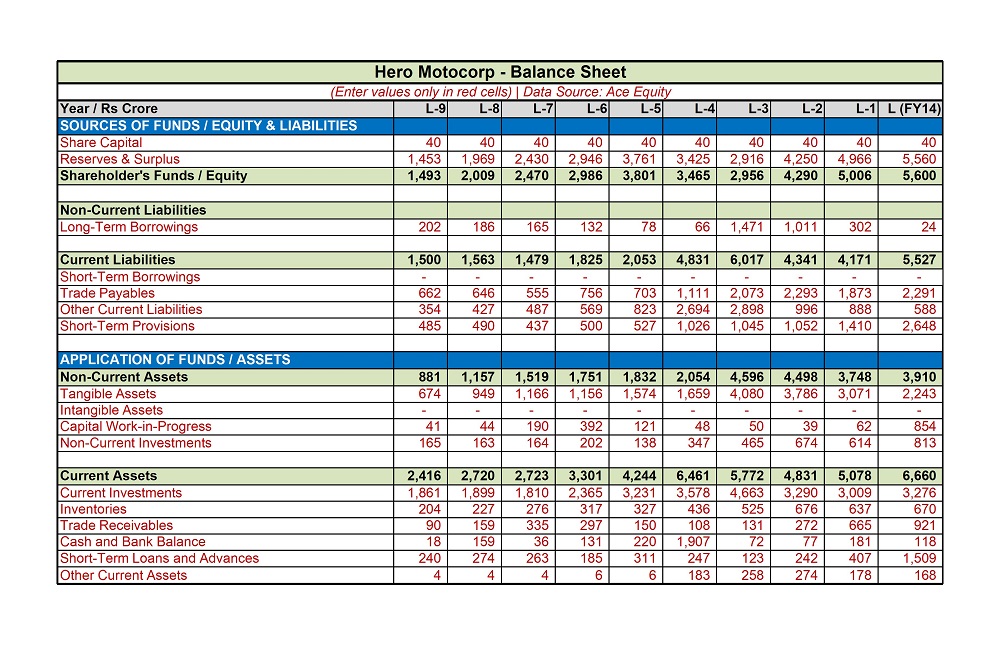

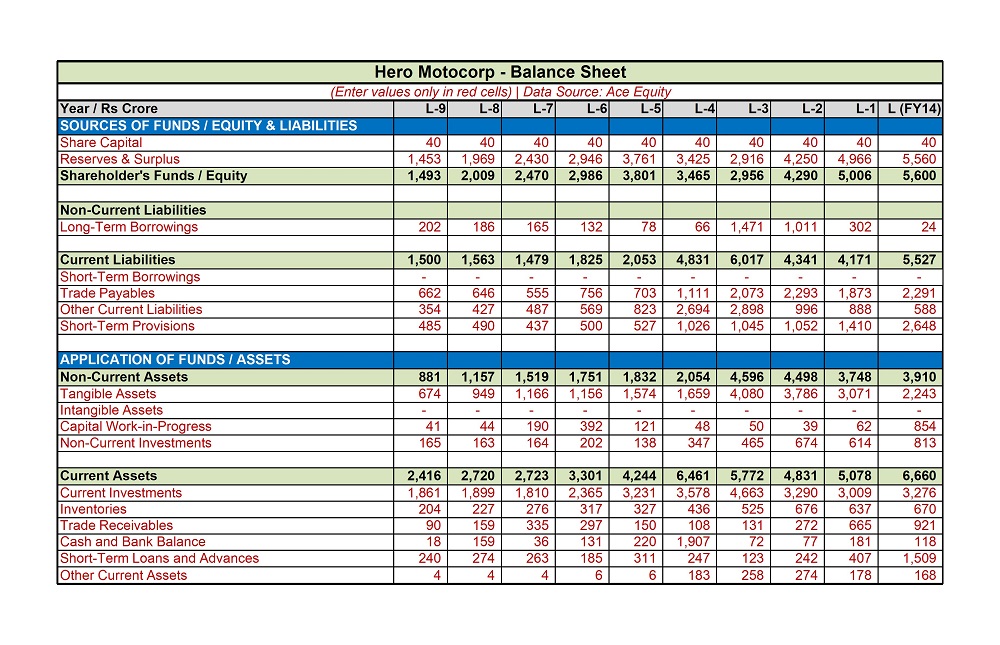

1. Data Collection

- Stock Prices: Import or input current stock prices.

- Historical Data: For analyzing trends and performance.

- Company Fundamentals: Financial ratios, earnings reports, etc.

- Personal Investments: List of your current investments and portfolio value.

2. Basic Investment Metrics

| Metric | Description |

|---|---|

| Current Price | Latest price of the stock |

| Price/Earnings Ratio (P/E) | Valuation metric indicating if a stock is overvalued or undervalued. |

| Dividend Yield | Rate of return from dividend payments. |

| Return on Equity (ROE) | Measures how effectively a company uses its equity to generate profits. |

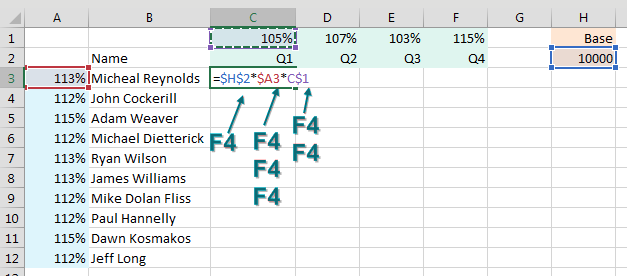

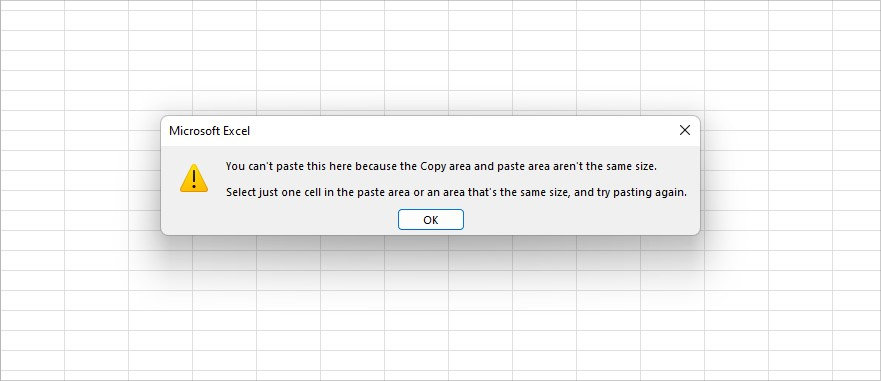

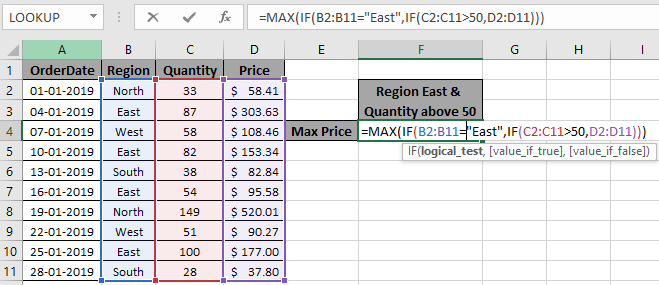

3. Formulas and Calculations

- Create formulas to calculate changes in stock prices, dividends received, total return, etc.

- Use conditional formatting to highlight trends or alerts, like when a stock hits a 52-week high or low.

📊 Note: Ensure your formulas are error-free by double-checking your cell references and inputs.

Advanced Features for Your Investment Template

Scenario Analysis

- Set up different investment scenarios to see potential future outcomes based on varying market conditions or company performance.

Portfolio Diversification

- Visualize how your investments are spread across different sectors, asset classes, or geographic regions using pie charts or bar graphs.

Goal Setting and Tracking

- Incorporate goals into your template to track your progress towards saving for retirement, buying a house, or other financial objectives.

Remember, the more tailored your Excel template is to your personal investment strategy, the more effective it will be in guiding your decisions.

As we wrap up our exploration of how Safal Niveshak can utilize Excel templates for investment strategy, it's clear that the power of Excel lies not just in its computational capabilities but in its ability to provide structure and visibility to your financial journey. By customizing and maintaining an Excel template, you can gain insights into your investment performance, make informed decisions, and stay on track with your long-term financial goals.

What is the benefit of using Excel for investment?

+

Excel allows for real-time data analysis, custom calculations, and visual representation of financial data, making it an indispensable tool for investors seeking detailed and personalized investment insights.

How can I ensure the accuracy of my investment calculations in Excel?

+

To ensure accuracy, regularly review and update your data inputs, double-check your formulas, and consider using tools like Goal Seek or Solver for complex calculations to validate your results.

Can I use Excel for predicting stock market trends?

+

Excel can be used for trend analysis using historical data and various forecasting models, but always remember that stock market predictions carry inherent uncertainties due to market volatility and external factors.