Discover Beta in Excel: Simple Steps for Investors

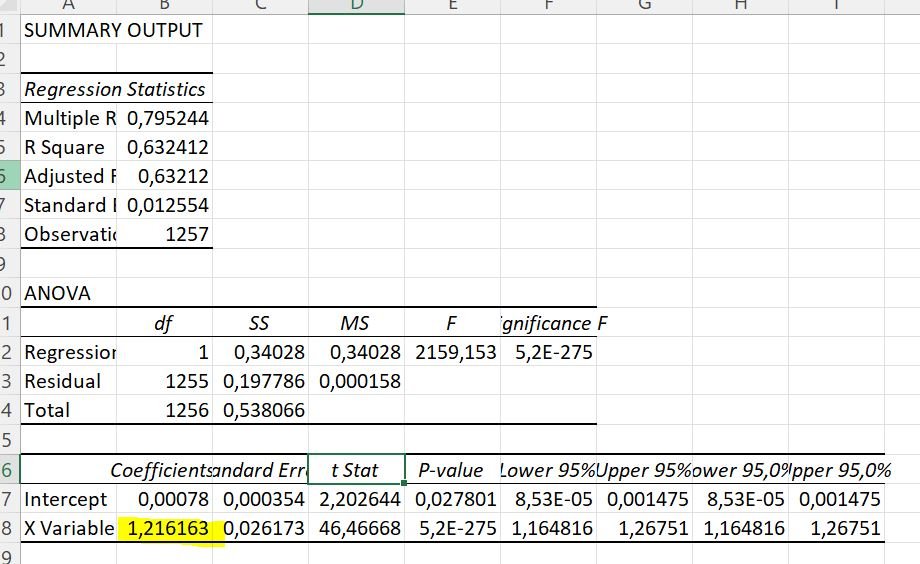

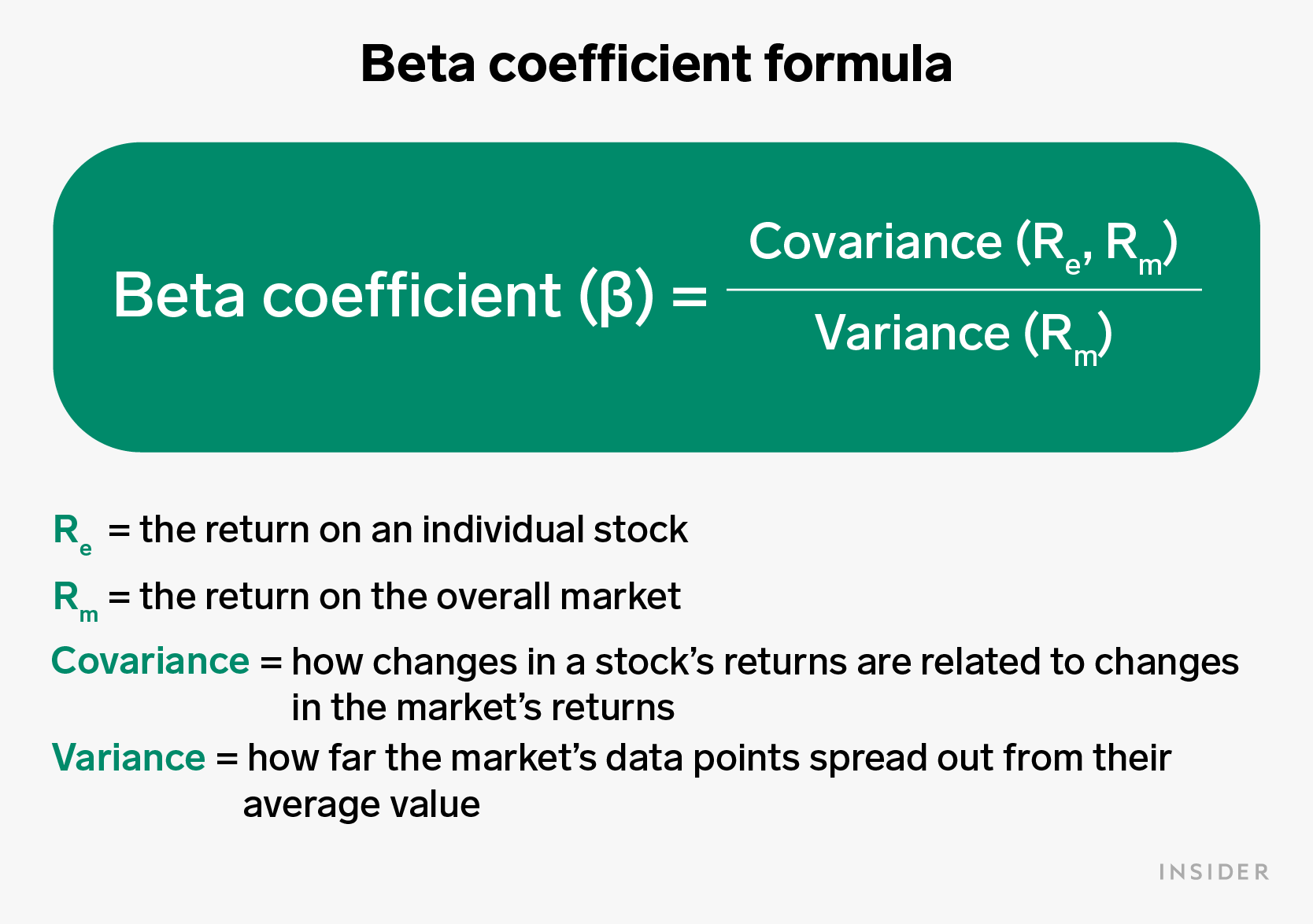

Understanding and calculating the Beta of a stock is essential for investors who wish to gauge the risk and expected return of their investment portfolios. Beta is a measure of a stock's volatility in relation to the overall market. A stock with a beta greater than 1 is more volatile than the market, while a beta less than 1 indicates less volatility. In this guide, we will walk through the simple steps to calculate Beta in Microsoft Excel, making it easier for investors to incorporate this crucial metric into their analysis.

Understanding Beta

Before we dive into the calculations, let’s briefly understand what Beta signifies:

- Beta > 1: The stock is more volatile than the market.

- Beta = 1: The stock moves in line with the market.

- Beta < 1: The stock is less volatile than the market.

- Beta < 0: The stock moves opposite to the market (this is rare and indicates a lack of correlation).

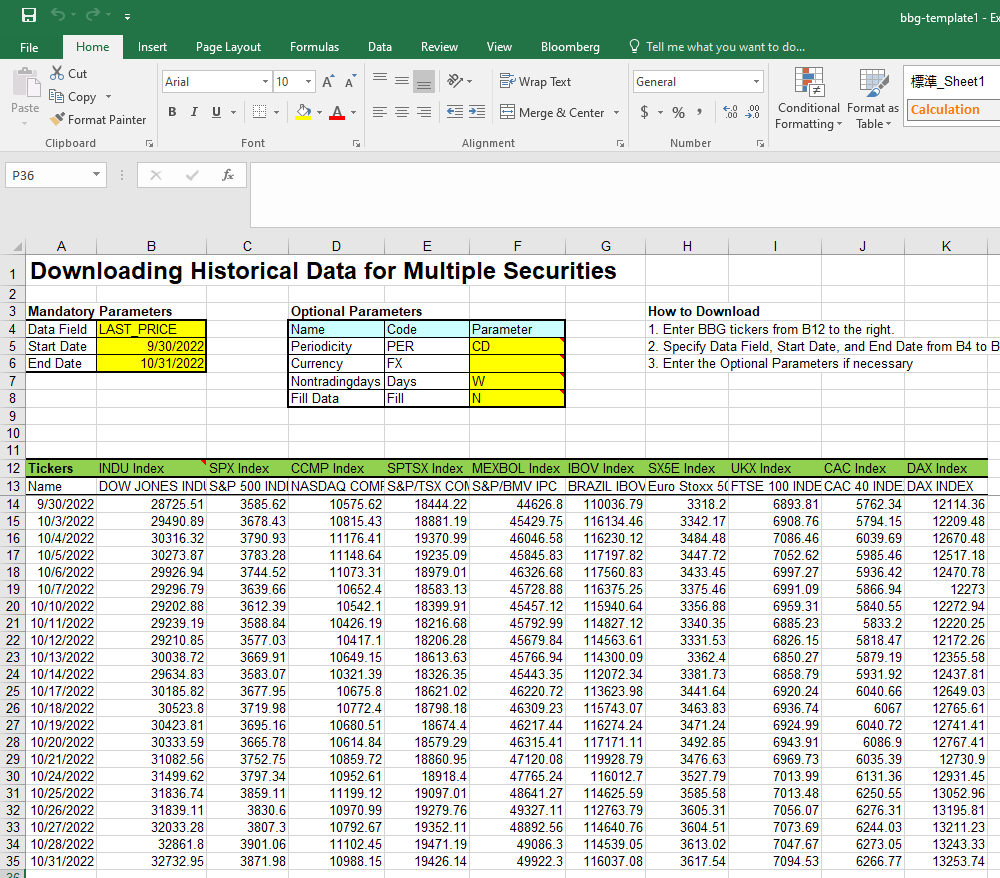

Gathering Data

To calculate Beta in Excel, you’ll need historical price data for the stock in question and a market index, like the S&P 500. Here’s how to collect this data:

- Choose a stock you want to analyze and a time frame for the data (e.g., monthly data for the past 5 years).

- Collect daily or monthly closing prices for both the stock and the market index. Financial websites like Yahoo Finance or Google Finance provide this data.

- Ensure the dates for both stock and market prices match exactly.

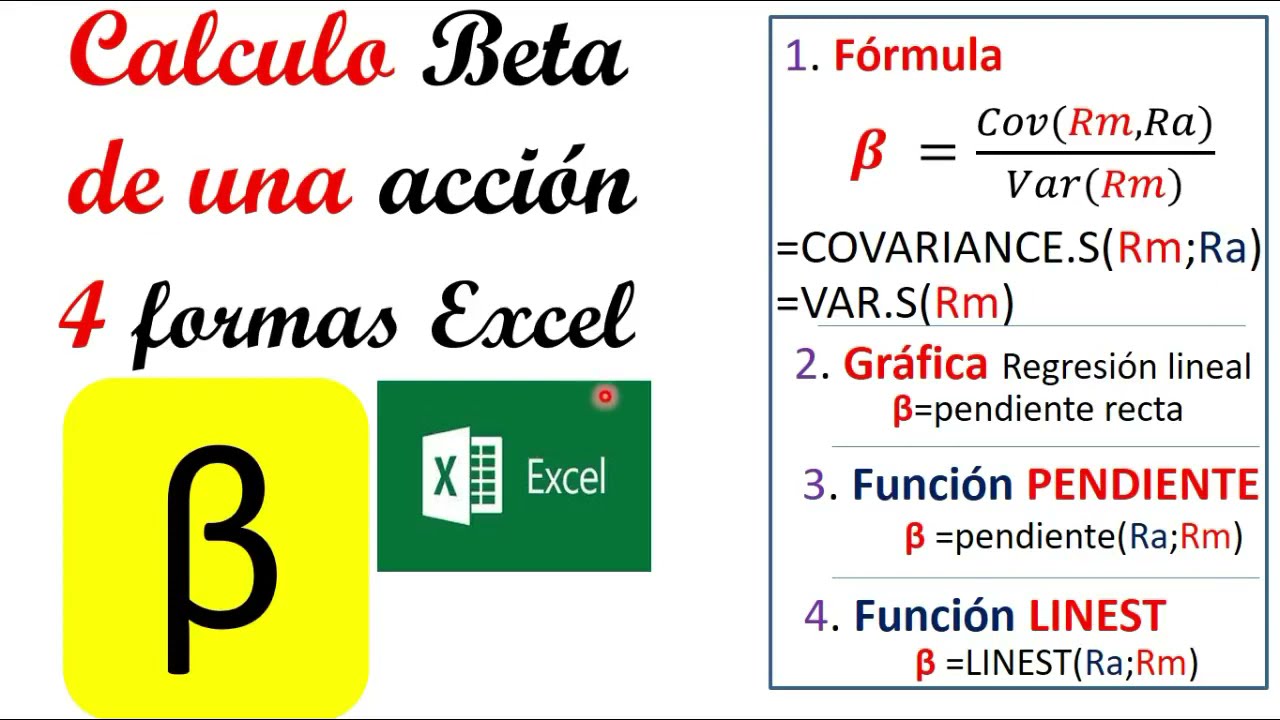

Calculating Beta in Excel

Once you have your data, follow these steps to calculate Beta in Excel:

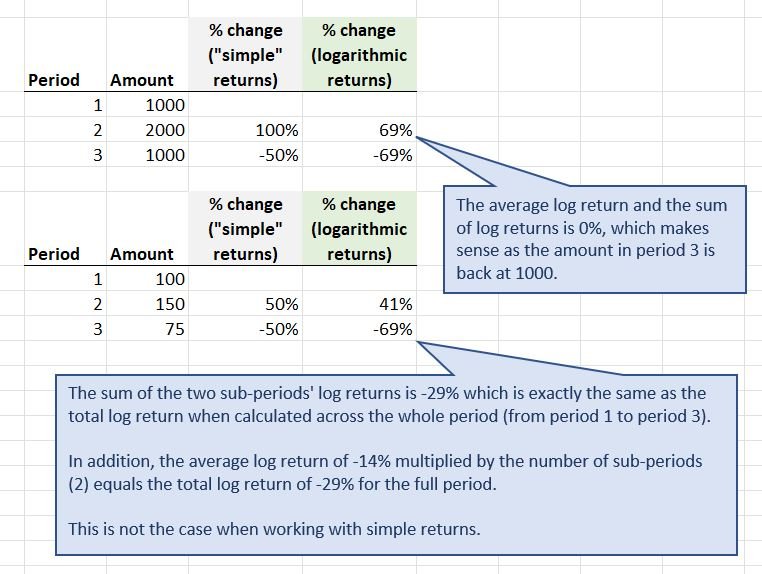

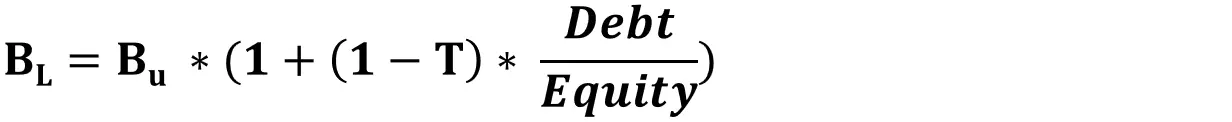

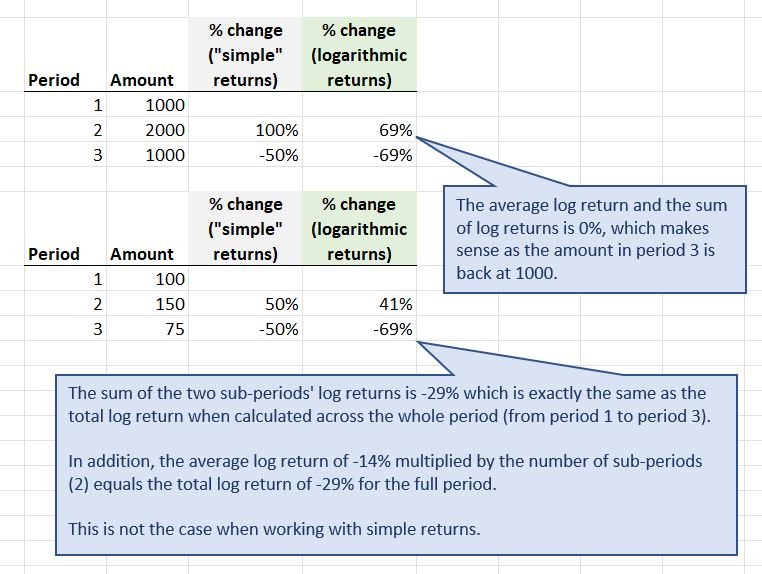

Step 1: Calculate Returns

Calculate the daily or monthly returns for both the stock and the market index. Here’s how:

- Return Formula:

Cell Formula C2 =LN(B2/B1)E2 =LN(D2/D1)

- Where:

- C2 is the cell where the stock’s return will be calculated.

- B2/B1 is the ratio of current to previous closing price for the stock.

- E2 is the cell where the market’s return will be calculated.

- D2/D1 is the ratio of current to previous closing price for the market.

- Copy these formulas down to cover all your data points.

Step 2: Compute Beta

Use Excel’s SLOPE function to find Beta:

- Formula in Excel:

Cell Formula A1 =SLOPE(C2:C52, E2:E52) - Here, A1 represents where you’ll place the Beta value.

- C2:C52 contains the stock returns.

- E2:E52 contains the market returns.

Step 3: Interpretation

Once you have the Beta value, interpret it:

- If Beta is greater than 1, the stock is more volatile than the market.

- If Beta is less than 1, the stock is less volatile than the market.

- A negative Beta means the stock moves in the opposite direction to the market.

Important Notes

🔍 Note: The Beta calculation assumes a linear relationship between the stock and market returns, which might not always hold true due to other influencing factors like company-specific news or events.

📝 Note: Ensure your data is clean. Missing values or inconsistencies can lead to incorrect Beta values.

Summary

Calculating Beta in Excel provides investors with a straightforward tool to evaluate a stock’s risk relative to the market. By following these simple steps, you can easily incorporate Beta into your investment strategy, helping you to make more informed decisions. Remember, while Beta is a useful metric, it should be one of many tools in your analytical arsenal.

What does a Beta of 1 mean?

+

A Beta of 1 means that the stock’s price movement matches the market’s movement. If the market goes up by 1%, the stock is expected to rise by 1% as well.

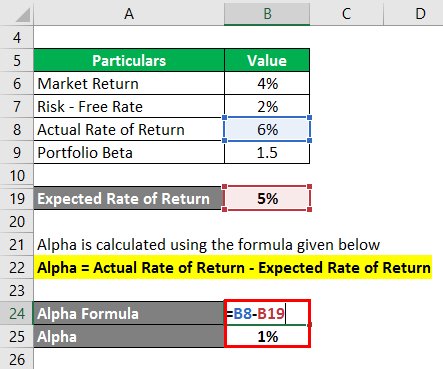

Is Beta the only measure of risk?

+

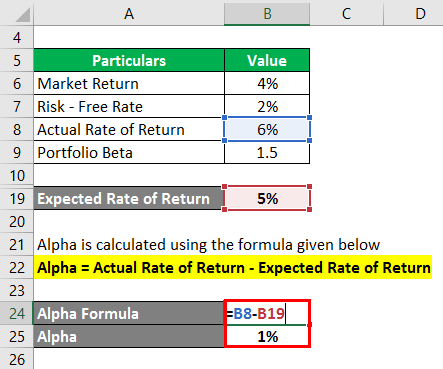

No, Beta measures systematic risk or market risk. Investors should also consider unsystematic risk, which can be mitigated through diversification, and other financial metrics like Alpha, Standard Deviation, and Sharpe Ratio.

Can Beta change over time?

+

Yes, a company’s Beta can change due to shifts in its business model, financial structure, or changes in the broader market. It’s advisable to periodically recalculate Beta.

How can I reduce the impact of Beta?

+

Diversification across different asset classes and sectors can help mitigate the impact of high Beta stocks by balancing them with low Beta stocks or assets like bonds or cash.

What is considered a high Beta?

+

Stocks with a Beta above 1.5 are generally considered high Beta, indicating they are significantly more volatile than the market.