Kentucky Tobacco Tax Excel Template Guide

Discovering the intricacies of Kentucky tobacco tax can be daunting, especially when you're managing a business that involves selling these products. This guide aims to provide you with a comprehensive Kentucky Tobacco Tax Excel Template to streamline your tax calculations and compliance processes, ensuring you're well-equipped to handle this aspect of your operations efficiently.

Understanding Kentucky Tobacco Tax

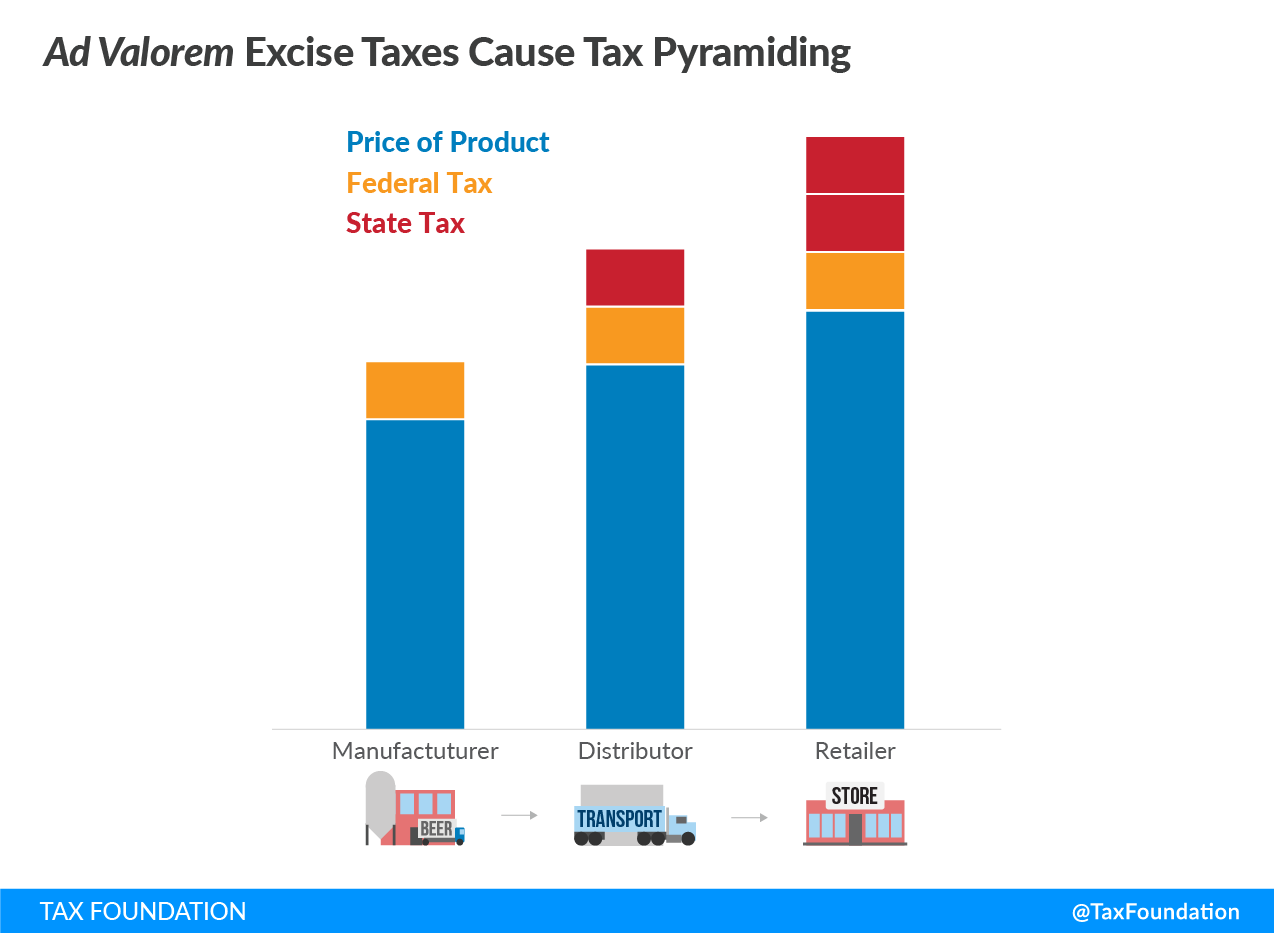

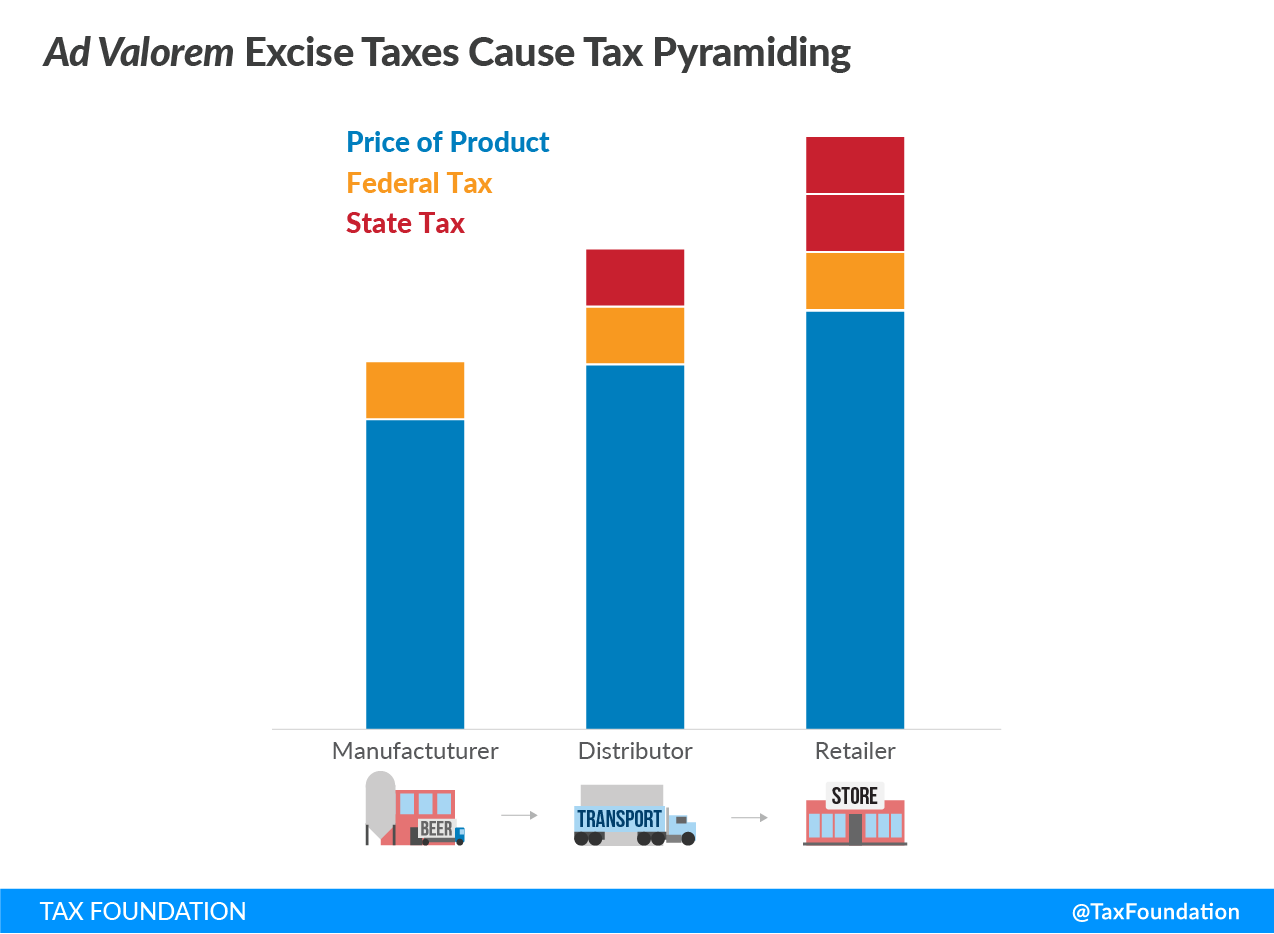

Kentucky imposes various taxes on tobacco products, including excise tax, use tax, and occasionally sales tax. Here’s a breakdown:

- Excise Tax: Kentucky levies an excise tax on all cigarettes, little cigars, and pipe tobacco. The rate varies:

- Cigarettes: 0.03 per cigarette or 0.60 per pack of 20.

- Little Cigars: Same rate as cigarettes if less than 3 pounds per 1,000 cigars.

- Pipe Tobacco: 12.5 cents per ounce.

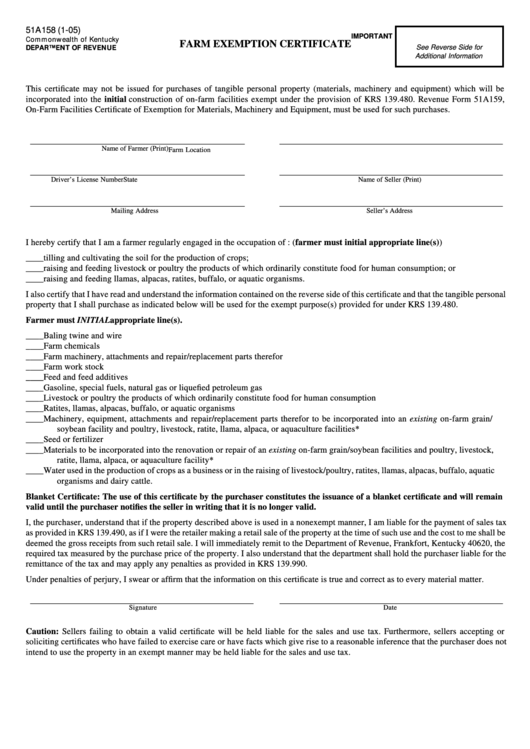

- Use Tax: This tax applies to tobacco products brought into Kentucky for personal use.

- Sales Tax: While primarily a retail sales tax, it can apply to tobacco products in certain contexts.

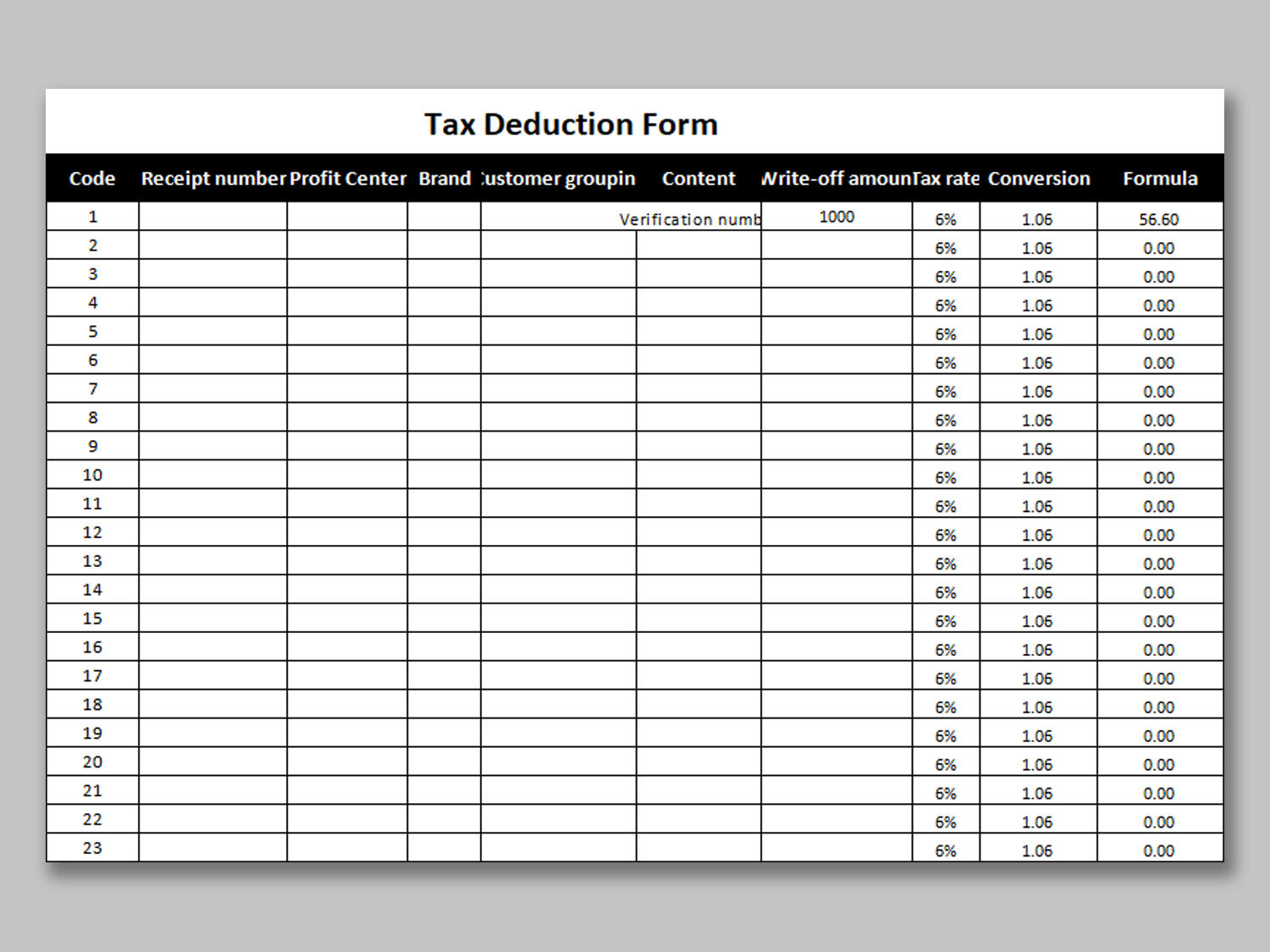

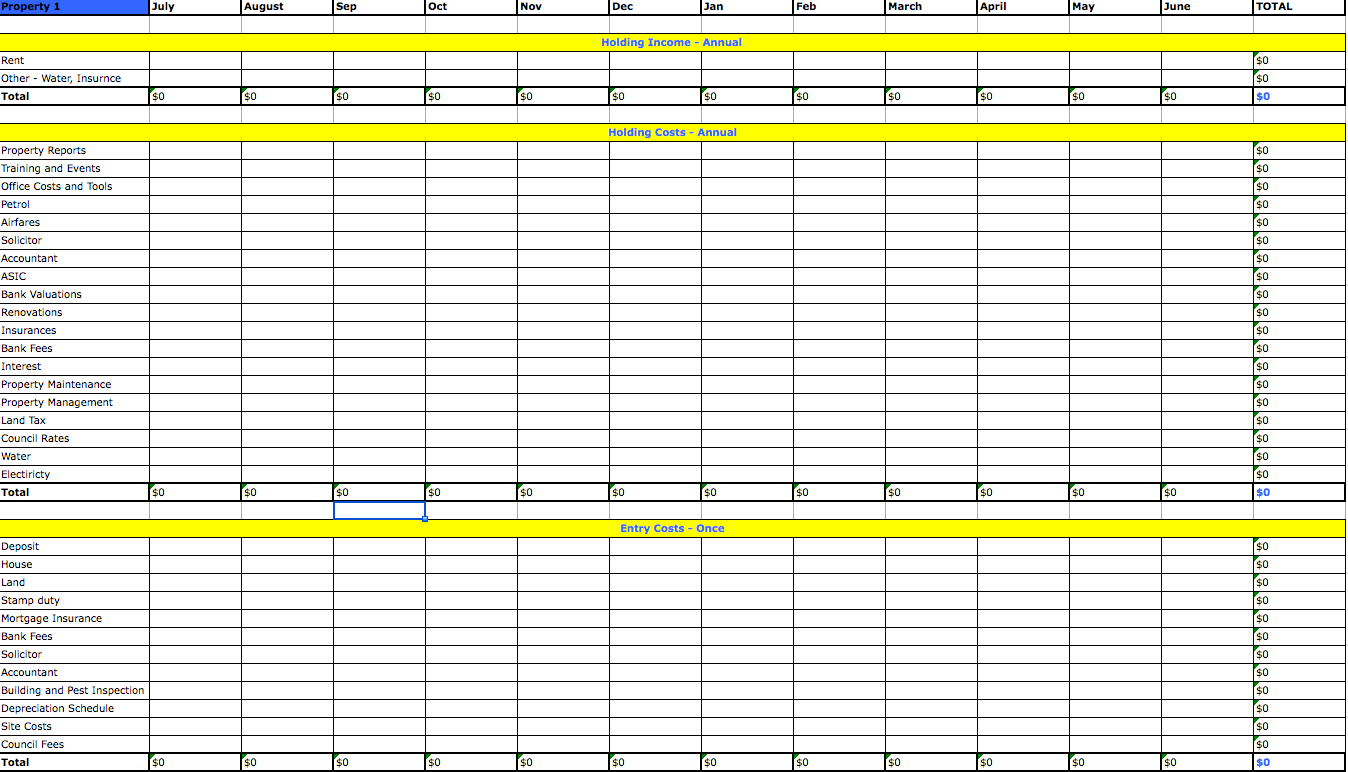

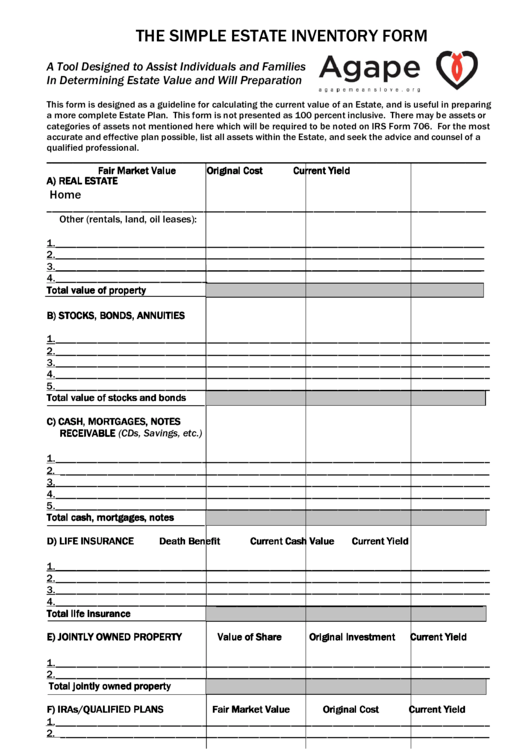

Setting Up Your Excel Template

Your Kentucky Tobacco Tax Excel Template should be structured to calculate and track your obligations easily. Here’s a step-by-step guide to setting up your template:

1. Open Excel and Create a New Workbook

Start by opening Microsoft Excel and creating a new blank workbook.

2. Designing the Spreadsheet

Create headers for each column to organize the data:

- Product Type

- Quantity Sold

- Tax Rate

- Tax Calculated

- Retail Price

- Total Sales

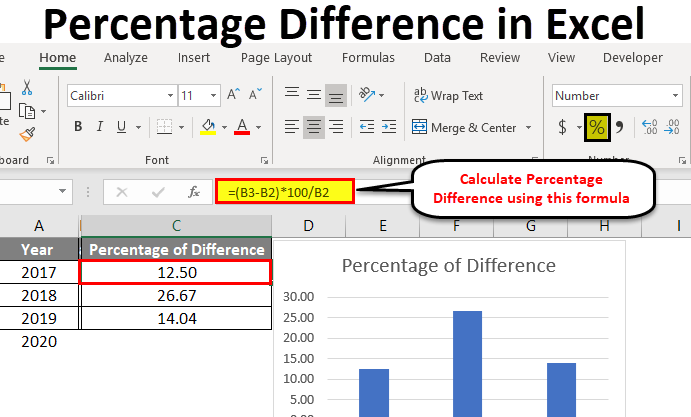

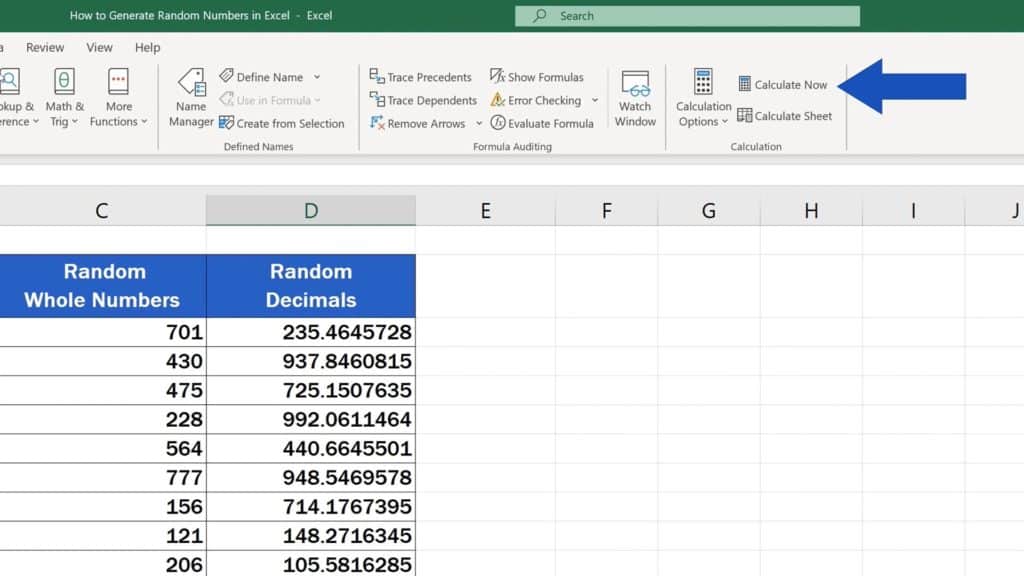

3. Input Data and Formulas

Enter the details for each type of tobacco product you sell:

- For Cigarettes:

Product Type Quantity Tax Rate Tax Price Sales Cigarettes 100 Packs 0.60</td> <td>=B2*C2</td> <td>5.50 =B2*E2

- Replicate for other products like Little Cigars and Pipe Tobacco.

💡 Note: Ensure that the formulas automatically update the tax calculations and total sales based on your input data.

4. Using Conditional Formatting

Set up conditional formatting to highlight cells where taxes might exceed a certain threshold or where there’s a discrepancy between calculated tax and reported tax:

- Select the Tax Calculated column.

- Go to Home > Conditional Formatting > New Rule.

- Choose ‘Use a formula to determine which cells to format’ and enter the formula for highlighting cells based on specific criteria.

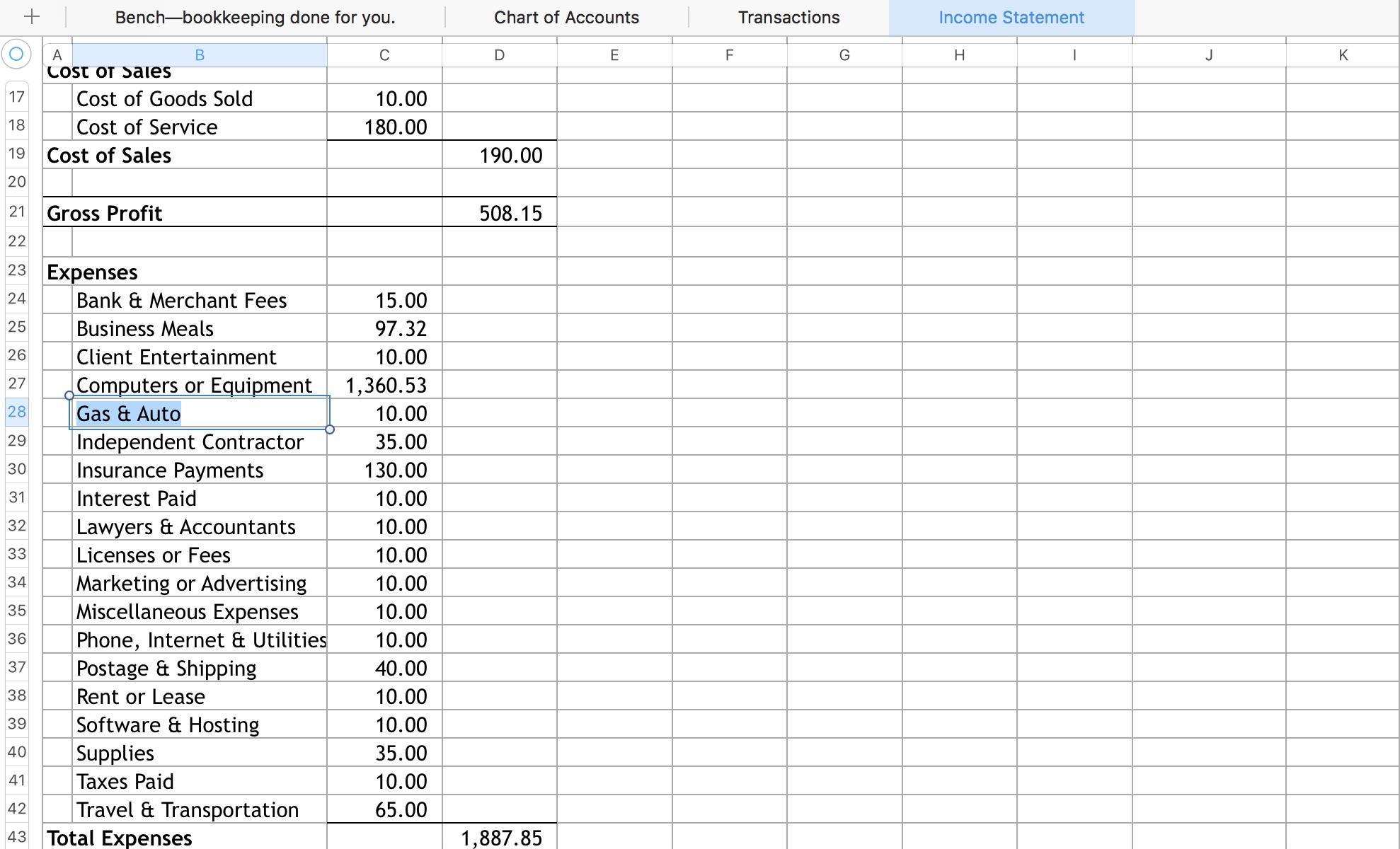

5. Add a Totals Row

At the bottom of your spreadsheet, include a row that sums up the total tax due, sales, and quantity sold:

- Total Tax Due: Use the SUM function on the tax column.

- Total Sales: SUM the total sales column.

- Total Quantity: SUM the quantity sold column.

Tips for Effective Use

To ensure the effectiveness of your Kentucky Tobacco Tax Excel Template, consider these tips:

- Regular Updates: Update your template regularly to reflect changes in tax laws or rates.

- Backup: Always keep backups of your data. Cloud storage or external drives can help prevent data loss.

- Accuracy: Double-check your data inputs and formulas to avoid calculation errors which could lead to incorrect tax reporting.

In sum, utilizing a well-structured Kentucky Tobacco Tax Excel Template can significantly reduce the time and complexity involved in calculating and filing your tobacco taxes. By following the steps outlined here, you'll be equipped to handle your tax responsibilities with greater ease, accuracy, and compliance. Remember to keep your template updated, back up your data, and always verify your entries for precision. With these tools and practices, you'll manage your tobacco tax obligations effectively, allowing you to focus more on running your business.

What if the tax rates change?

+

You should update your Excel template to reflect any changes in the tax rates promptly. This can be done by simply changing the values in the Tax Rate column for each product type. Ensure you also check for any related changes in tax laws which might affect your calculations or reporting requirements.

Can I use this template for other states?

+

Yes, while this guide focuses on Kentucky, you can adapt this template for other states. You would need to update the tax rates and possibly the structure of the template to match the tax laws of other states.

How do I handle taxes on returns and exchanges?

+

Include a section in your Excel template for returns and exchanges. Adjust the quantities sold, tax calculated, and total sales accordingly to reflect the transactions.