3 Simple Ways to Calculate Payback Period in Excel

Unlock the secrets of investment analysis with Excel, a tool not only for tabulation but also a powerful ally for financial decision-making. Today, we delve into a critical financial metric—the payback period—and how you can effortlessly calculate it using Microsoft Excel. Whether you're a budding entrepreneur, a financial analyst, or simply someone interested in personal finance, understanding the payback period can provide invaluable insights into the financial health and feasibility of your projects or investments. Let's explore three simple methods to compute the payback period in Excel, ensuring you're equipped with the knowledge to make informed financial choices.

Understanding Payback Period

Before we dive into the Excel methods, let’s clarify what the payback period signifies:

- It represents the time it takes for an investment to generate enough cash flows to recover the initial outlay.

- It’s a straightforward measure of an investment’s liquidity and risk, favoring shorter payback periods for investments.

💡 Note: While useful, the payback period doesn’t account for the time value of money, which means it might overlook profitability over the long term.

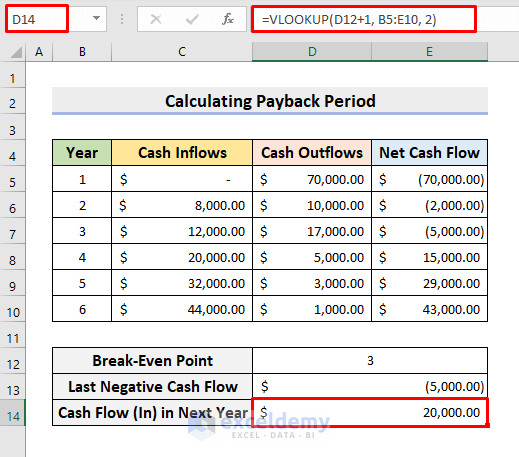

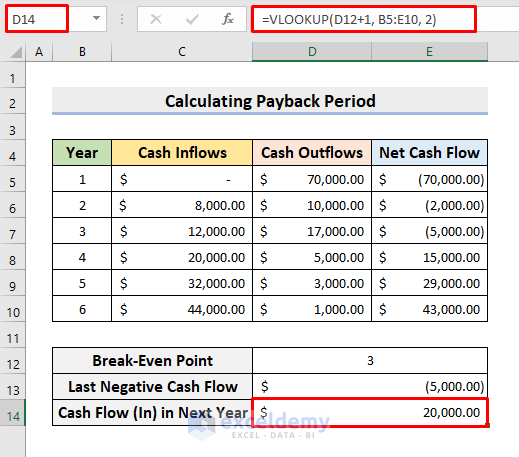

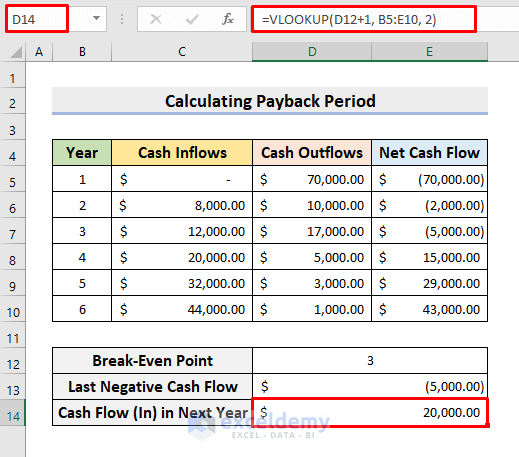

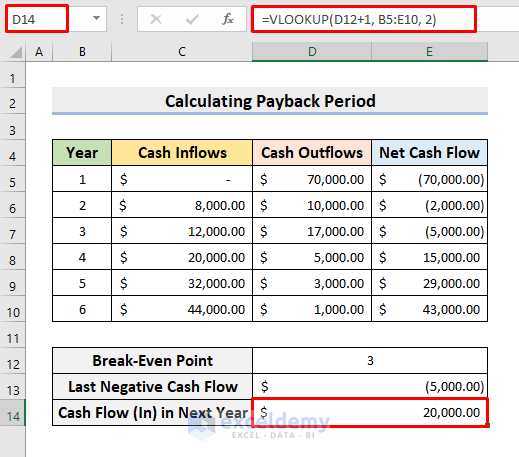

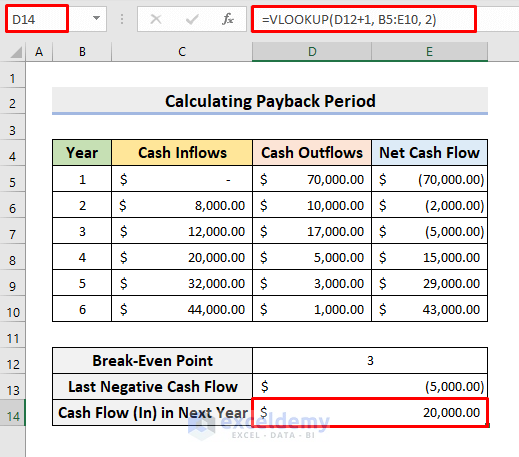

Method 1: Manual Calculation

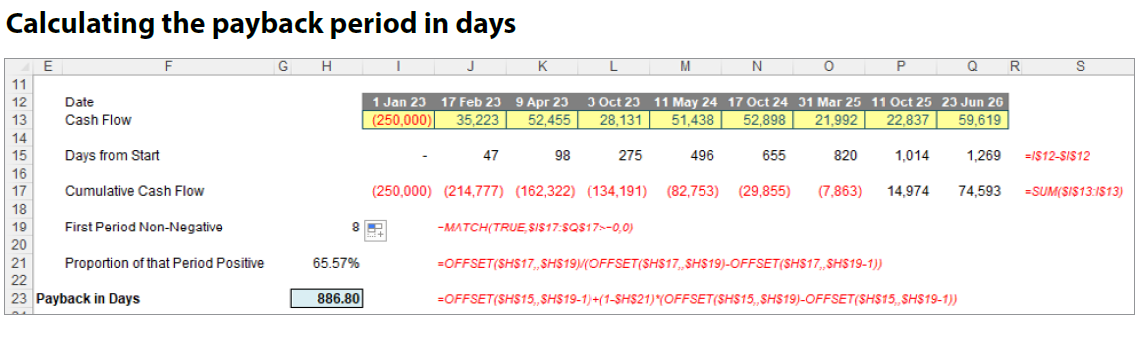

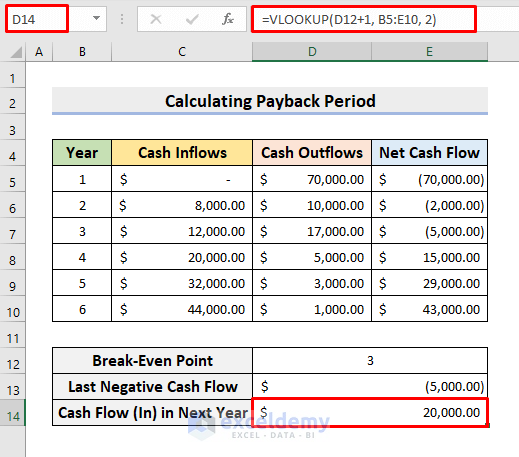

The simplest way to calculate the payback period manually involves:

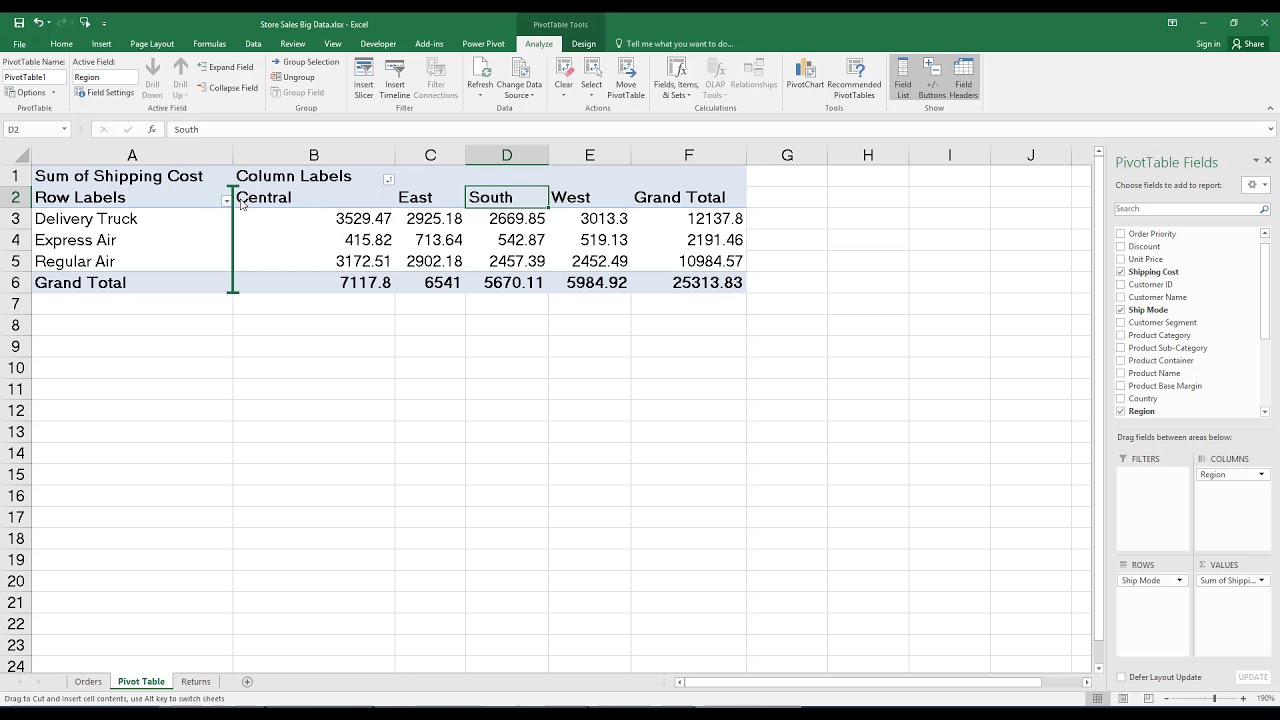

- Setting up a table with:

Year Cash Inflow Cumulative Cash Flow 0 -Initial Investment -Initial Investment 1 Year 1 Cash Inflow Year 1 Cash Inflow - Initial Investment … … …

- Calculate the cumulative cash flows year by year until it turns positive.

- The year in which the cumulative cash flow becomes positive indicates the full recovery of the initial investment.

- For fractional recovery, interpolate the data between the last negative and first positive cumulative cash flows.

Here’s how to manually calculate in Excel:

- Input the cash flows in a column (B).

- Calculate cumulative cash flows in an adjacent column © using the formula:

=B2for the first year, then=C2+B3for the next, etc. - Identify the year when cumulative cash flow becomes positive.

- Calculate the partial year payback if applicable with:

=FLOOR(ABS(MIN(IF(C:C<0,C:C)))/CUMIPMT(rate, nper, pv, start_period, end_period, type)).

🧮 Note: This method works best for investments with uniform cash flows, allowing for a simple division of the negative cumulative cash flow by the next positive cash flow to find the fractional year.

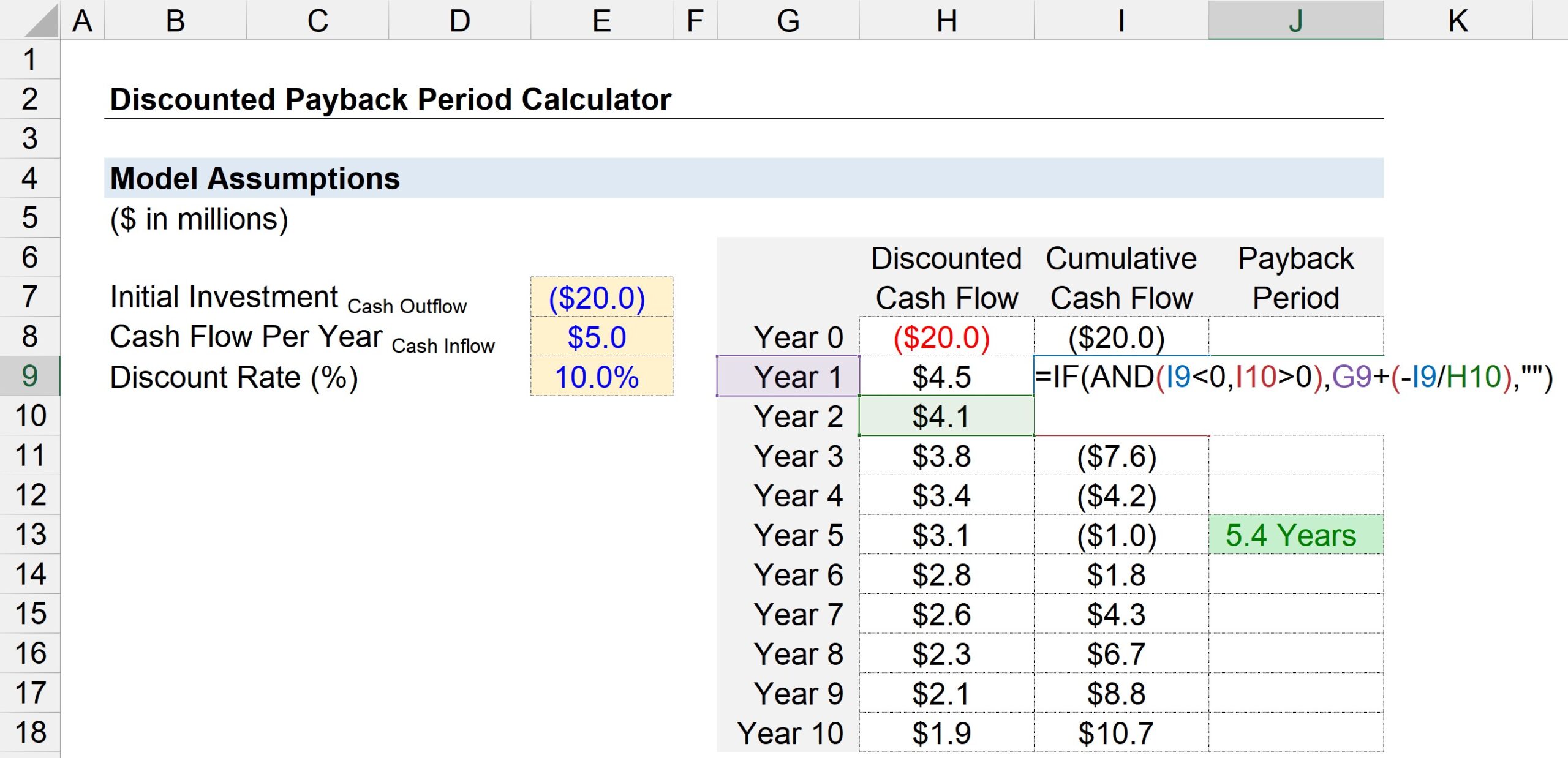

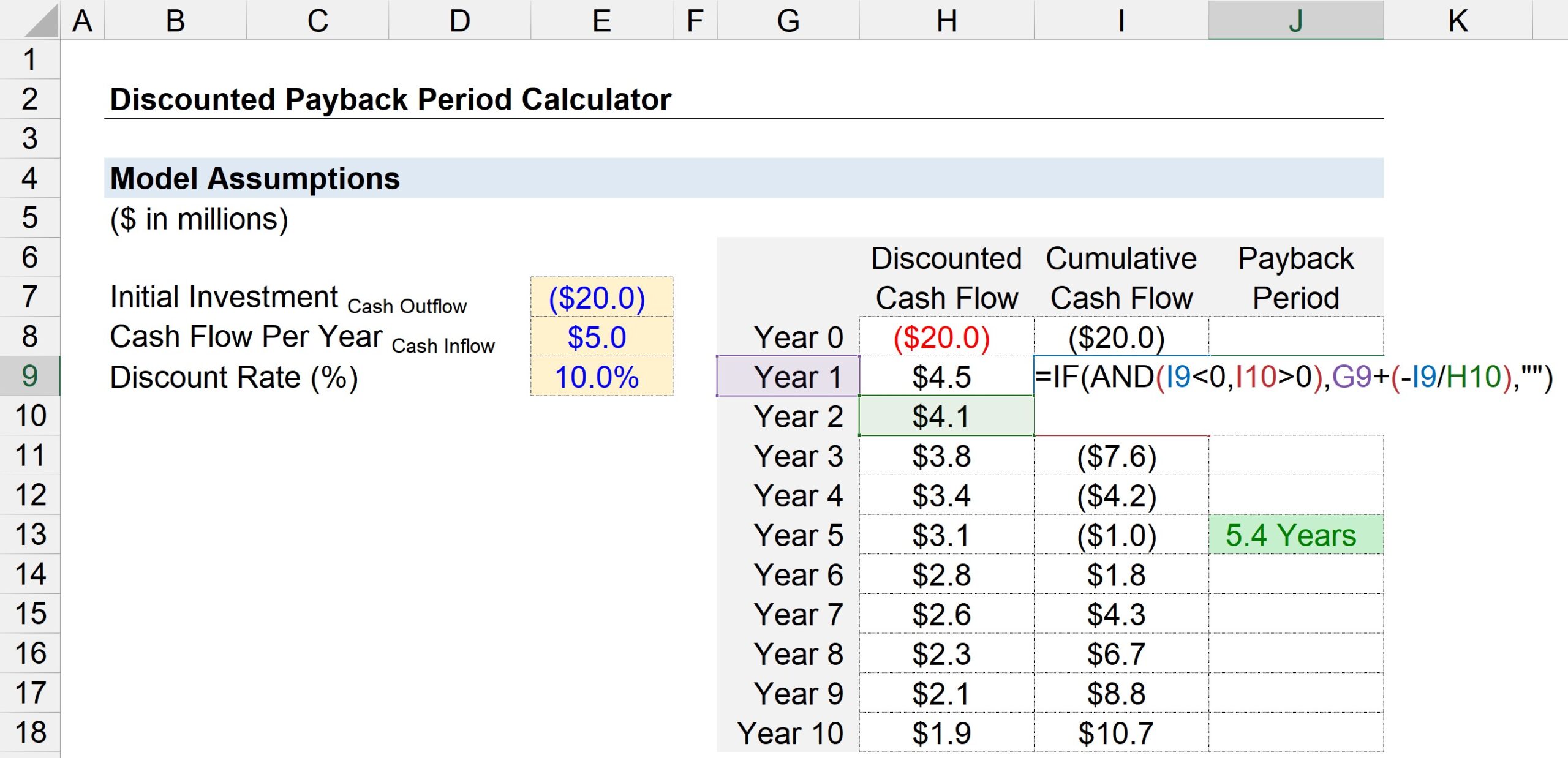

Method 2: Using Excel’s Financial Functions

For a more advanced calculation using Excel’s built-in financial functions:

- Use the

NPEVfunction to compute the Net Present Value (NPV) of cash flows. - Combine

CUMIPMTorCUMPRINCfunctions withNPEVto approximate the payback period.

The formula could look like this:

=IF(NPV(discount_rate, cash_flows_range)=0,

“Investment Recovers in Initial Year”,

FLOOR(ABS(NPV(discount_rate, cash_flows_range)/CUMIPMT(discount_rate, years, -initial_investment, year_before_break_even, year_of_break_even, 0))))This formula provides a quick estimation but might not be precise in all scenarios due to the assumptions it makes.

Method 3: Creating a Custom Function with VBA

For the utmost flexibility and accuracy, you can create a custom VBA function:

- Go to Excel, press

Alt+F11to open the Visual Basic Editor. - Insert a new module and write the following VBA function:

Function PaybackPeriod(initialInvestment As Double, cashFlows As Range) As Double

Dim cumulativeCashFlow As Double

Dim period As Integer

cumulativeCashFlow = -initialInvestment

For period = 1 To cashFlows.Count

cumulativeCashFlow = cumulativeCashFlow + cashFlows.Cells(period).Value

If cumulativeCashFlow >= 0 Then

PaybackPeriod = period - 1 + (initialInvestment - cumulativeCashFlow) / cashFlows.Cells(period).Value

Exit Function

End If

Next period

PaybackPeriod = -1 'Indicate that the investment never recovers the initial outlay

End Function

- Save the function and use it in your worksheet as:

=PaybackPeriod(A1,B2:B11).

This method allows for more complex calculations, offering a highly customized payback period analysis.

🛠️ Note: VBA functions require some knowledge of programming but offer unparalleled flexibility in financial modeling.

Wrapping Up

Calculating the payback period in Excel isn’t just about crunching numbers; it’s about gaining insight into the viability and risk of investments. Whether you’re manually computing, using Excel’s financial functions, or crafting a custom VBA function, each method has its unique benefits. The choice depends on your comfort level with Excel and the depth of analysis you need. Armed with these tools, you can now evaluate investments with a clearer perspective, ensuring that you maximize returns and manage risk effectively. As you embark on your financial journey, remember that the payback period, while simple, offers a window into the short-term financial health of an investment, guiding your decisions towards stability and growth.

What is the significance of the payback period?

+

The payback period is significant because it provides a measure of how quickly an investment can recoup its initial cost, offering insights into its liquidity and risk.

Can the payback period be negative?

+

The payback period cannot be negative. If cash flows never recover the initial investment, then it’s often indicated as a negative value or an indefinite period.

How does the payback period differ from ROI?

+

Return on Investment (ROI) measures the efficiency of an investment by comparing the gain from the investment to its cost, whereas the payback period calculates how long it will take for the initial investment to be recovered through net cash inflows.