7 Essential Tips for ABA Business Financial Projections in Excel

Introduction to ABA Business Financial Projections

Financial projections are a critical component for any business, including Applied Behavior Analysis (ABA) practices. Excel, with its powerful analytical tools, becomes an indispensable resource for ABA professionals aiming to forecast revenue, expenses, and financial health. Here are 7 essential tips tailored for creating effective financial projections in Excel for an ABA business.

1. Define Your Business Model

Before diving into financial projections, understanding your business model is paramount. Here’s what you should consider:

- Revenue Streams: Identify how your ABA practice will generate income. This could be through direct billing, insurance claims, or in-school contracts.

- Service Offerings: Define what services you offer, from individual therapy sessions to group activities or caregiver training.

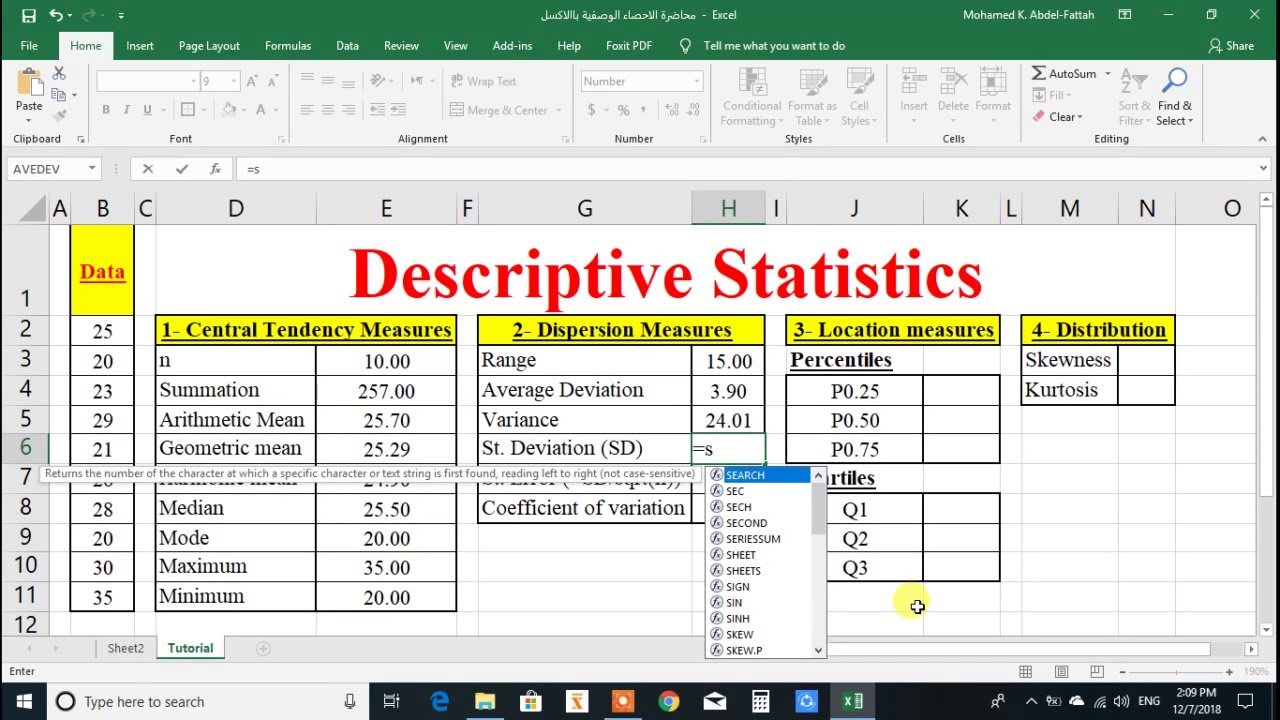

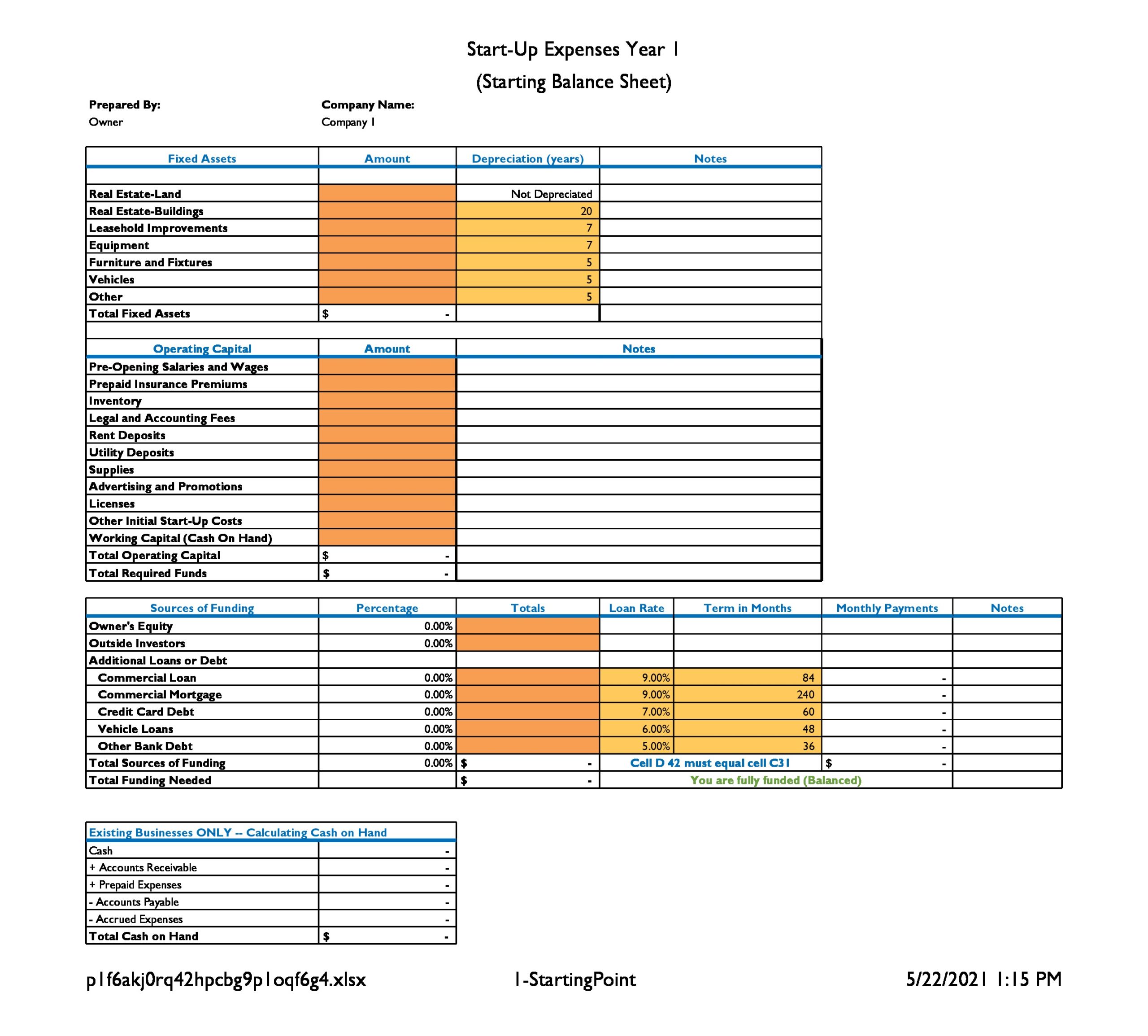

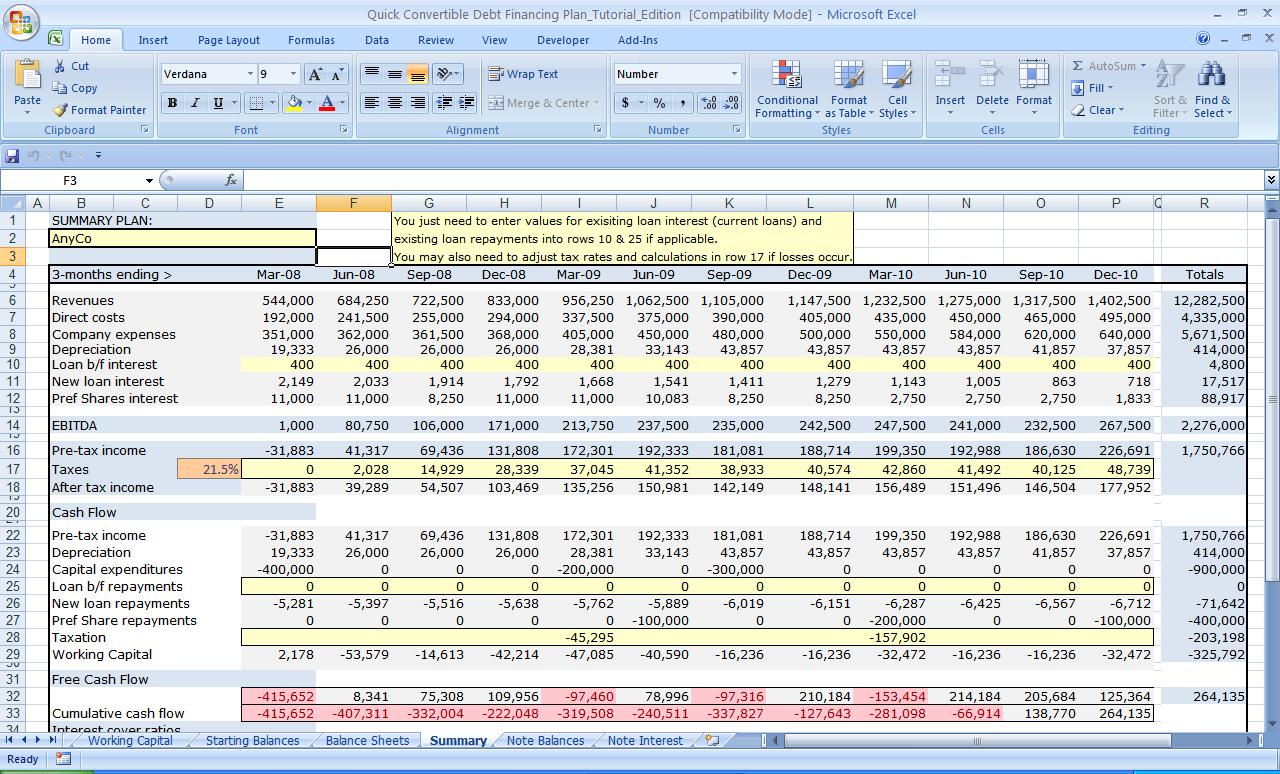

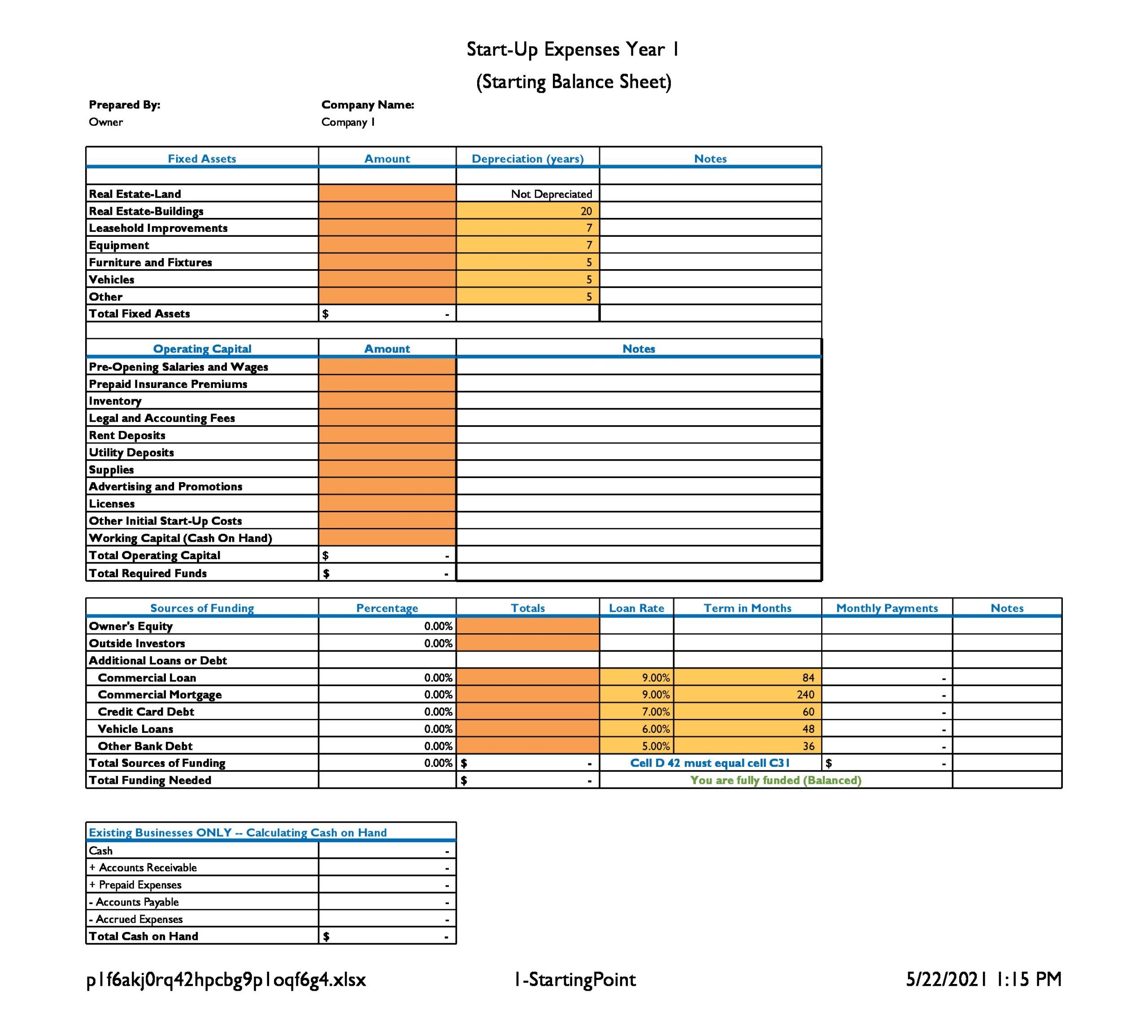

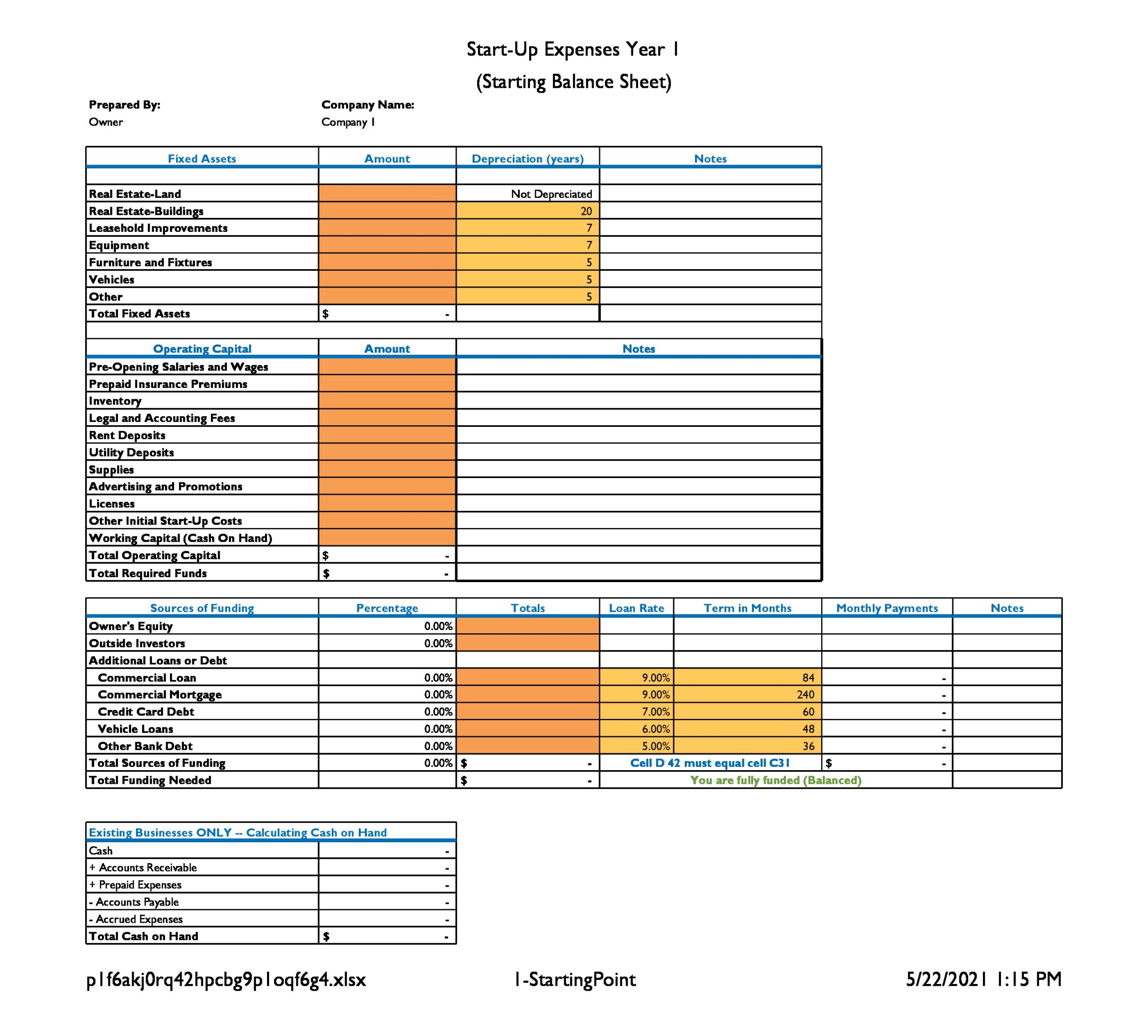

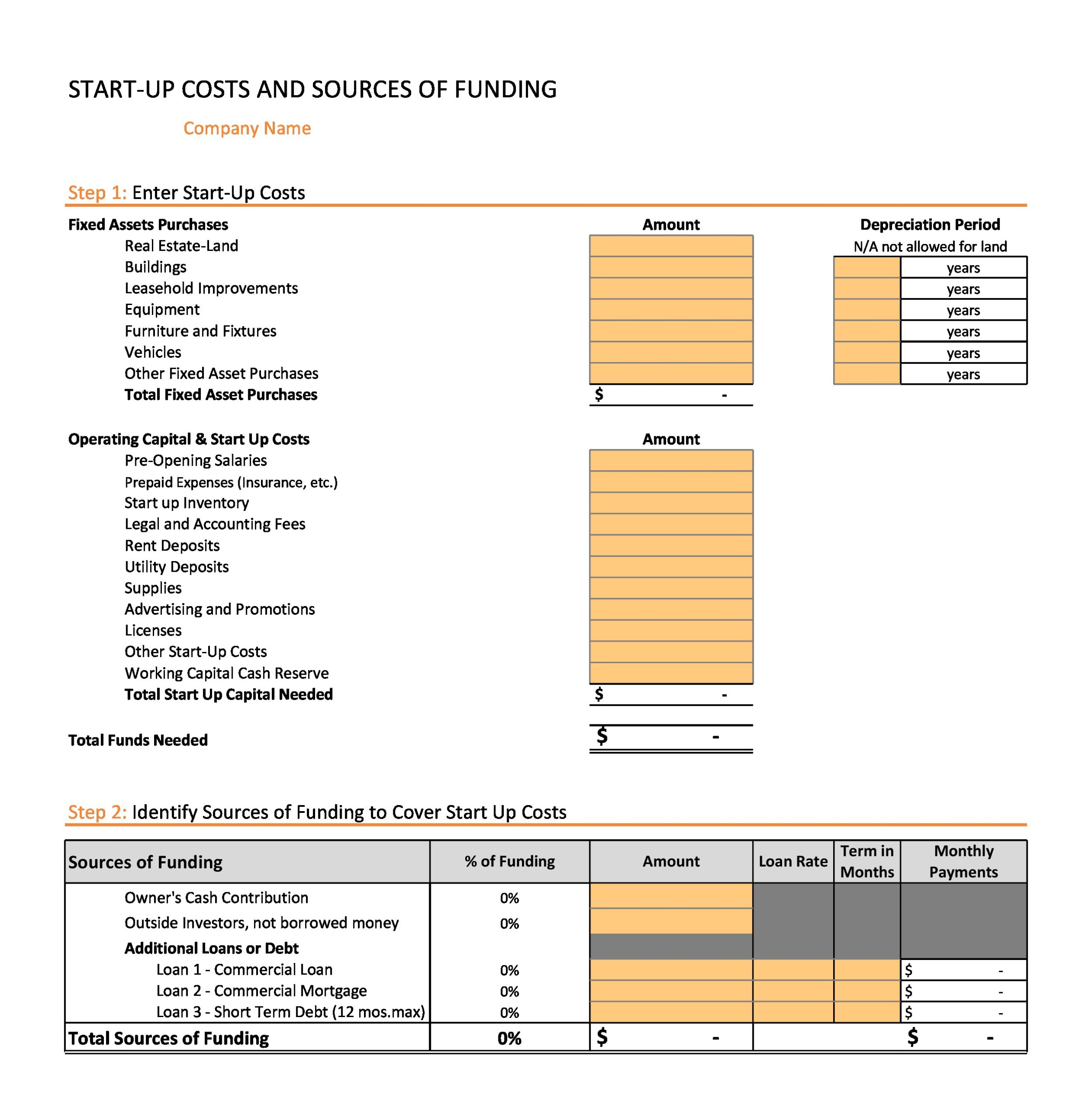

2. Set Up an Excel Workbook for Financial Projections

Organize your Excel workbook in a manner that reflects your business operations:

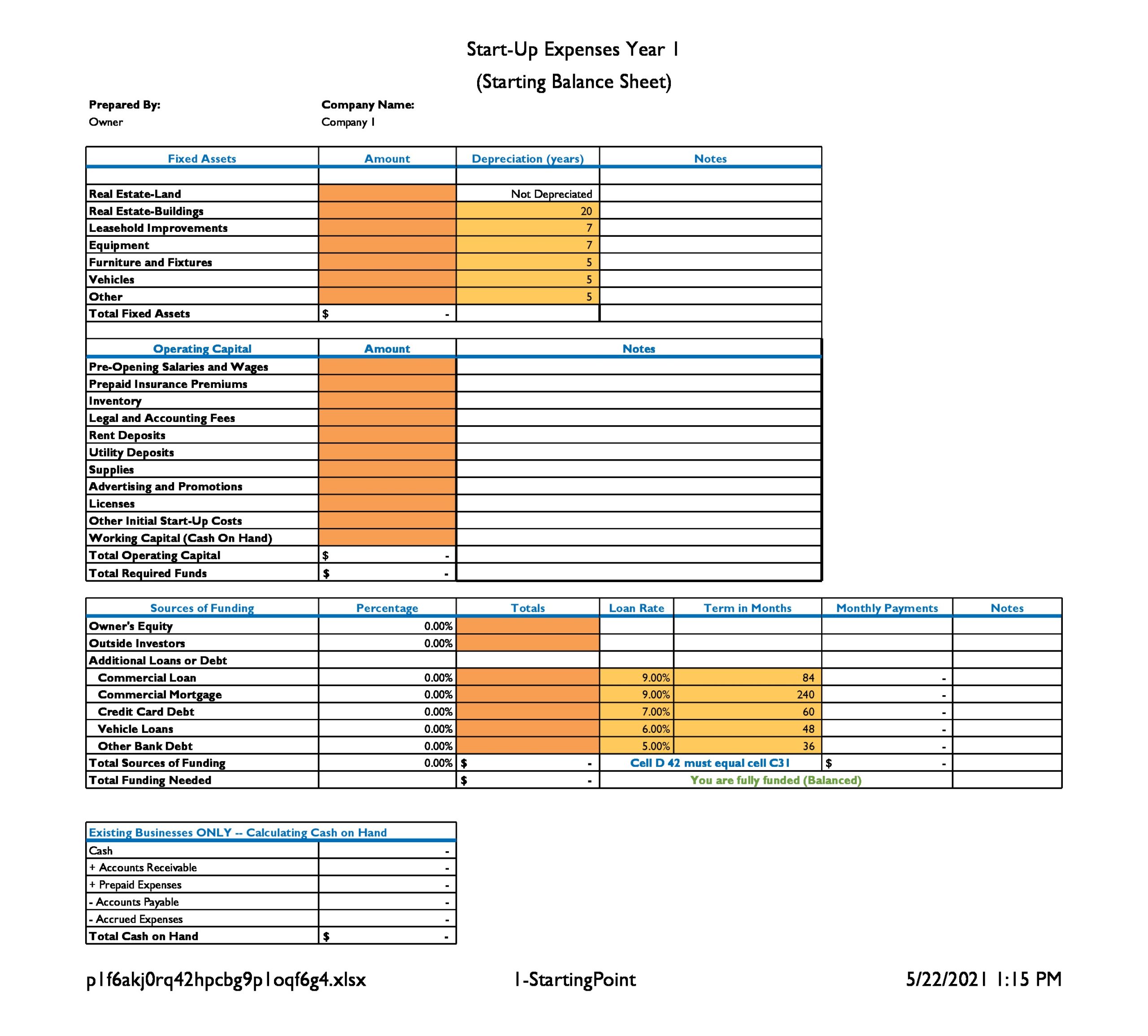

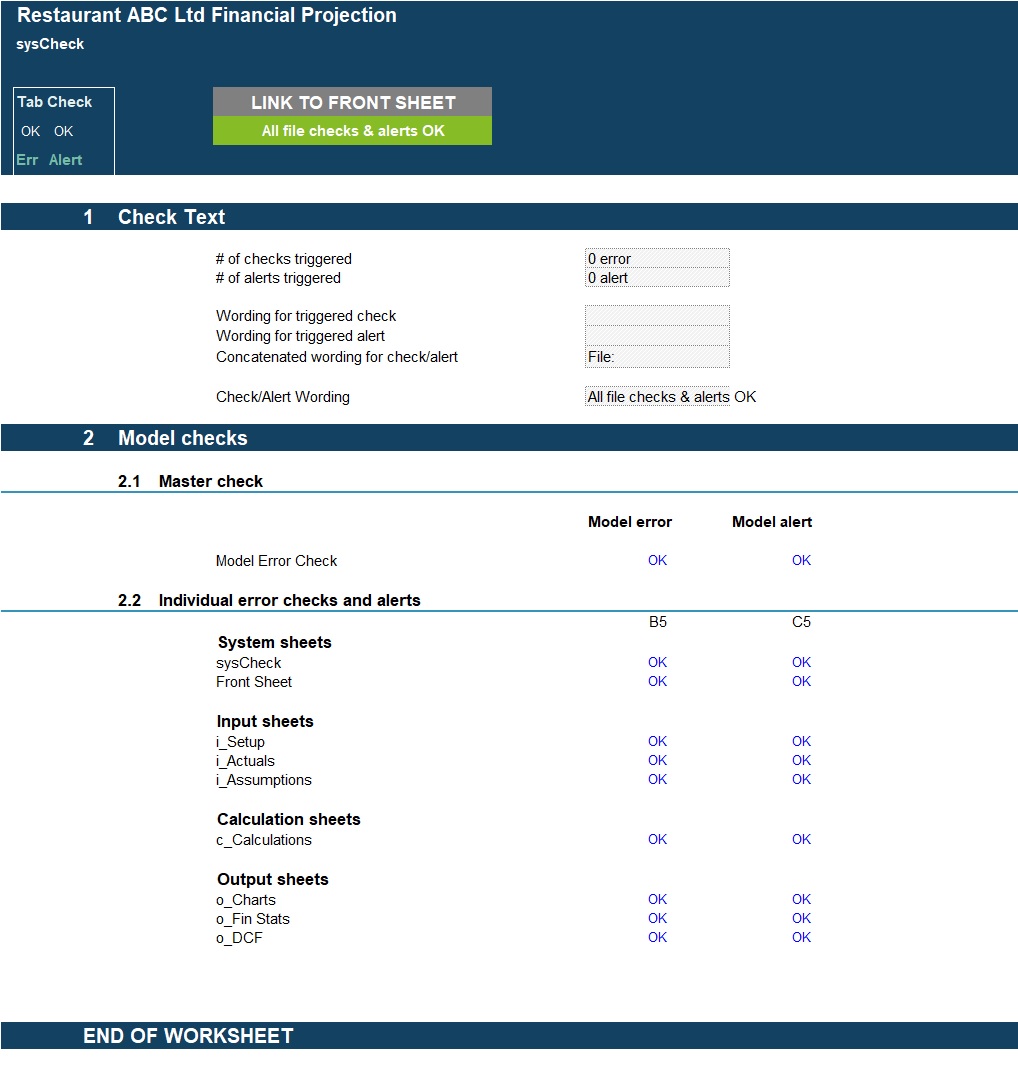

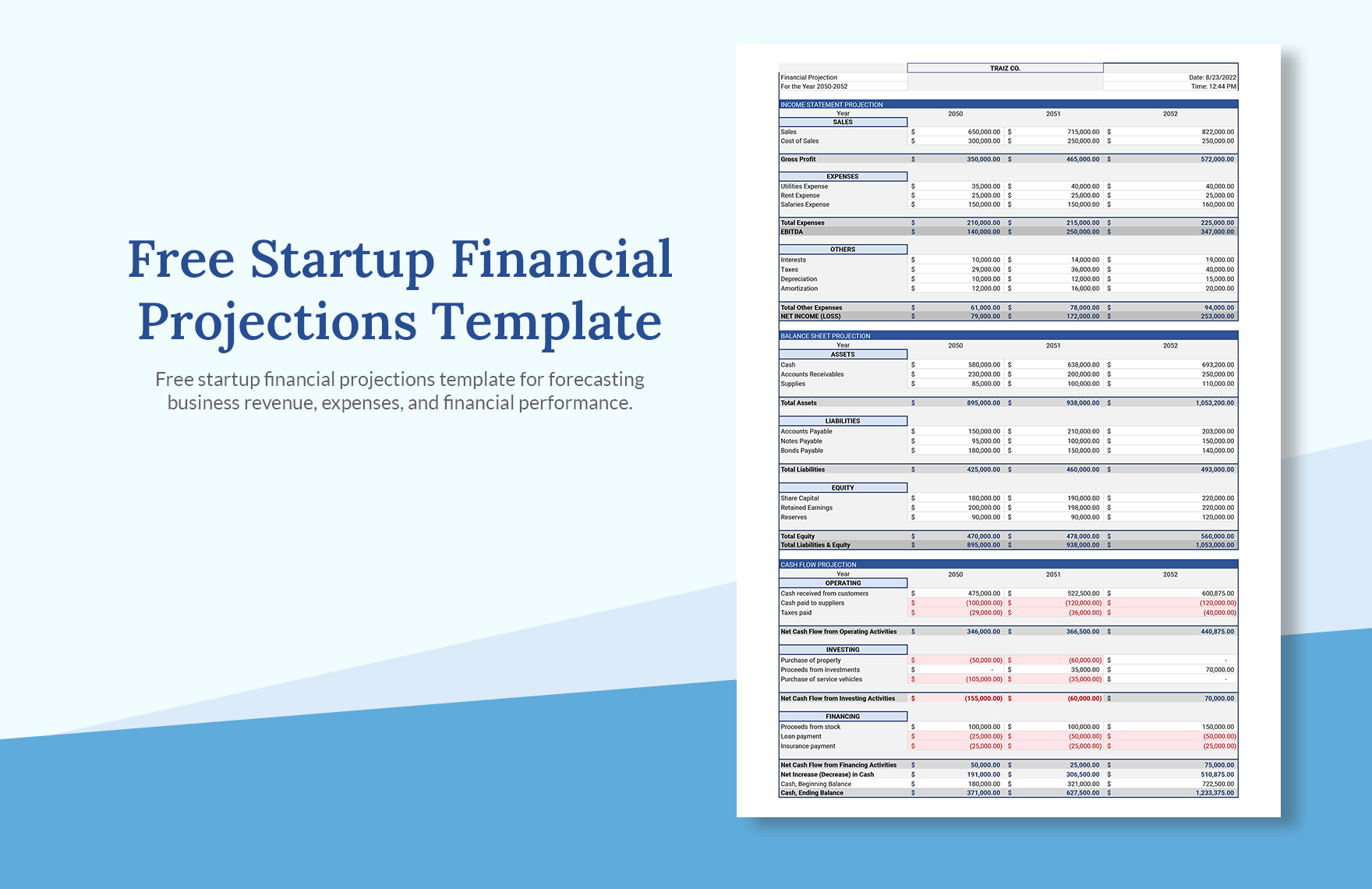

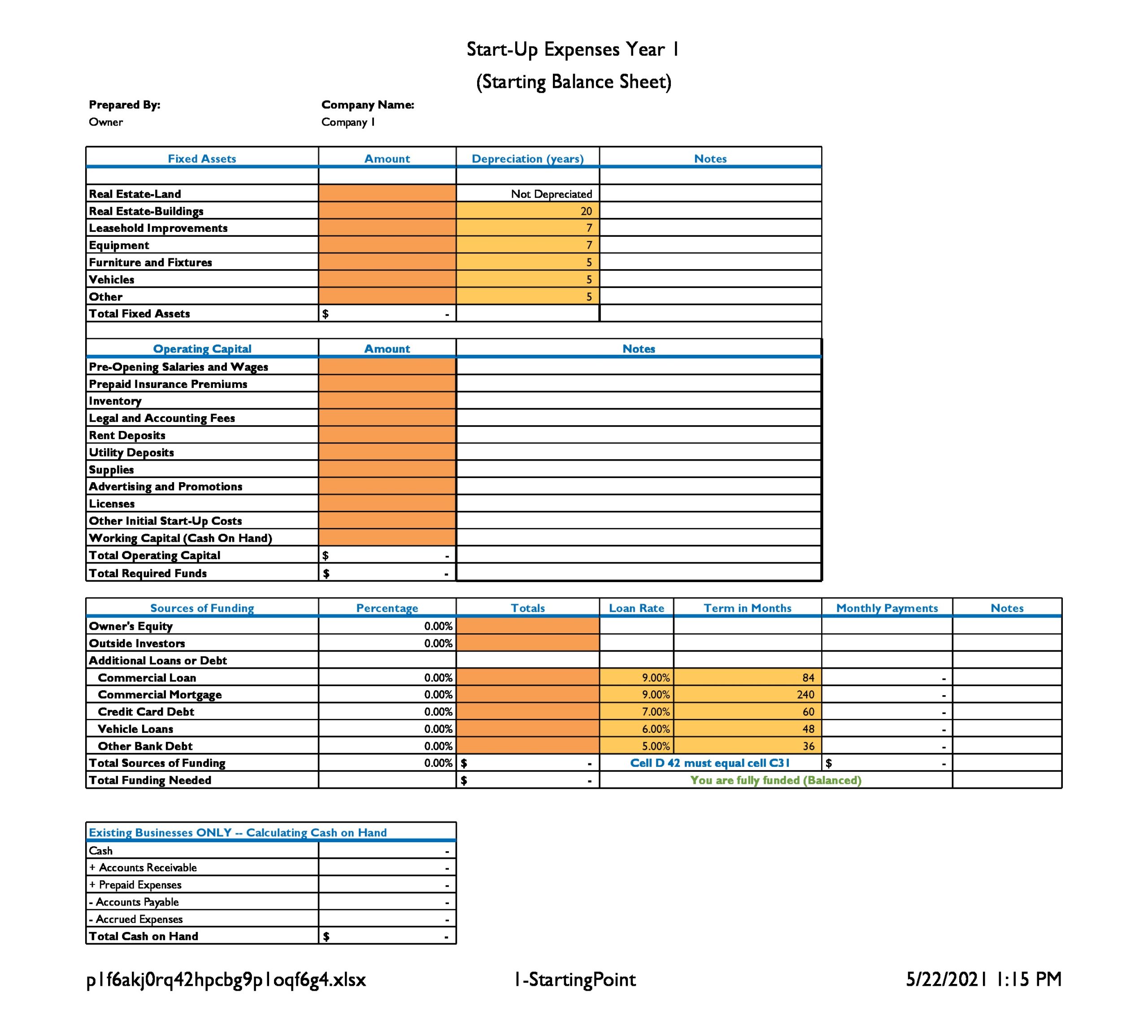

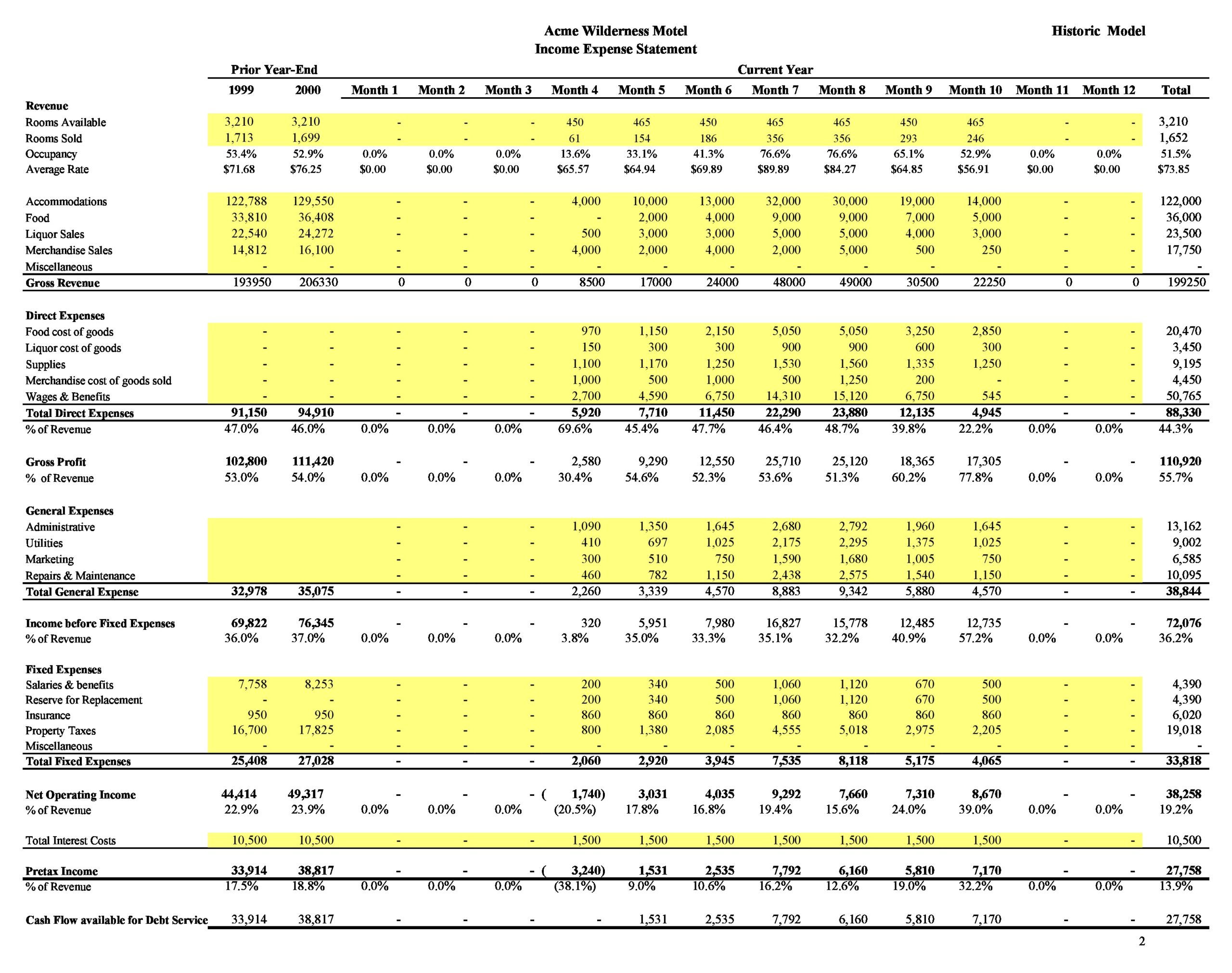

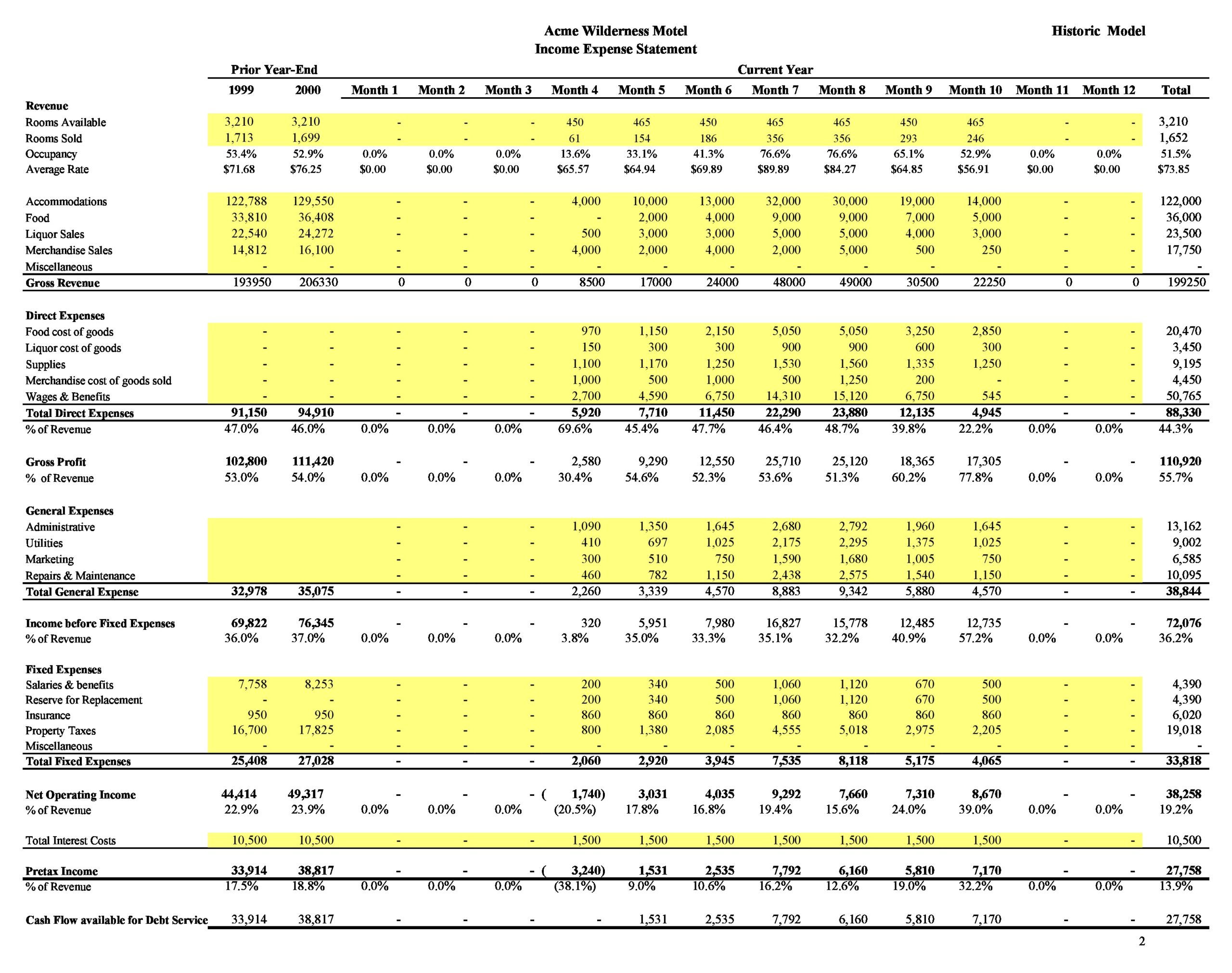

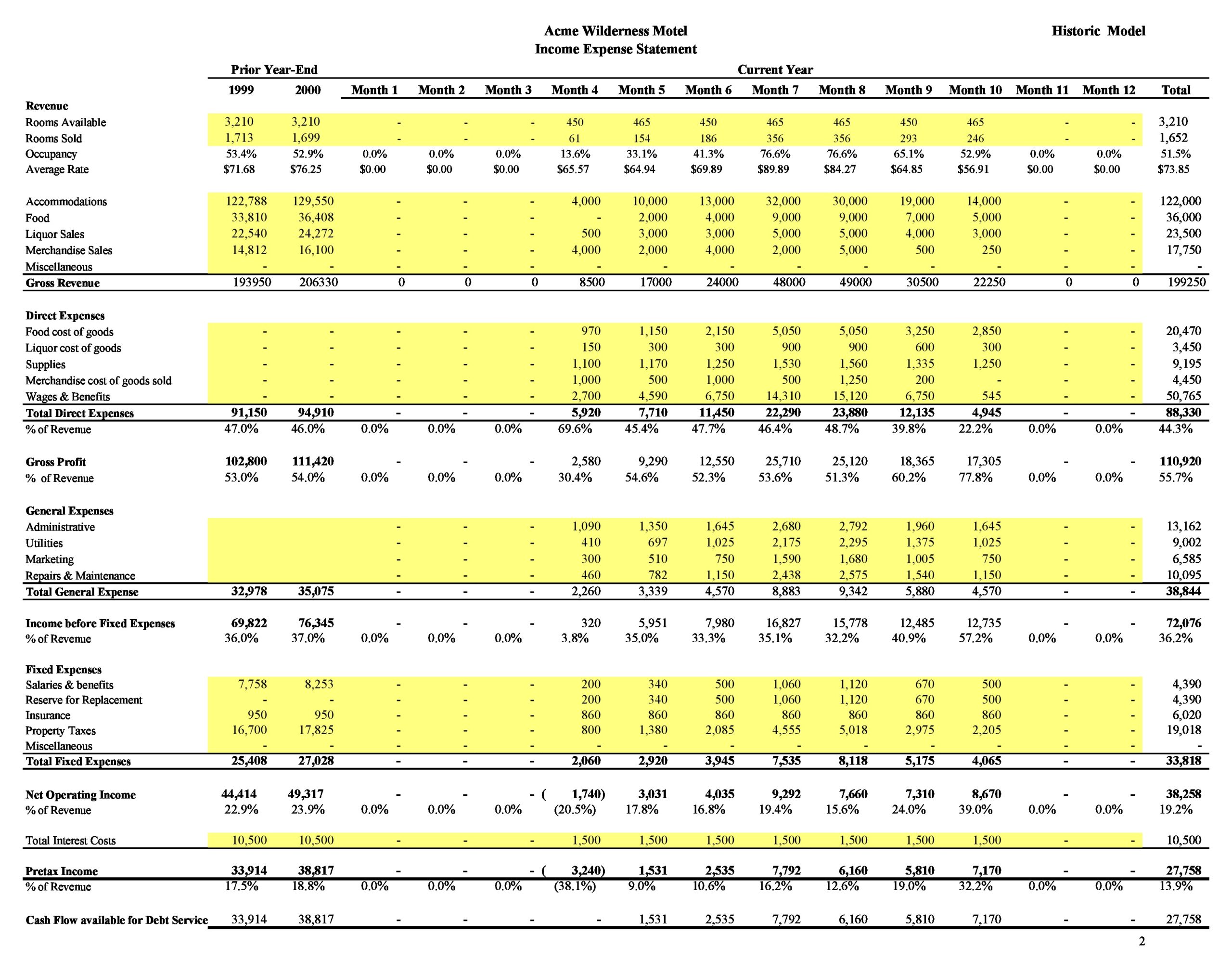

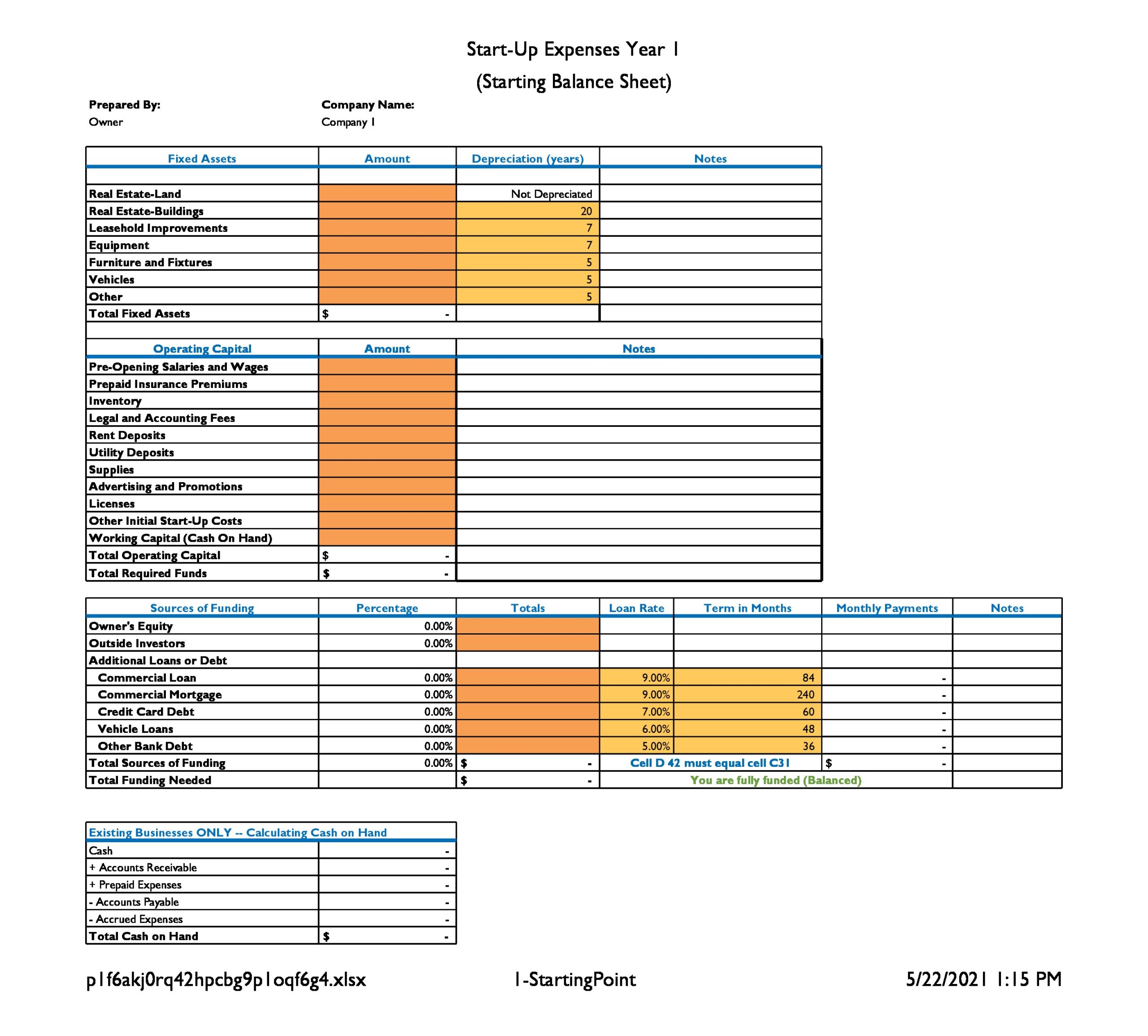

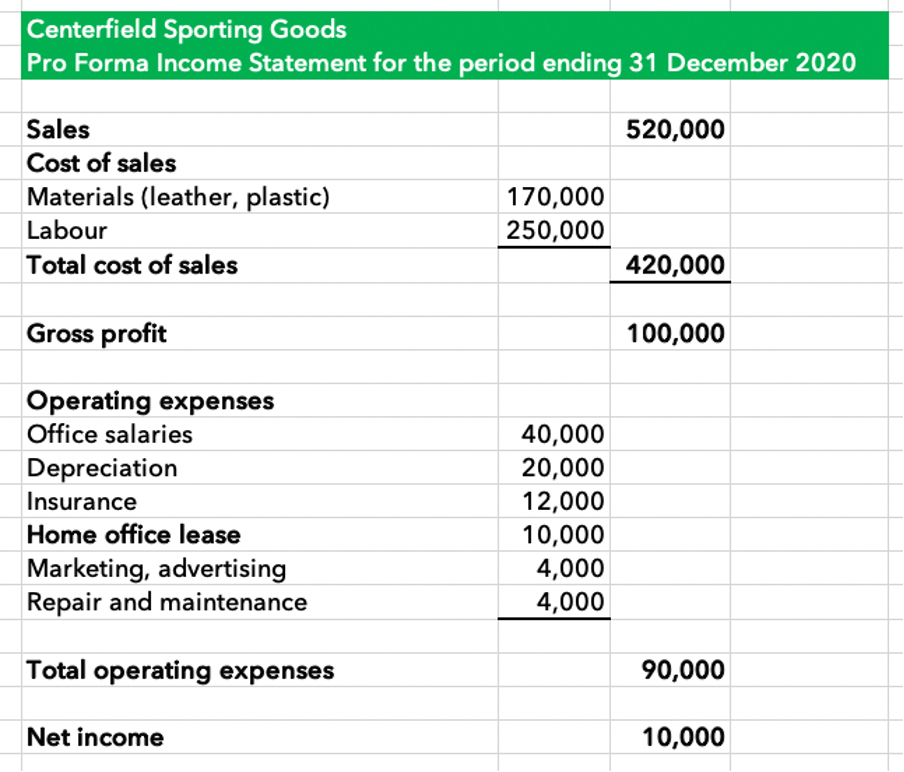

- Create separate sheets for Income Statement, Balance Sheet, and Cash Flow Statements.

- Include tabs for assumptions, where you can input variables like average session rates or staff salaries.

| Sheet Name | Description |

|---|---|

| Assumptions | Variables influencing financial projections |

| Income Statement | Revenue and expenses over time |

| Balance Sheet | Assets, liabilities, and equity |

| Cash Flow | Cash inflows and outflows |

💡 Note: Always update the assumptions sheet when there are changes in your business model or financial strategy to keep projections accurate.

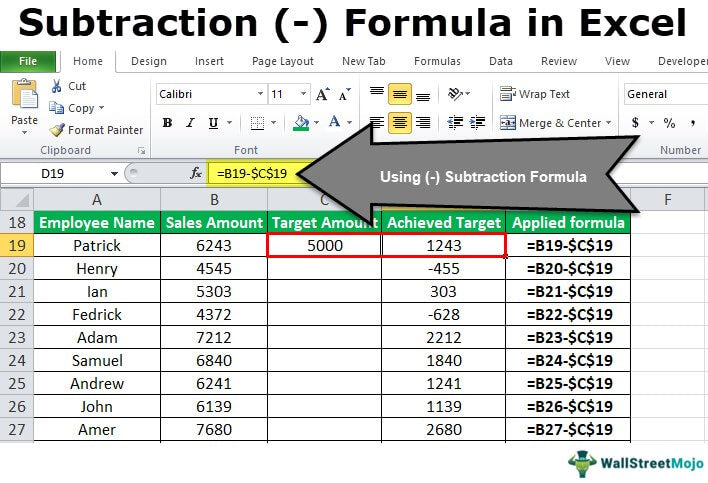

3. Use Formulas for Automatic Updates

Excel excels in automation. Use formulas to ensure your projections update dynamically:

- Use Absolute References: For fixed values like tax rates or salaries, use ‘$’ to lock cells.

- Create Links: Link cells across sheets to reflect changes in income or expenses automatically.

4. Integrate Seasonal and Growth Assumptions

ABA practices might experience variations due to school cycles or seasonal trends:

- Seasonality: Project lower activity during holiday periods or higher demand when schools reopen.

- Growth Patterns: Reflect expansion plans or market growth in your projections.

5. Include Staff and Operational Expenses

ABA practices rely heavily on skilled staff and operational infrastructure:

- Staff Costs: Salaries, benefits, training, and professional development.

- Operating Expenses: Rent, utilities, materials, software, and marketing costs.

- Account for these costs on a monthly or quarterly basis to gauge cash flow accurately.

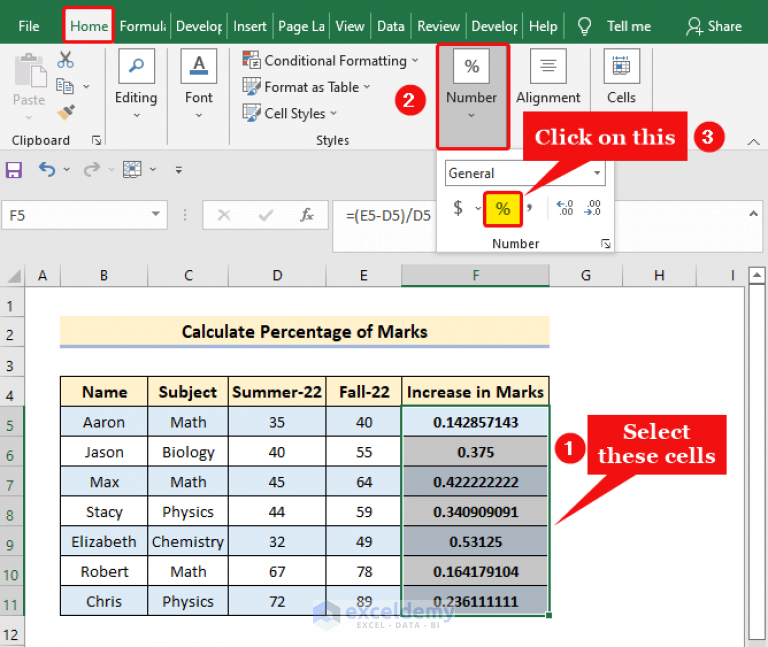

6. Forecast Revenue

Revenue forecasting for ABA businesses requires careful analysis:

- Project both the number of clients and session frequency to estimate income.

- Consider reimbursement rates from insurance providers or billing contracts.

7. Scenario Analysis

Create scenarios to understand how your business might react to different situations:

- Best Case: What happens if client growth exceeds expectations?

- Worst Case: How can you sustain operations if client numbers drop?

- Base Case: Your most likely scenario for cautious yet hopeful planning.

Summing Up

By following these seven tips, ABA business owners can craft financial projections that not only help in securing funding but also provide a roadmap for growth. Accurate projections can serve as a foundation for strategic planning, identifying potential financial pitfalls, and ensuring that your business remains sustainable and profitable. Remember, financial projections are not just numbers; they reflect your business vision and strategy in the evolving field of ABA therapy.

Why are financial projections important for ABA practices?

+

Financial projections help ABA practices understand their financial health, plan for growth, secure funding, and manage resources efficiently. They are crucial for making informed business decisions.

How often should financial projections be updated?

+

Financial projections should be reviewed and potentially updated quarterly or whenever there is a significant change in the business environment, client base, or operational model.

What if my projections do not align with actual results?

+

Deviations in projections from actual results should be analyzed. They might indicate a need for strategy adjustment, cost review, or reassessment of revenue assumptions. Regularly refine projections to make them more accurate over time.

Can Excel’s scenario analysis feature be used for ABA businesses?

+

Yes, Excel’s scenario manager can be particularly useful for ABA businesses to model different outcomes based on client growth, service offerings, and market conditions, providing valuable insights for strategic planning.