5 Easy Steps to Calculate YoY Growth in Excel

Understanding Year over Year (YoY) growth is essential for businesses and investors looking to evaluate the performance of financial metrics over time. YoY growth provides insight into how a company's performance has improved or declined compared to the same period in the previous year. Excel, with its robust data manipulation capabilities, is an ideal tool for calculating and analyzing this metric. Here are 5 easy steps to calculate YoY growth in Excel:

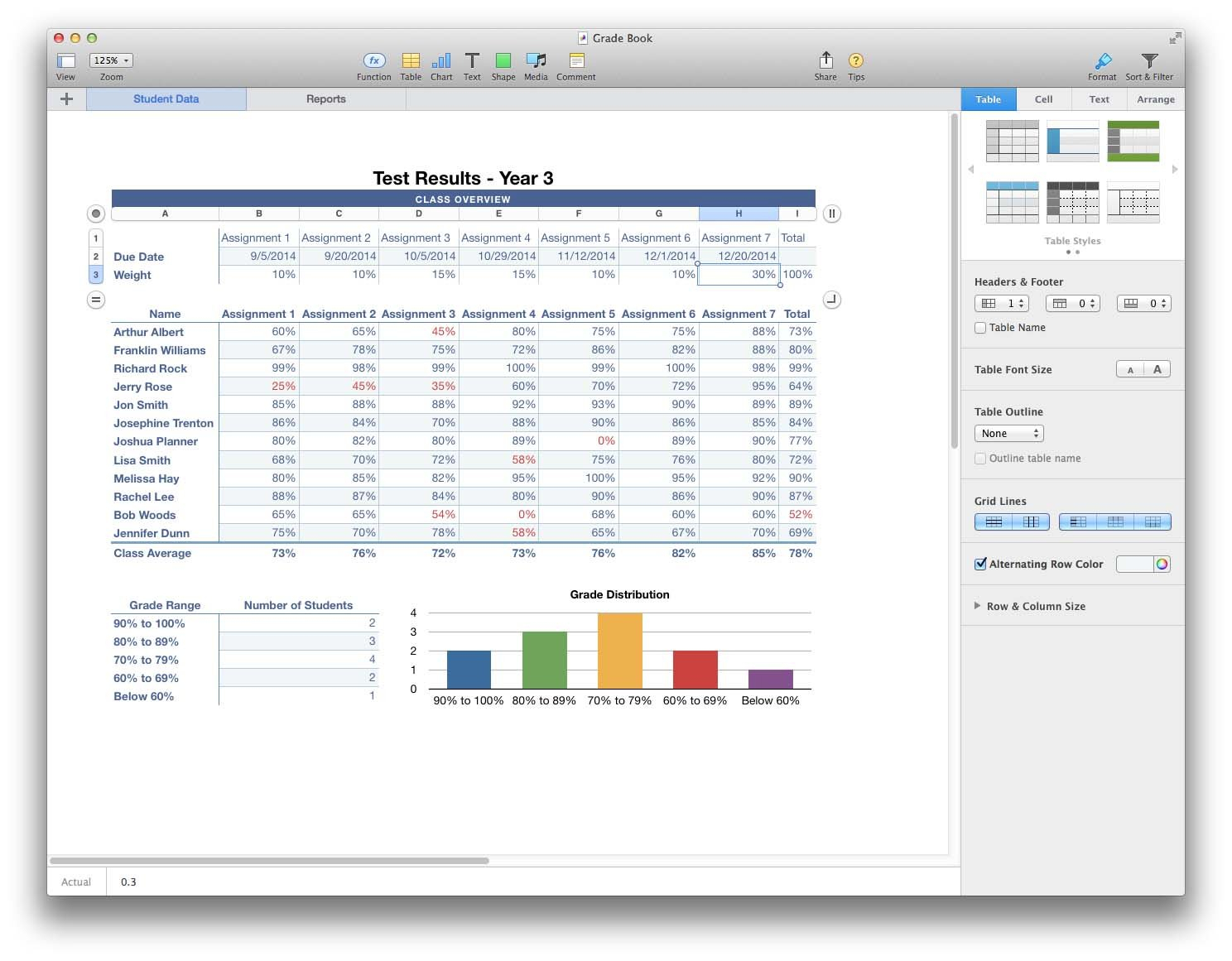

Step 1: Organize Your Data

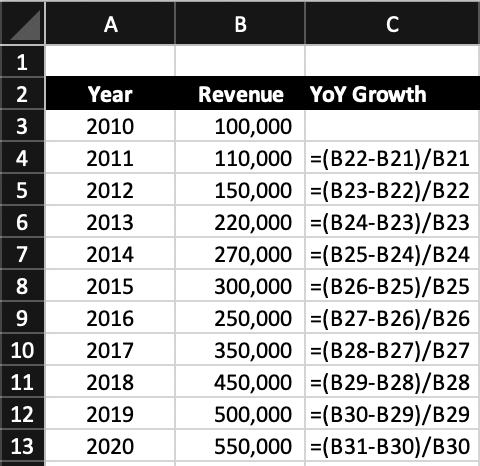

Before you can calculate YoY growth, you need to have your data in order. Here’s how to set it up:

- Create columns for the different periods (years, quarters, months) you want to analyze.

- Include a column for the metric you are analyzing, like revenue, profit, or any other quantitative measure.

📅 Note: Ensure the date format in Excel is correct, as this will affect how you reference data.

Step 2: Enter Your Data

Populate your spreadsheet with the relevant figures:

- Input the data for the metric for the current period and the previous year's same period.

| Year | Metric |

|---|---|

| 2021 | $10,000 |

| 2022 | $12,000 |

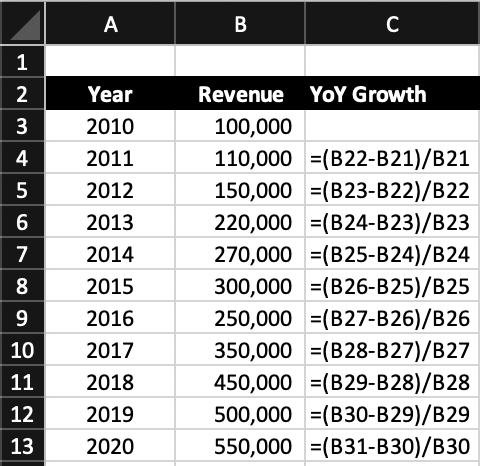

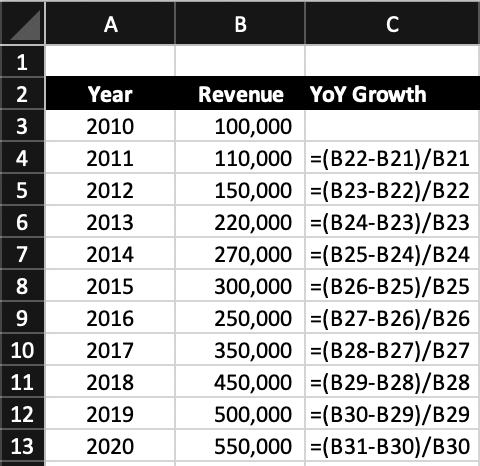

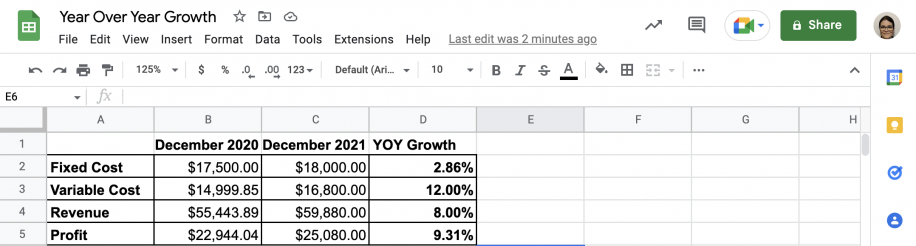

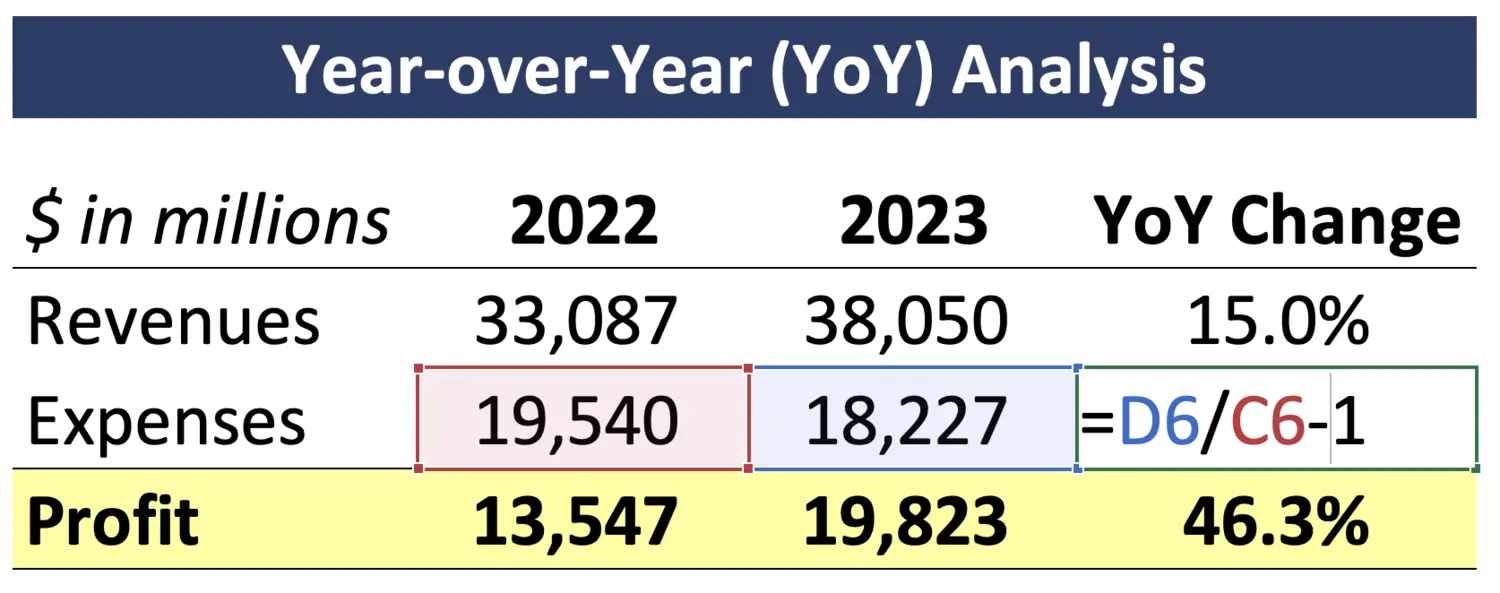

Step 3: Calculate the Growth Rate

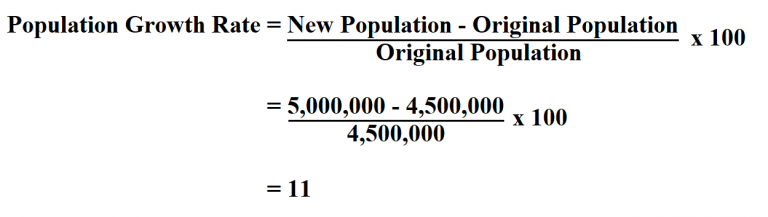

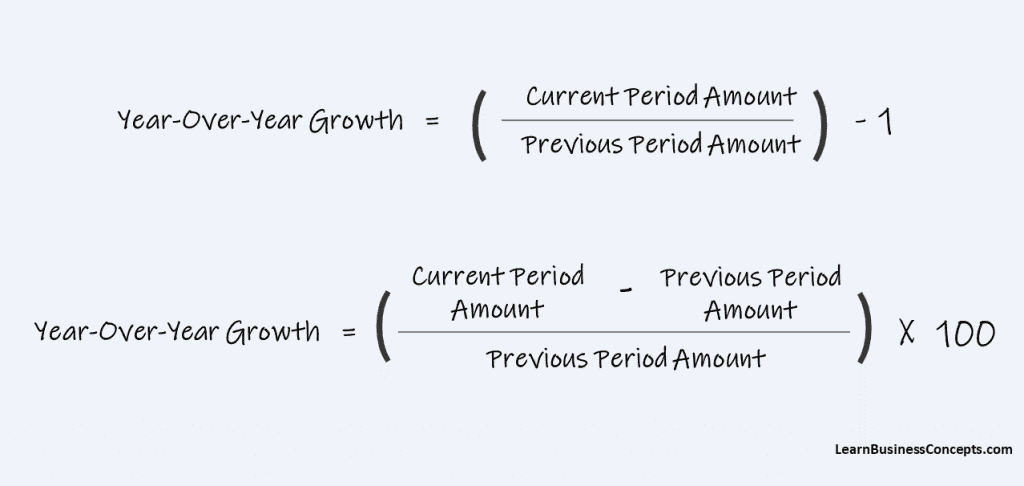

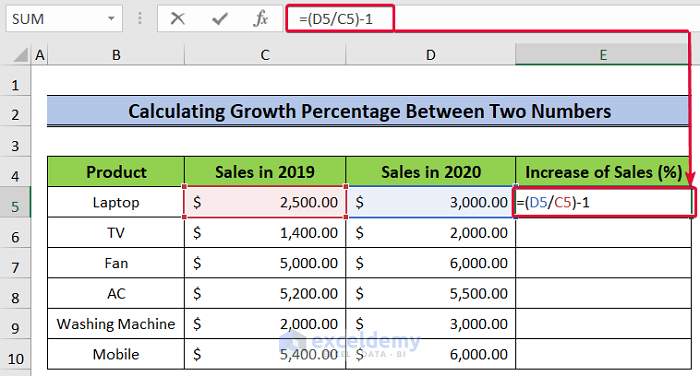

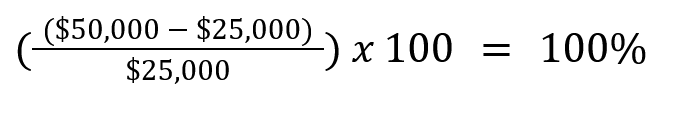

Now, let's calculate the YoY growth rate:

- In a new column, apply the formula to calculate the growth percentage: =(New Value - Previous Value) / Previous Value.

- Multiply the result by 100 to convert it into a percentage.

=((B2-B1)/B1)*100

⚠️ Note: If the previous value is zero, this calculation will result in an error. Handle this scenario by ensuring that the company had revenue in the base year.

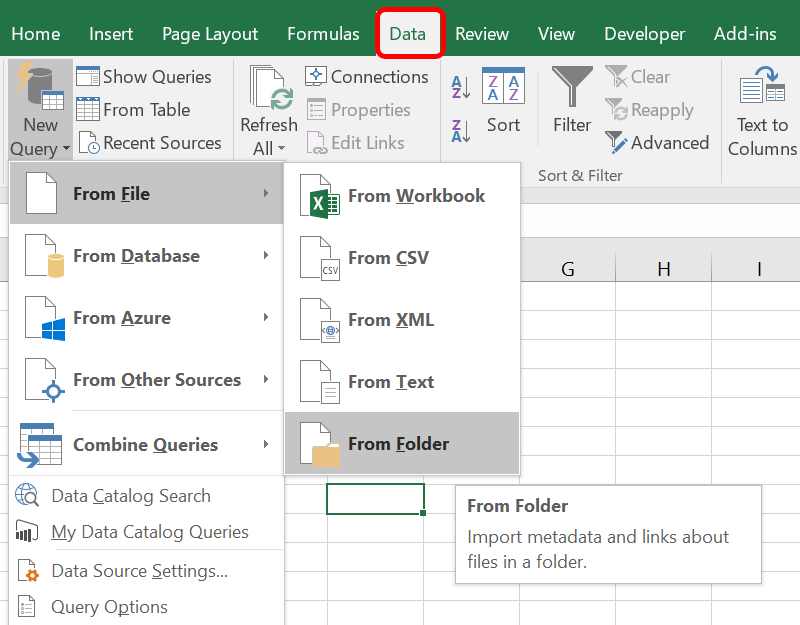

Step 4: Visualize Your Data

To make your YoY growth analysis more impactful:

- Create a chart in Excel to visually represent the growth trend.

Here are some chart types that work well for YoY growth:

- Line Chart: Ideal for showing the trend over time.

- Column Chart: Good for comparing different periods.

Step 5: Analyze and Interpret

After calculating and visualizing the growth:

- Look at the results to identify trends.

- Examine factors that might have contributed to the growth or decline.

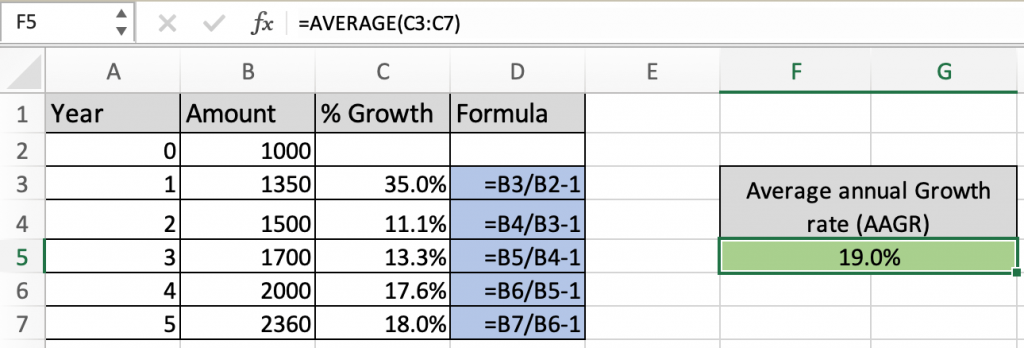

Additional Tips for Enhancing Your Analysis:

- Use conditional formatting to highlight significant changes in growth rates.

- Include average annual growth rates for a broader perspective.

- Consider seasonality effects which can skew YoY growth rates in some industries.

🌡️ Note: Always check for and handle any anomalies in the data, as they can significantly affect your analysis.

By following these steps, you can not only calculate YoY growth in Excel but also gain meaningful insights into your business’s performance, helping with strategic decision-making. If you delve deeper into analyzing the data, you might uncover growth drivers or challenges, enabling you to make informed adjustments to your business strategies.

Why is YoY Growth Important?

+

YoY growth is crucial because it helps remove seasonal variations and provides a clear picture of performance changes over the years. This metric can highlight trends that might not be visible in shorter time frames.

Can YoY Growth be Negative?

+

Yes, YoY growth can be negative, indicating a decline in the metric being analyzed. For example, if revenue in 2022 is less than 2021, the YoY growth would be negative, suggesting a loss or decrease in business performance.

How Often Should YoY Growth be Calculated?

+

YoY growth is most commonly calculated quarterly or annually. However, depending on your business needs, you could calculate it monthly or even weekly, keeping in mind that shorter time frames can introduce more volatility into your data.