5 Easy Steps to Create a Balance Sheet in Excel

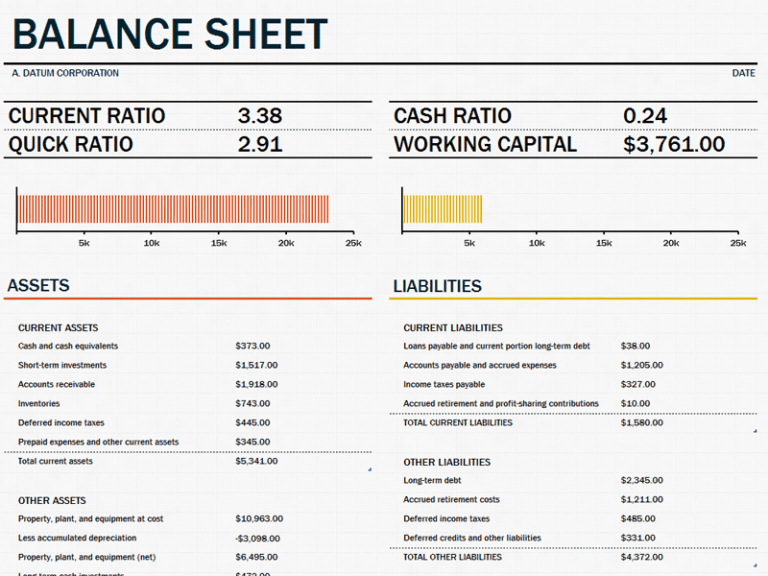

Understanding your company's financial health is vital in the business world. A balance sheet serves as a fundamental tool for this purpose, providing a snapshot of a company's financial position at a specific point in time. This document displays assets, liabilities, and equity, allowing for a clear view of what the business owns, owes, and the residual interest of shareholders. With Microsoft Excel's intuitive features, creating a balance sheet is straightforward, even for those new to accounting. Let's walk through the process in five easy steps.

Step 1: Plan Your Layout

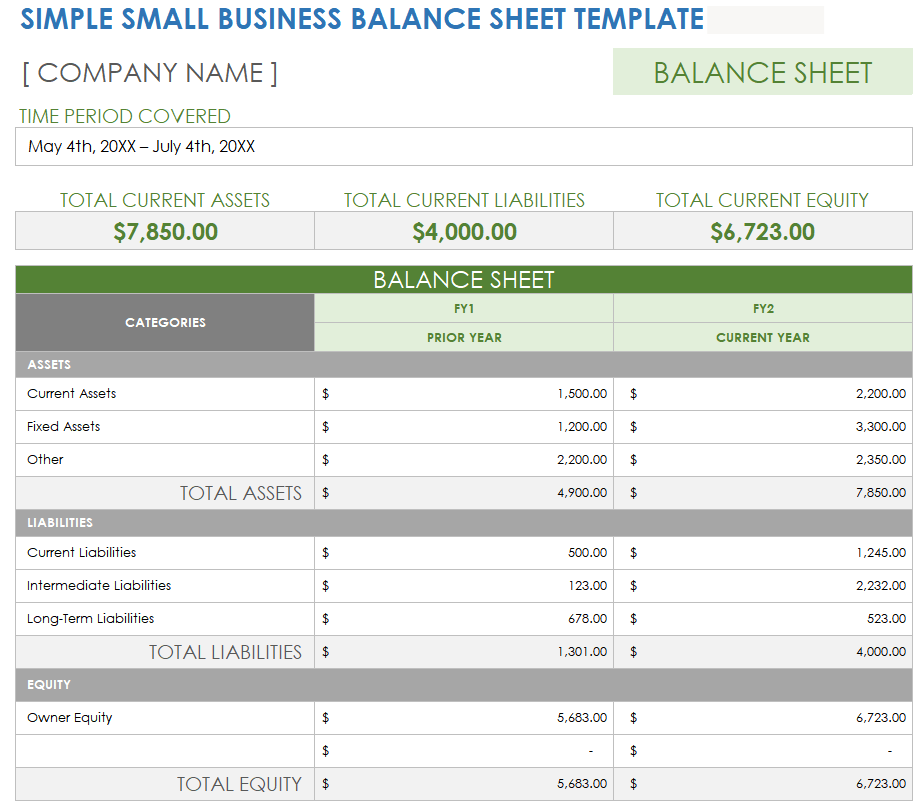

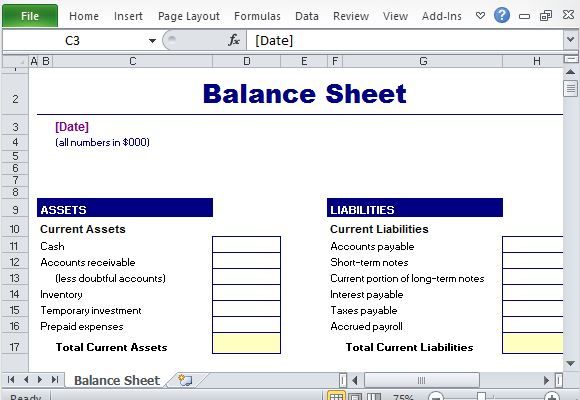

- Decide if your balance sheet will be vertical or horizontal. Traditional formats are vertical, but some prefer a horizontal layout for clarity.

- Determine the sections: Assets, Liabilities, and Equity. Each section will have its subsections.

- Plan for headers, footers, and perhaps a section for the company's name, date, and title.

💡 Note: A well-planned layout enhances readability and can prevent errors in data entry.

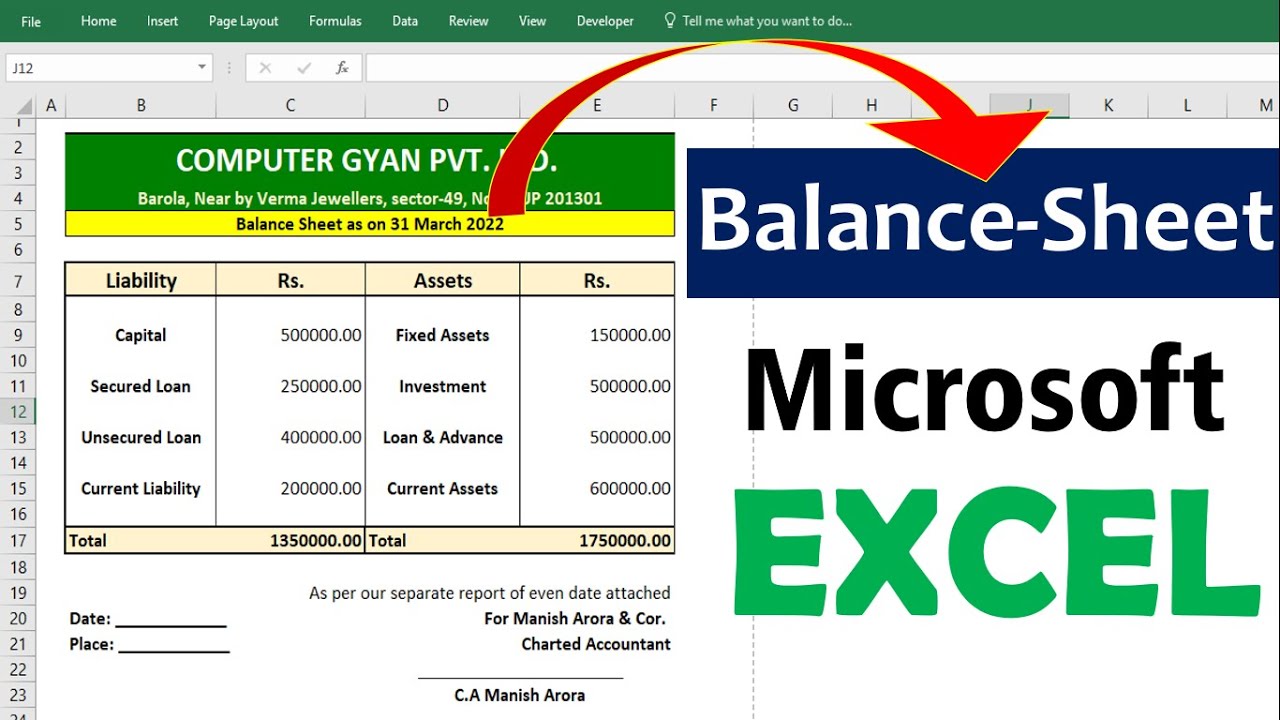

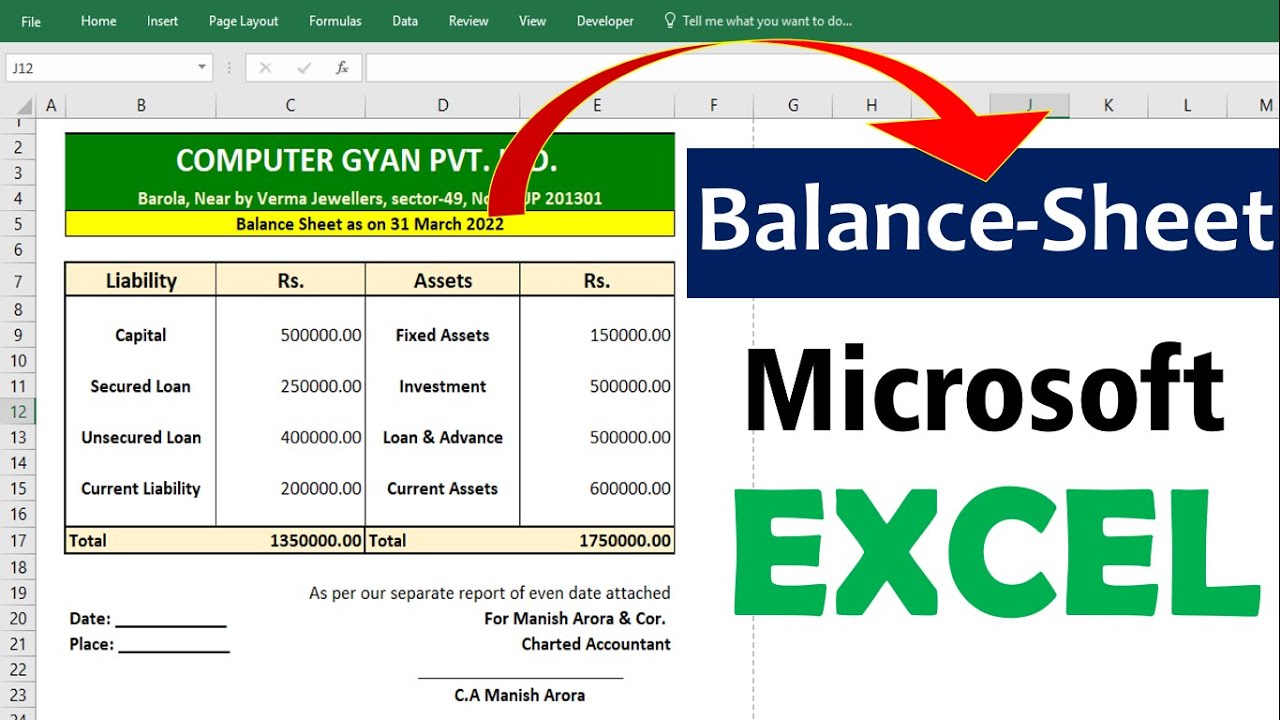

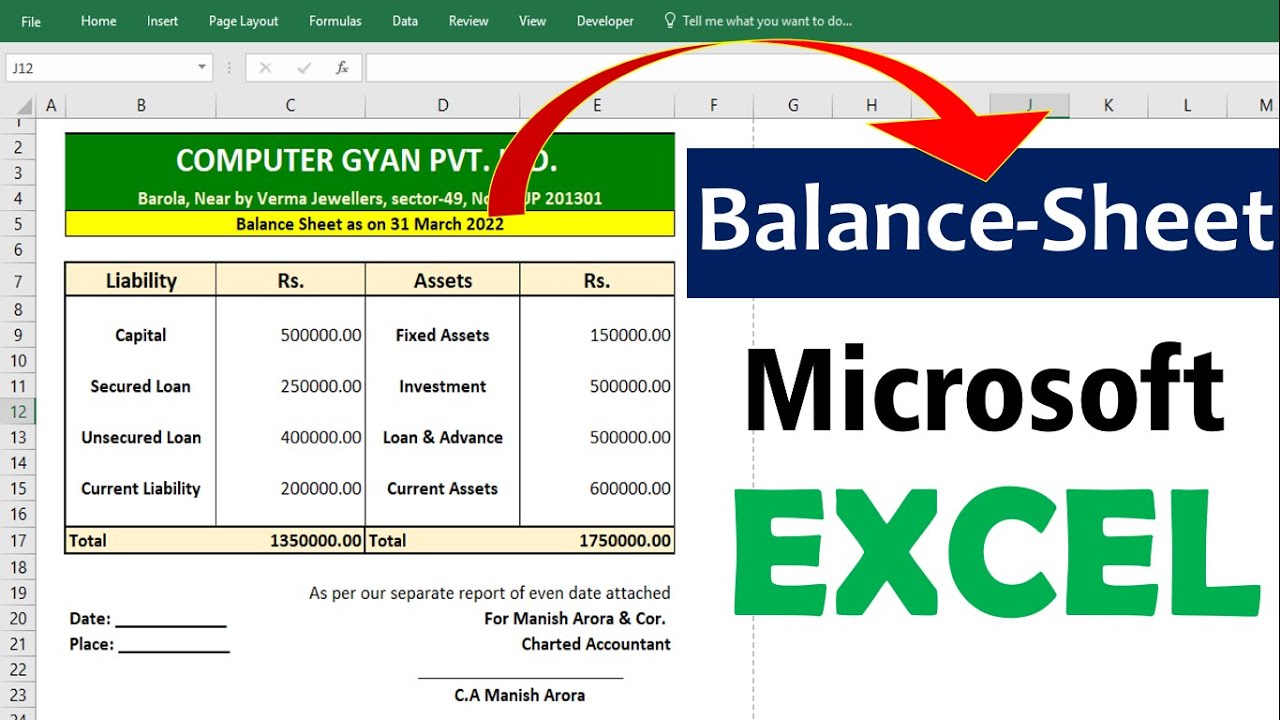

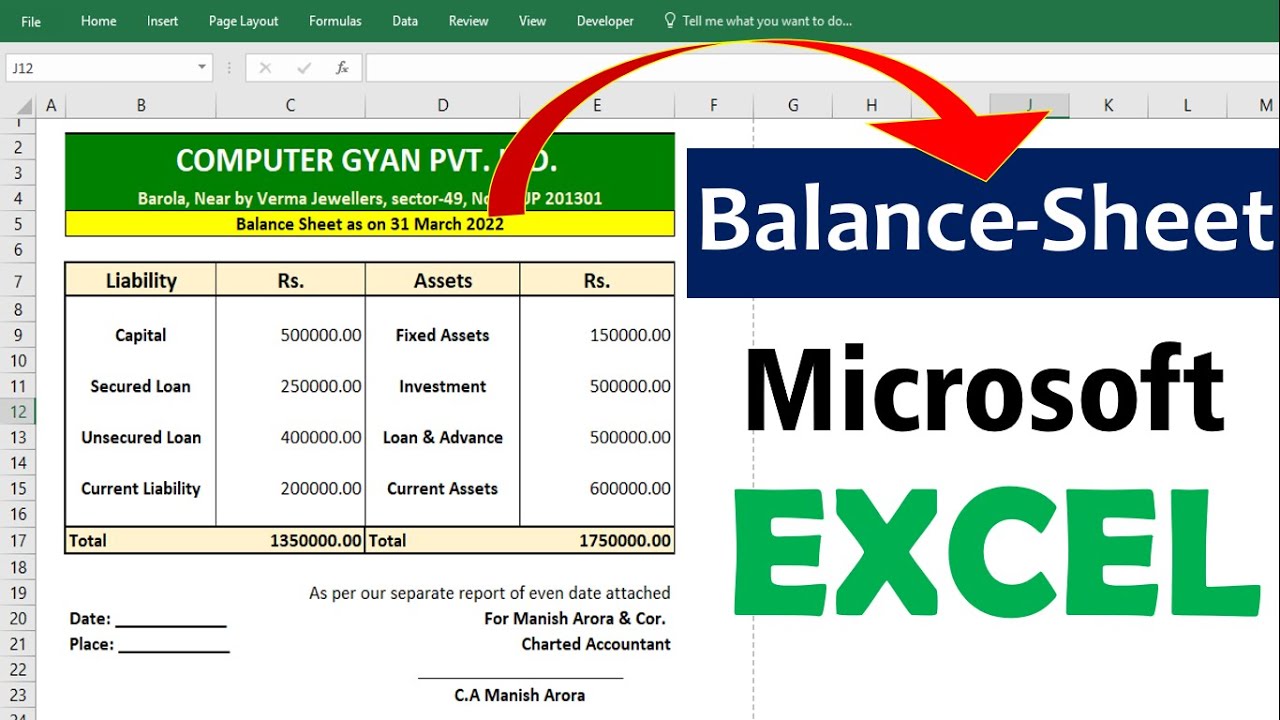

Step 2: Set Up the Spreadsheet

Open Excel and set up your document:

- Start with the company name at the top, followed by the balance sheet's title.

- Under the title, add the date for which the balance sheet applies.

- Create three main headings: Assets, Liabilities, and Equity.

| Section | Subsection |

|---|---|

| Assets | Current Assets |

| Non-Current Assets | |

| Intangible Assets | |

| Liabilities | Current Liabilities |

| Long-Term Liabilities | |

| Equity |

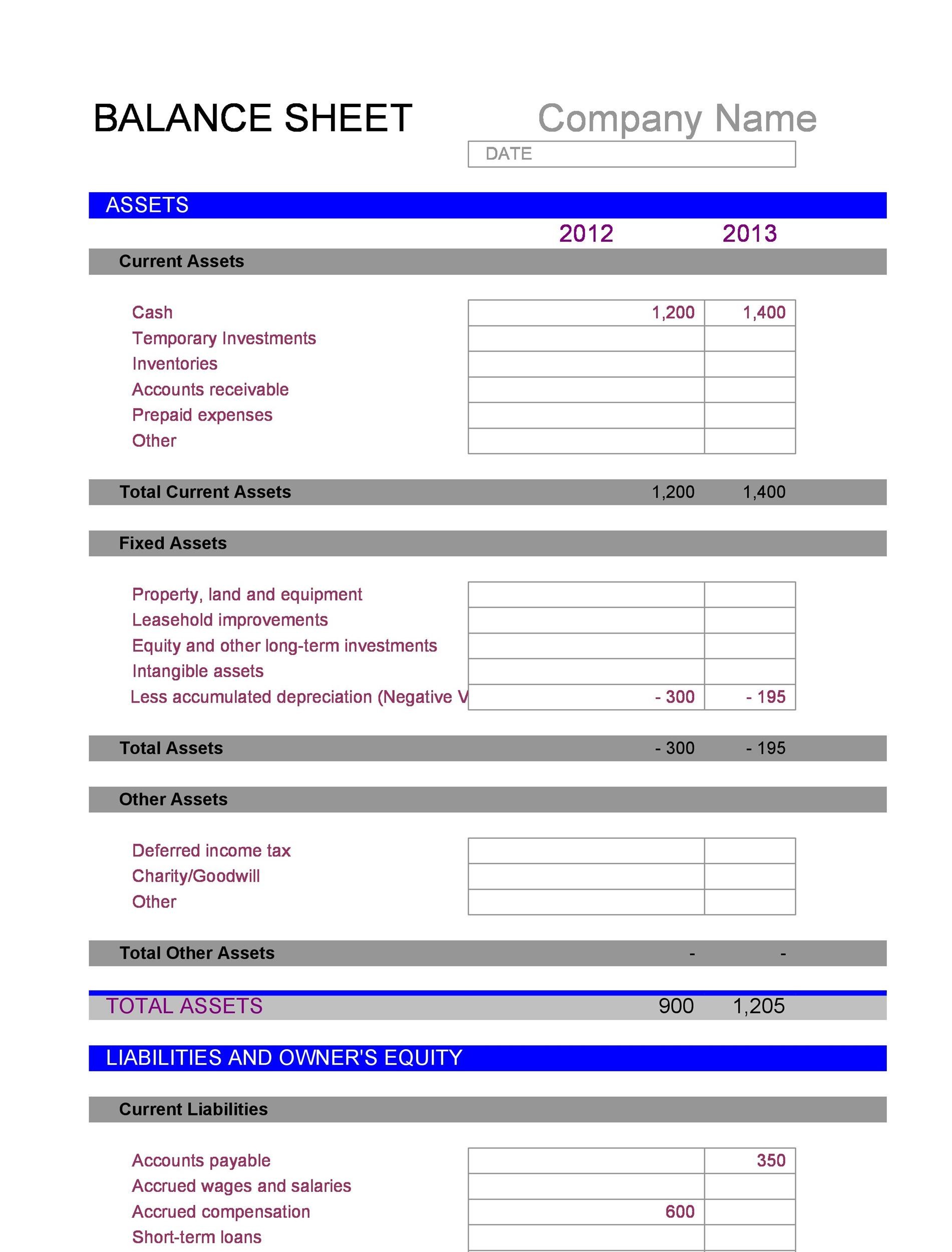

Step 3: Input Your Data

Now, input your financial data into the relevant sections:

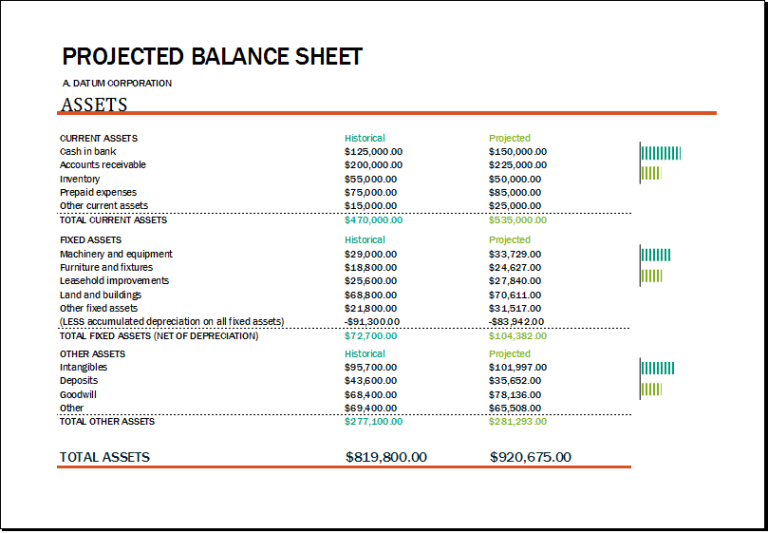

- Assets: List and categorize all your company's assets. Use columns for labeling and entering values. For example:

- Cash

- Accounts Receivable

- Inventory

- Property, Plant, and Equipment

- Liabilities: Detail all debts and obligations. Examples include:

- Accounts Payable

- Notes Payable

- Long-Term Debt

- Equity: Calculate and enter the owner's equity. This includes:

- Common Stock

- Retained Earnings

- Dividends Paid

Ensure to double-check your entries for accuracy.

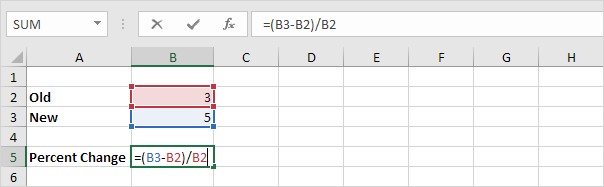

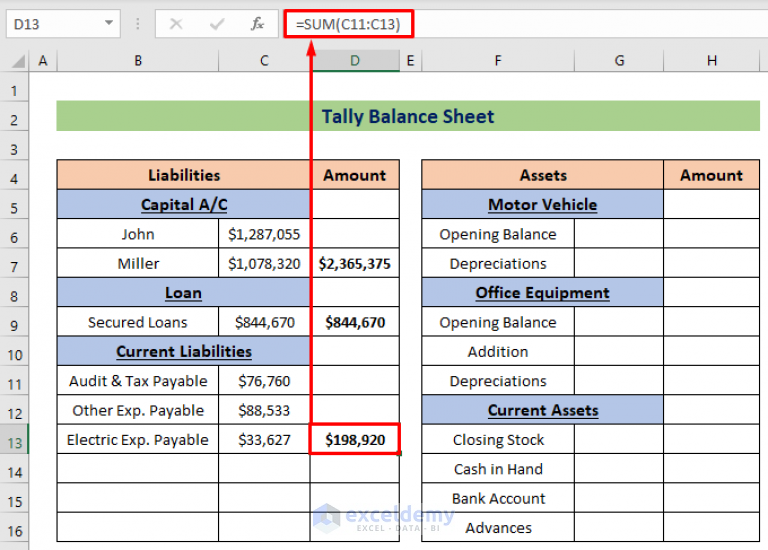

Step 4: Calculate Totals

Once you've entered all the data, calculate the totals for each section:

- Sum up the values under each category of Assets, Liabilities, and Equity.

- Use Excel's

SUM()function to add up numbers. - Verify that your equation Total Assets = Total Liabilities + Total Equity holds true.

🔍 Note: If the equation does not balance, review your entries for any errors or missing data.

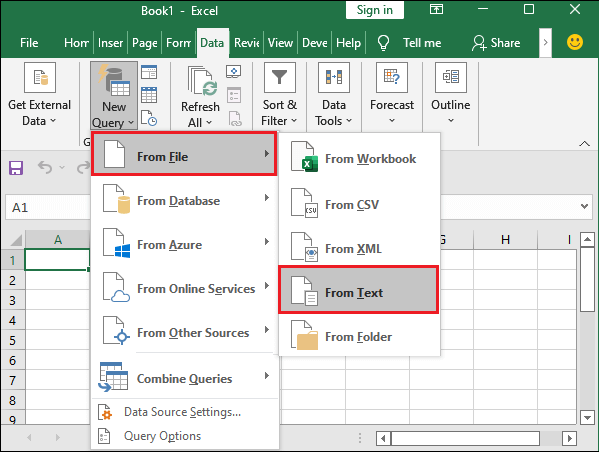

Step 5: Formatting and Analysis

Excel offers tools to make your balance sheet visually appealing and informative:

- Formatting:

- Use

CTRL + 1to open the formatting options where you can choose fonts, colors, and cell styles. - Apply borders to clearly define sections.

- Use

- Analysis:

- Add conditional formatting to highlight key figures, like cells with negative values.

- Insert formulas or charts to analyze trends, ratios, or financial ratios like current ratio, debt-to-equity ratio, etc.

Creating a balance sheet in Excel is more than just a financial exercise; it's about gaining insights into your company's financial health. By meticulously planning the layout, inputting data accurately, and using Excel's analytical tools, you provide a clear picture to stakeholders, investors, and yourself about where your business stands financially. Remember, a well-prepared balance sheet is not only a reflection of past and present financial activities but also a guide for future financial decisions.

Why should I use Excel to create a balance sheet?

+

Excel allows for dynamic updates, easy data manipulation, and provides various tools for analysis. It’s widely used due to its accessibility, familiarity, and the ability to integrate with other software for financial management.

Can I use other software besides Excel for creating a balance sheet?

+

Absolutely! Software like Google Sheets, QuickBooks, or specialized accounting software can also be used to create balance sheets, each with its own set of features and capabilities.

How often should a balance sheet be prepared?

+

While balance sheets can be prepared at any time, they are typically done at the end of each accounting period, often monthly, quarterly, or annually for reporting purposes.