Easily Calculate WACC in Excel: Step-by-Step Guide

Understanding the Weighted Average Cost of Capital (WACC) is crucial for any business, particularly when making decisions on capital budgeting, valuing companies, or performing financial analysis. WACC represents the average rate a company expects to pay to finance its assets, which might be comprised of equity, debt, or a combination of both. Calculating WACC in Excel is straightforward once you know the steps. This guide will take you through the process, ensuring you grasp both the concept and the mechanics of its calculation.

What is WACC?

Before diving into the calculations, it's important to define what WACC entails:

- Weighted: The significance of each capital component (debt, equity, etc.) is reflected by its proportionate share of total capital.

- Average: Since different sources of capital have different costs, WACC averages these costs, considering the relative size of each capital component.

- Cost of Capital: It includes costs like interest on debt and the expected return required by shareholders.

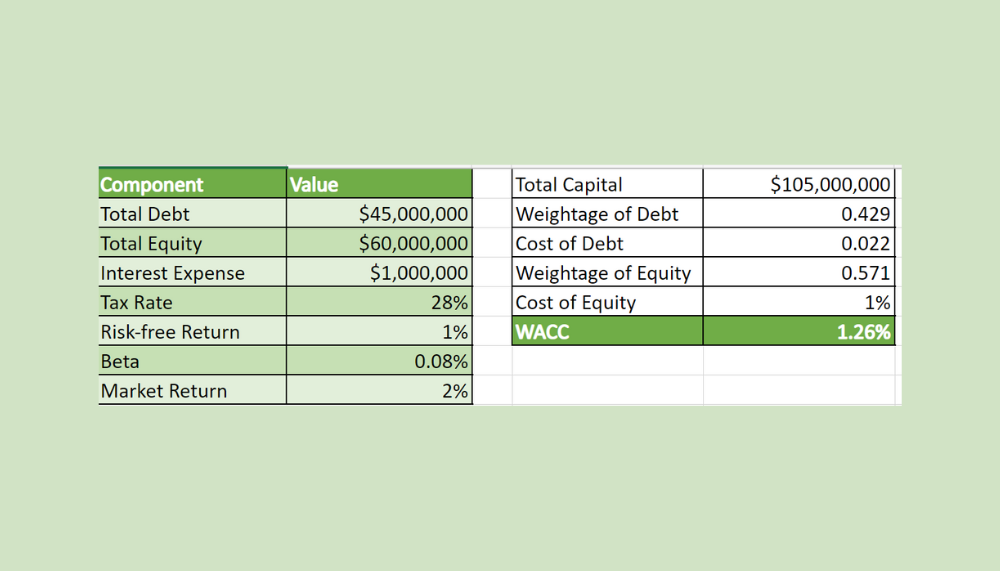

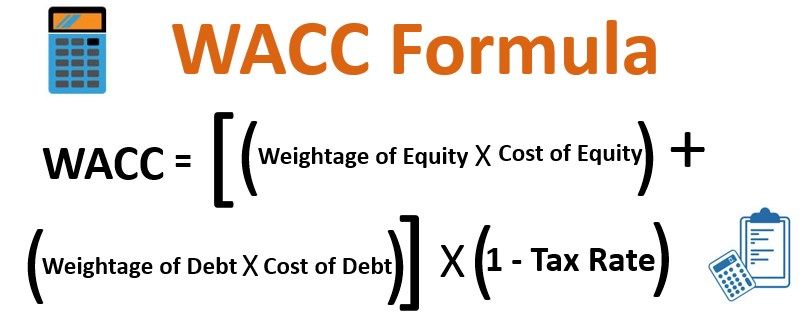

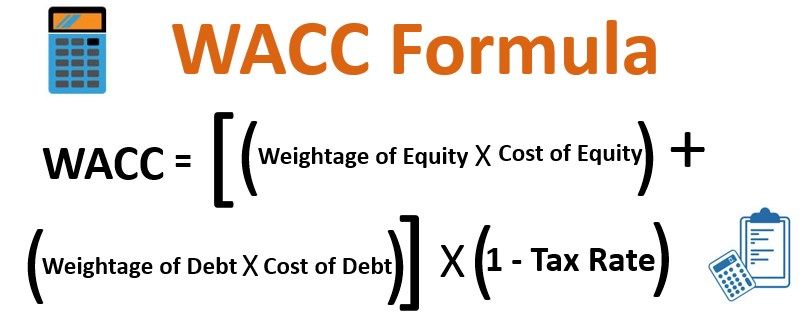

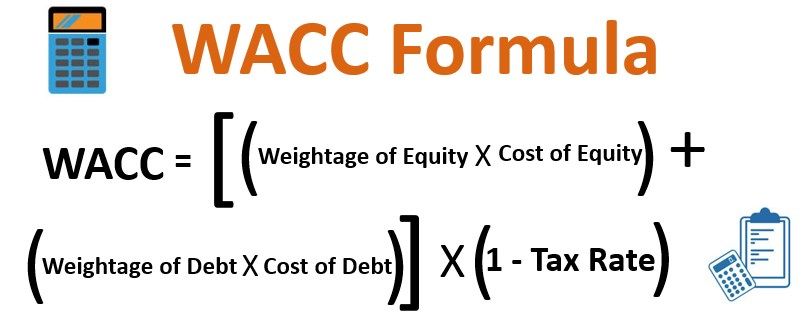

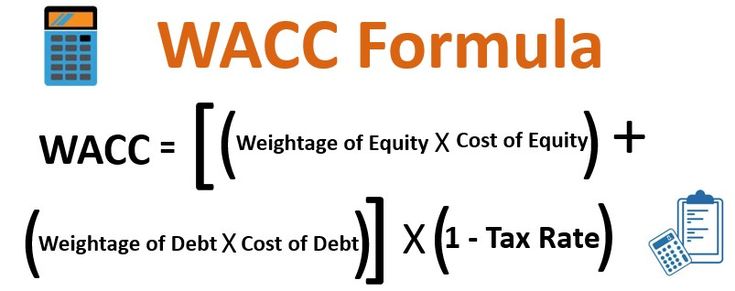

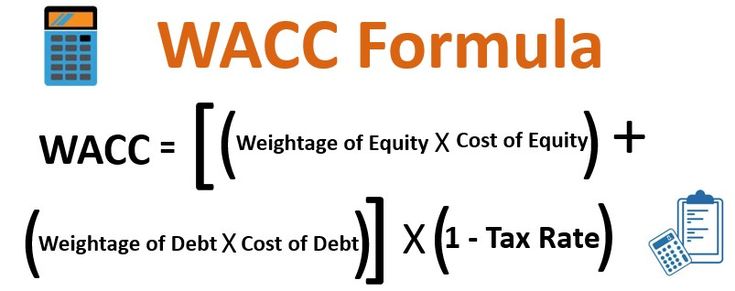

The formula for WACC is:

WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc)

Where:

- E = Market value of the company's equity

- D = Market value of the company's debt

- V = Total market value of company's financing (E + D)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

Step-by-Step Guide to Calculate WACC in Excel

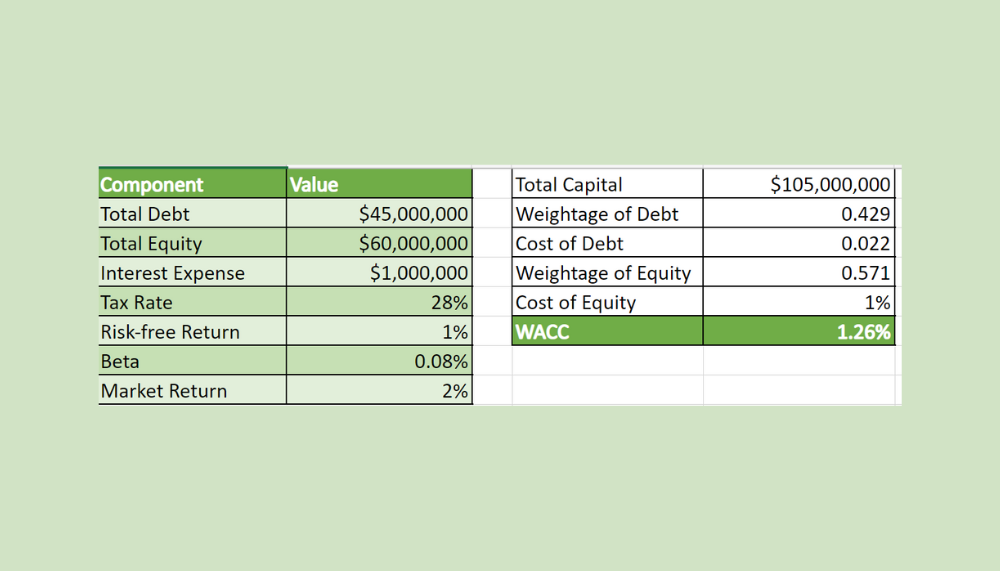

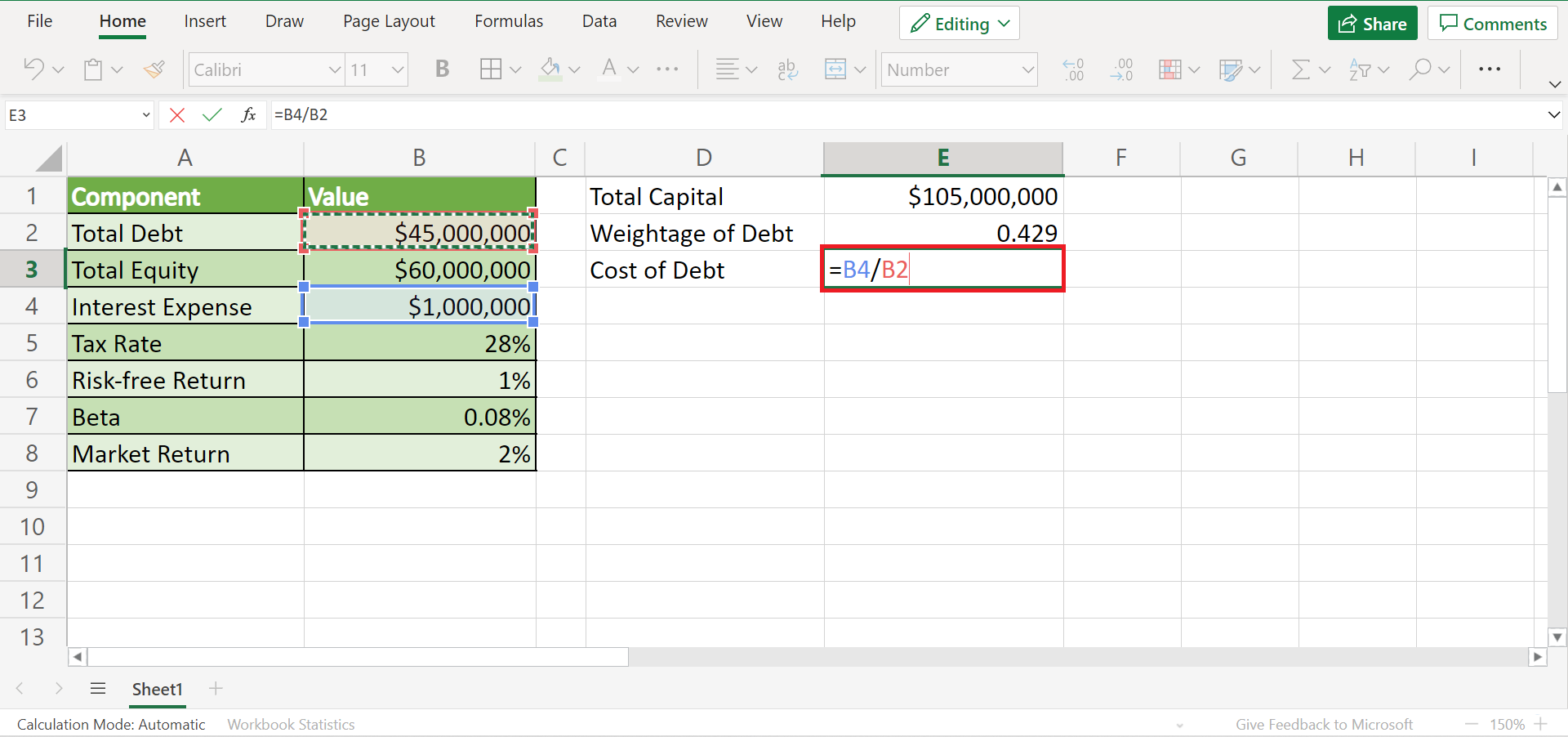

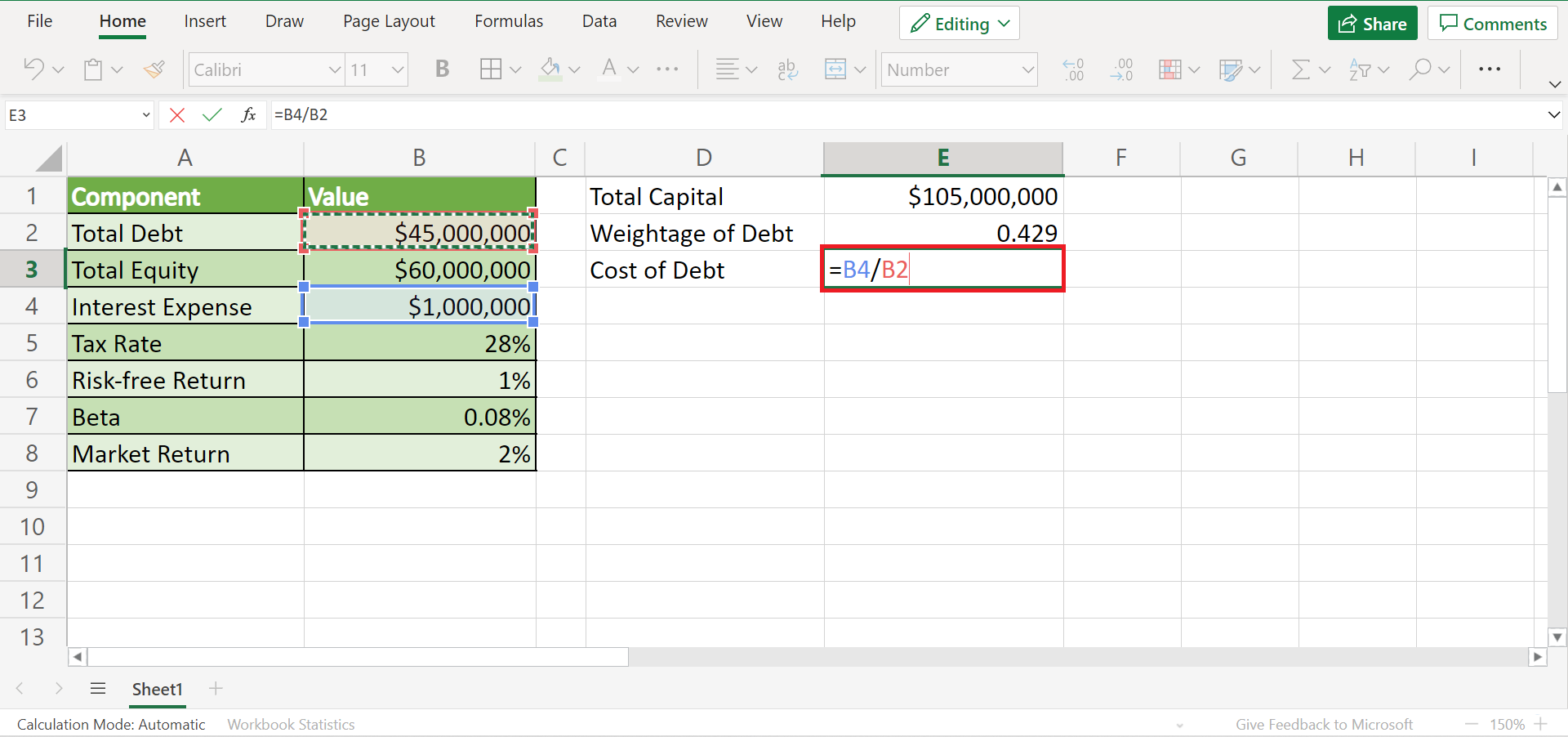

1. Prepare Your Data

First, ensure you have the necessary data:

- Market value of equity (share price * number of shares)

- Market value of debt

- Corporate tax rate

- Cost of equity (often estimated using models like CAPM)

- Pre-tax cost of debt (interest rate of debt)

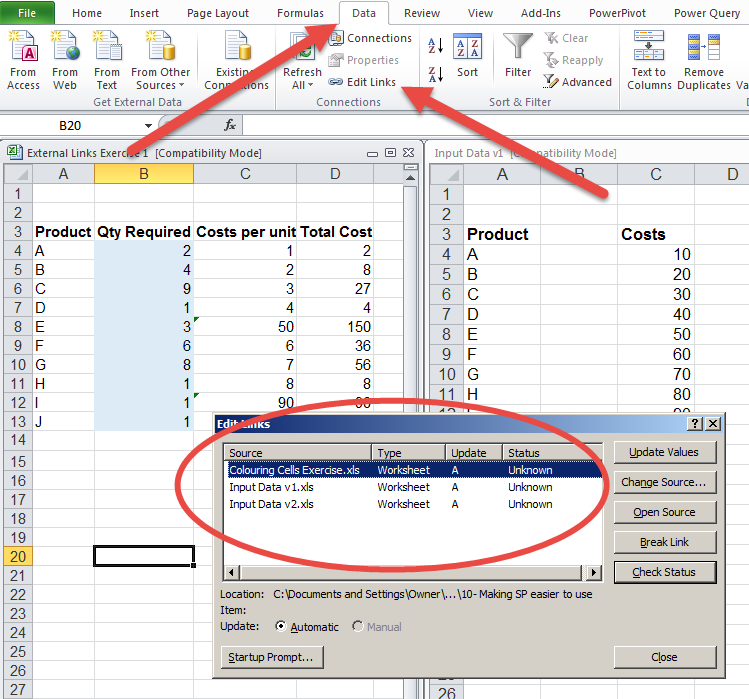

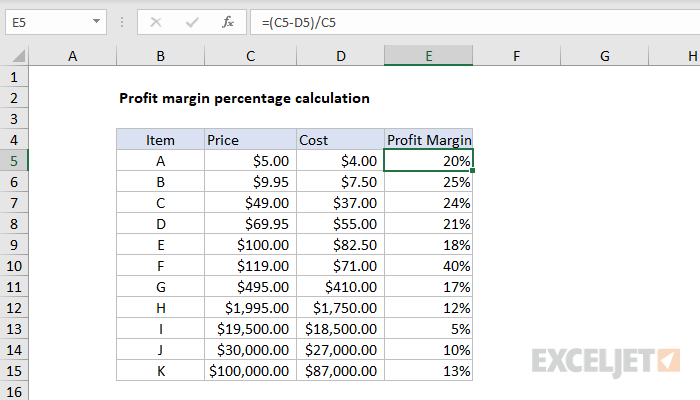

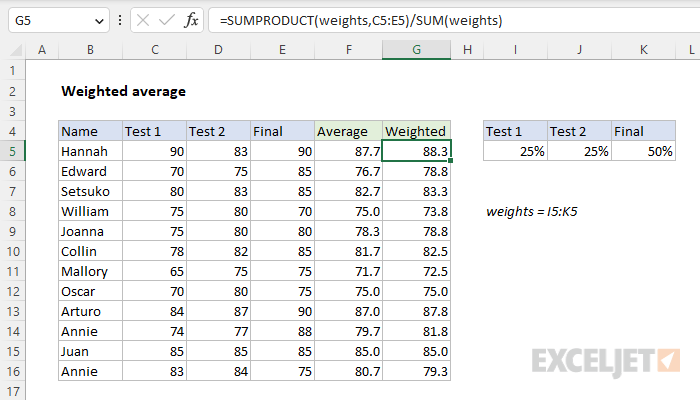

2. Set Up Your Excel Worksheet

Create columns in your Excel worksheet as follows:

| Component | Value | Weight | Cost | Weighted Cost |

|---|---|---|---|---|

| Equity | E | E / (E+D) | Re | = (E / (E+D)) * Re |

| Debt | D | D / (E+D) | Rd * (1-Tc) | = (D / (E+D)) * (Rd * (1-Tc)) |

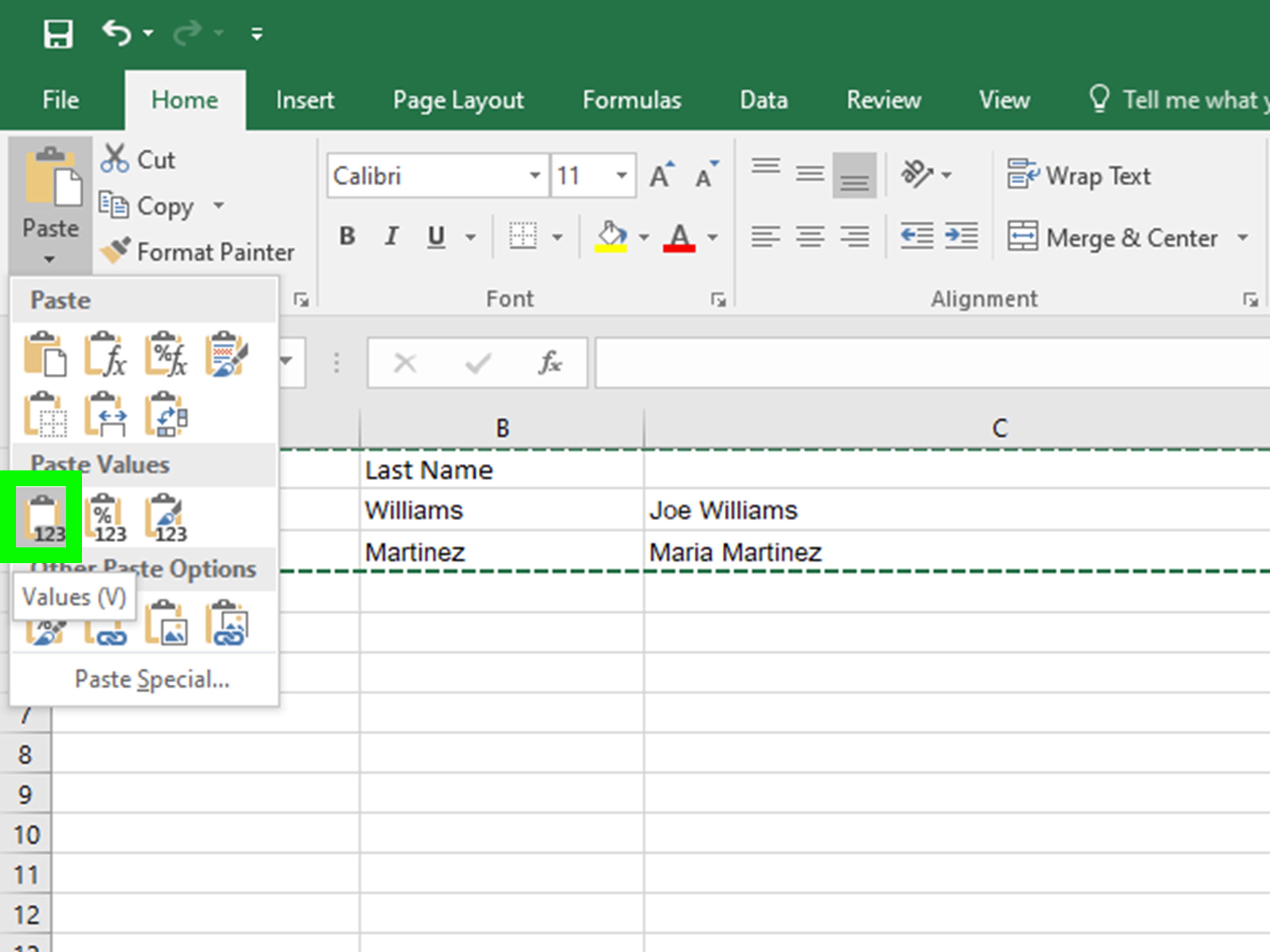

3. Input Values

- Enter the market value of equity into the cell under “Value” for Equity.

- Enter the market value of debt into the cell under “Value” for Debt.

- Enter the tax rate, cost of equity, and pre-tax cost of debt in their respective cells.

4. Calculate Weights

Use formulas to compute weights:

- For Equity:

=B2/(B2+B3) - For Debt:

=B3/(B2+B3)

📌 Note: B2 and B3 are the cells containing the values of equity and debt respectively.

5. Determine Costs

- For equity: Use the cell where you input the cost of equity.

- For debt: Multiply the pre-tax cost of debt by (1 - tax rate) to get the after-tax cost.

6. Calculate Weighted Costs

Multiply the weights by their respective costs:

- Equity Weighted Cost:

=C2*D2 - Debt Weighted Cost:

=C3*D3

7. Sum Up for WACC

Finally, sum up the weighted costs of equity and debt to get the WACC:

=E2+E3

Notes on Using WACC

🔍 Note: When using WACC for analysis:

- Remember, WACC is sensitive to changes in capital structure, especially if you have significant amounts of debt or fluctuating interest rates.

- Ensure your figures for equity and debt are current market values, not book values, for a more accurate WACC calculation.

- WACC can be used as a hurdle rate for investment projects or as a discount rate in valuation models.

In wrapping up, calculating WACC in Excel provides a tangible measure of the minimum return a company must earn on its investments to satisfy its stakeholders. This process, although seemingly complex, becomes manageable with the structured steps and understanding provided here. From gathering necessary data to using Excel formulas to compute the final WACC, the journey elucidates not just a financial metric but the essence of corporate finance strategy. Remember, this calculation is dynamic, reflecting changes in market conditions and company performance, so regular updates are advisable for accurate decision-making.

What is the significance of using market value instead of book value for WACC calculations?

+

Market value reflects the current value of the company in the market, providing a more accurate representation of what investors perceive the company’s worth to be. This is crucial for WACC calculations as it impacts the weights of debt and equity, influencing the overall cost of capital.

How often should WACC be recalculated?

+

WACC should be recalculated whenever there are significant changes in the company’s capital structure, interest rates, or if there are material changes in the company’s market value. Regular annual reviews are also advisable.

Can WACC be negative?

+

WACC typically cannot be negative because it represents the cost of capital, which would imply that the company is being paid to use capital, a scenario not seen in typical financial structures. However, very low or negative interest rates on debt could theoretically lower WACC significantly, but other factors would still keep WACC positive.

How does inflation affect WACC?

+Inflation affects WACC indirectly by impacting interest rates, which in turn influence the cost of debt. Rising inflation might increase the cost of debt due to higher interest rates, which could increase WACC if the proportion of debt in the capital structure is significant.

What if the company’s capital structure includes preferred stock?

+If preferred stock is part of the capital structure, you would include it in the WACC calculation. Its cost would be the fixed dividend rate, and its weight would be based on its market value proportion in the total capital structure.