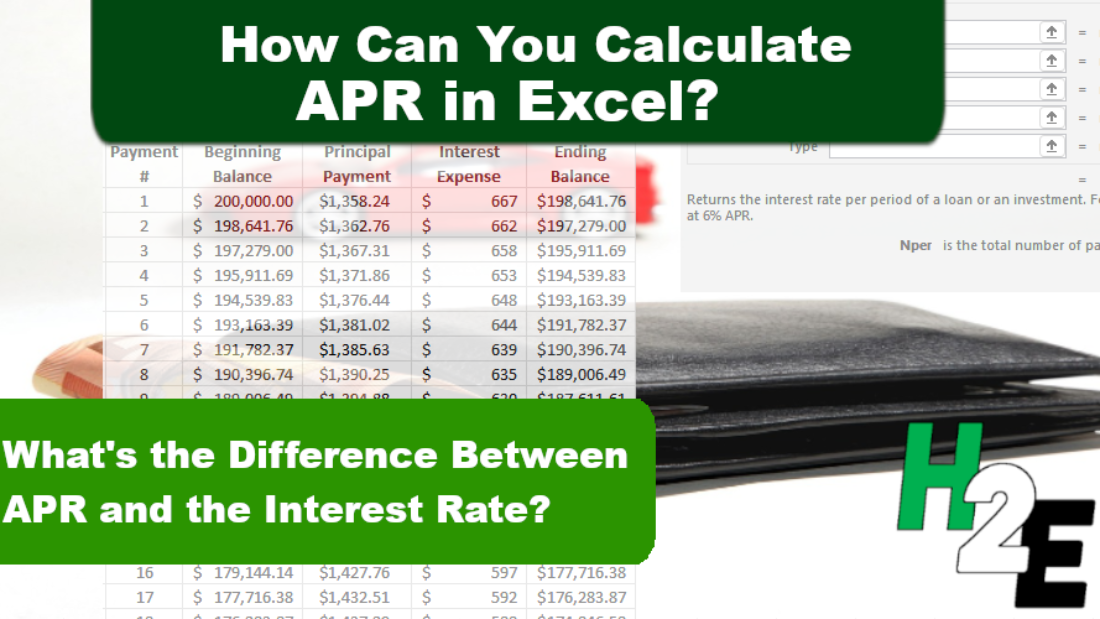

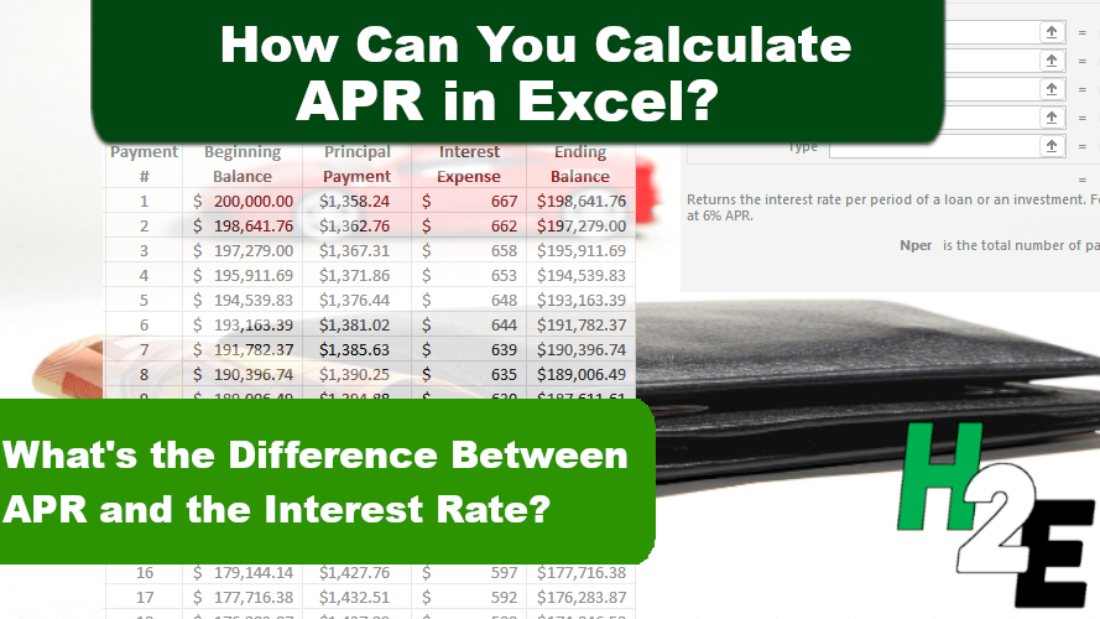

5 Easy Steps to Calculate APR in Excel

Understanding how to calculate the Annual Percentage Rate (APR) in Excel can be incredibly beneficial, whether you're assessing loan terms or planning an investment strategy. The process might seem daunting, but it's quite straightforward when you break it down into simple steps. Below, we'll guide you through calculating APR using Microsoft Excel, making financial analysis less intimidating.

Step 1: Collect Necessary Data

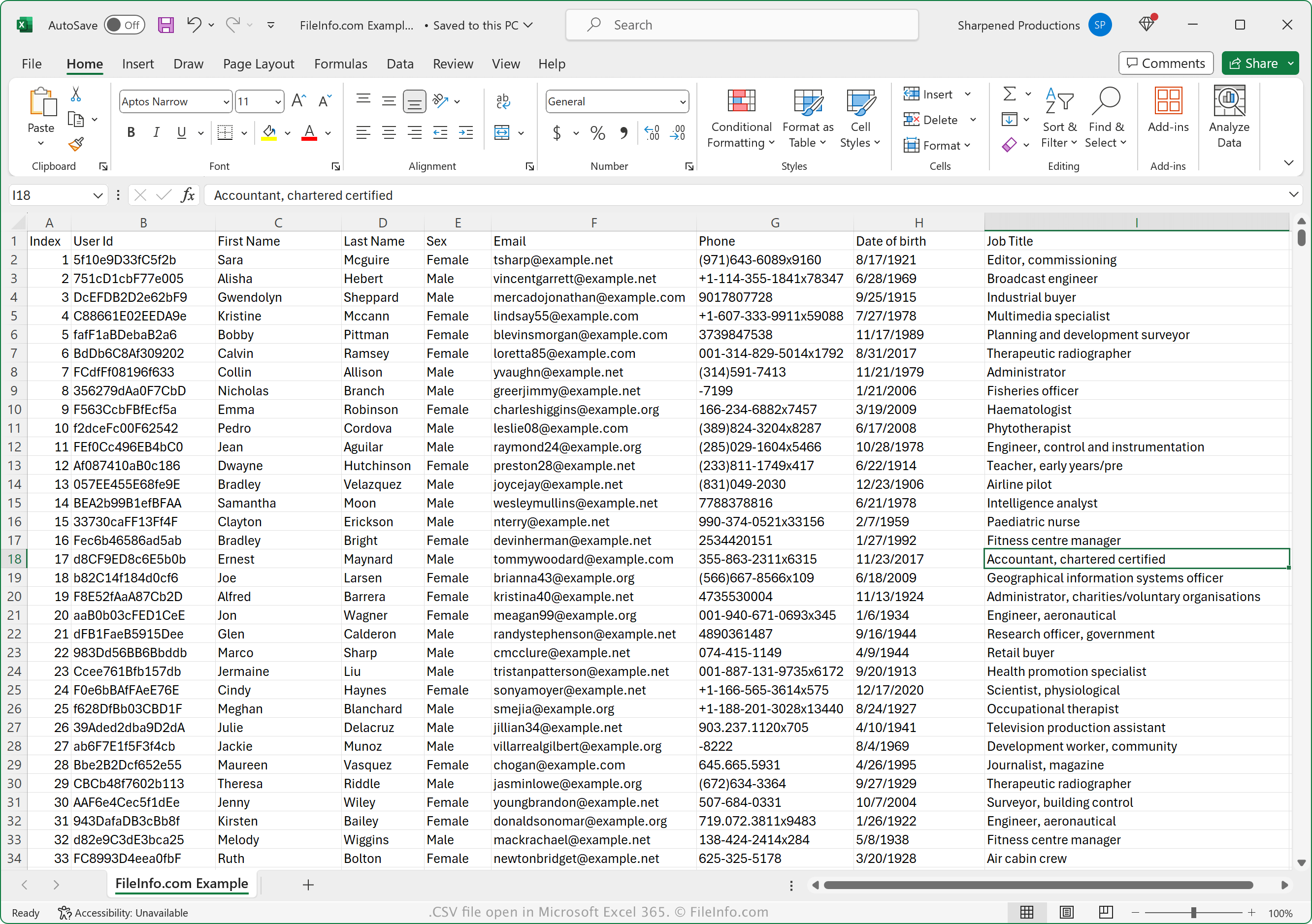

Before you start, you need to gather all the necessary details about the loan or investment:

- Principal Amount (P): This is the initial amount of the loan or investment.

- Interest Rate ®: This could be the annual or monthly interest rate.

- Number of Payments (n): This is the total number of payments you will make or receive.

- Frequency of Compounding (m): Number of times interest is compounded per period (e.g., monthly, quarterly, etc.).

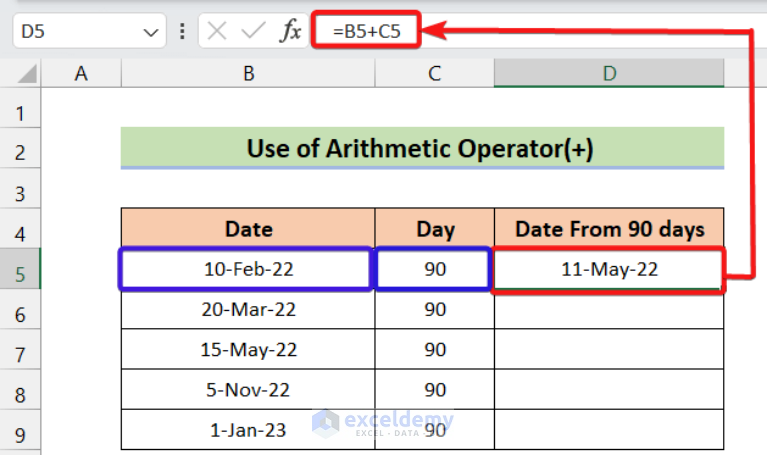

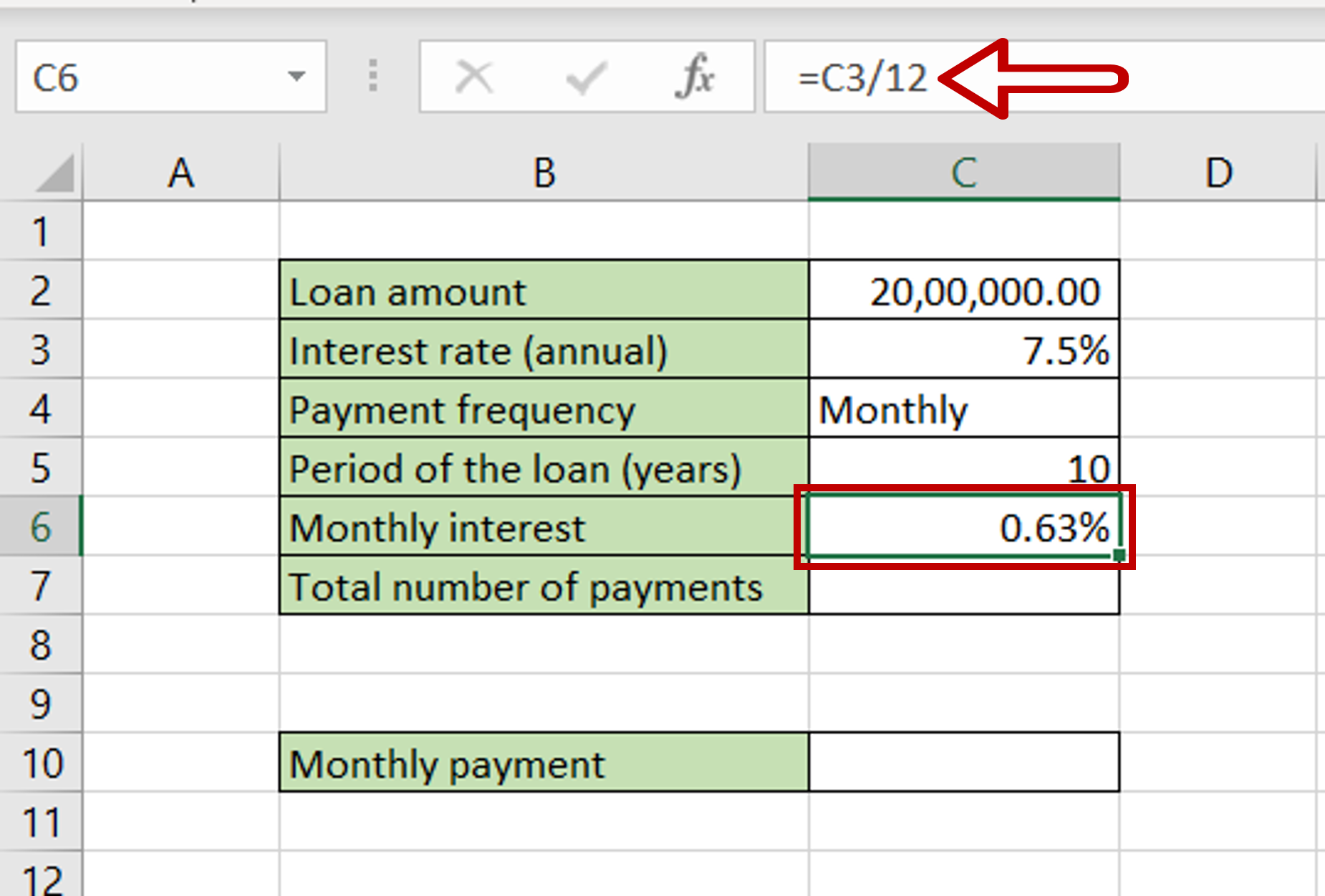

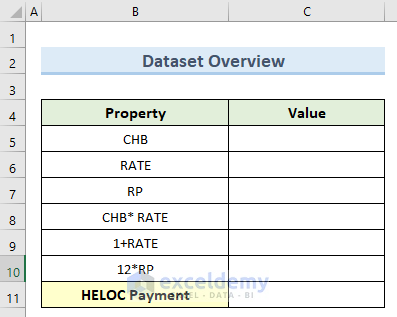

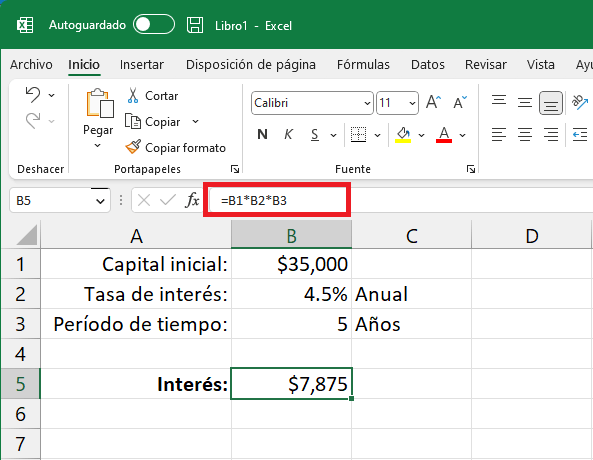

Step 2: Set Up Your Excel Sheet

Here’s how you should set up your Excel spreadsheet for clarity:

- In cell A1, enter “Principal Amount”.

- In cell A2, enter “Annual Interest Rate”.

- In cell A3, enter “Number of Payments”.

- In cell A4, enter “Frequency of Compounding”.

- In cells B1 through B4, input the respective data values collected in step 1.

⚠️ Note: Ensure the interest rate is in the same format as the compounding frequency (e.g., if it’s an annual rate, the compounding should also be annual).

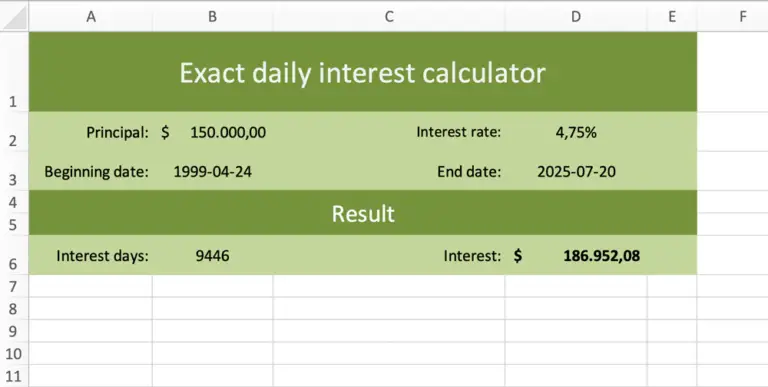

Step 3: Calculate the Effective Annual Rate (EAR)

Now we’ll find the Effective Annual Rate, which accounts for compound interest:

- In cell B5, type the formula for EAR:

=((1+(B2/B4))^B4)-1. This computes the Effective Annual Rate.

Step 4: Calculate APR

With the EAR calculated, we now convert it to APR:

- In cell B6, enter:

=B5*100. This will convert the effective rate into an approximate APR percentage.

💡 Note: This is an approximation because APR usually does not include the effect of compounding as EAR does.

Step 5: Interpret Your APR

Once you’ve calculated the APR:

- Compare it with other financial products or loans to see which is more cost-effective.

- Remember that APR only considers interest and certain fees, not the effect of compound interest.

Here’s a simple example of how APR might appear:

| Loan | Principal ($) | Annual Interest Rate (%) | APR (%) |

|---|---|---|---|

| Home Loan | 150000 | 4 | 4.03 |

| Car Loan | 30000 | 6 | 6.17 |

In summary, mastering the calculation of APR in Excel provides you with a powerful tool for financial decision-making. It allows you to quickly analyze loan terms, compare investment options, and understand the true cost of borrowing. By following these five easy steps, you can efficiently evaluate financial products to make informed decisions. Remember that while the steps outlined here are straightforward, considering all associated fees and the effects of compounding can provide a more comprehensive view of financial products.

Why is APR important when evaluating loans?

+

APR gives you a more accurate picture of the total cost of borrowing because it includes not only the interest rate but also other associated fees, providing a standardized way to compare different loan options.

Does APR include compound interest?

+

APR does not include the effect of compound interest. It’s an annualized rate that accounts for interest rate and specific fees but not the frequency at which interest is compounded. For a more comprehensive view, consider the Effective Annual Rate (EAR).

How often should I recalculate APR for ongoing loans?

+

Recalculating APR isn’t typically necessary for ongoing loans unless there are changes in the terms or fees associated with the loan. However, when comparing new loans or when terms change, it’s wise to calculate the new APR to understand the updated cost.