Import Ohio Tobacco Tax Data Easily with Excel

Managing tax data, especially for specific industries like tobacco, can be an overwhelming task given the volume of information involved. For businesses operating in Ohio, staying compliant with tobacco tax regulations requires efficient tools to handle this complex data. Microsoft Excel, a versatile tool with a variety of functions, can significantly simplify this process when you know how to use it effectively. This post will guide you through the steps to import Ohio Tobacco Tax Data into Excel, ensuring accuracy and compliance in your financial reporting.

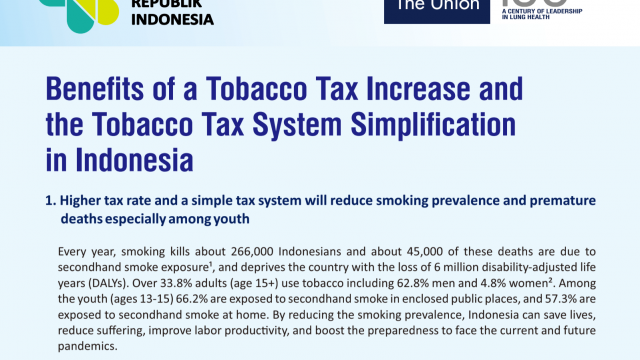

Understanding the Ohio Tobacco Tax

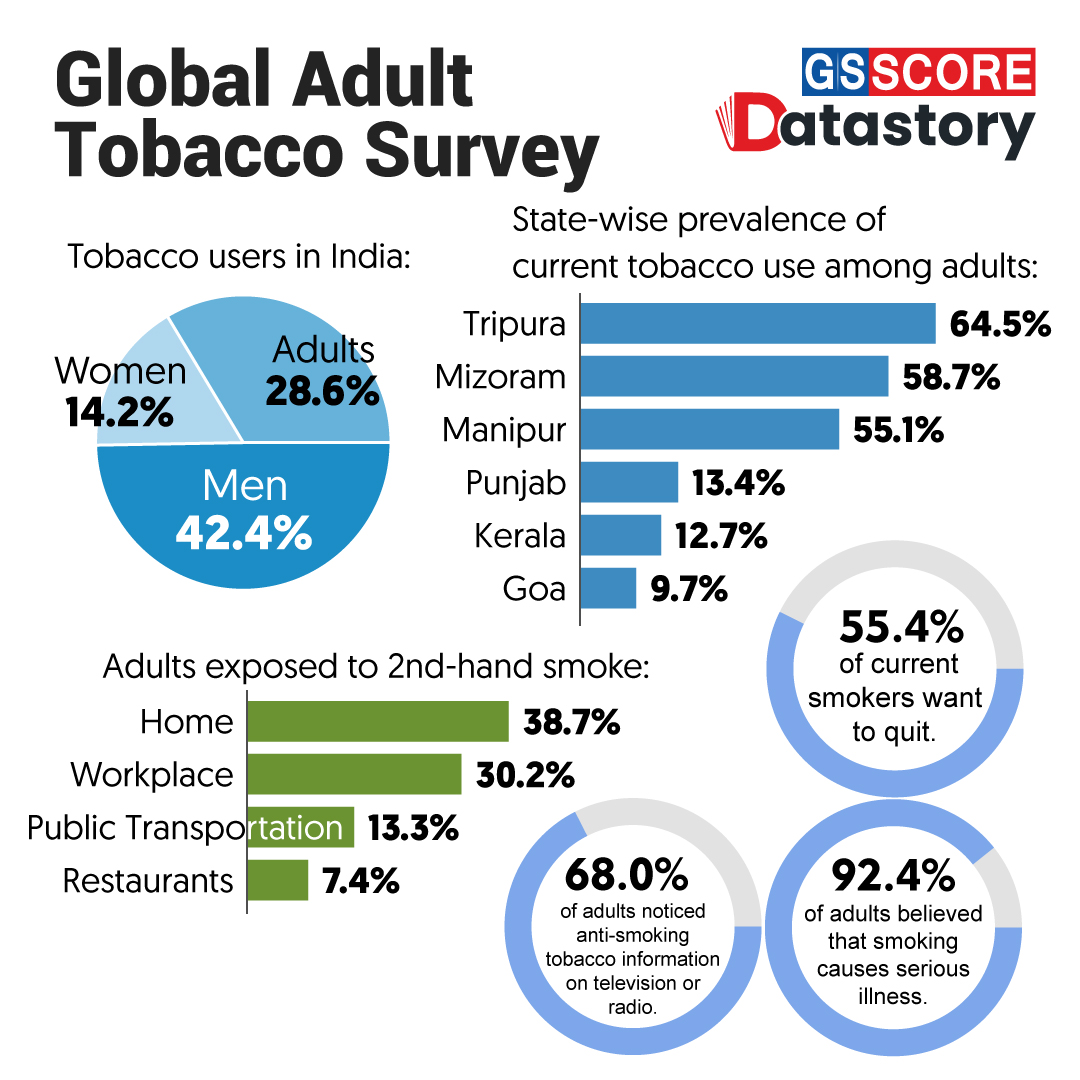

Before delving into the process of importing data, it’s crucial to grasp what the Ohio tobacco tax entails:

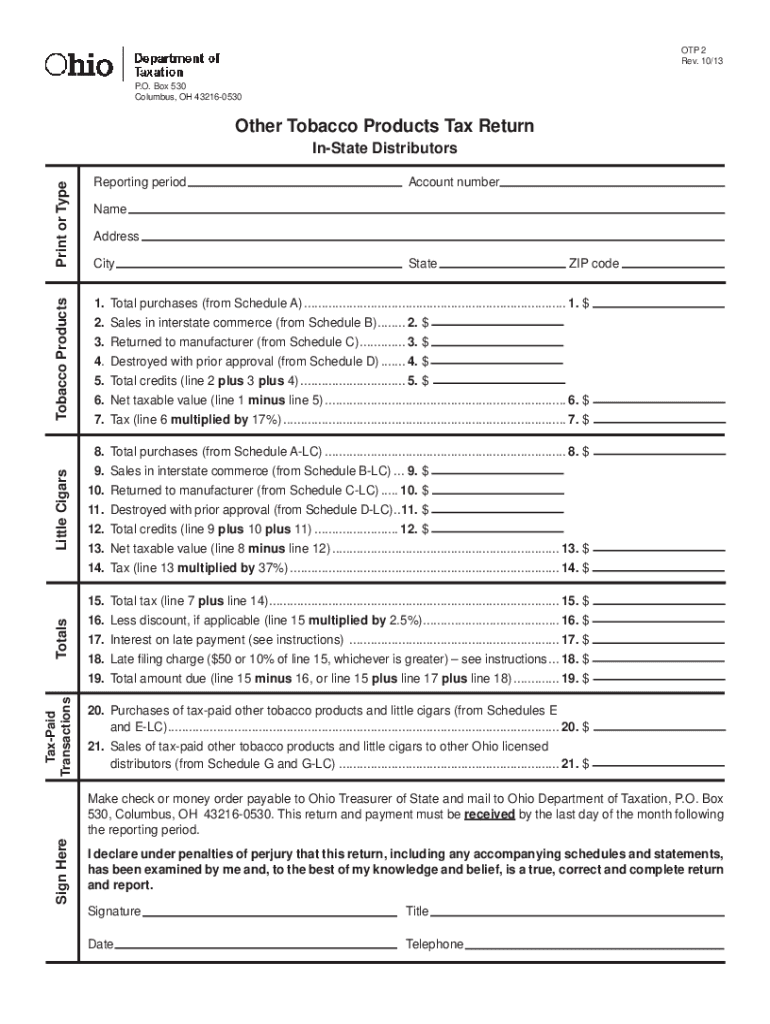

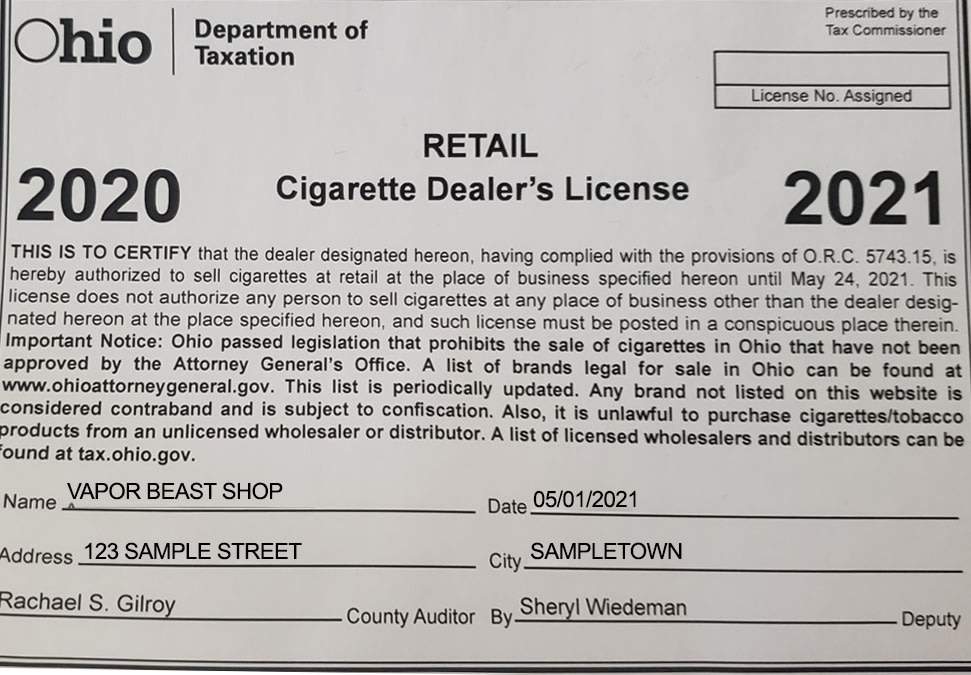

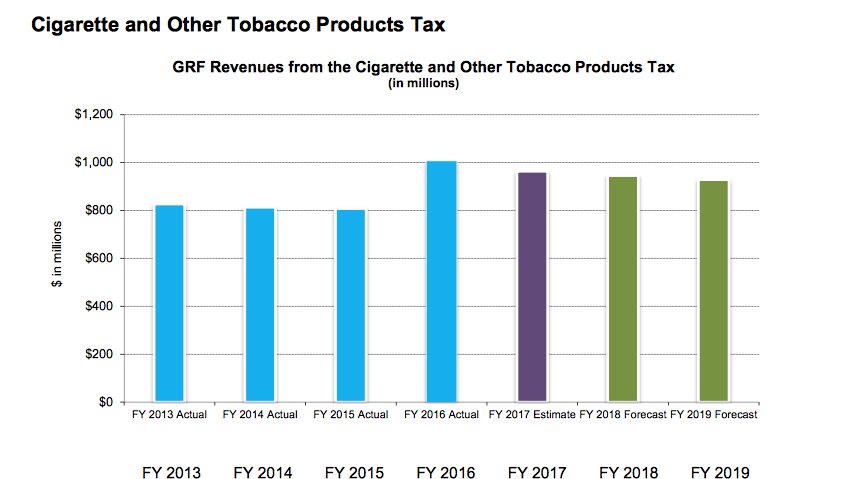

- Types of Tobacco Tax: Ohio imposes taxes on various tobacco products like cigarettes, cigars, and e-cigarettes.

- Tax Rates: Rates can change, so regular updates are necessary.

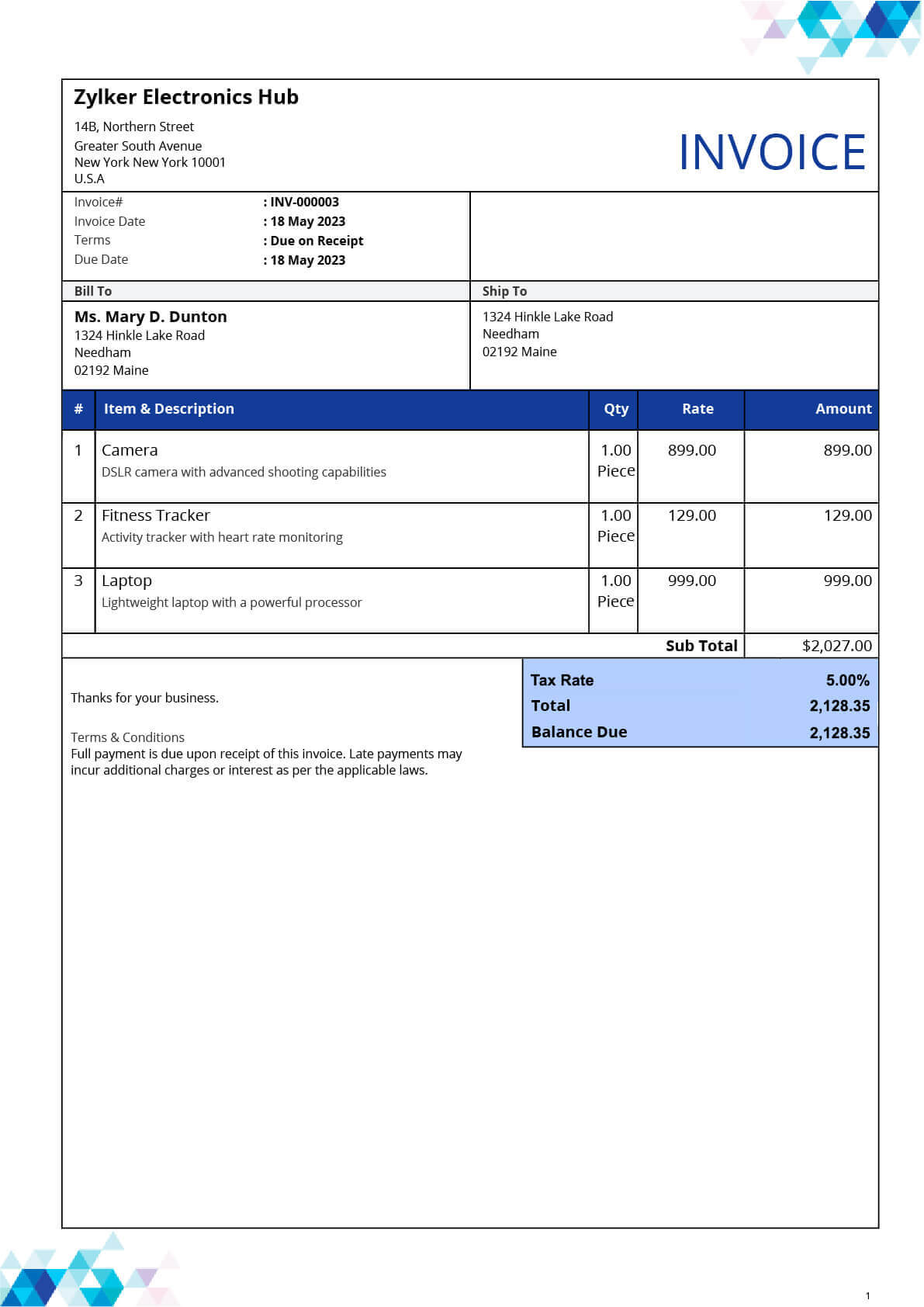

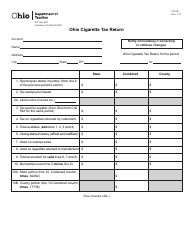

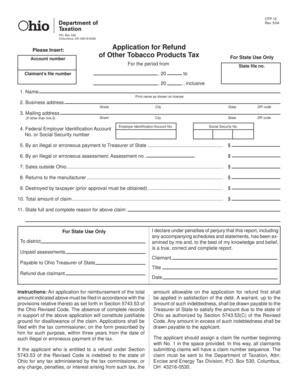

- Reporting: Businesses must submit reports detailing sales, tax calculations, and payments.

Step-by-Step Guide to Importing Data

Follow these detailed steps to import your Ohio Tobacco Tax Data into Excel:

Gather the Necessary Data

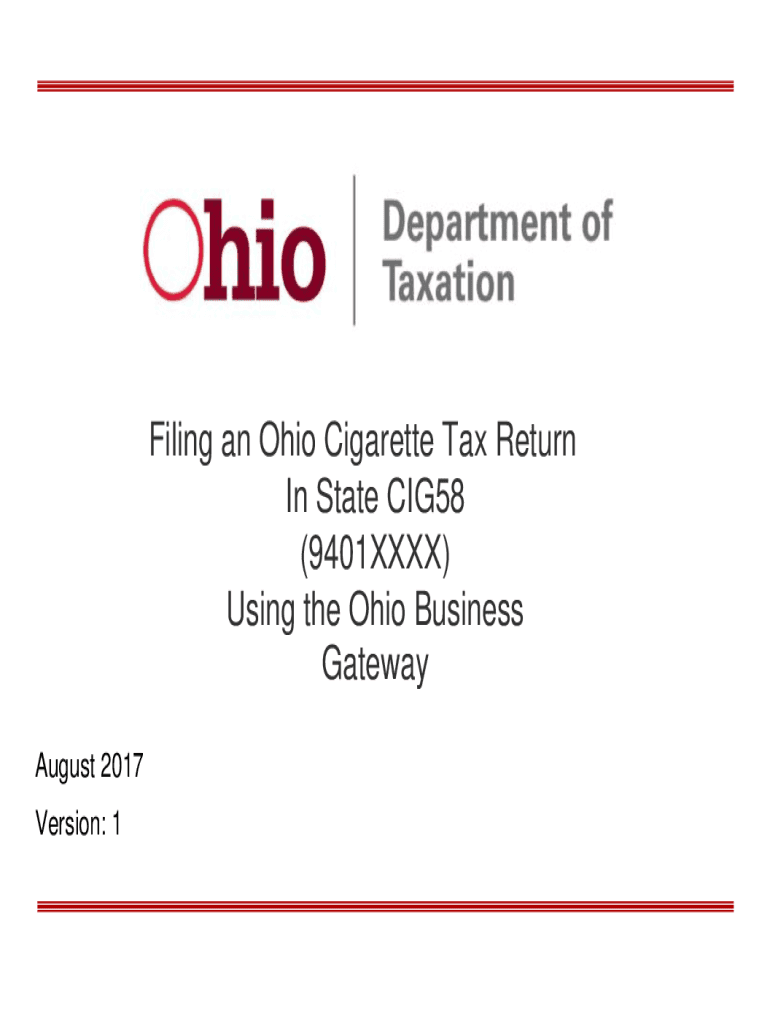

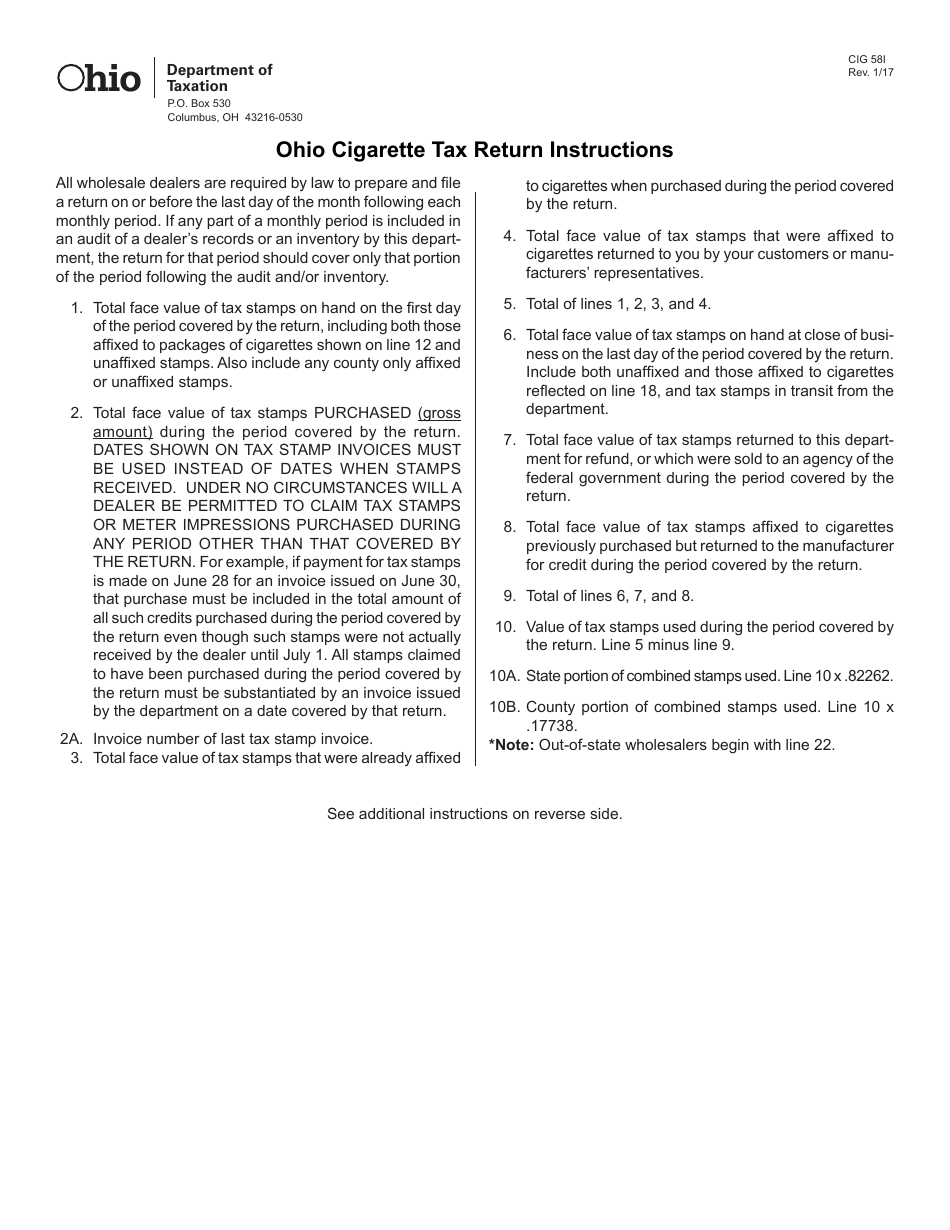

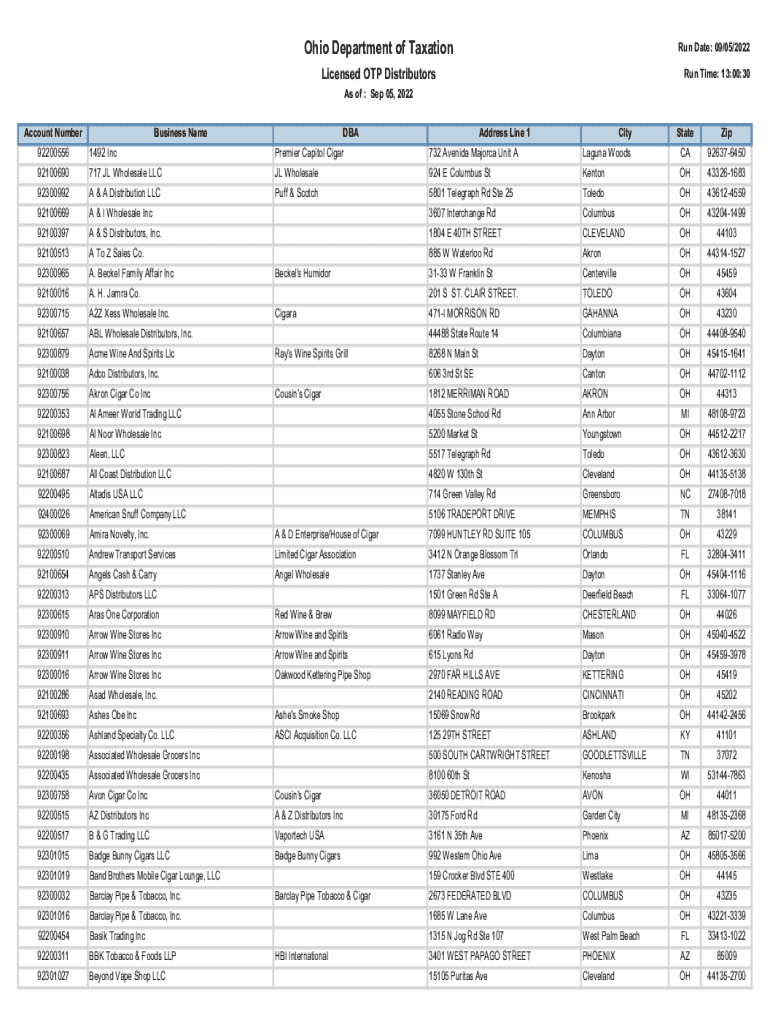

- Obtain the latest Ohio tobacco tax rates from the Ohio Department of Taxation.

- Ensure your internal sales and inventory data is up-to-date.

Create an Excel Workbook

Open a new Excel workbook and:

- Add a sheet labeled “Rates” for tax rate information.

- Add a sheet labeled “Sales” for your sales data.

- Create a sheet named “Calculations” for tax calculations.

Importing Rates Data

Use the following method to import the tax rate data:

- Copy the rates directly from the Ohio Department of Taxation website.

- Paste them into the “Rates” sheet in your workbook.

Importing Sales Data

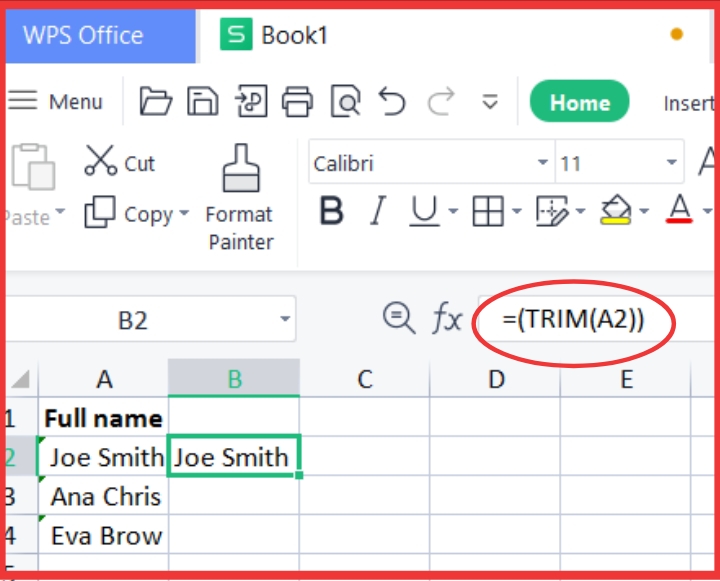

- If the data is in a flat file:

- Select “Data” > “Get External Data” > “From Text”

- Choose your file and import, ensuring correct delimiters.

- If you have database access, connect to your database:

- Use “Data” > “New Query” > “From Database”

- Select the appropriate database connection and retrieve the data.

⚠️ Note: Ensure the format of the imported data matches your Excel column headings for accurate mapping.

Perform Tax Calculations

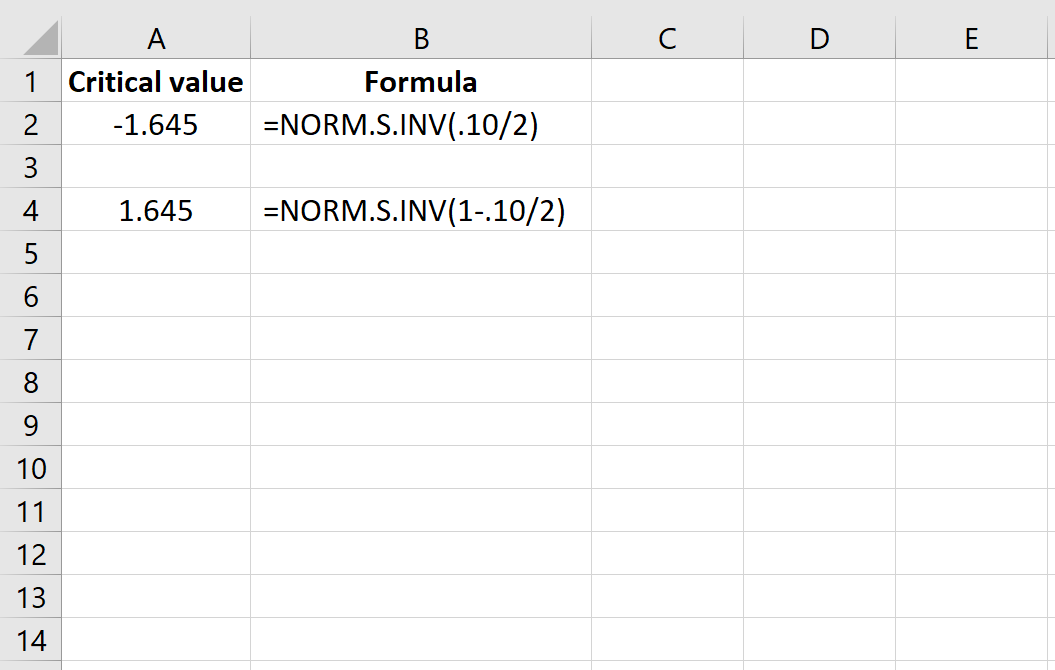

Once you have imported the data, here’s how to calculate the taxes:

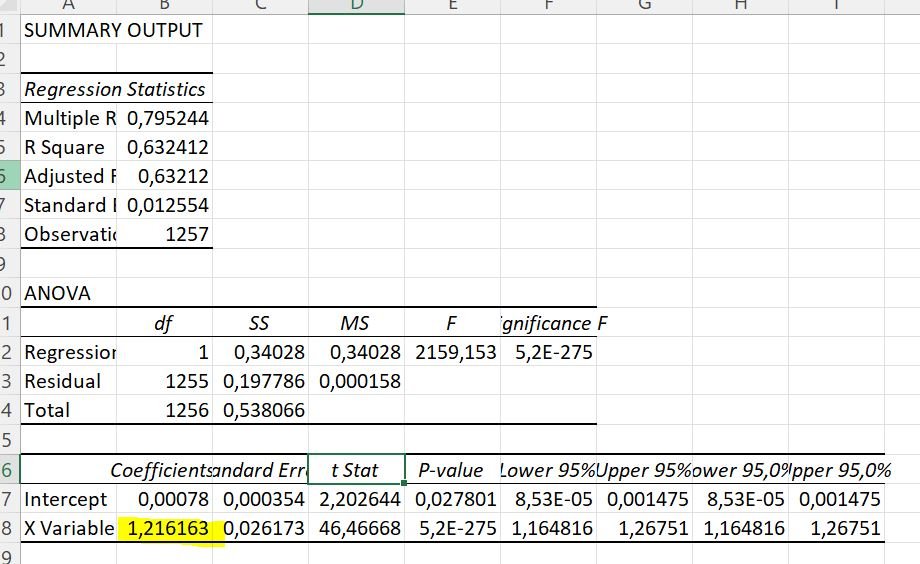

- Link Rates and Sales: Use formulas to connect the tax rates to the sales data.

- Calculate Total Tax: Use an Excel formula to compute the total tax amount.

- Summarize by Product: Create pivot tables to summarize and analyze the data.

Organizing Data for Compliance

To ensure compliance, organize your data effectively:

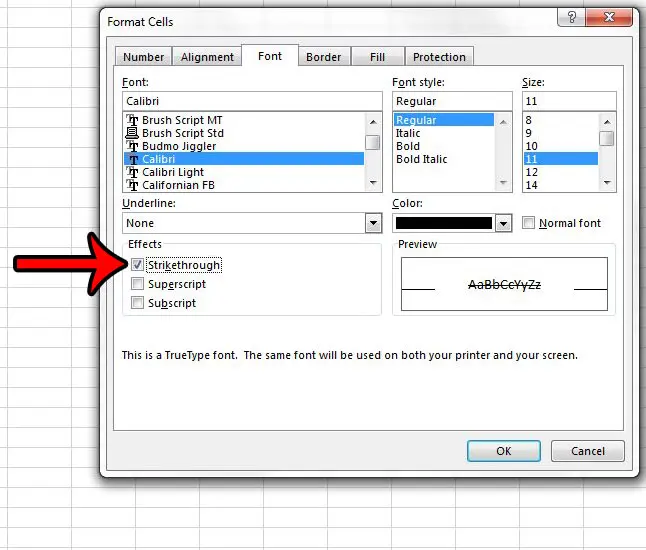

- Use Filters: Apply filters to sort through different tax categories.

- Create Macros: Automate repetitive tasks with macros for consistency.

- Implement Data Validation: Ensure entered data meets specific criteria.

The process of importing and managing Ohio Tobacco Tax Data in Excel can seem daunting, but with a systematic approach, it becomes manageable. By understanding the tax specifics, importing data accurately, and setting up your workbook for compliance reporting, you ensure accuracy in your financials and maintain compliance with regulatory standards.

Why is it important to use Excel for Ohio Tobacco Tax Data?

+

Excel offers robust data manipulation tools, calculation capabilities, and reporting functionalities that streamline the tax reporting process for businesses dealing with Ohio tobacco taxes.

How often do I need to update the tax rates in my Excel workbook?

+

It’s recommended to update the tax rates at least quarterly or whenever the Ohio Department of Taxation announces changes.

Can I automate the tax calculation process in Excel?

+

Yes, by using formulas and macros, you can automate the tax calculations based on the sales data and tax rates you’ve imported, saving time and reducing human error.

What if the sales data format changes?

+

If the format of your sales data changes, you might need to adjust your import settings, update your macros, or revise your formulas to ensure the data is imported and calculated correctly.