Mastering Payback Period Calculation with Excel: Easy Guide

In the realm of financial analysis, the payback period is a key metric that helps businesses evaluate the time it takes for an investment to generate enough cash flow to recover the initial outlay. Whether you are considering launching a new product line, purchasing new equipment, or investing in a project, understanding how to calculate the payback period efficiently can significantly aid your decision-making process. This comprehensive guide will walk you through mastering payback period calculation using Microsoft Excel, making it an easy task even for beginners.

Understanding the Payback Period

Before diving into the mechanics, it’s crucial to grasp what the payback period is and why it’s important:

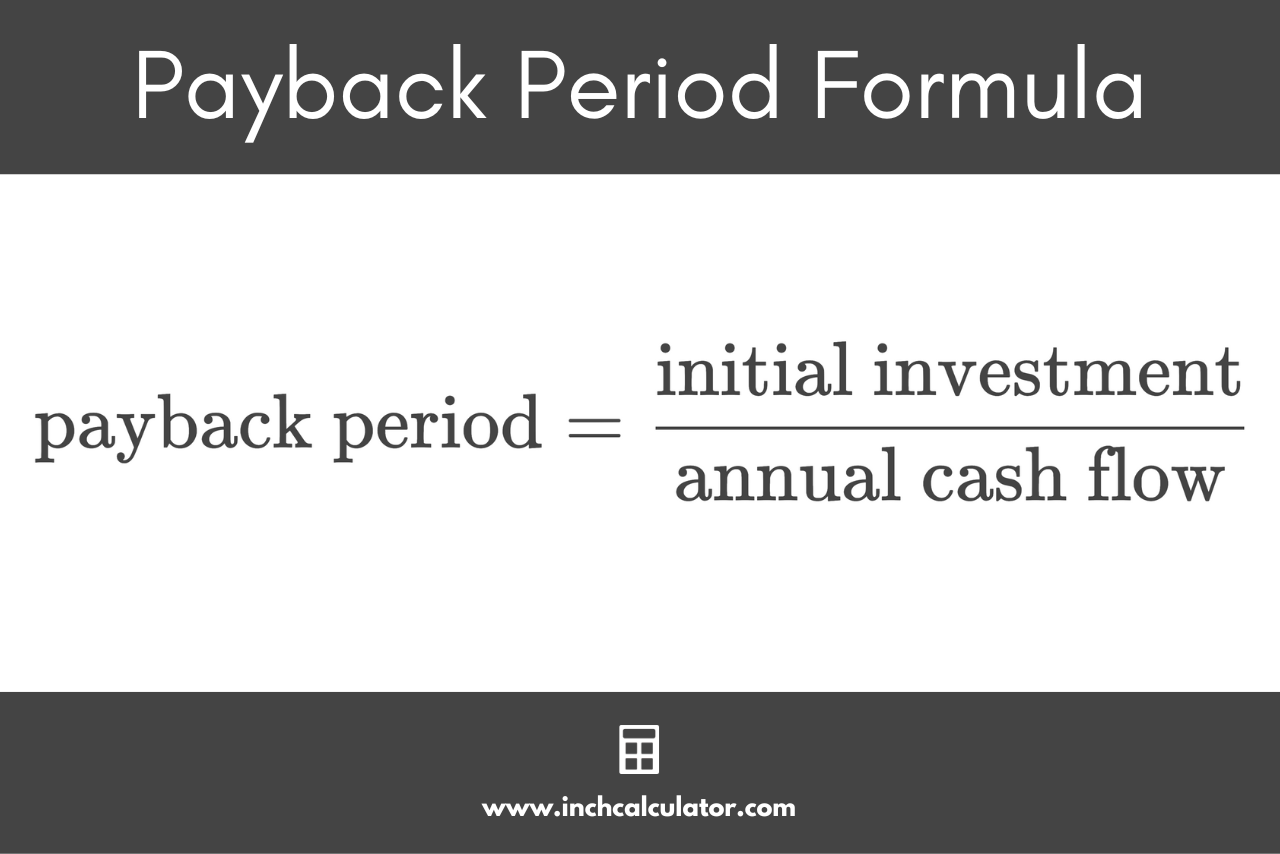

- Definition: The payback period is the duration, typically expressed in years, it takes for an investment to recoup the initial amount invested through its net cash inflows.

- Purpose: It helps in assessing the risk associated with an investment. Shorter payback periods generally indicate less risk since the money is recovered faster.

- Limitations: While simple, it does not account for the time value of money or cash flows beyond the payback period.

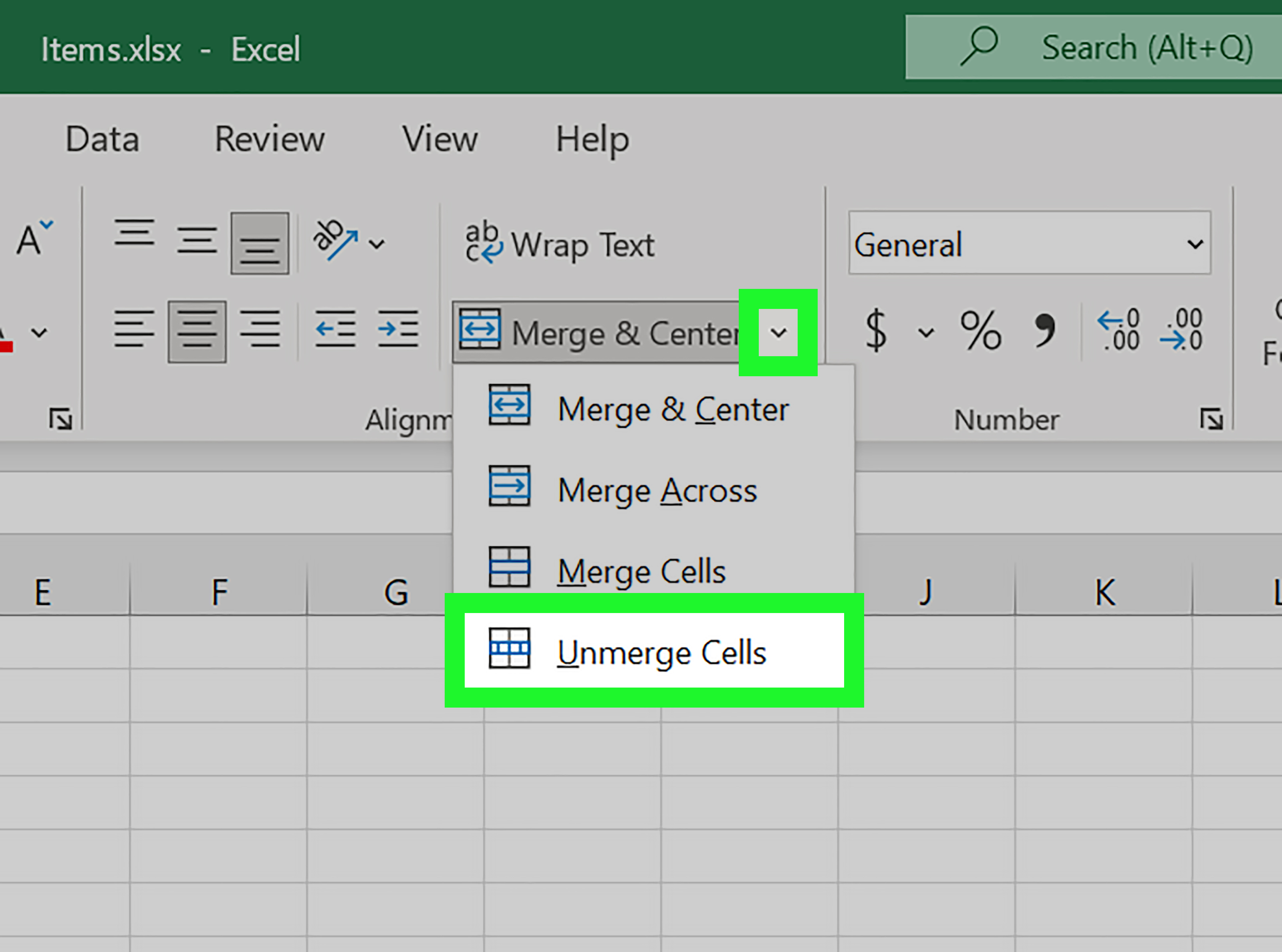

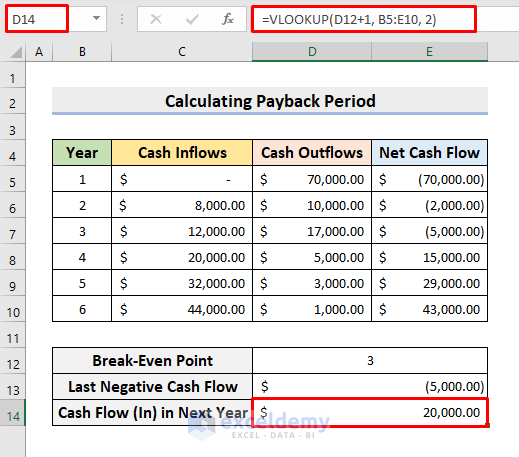

Setting Up Your Excel Worksheet

First, prepare your Excel worksheet by:

- Creating column headers for Year, Annual Cash Flow, and Cumulative Cash Flow.

- Entering the initial investment as a negative value in the first year’s cell for Cash Flow.

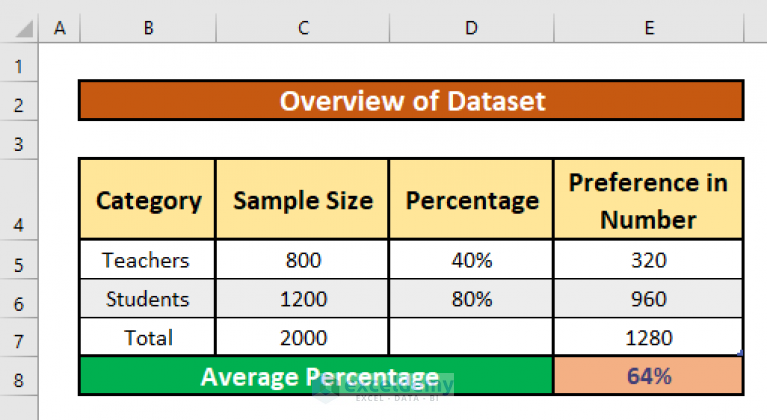

Calculating Annual and Cumulative Cash Flows

| Year | Annual Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | -50000 | -50000 |

| 2 | 15000 | -35000 |

| 3 | 20000 | -15000 |

| 4 | 25000 | 10000 |

Here's how to calculate:

- Annual Cash Flow: Enter the expected cash flows for each year of the project's life cycle. Remember, positive numbers for inflows and negative for outflows.

- Cumulative Cash Flow: In the Cumulative Cash Flow column, add the cash flow of the current year to the sum of all prior cash flows.

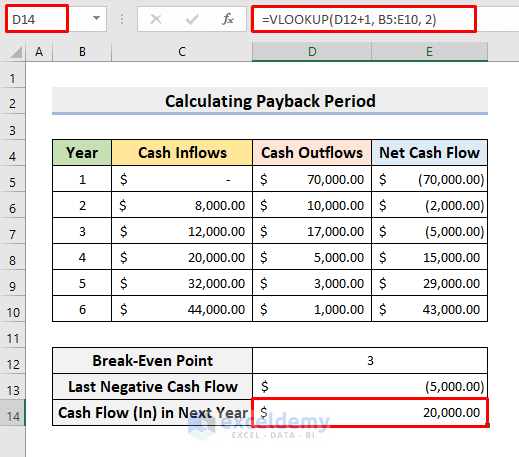

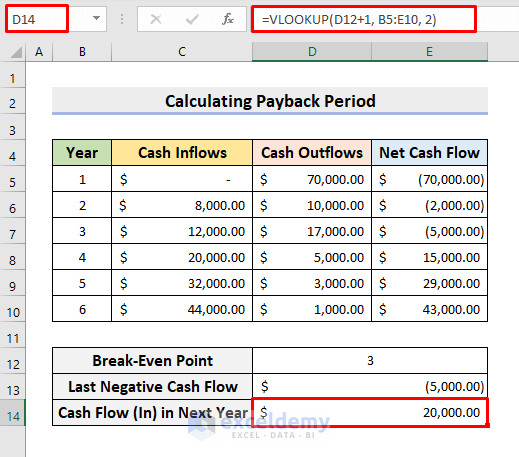

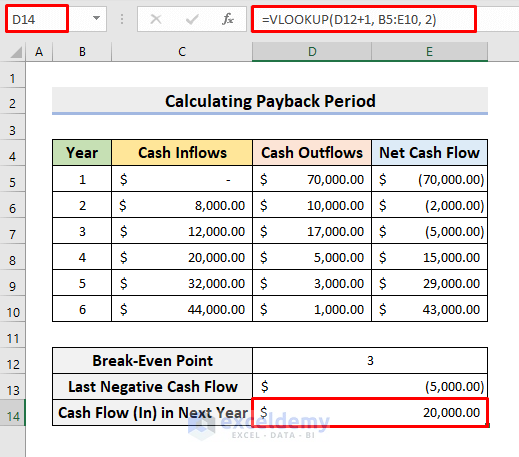

Determining the Payback Period

To calculate the payback period:

- Identify the year when the Cumulative Cash Flow first turns positive.

- Use the formula:

Payback Period = Year Before Positive Cumulative Cash Flow + (Yearly Cash Flow Needed / Yearly Cash Flow Received in Positive Year)

💡 Note: If your investment has uneven cash flows, you might need to interpolate the exact payback period within a year.

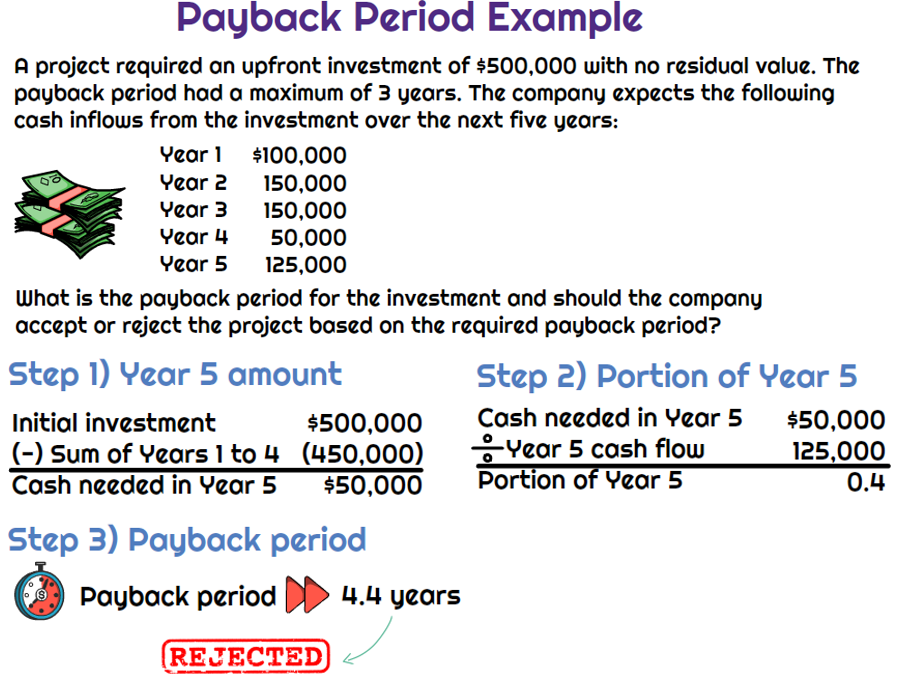

Example Calculation

Let’s apply our example data from the table above:

- The investment breaks even between Year 3 and Year 4.

- At the end of Year 3, there’s a cumulative deficit of 15,000.</li> <li>In Year 4, we have a positive inflow of 25,000.

- Using the formula:

Payback Period = 3 + (15000 / 25000) = 3.6 Years

Your project will recover its initial investment within 3.6 years.

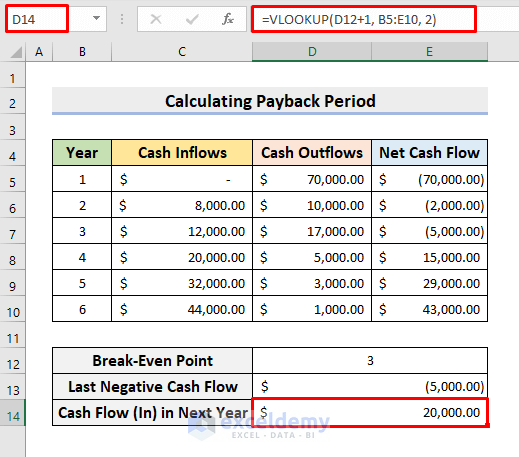

Advanced Features in Excel

For more advanced analysis:

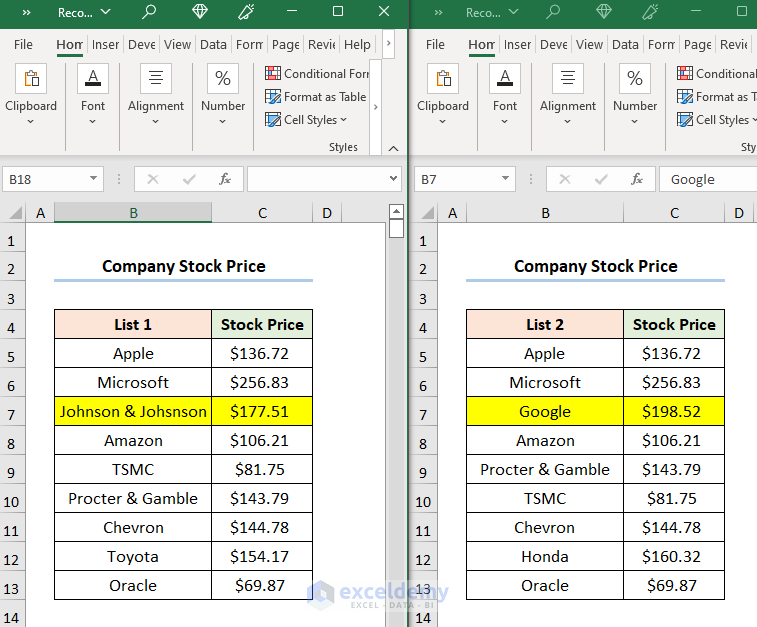

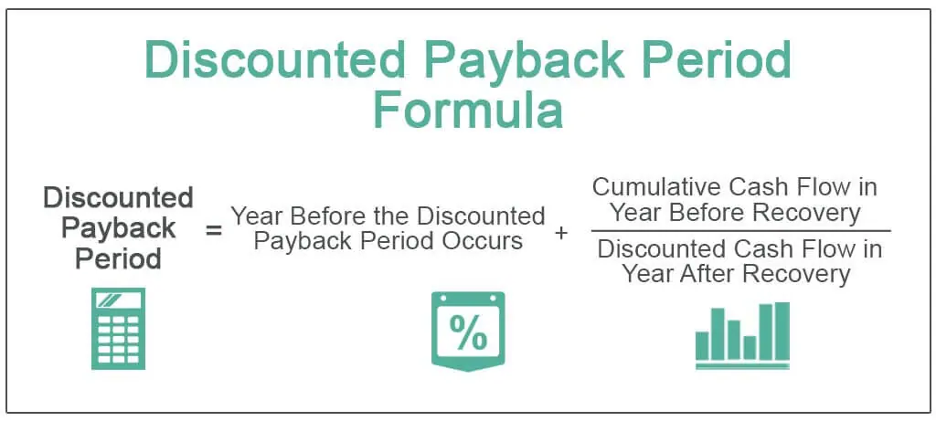

- NPV (Net Present Value): Use Excel’s NPV function to account for the time value of money.

- Data Tables: Create data tables to assess how changes in variables like cash flows or the discount rate impact the payback period.

- Charts: Visualize the payback timeline to make it easier to interpret the data.

📝 Note: Excel offers conditional formatting to highlight when the Cumulative Cash Flow becomes positive, making it visually easier to spot the payback point.

Summarizing Your Findings

After mastering the calculation process, here are some key points to remember:

- The payback period is a straightforward metric for evaluating the liquidity of an investment.

- Excel can simplify the calculation significantly with its formula capabilities.

- Considering both NPV and payback period provides a more robust investment analysis framework.

🎯 Note: Always cross-reference your calculations with actual financial data to ensure accuracy.

The simplicity of the payback period makes it an attractive metric for quick investment assessments. However, complementing it with other financial analysis tools gives a more comprehensive view of potential investments. By following this guide, you can now confidently use Excel to calculate the payback period, making your financial analysis more effective and informed.

What if my investment has uneven cash flows?

+

For uneven cash flows, use interpolation within the year where the cash flow changes from negative to positive to find the exact payback period.

Can the payback period be used solely for investment decisions?

+

No, while useful, the payback period should be combined with other metrics like NPV or IRR for a complete financial analysis.

How can I adjust for risk in my payback period calculation?

+

While the payback period itself does not directly adjust for risk, you can set a threshold or benchmark for acceptable payback periods based on risk tolerance or industry standards.