Free Excel Bankruptcy Inventory Template: Simplify Your Finances

When businesses find themselves in the throes of financial distress, the clarity and organization provided by a bankruptcy inventory can be a beacon of hope. Navigating through the storm of bankruptcy requires not just resilience but also an organized approach to manage all assets, debts, and financial records. Here, a tool like an Excel Bankruptcy Inventory Template can be invaluable, helping you keep track of every aspect of your finances during these turbulent times.

What is Bankruptcy and Why is Inventory Important?

Bankruptcy is a legal status of an individual or a company that can’t repay debts to creditors. This process allows the insolvent entity to either restructure its debt or liquidate assets to settle with creditors. In both scenarios, maintaining an accurate inventory of all assets, liabilities, and transactions becomes crucial. Here’s why:

- Asset Liquidation: Knowing what you have can help determine what can be sold to pay off debts.

- Debt Restructuring: Understanding your debts aids in negotiating terms with creditors.

- Legal Compliance: Accurate financial records are required for court proceedings.

- Future Planning: A detailed inventory helps in planning for future financial stability or re-entering the market.

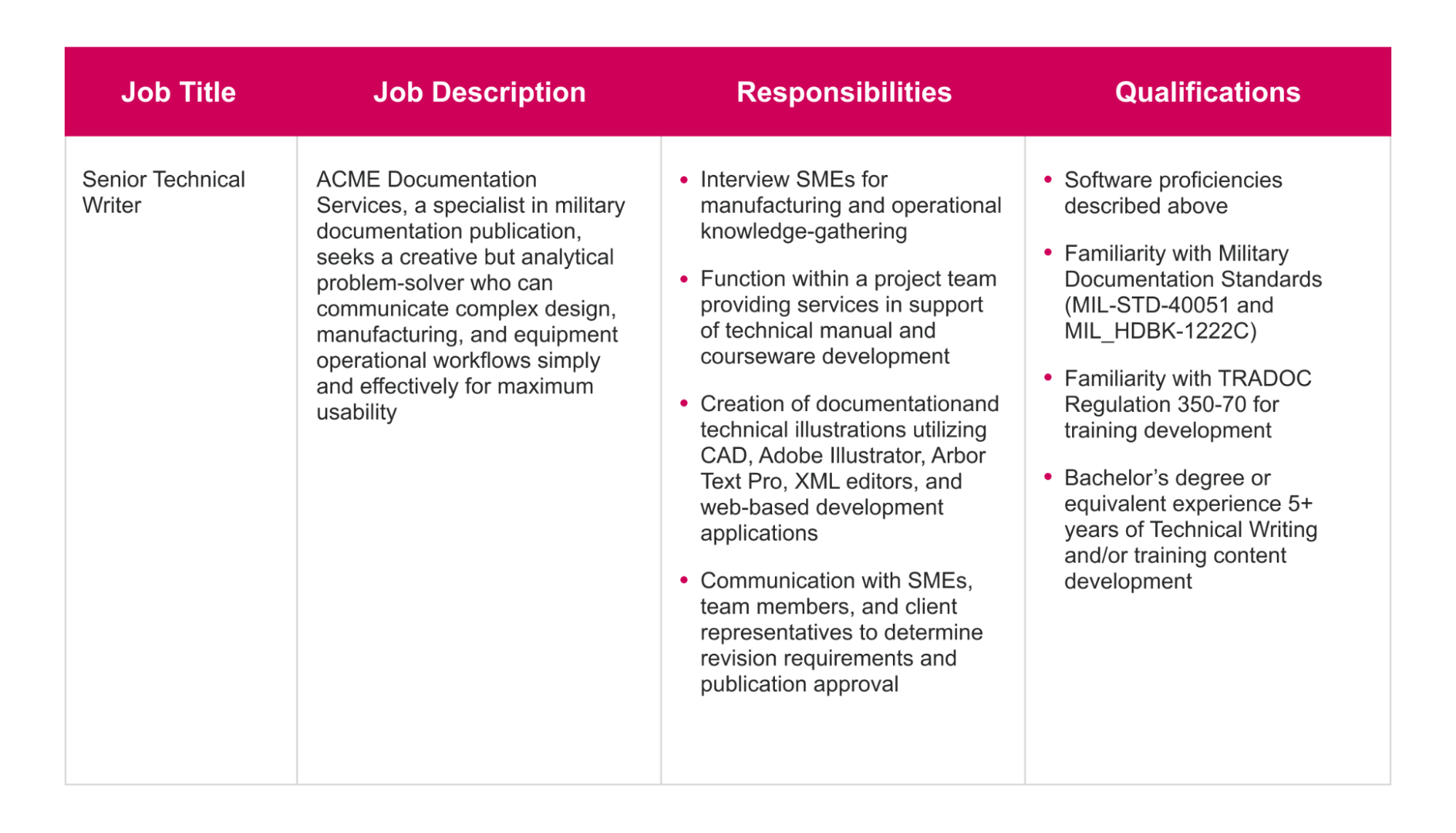

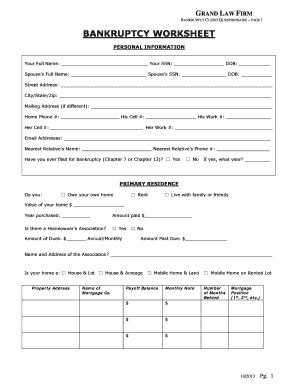

Creating Your Excel Bankruptcy Inventory Template

Let’s delve into creating an Excel template that will streamline your bankruptcy inventory process:

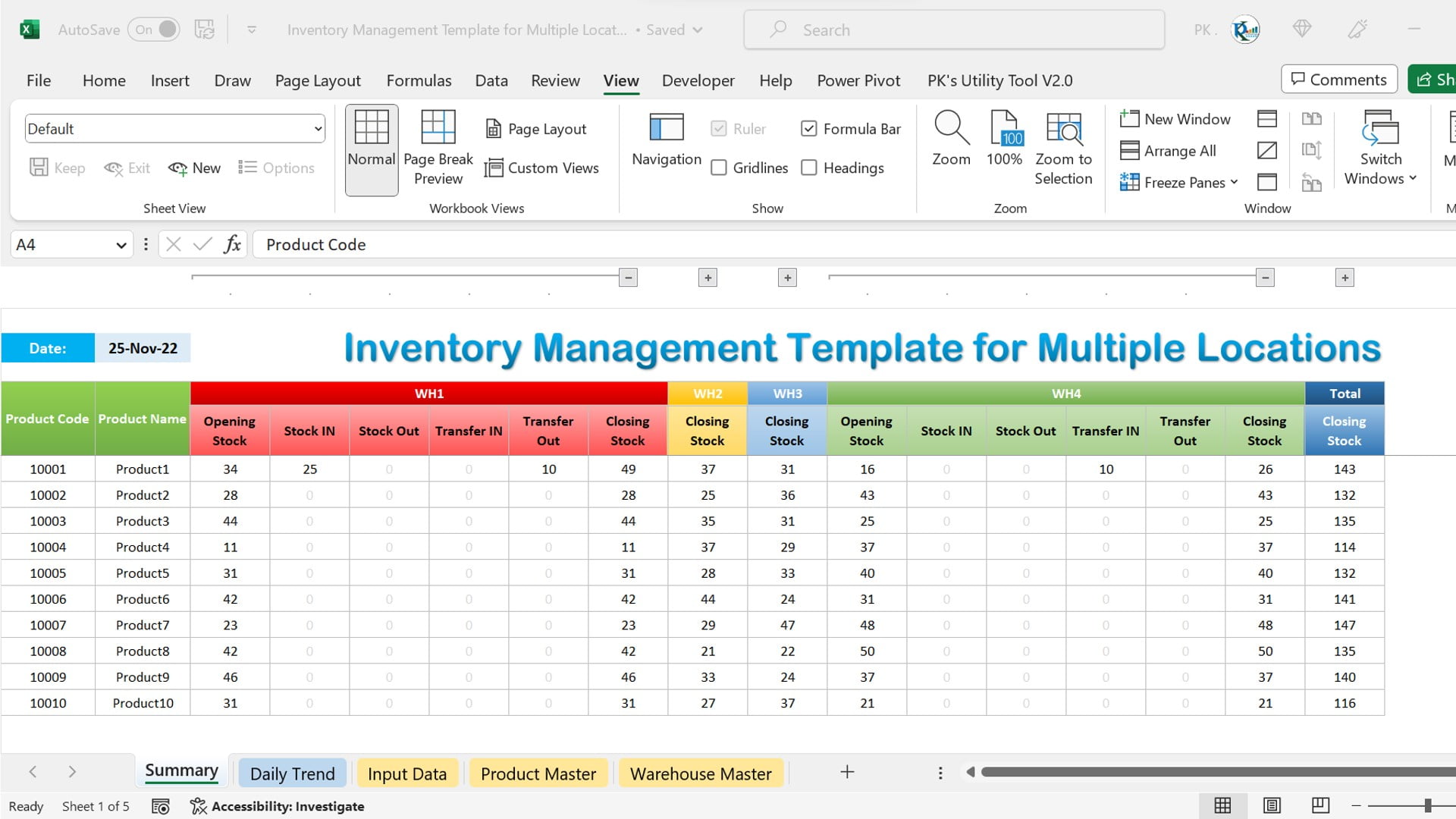

1. Set Up the Workbook

Start by opening a new Excel workbook. Name the file something intuitive like “Bankruptcy Inventory” and consider setting up separate sheets for different categories:

- Assets

- Debts

- Income and Expenses

- Legal Documents

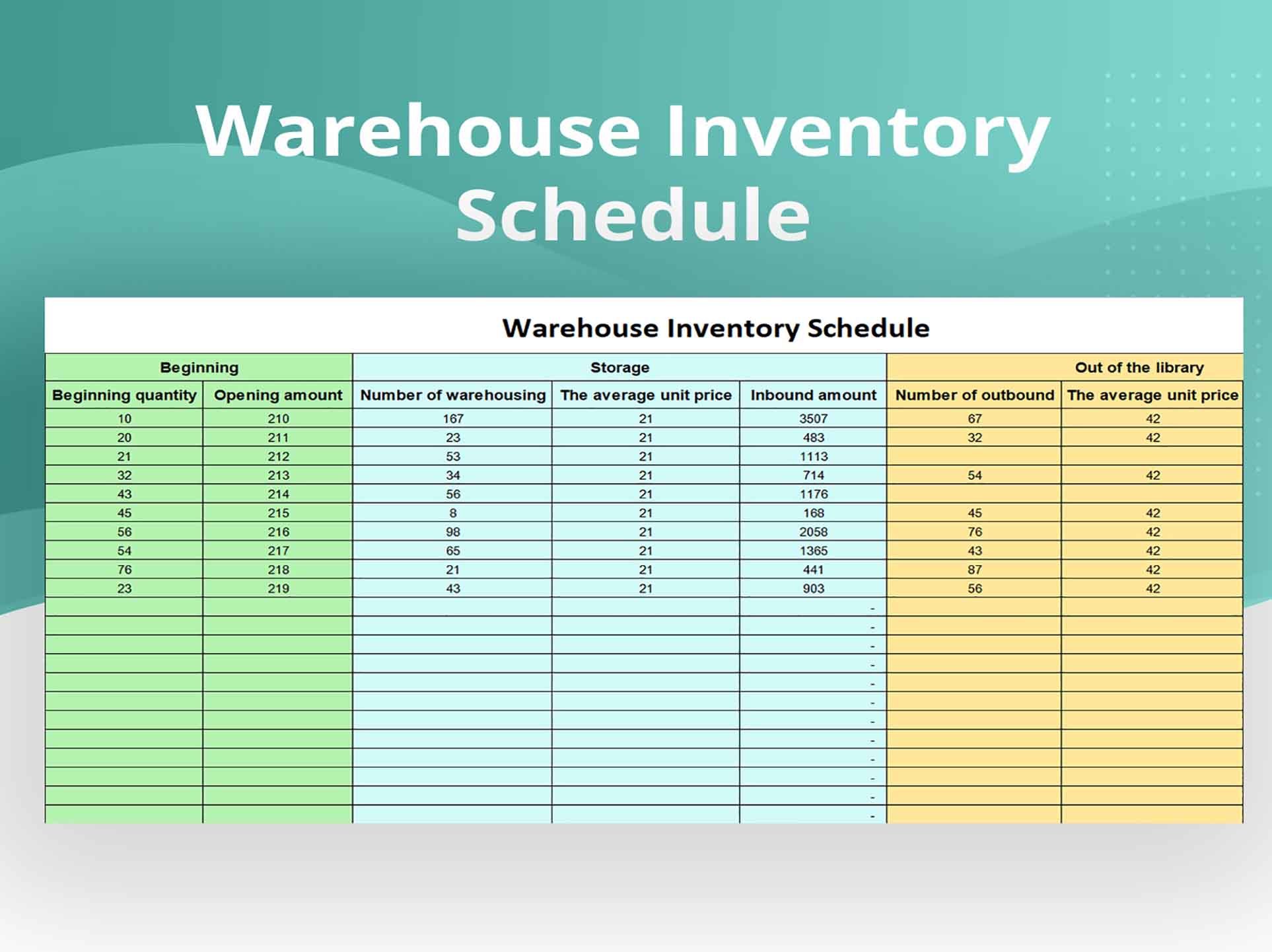

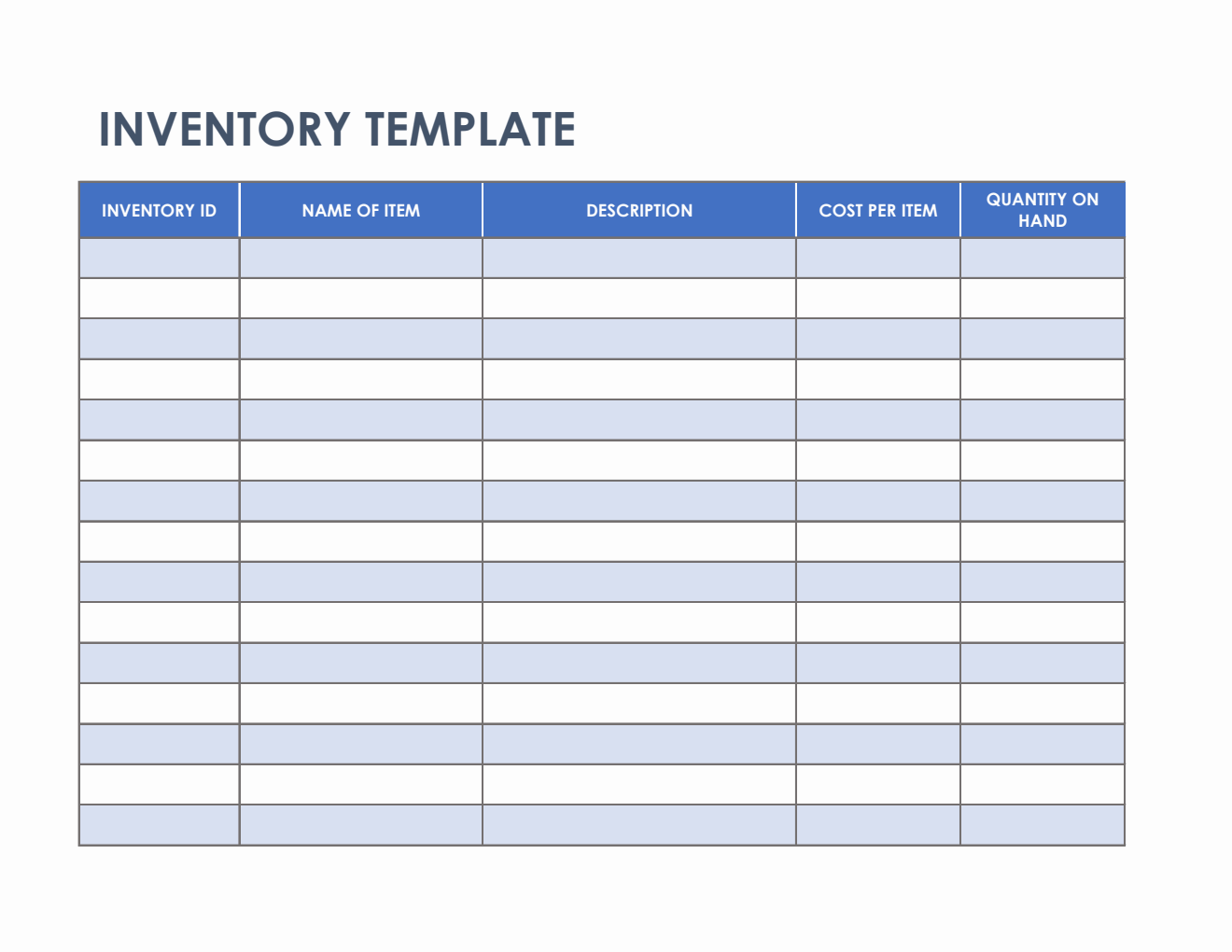

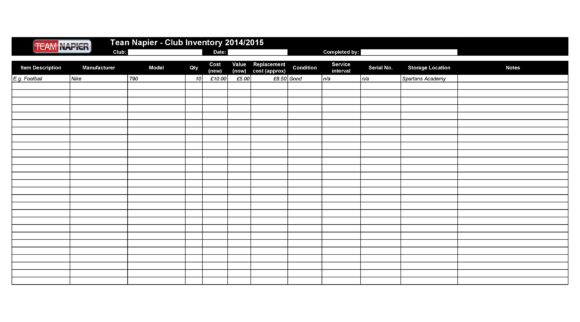

2. Assets Sheet

Here you’ll detail every tangible and intangible asset. Here is how to structure it:

| Asset Category | Description | Value | Estimated Sale Price | Notes |

|---|---|---|---|---|

| Property | 123 Main Street, Anytown, USA | 200,000</td> <td>150,000 | Joint ownership with spouse | |

| Vehicles | 2019 Toyota Camry | 25,000</td> <td>12,000 | Recently serviced |

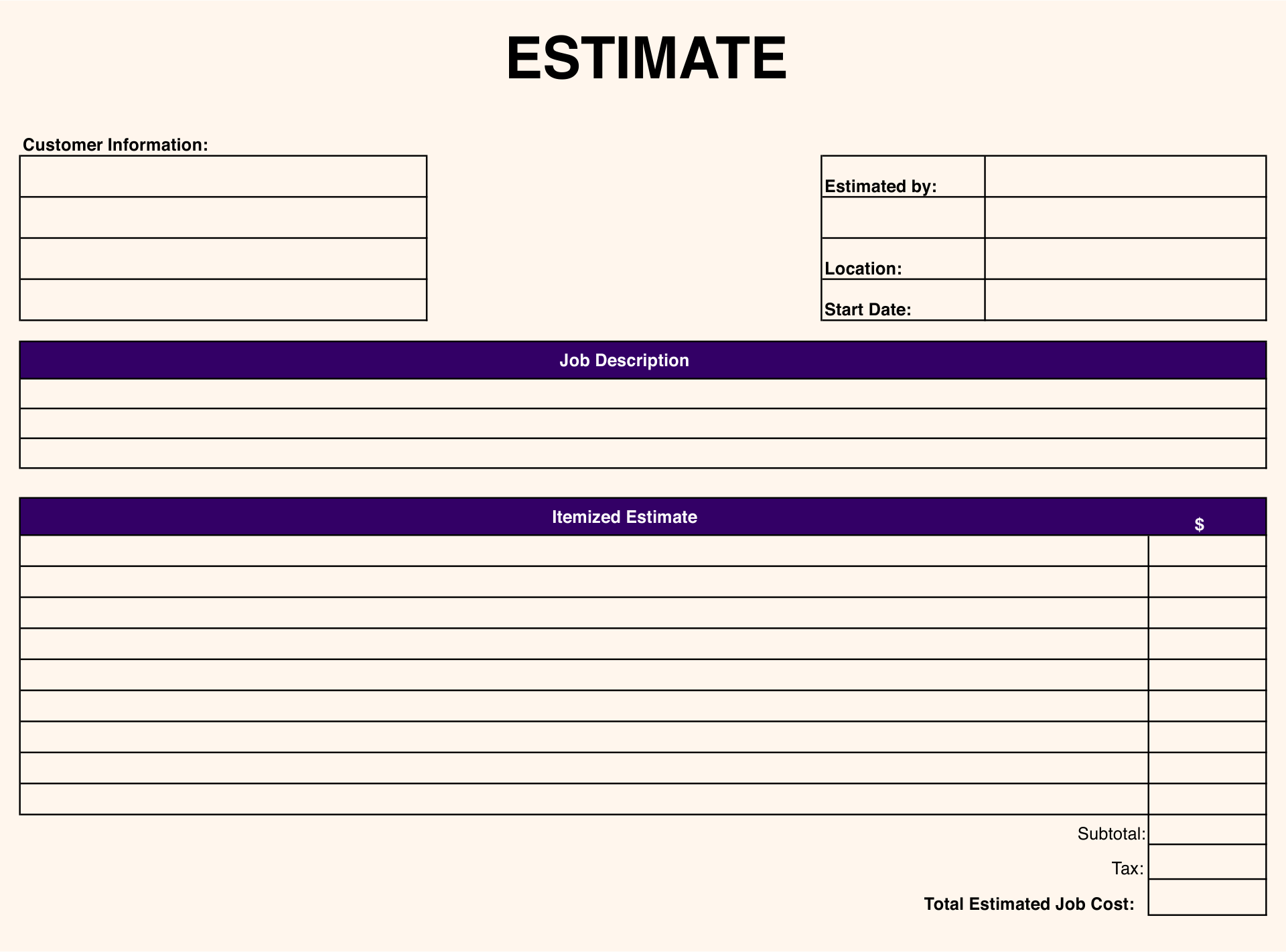

3. Debts Sheet

List all your outstanding debts:

| Creditor | Type of Debt | Principal Owed | Interest Rate | Current Balance | Payment Status |

|---|---|---|---|---|---|

| Bank of America | Mortgage | 180,000</td> <td>3.5%</td> <td>185,000 | Delinquent | ||

| Visa | Credit Card | 5,000</td> <td>20%</td> <td>5,000 | Current |

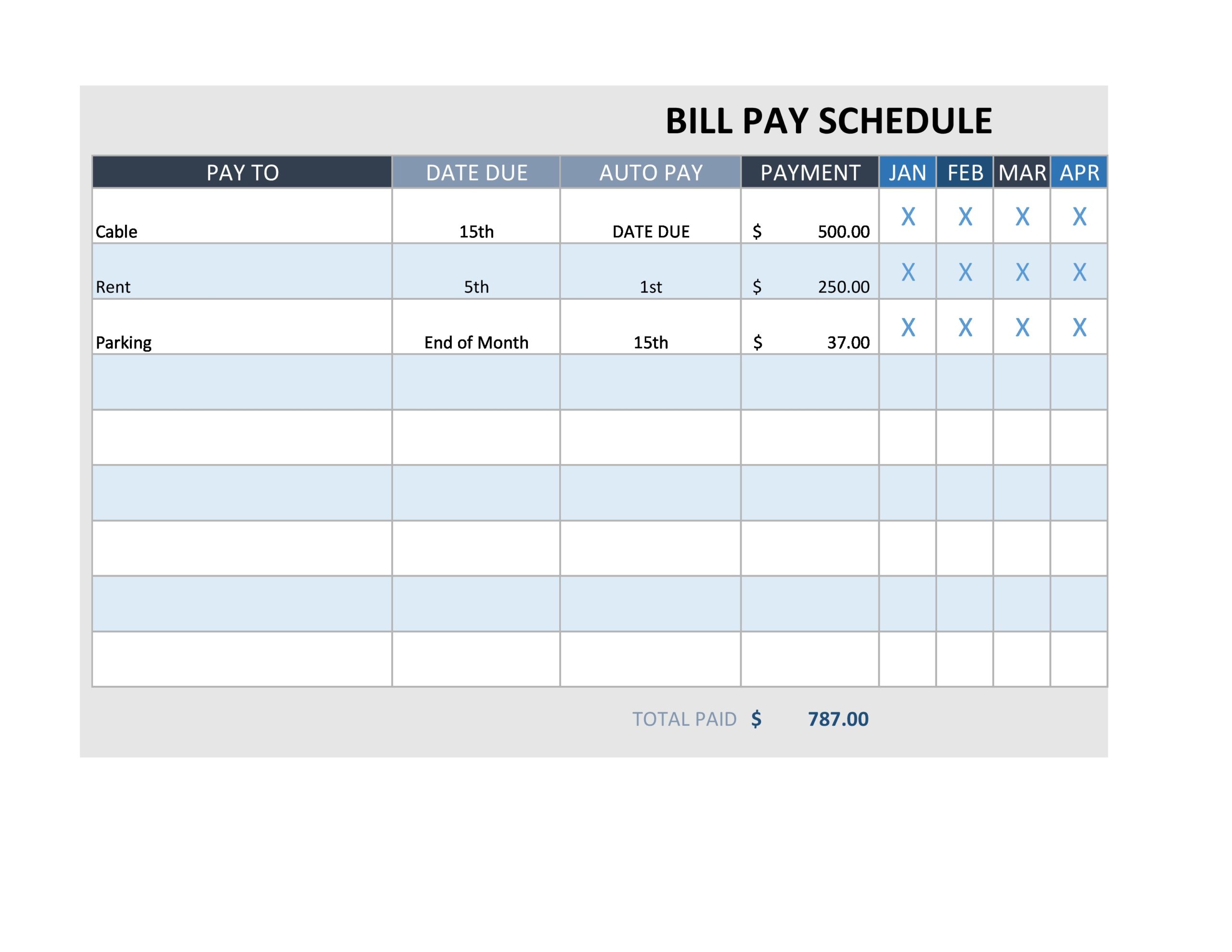

4. Income and Expenses Sheet

Track your income sources and where every penny goes:

| Income Source | Amount | Frequency |

|---|---|---|

| Salary | $4,000 | Monthly |

| Expense Category | Amount | Frequency |

| Utilities | $200 | Monthly |

5. Legal Documents Sheet

Record details about all legal documents related to your bankruptcy case:

| Document Name | Date Issued | Description |

|---|---|---|

| Notice of Bankruptcy | 03/15/2023 | Received notice from court |

📜 Note: Always keep these documents handy and updated as they could be crucial during legal proceedings or negotiations with creditors.

Best Practices for Maintaining Your Inventory

- Regular Updates: Update your inventory regularly to reflect changes in value, new assets, or paid off debts.

- Accuracy: Ensure all entered data is as accurate as possible. Use current market values for assets and exact debt amounts.

- Backup: Regularly save and back up your Excel file to avoid losing critical financial information.

- Shared Access: If you’re working with a team or legal advisors, consider using cloud-based solutions for real-time updates and collaboration.

How to Use Your Inventory in Bankruptcy Proceedings

Your detailed inventory will serve multiple purposes:

- Asset Declaration: Your asset sheet helps accurately declare what you own for the court.

- Debt Negotiation: Understanding your debts thoroughly can aid in negotiating with creditors.

- Legal Documentation: The legal documents sheet ensures you have all necessary papers in one place for easy access.

- Future Financial Planning: Post-bankruptcy, use this data to plan your financial recovery and avoid future pitfalls.

The journey through bankruptcy is never easy, but with a well-organized Excel Bankruptcy Inventory Template, you gain control over a chaotic process. By meticulously listing your assets, debts, income, and expenses, you not only comply with legal requirements but also set a foundation for your financial recovery. Remember, the accuracy and regularity of updating your inventory can significantly impact the outcomes of your bankruptcy proceedings. Keep this tool close at hand, and leverage it to navigate through your financial restructuring with precision and clarity.

Can I include future income in my inventory?

+

While future income projections are not part of a traditional inventory, documenting expected earnings can be useful for budgeting and planning post-bankruptcy.

How often should I update my bankruptcy inventory?

+

Update your inventory as soon as changes occur, such as acquiring new assets, changes in debt status, or significant changes in your financial situation.

Is there a legal obligation to maintain an inventory during bankruptcy?

+

Yes, you are legally required to provide accurate financial records, including an inventory of assets, when filing for bankruptcy. This inventory helps the court and creditors assess your financial situation.