5 Easy Excel Formulas for Payback Period Calculation

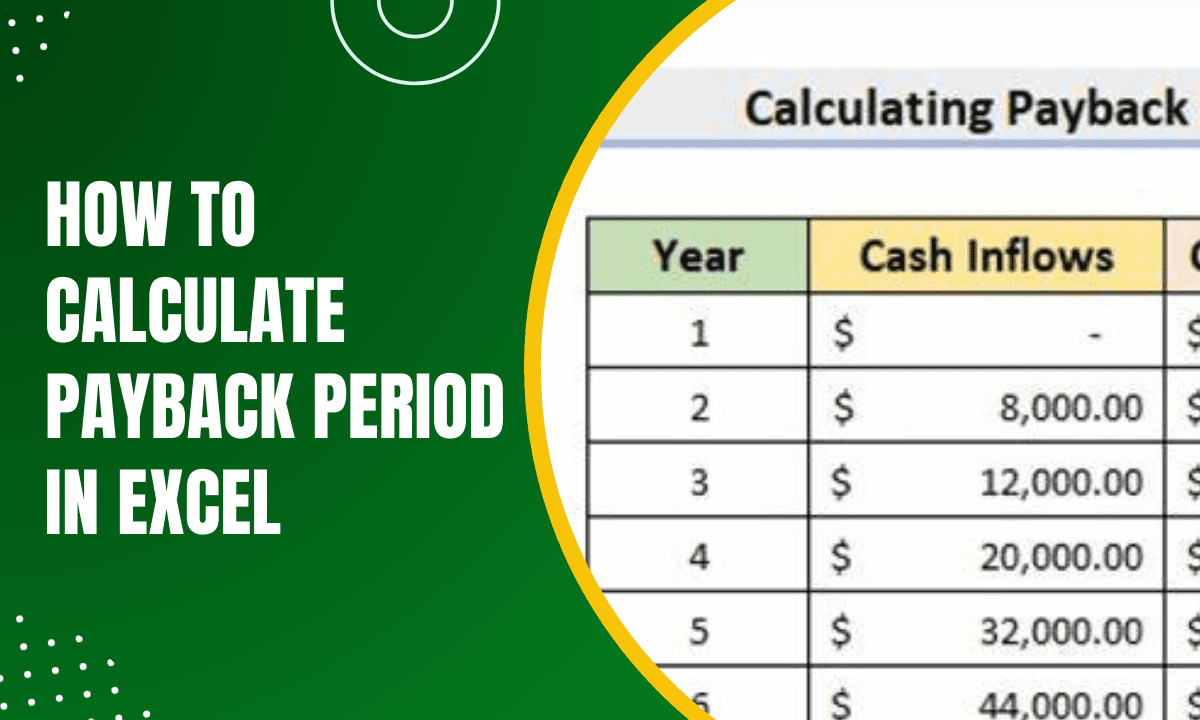

Calculating the payback period is essential for businesses to evaluate how long it will take to recover the cost of an investment. Excel is a powerful tool that can simplify this process through various formulas. Here, we'll explore five easy Excel formulas tailored to help you calculate the payback period for different scenarios. Whether you're considering an investment in new equipment, a project, or any other business venture, these formulas will guide you in your financial planning.

1. Standard Payback Period

The basic formula for calculating the payback period assumes a constant annual net cash inflow:

- Formula: Initial Investment / Annual Cash Inflows

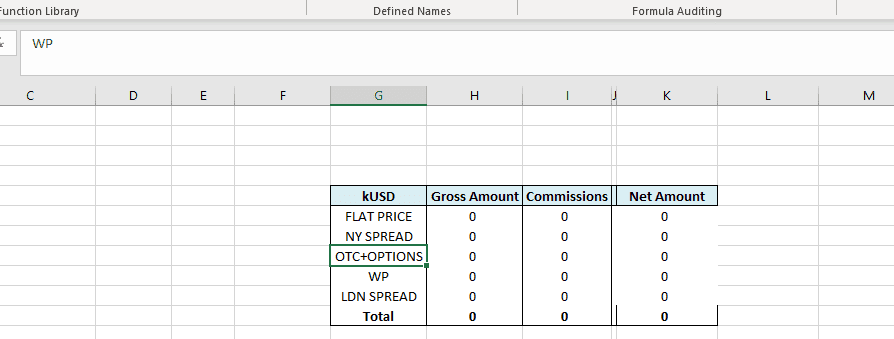

In Excel, you could use:

<p>=B2/B3</p>

Where:

- B2 represents the initial investment (cost).

- B3 represents the annual cash inflow.

2. Using CUMIPMT for Non-Uniform Cash Flows

For investments with varying cash flows each year, Excel's CUMIPMT function can be used to calculate cumulative payments, which, in this context, can represent the cumulative cash flows. Here’s how you can set it up:

<p>=CUMIPMT(Rate, NPer, PV, 1, NPer, Type)</p>

Where:

- Rate is the rate of return or the discount rate.

- NPer is the number of periods over which the investment is to be repaid.

- PV is the present value, or the initial investment.

- Type is set to 0 for cash flows at the end of the period or 1 for beginning.

To find the payback period, you would typically use a cumulative sum to determine when the initial investment is recovered:

<p>=IF(SUM(Cumulative_Cash_Flows)>=Initial_Investment, MATCH(TRUE, Cumulative_Cash_Flows>=Initial_Investment, 0), "> Year NPer")</p>

📌 Note: This formula assumes your cumulative cash flows are calculated correctly in a range, and the investment is not recovered by Year NPer.

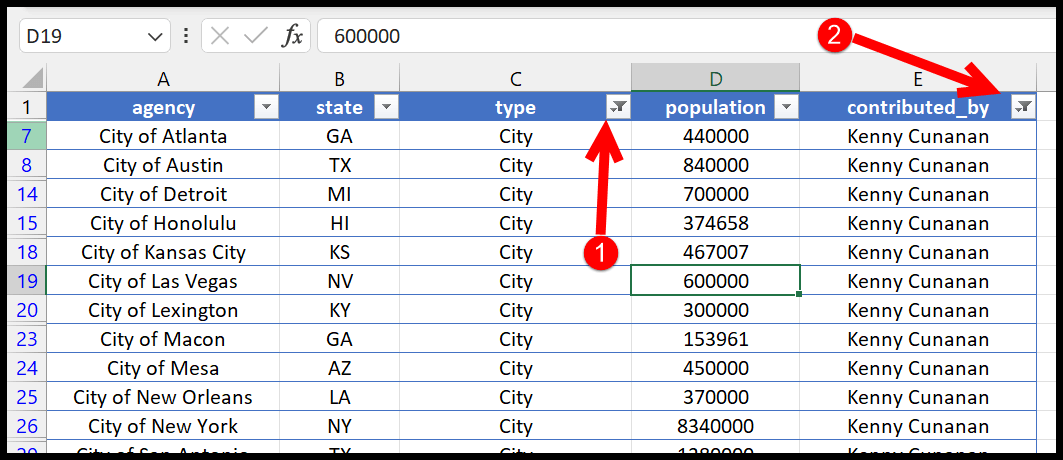

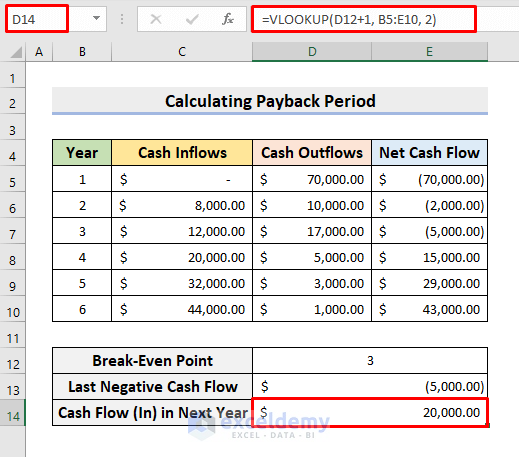

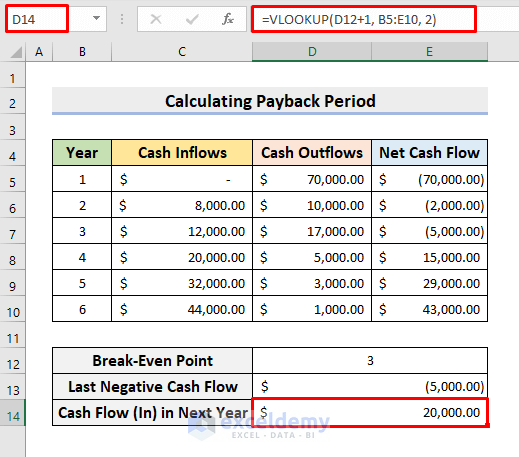

3. Using VLOOKUP for Detailed Cash Flows

When you have detailed cash flow projections, VLOOKUP can help determine the exact time period when the investment is paid back:

<p>=VLOOKUP(Initial_Investment, [Cash_Flow_Range], [Column_Number], TRUE)</p>

Where:

- [Cash_Flow_Range] is a table that includes the cumulative cash flows.

- [Column_Number] specifies which column in the table to return the payback period from.

4. NPV for Payback Period Adjustment

To account for the time value of money, you might also calculate the Net Present Value (NPV) of cash flows:

<p>=NPV(Discount_Rate, Cash_Flow_Range)</p>

Then:

<p>=IF(NPV>=Initial_Investment, MATCH(TRUE, NPV_Array>=Initial_Investment, 0), "> Year N")</p>

Where:

- NPV_Array is the array of NPVs calculated for each period.

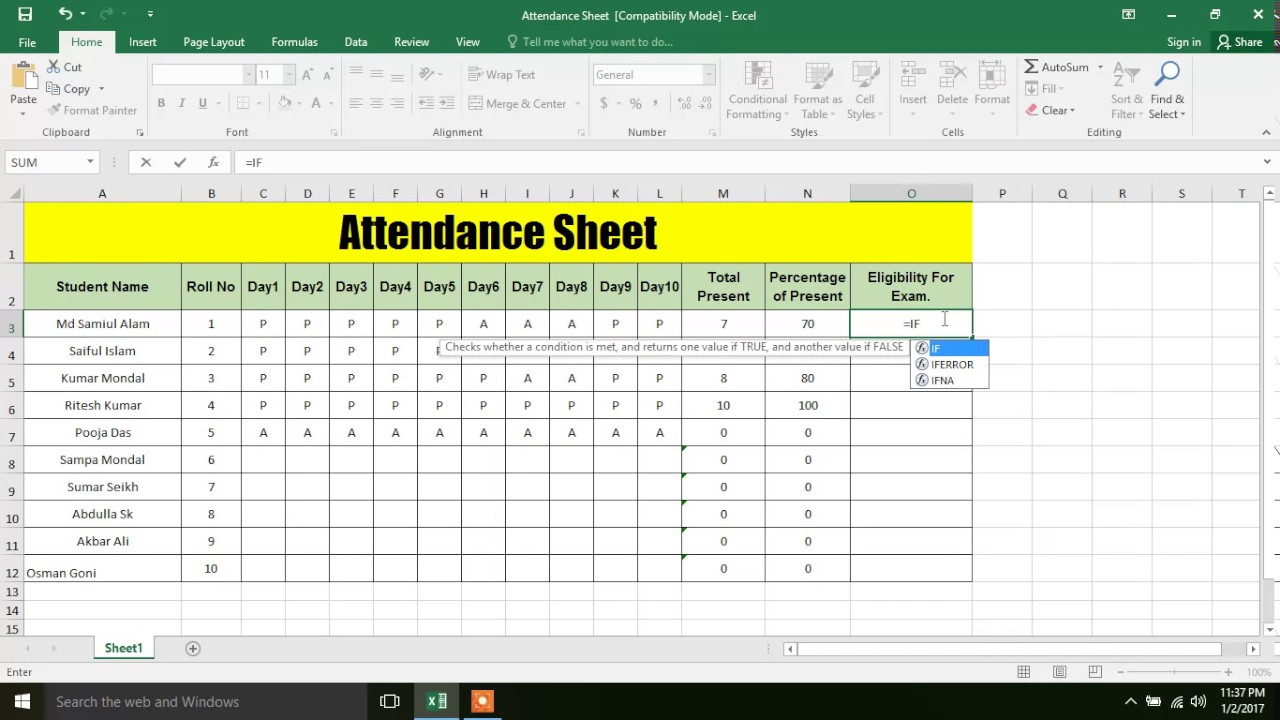

5. Using IF Statements for Partial Years

Sometimes, you might need to determine the exact partial year in which the investment is recovered. Here’s an example:

<p>=IF(Cumulative_Cash_Flows > Initial_Investment,

A2 - (Cumulative_Cash_Flows - Initial_Investment) / B2,

"Cumulative cash flow not yet covered")</p>

Where:

- A2 is the year or period number.

By using these Excel formulas, you can calculate the payback period for various scenarios, ensuring that your investment analysis is both accurate and efficient. Remember, while these formulas provide estimates, they should be complemented by sensitivity analysis or scenario planning for a more robust evaluation:

🔍 Note: Always verify your input data for accuracy before making any investment decisions.

As you integrate these methods into your financial toolkit, they will not only aid in evaluating investment projects but also streamline your financial modeling process. Understanding how and when your investments will pay off is crucial for strategic business decisions, ensuring that you allocate resources wisely and effectively.

What is a payback period?

+

The payback period is the time it takes for an investment to generate enough cash flow to recover the initial investment cost. It’s a basic capital budgeting tool used to assess the profitability of a project or investment.

Why should I use Excel for payback period calculation?

+

Excel provides flexibility with its vast array of functions, allowing for complex calculations and scenario analysis. This makes it an ideal tool for dynamically calculating payback periods under different assumptions and conditions.

Can these formulas account for reinvestment of cash flows?

+

Yes, by using functions like NPV or setting up a cash flow reinvestment model within Excel, you can simulate how reinvested cash flows would affect the payback period.