5 Easy Steps to Calculate Payback Period in Excel

The payback period is a fundamental metric in financial analysis used to evaluate the length of time required to recover the initial investment cost through the cash flows generated by the investment. This is particularly useful for comparing projects or investments with similar expected returns. Here's how you can calculate the payback period using Microsoft Excel, ensuring clarity, precision, and efficiency in your financial analysis.

Step 1: Gather Your Data

The first step in calculating the payback period involves collecting all necessary data:

- Initial Investment: The amount of money invested initially.

- Cash Flows: The net cash inflows each period from the investment.

Here, you’ll enter your initial investment in one cell (say A1), and your cash flows from each period in cells A2, B2, C2, and so forth.

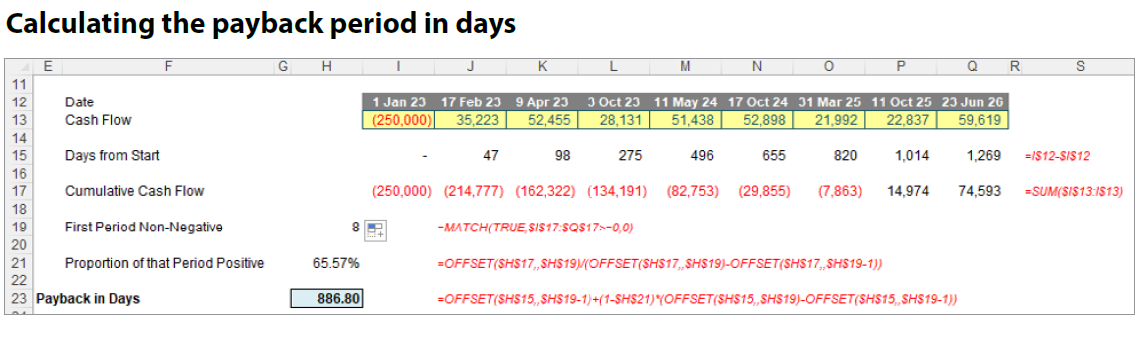

Step 2: Sum Cash Flows to Find Cumulative Cash Flows

To calculate the payback period, you need to determine the cumulative cash flows. This is done by:

- Entering each period’s cash flow in a row (e.g., A2 for year 1, B2 for year 2).

- Summing the cash flows from the first period up to each subsequent period to get the cumulative total. Use the formula

=SUM(A2:A#)where # is the last cell of your data series.

| Period | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | 20,000</td><td>20,000 | |

| 2 | 35,000</td><td>55,000 | |

| 3 | 40,000</td><td>95,000 |

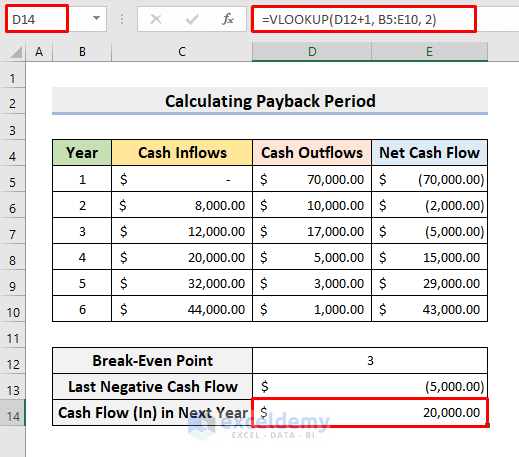

Step 3: Determine When the Cumulative Cash Flow Exceeds Initial Investment

Using the cumulative cash flows, identify the point where the cash inflows surpass the initial investment:

- Look for the first period where the cumulative cash flow (in the above example, it’s $95,000) is equal to or greater than the initial investment.

If the cumulative cash flow doesn’t reach or exceed the initial investment in the given periods, you’ll need to interpolate between the two periods for a more precise calculation.

Step 4: Calculate the Fractional Payback Period

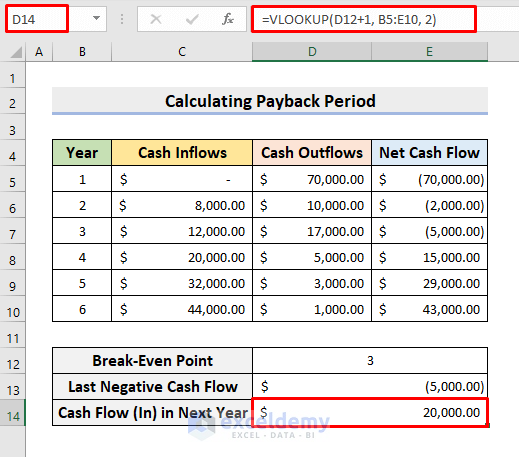

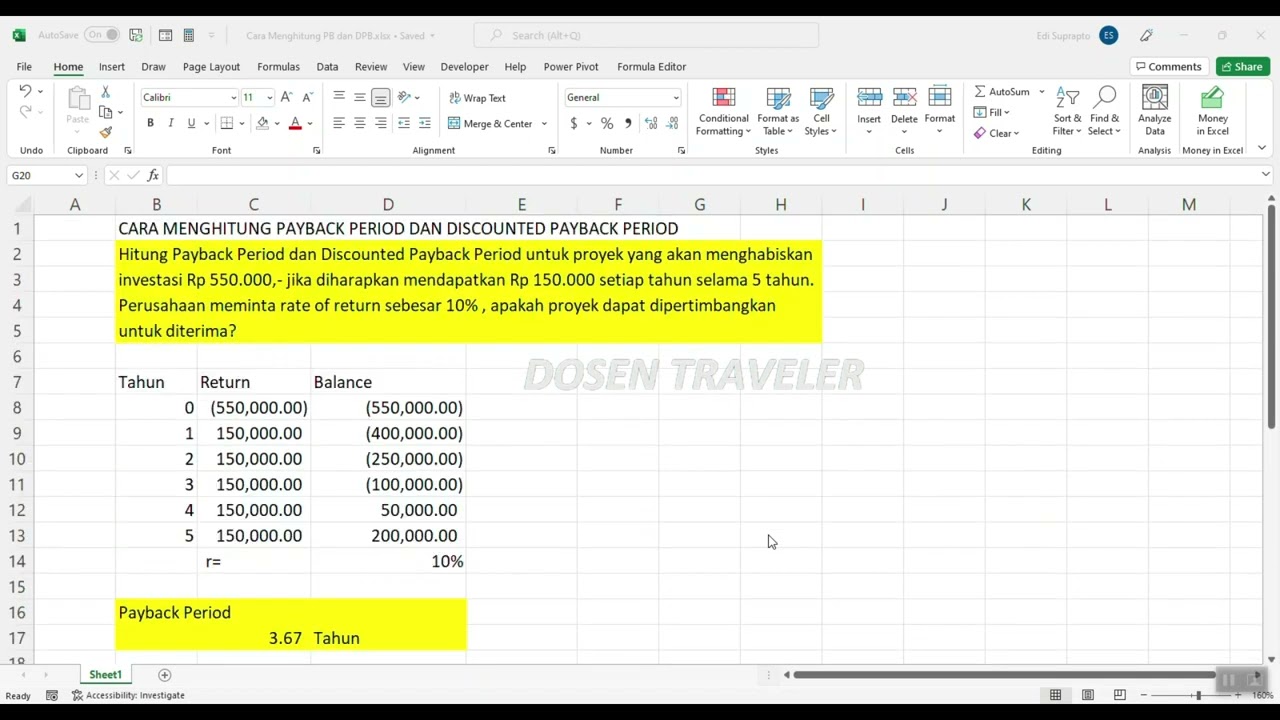

When the cumulative cash flow exceeds the initial investment between two periods, use the following formula to determine the fractional payback period:

- Payback Period = Last Period Before Recovery + ((Initial Investment - Cumulative Cash Flow of Last Period) / Cash Flow in Recovery Period)

For example, if the initial investment is 100,000, the last period's cumulative cash flow is 55,000, and the recovery period’s cash flow is $40,000, the formula would be:

=2 + ((100000 - 55000) / 40000) = 2 + 1.125 = 3.125 years⚠️ Note: Ensure to adjust the periods and amounts based on your actual data.

Step 5: Review and Interpret Your Results

Now that you’ve calculated the payback period:

- Evaluate if the investment is worth pursuing based on the payback period.

- Compare this period with the project’s expected lifespan or other investments’ payback periods.

As we wrap up this guide, remember that the payback period is a simple yet effective tool for initial project screening. It provides a quick snapshot of investment recovery but should be used in conjunction with other financial metrics like Net Present Value (NPV) and Internal Rate of Return (IRR) for a comprehensive analysis. The method detailed here leverages Excel's computational power for an efficient and straightforward calculation. When making decisions, consider how the payback period aligns with your financial goals and the time horizon for your investment.

What if the cash flows are not evenly distributed?

+

If cash flows are uneven, you’ll still follow the same steps. However, you might need to interpolate between periods when the initial investment recovery happens.

Can the payback period be used for all types of investments?

+

The payback period is best suited for comparing similar projects or investments. For investments with varying risk profiles or cash flow patterns, other metrics like NPV and IRR might be more appropriate.

How does inflation affect the payback period calculation?

+

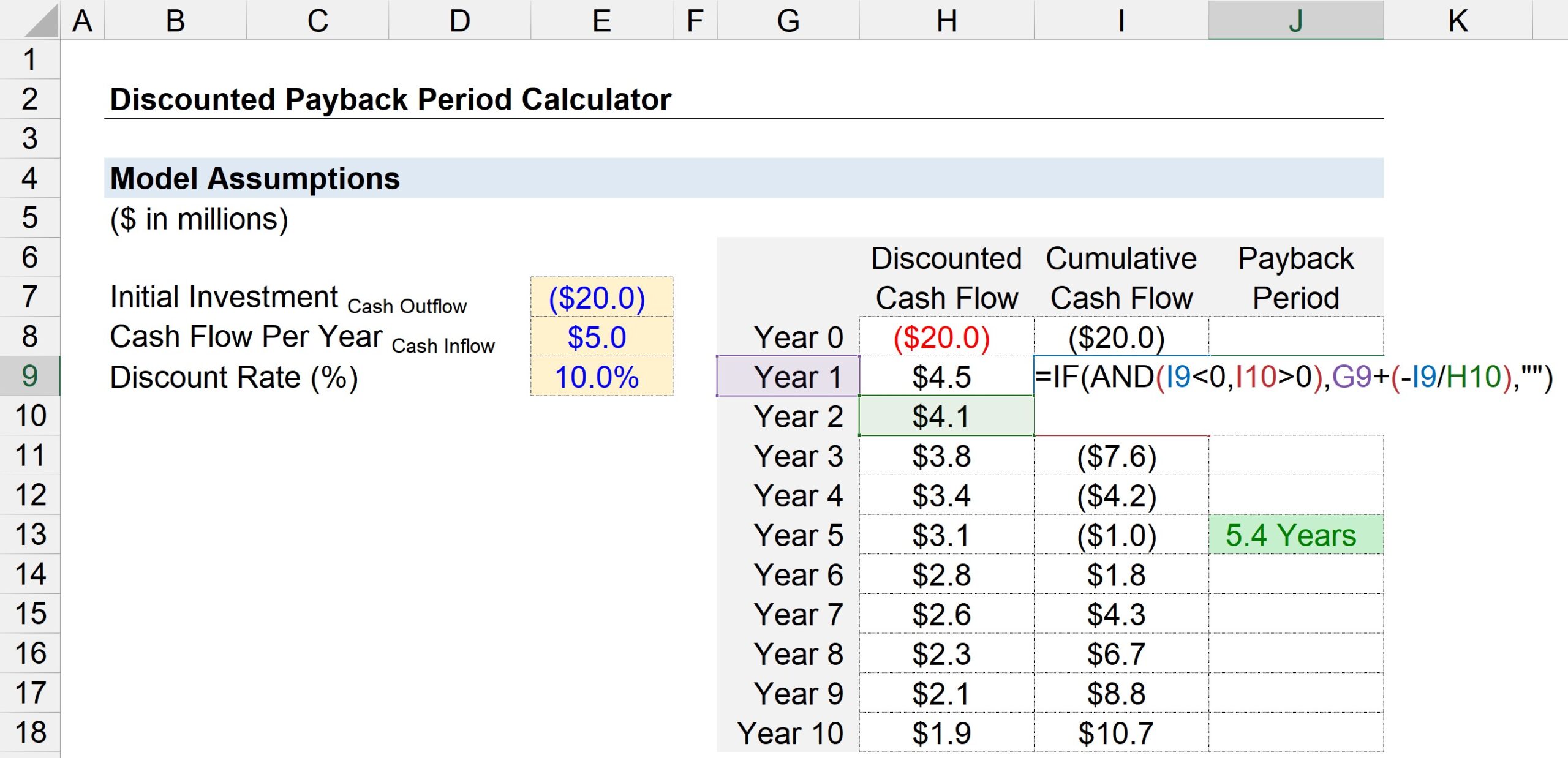

Inflation can skew the payback period. Using real cash flows (adjusted for inflation) or nominal cash flows with an inflation-adjusted discount rate would provide a more accurate picture.

Is there a way to automate the calculation of the payback period in Excel?

+

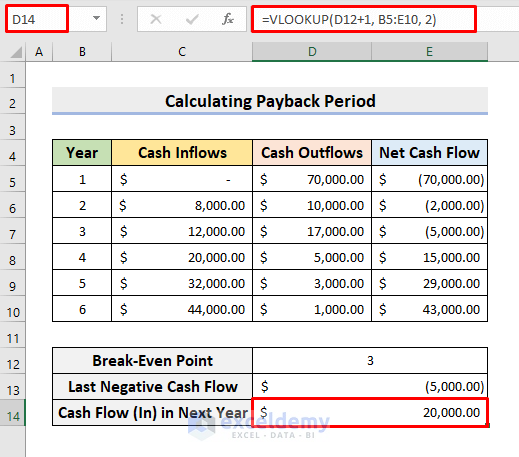

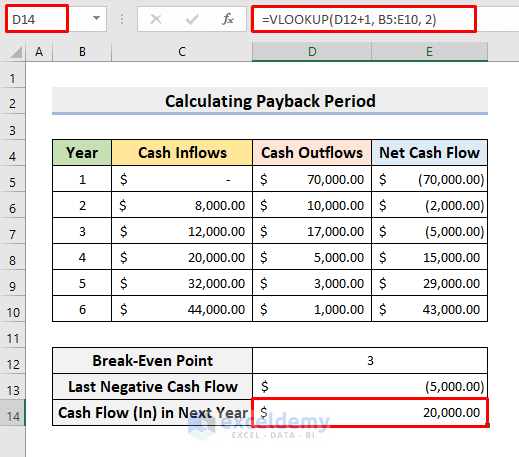

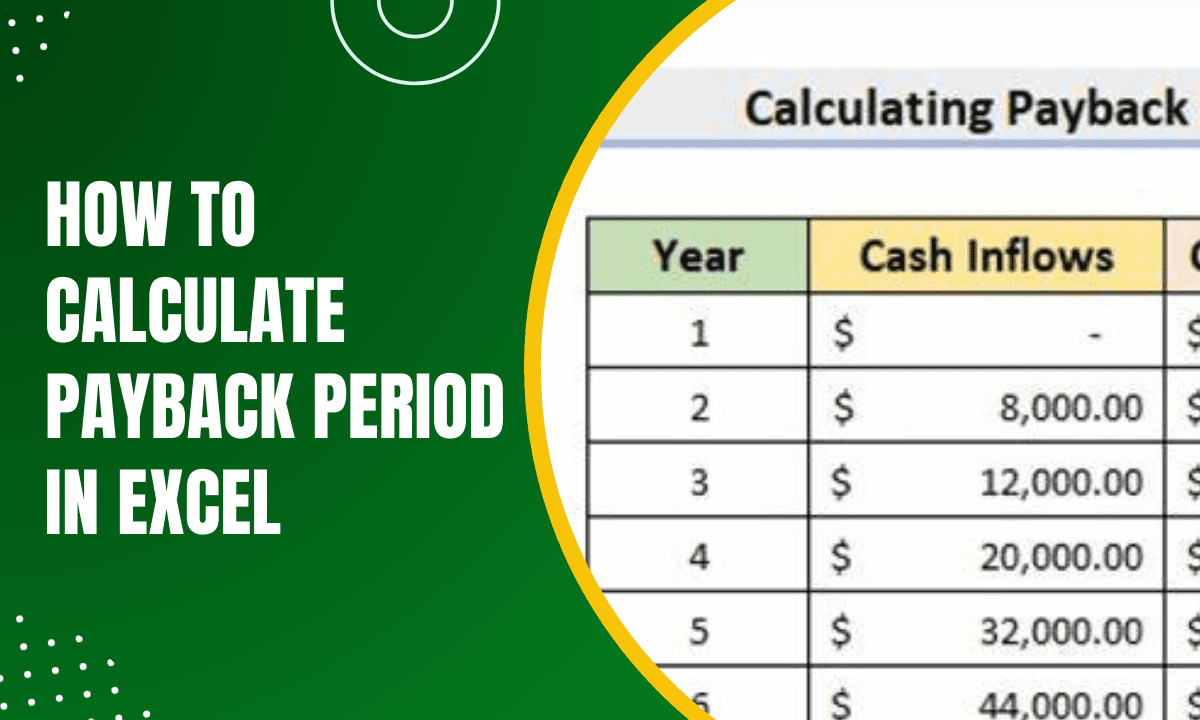

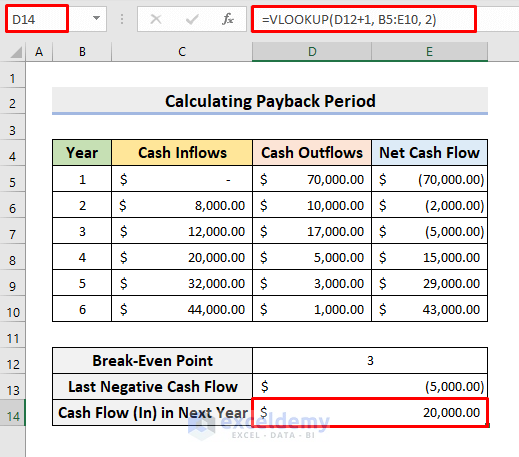

Yes, using functions like VLOOKUP or conditional formatting along with formulas, you can set up Excel to automatically highlight or calculate the payback period once data is entered.

What limitations should I be aware of when using the payback period?

+

The payback period does not consider the time value of money, profitability beyond the recovery period, or changes in project risks over time. It’s more of a liquidity measure than a measure of investment return.