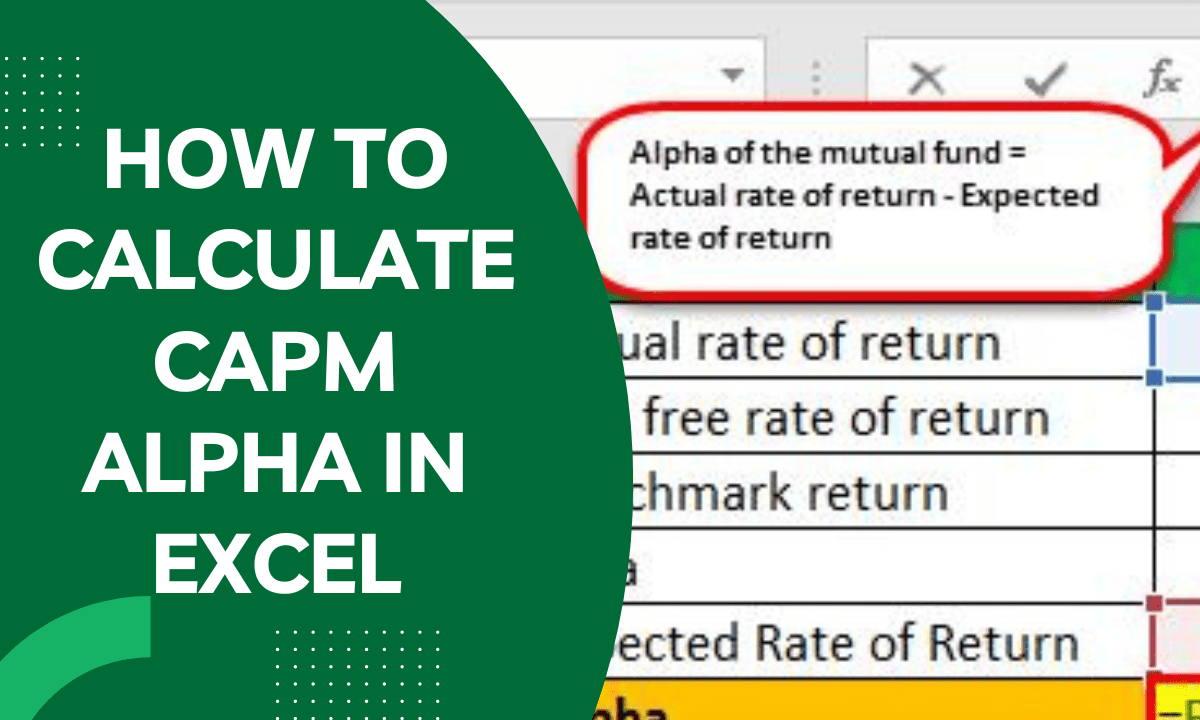

How To Calculate Capm Alpha In Excel

In the world of financial analysis, understanding the Capital Asset Pricing Model (CAPM) is crucial for evaluating investment performance. One of the key metrics derived from CAPM is the alpha, which measures a security’s return above or below its expected return based on its risk profile. Calculating alpha can be an insightful endeavor for investors looking to assess how well their investments are performing. In this post, we’ll explore how to calculate CAPM alpha in Excel in a way that’s both accessible to beginners and comprehensive for the more seasoned investors.

Understanding CAPM and Alpha

Before we dive into the calculations, let’s break down what CAPM and alpha represent:

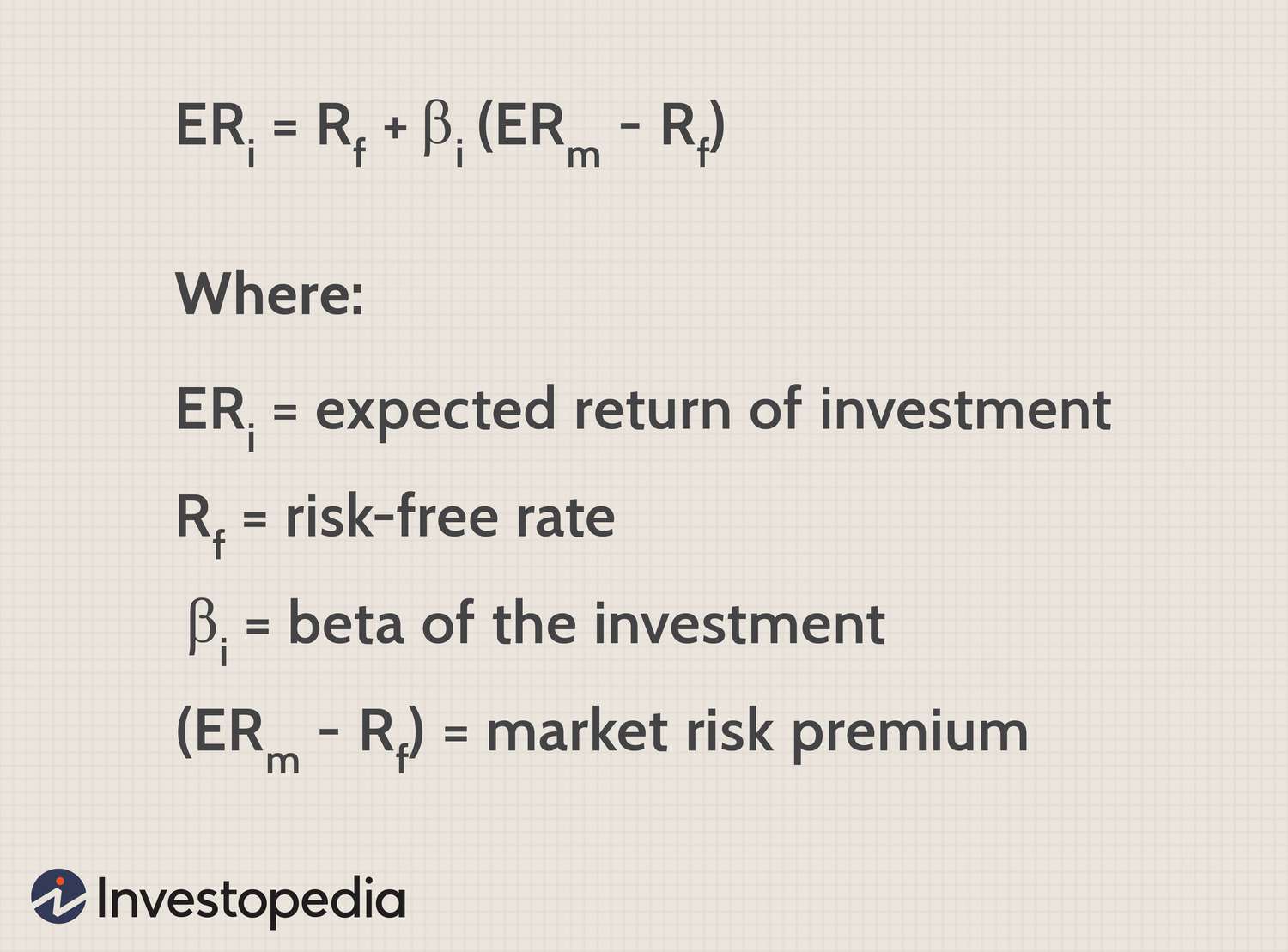

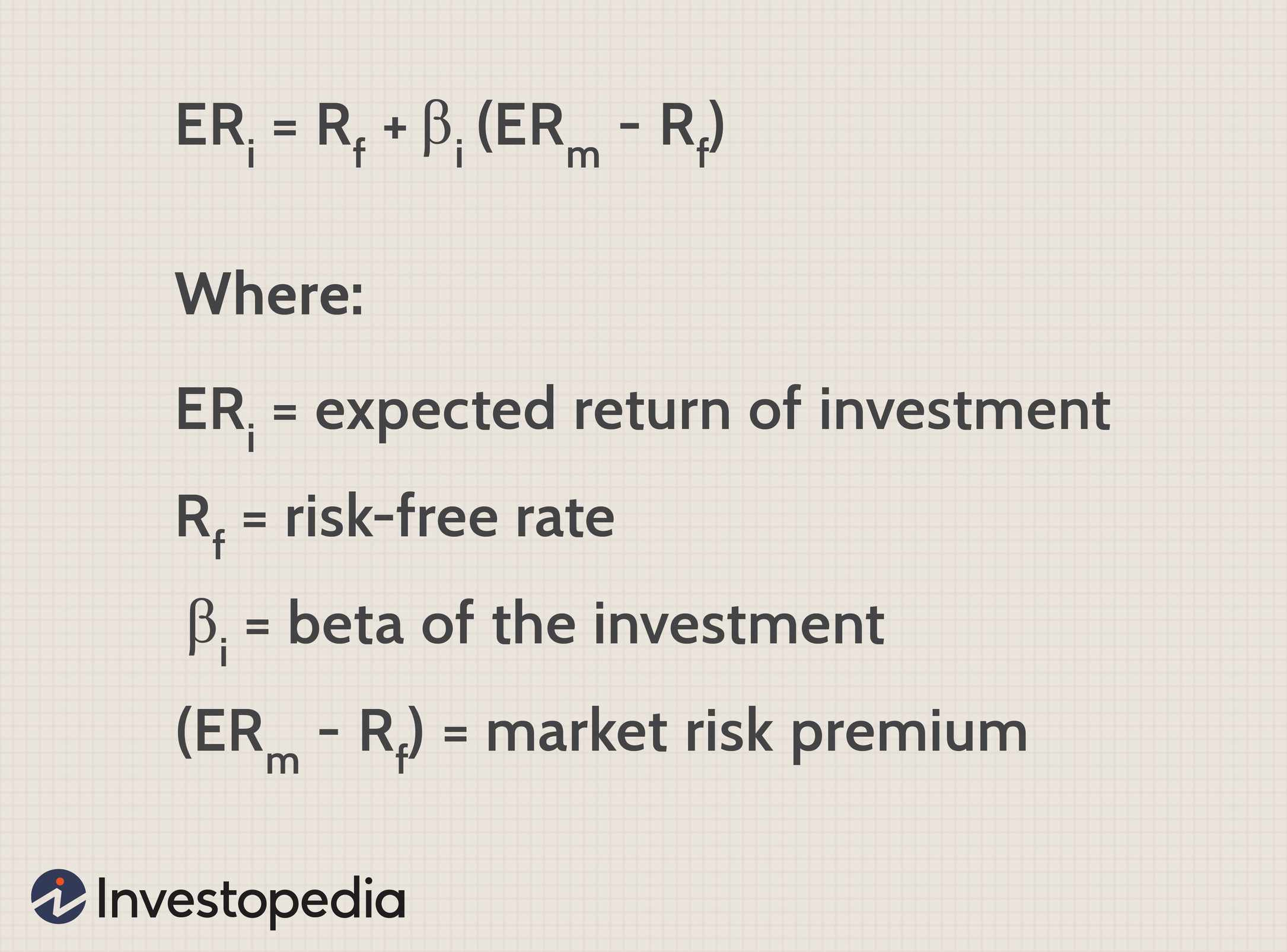

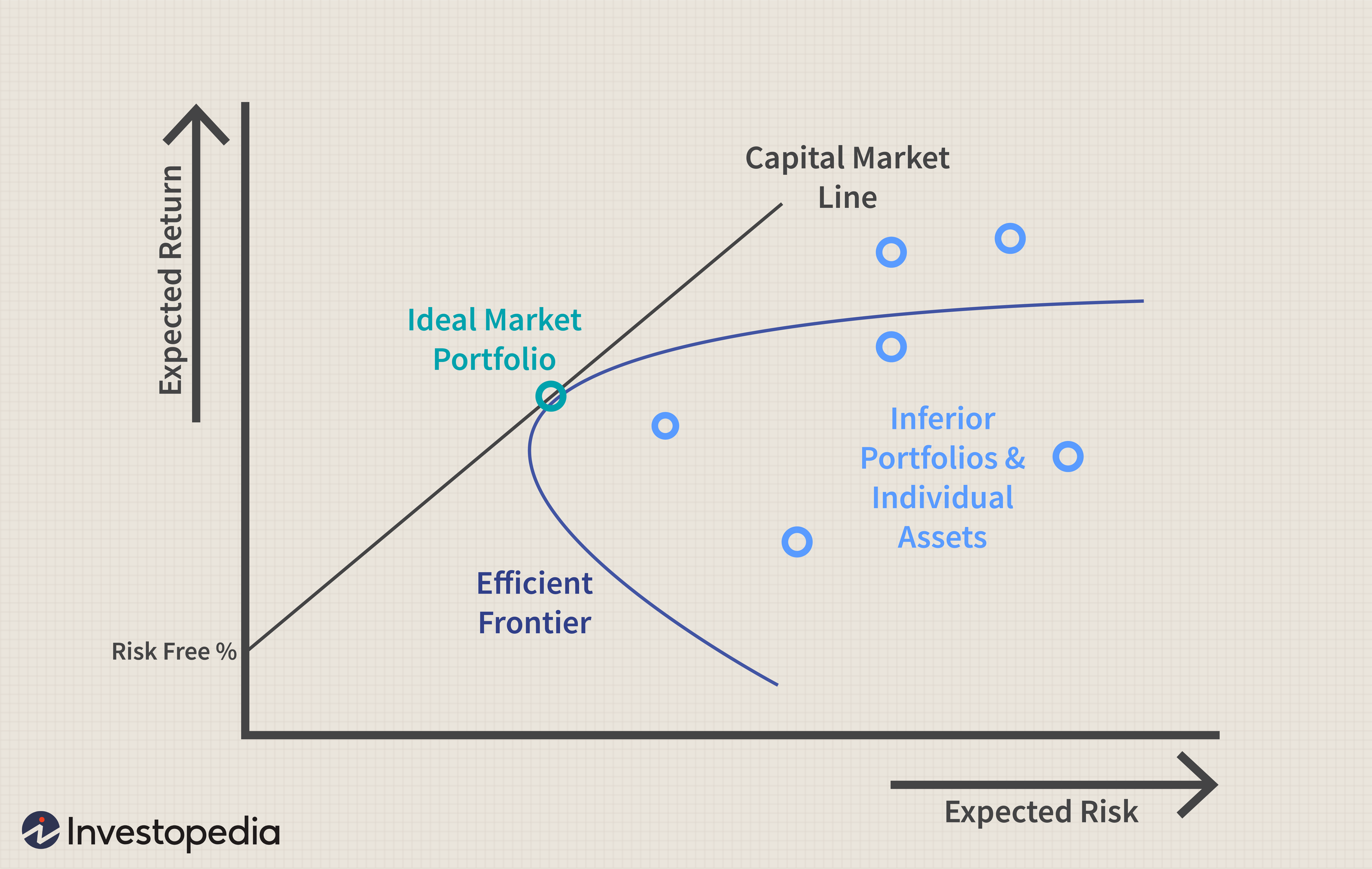

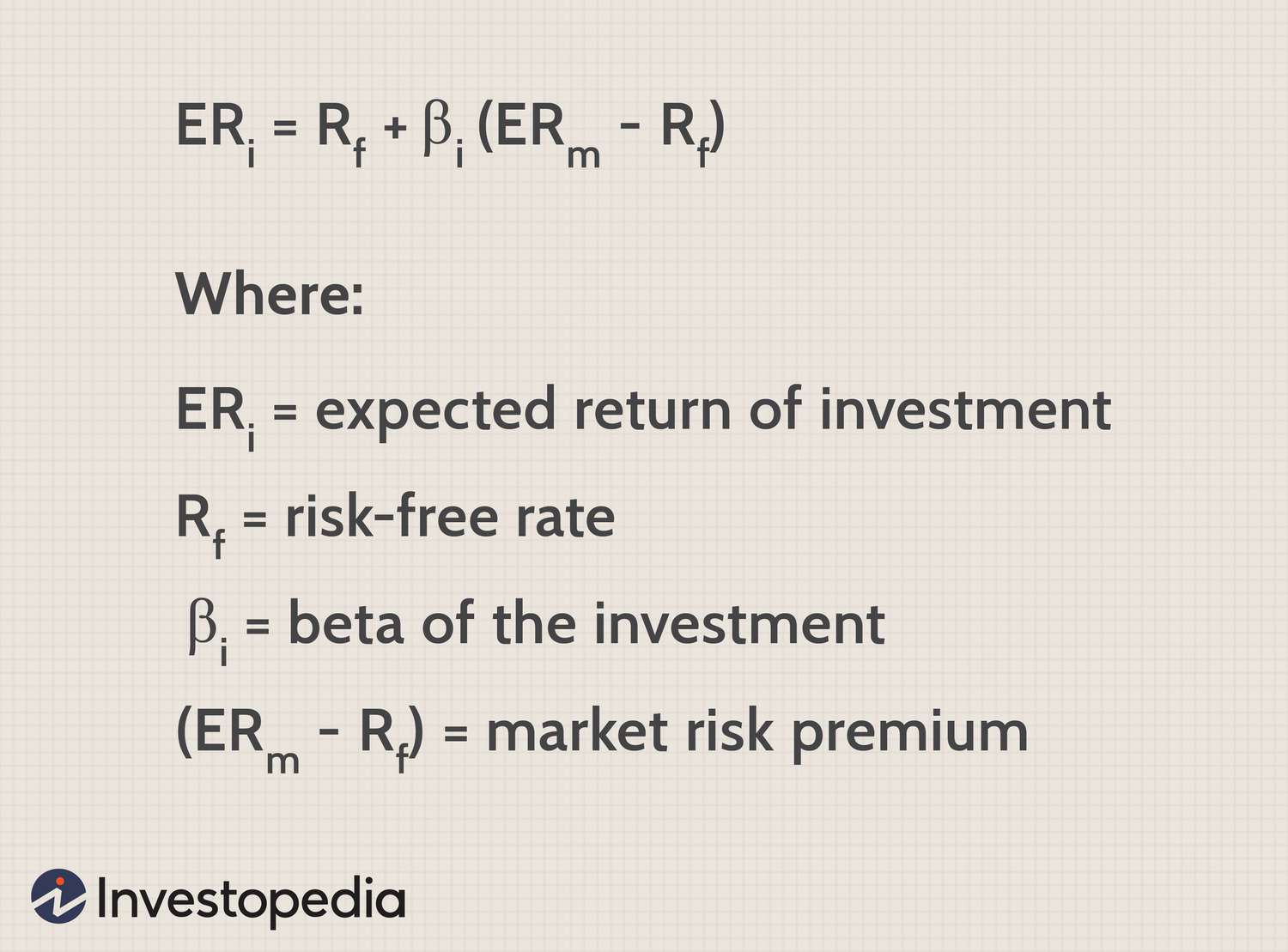

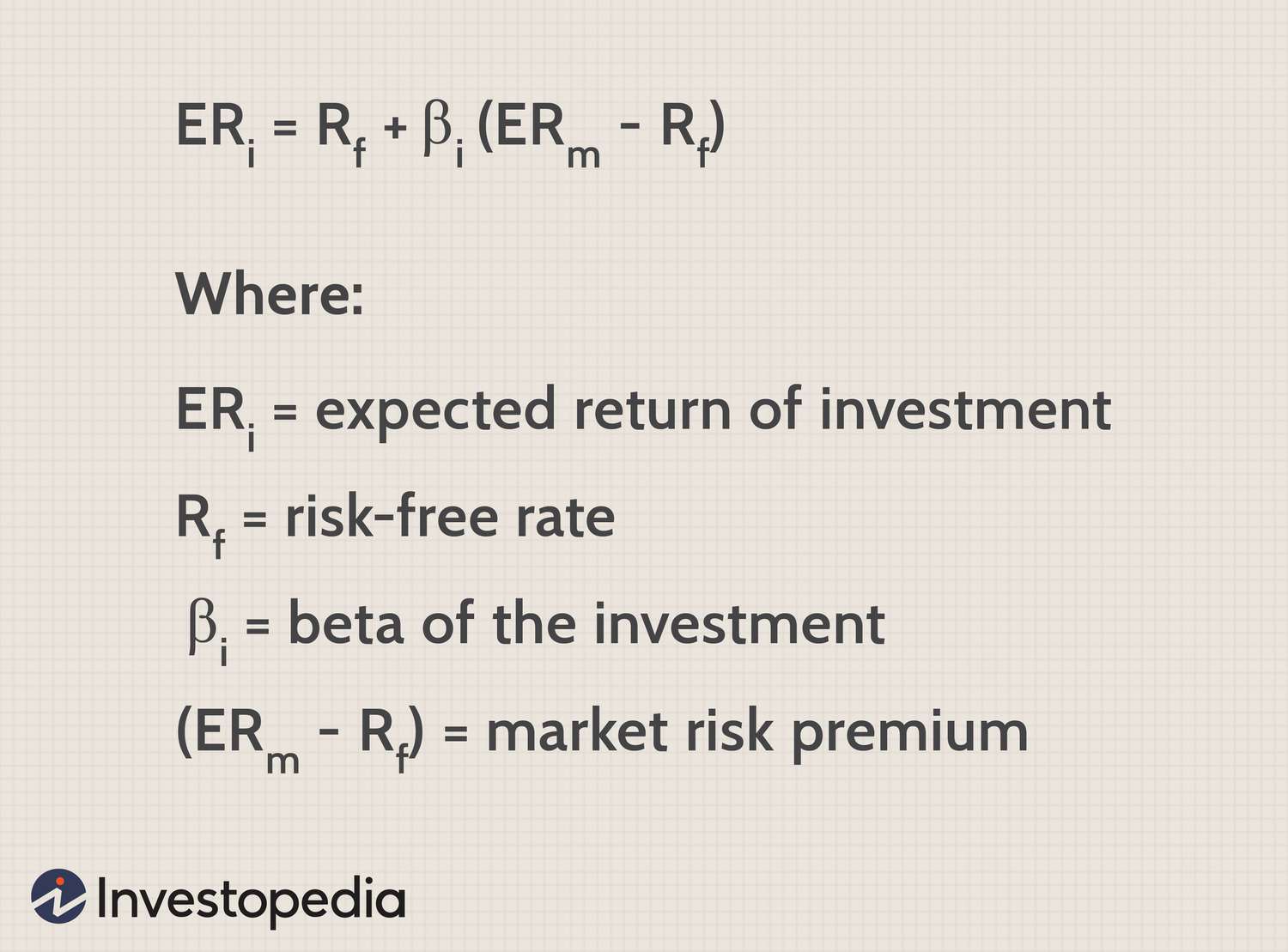

- Capital Asset Pricing Model (CAPM): CAPM suggests that the expected return of a security or a portfolio equals the rate on a risk-free security plus a risk premium. The formula is:

E(Ri) = Rf + βi * (E(Rm) - Rf)

Here: - E(Ri) is the expected return of the security or portfolio. - Rf is the risk-free rate. - βi (beta) measures the security’s sensitivity to market movements. - E(Rm) is the expected market return.

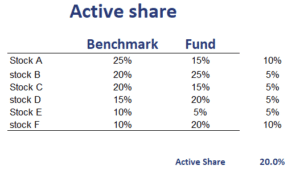

- Alpha (α): This is the measure of performance. It represents the excess return of an investment relative to the return of a benchmark index, adjusted for risk.

Why Calculate Alpha?

Calculating alpha helps investors:

- Understand how much better or worse an investment has performed relative to a benchmark.

- Assess the value added or subtracted by an investment manager.

- Evaluate the intrinsic value of an investment strategy beyond just market movements.

Step-by-Step Guide to Calculate CAPM Alpha in Excel

Here’s how you can calculate CAPM alpha using Excel:

1. Gathering Required Data

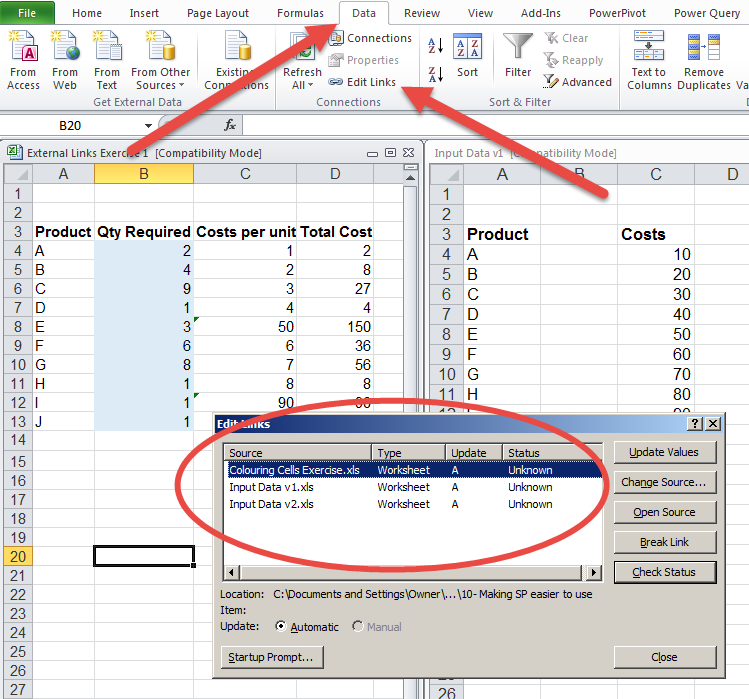

First, you’ll need the following information:

- Return of the Security ®: You can either use historical returns or expected returns based on forecasts.

- Risk-Free Rate (Rf): Commonly, the yield of government securities like U.S. Treasury Bonds.

- Beta (β): This can be obtained from financial databases or calculated.

- Market Return (E(Rm)): Typically, the return of an index like the S&P 500.

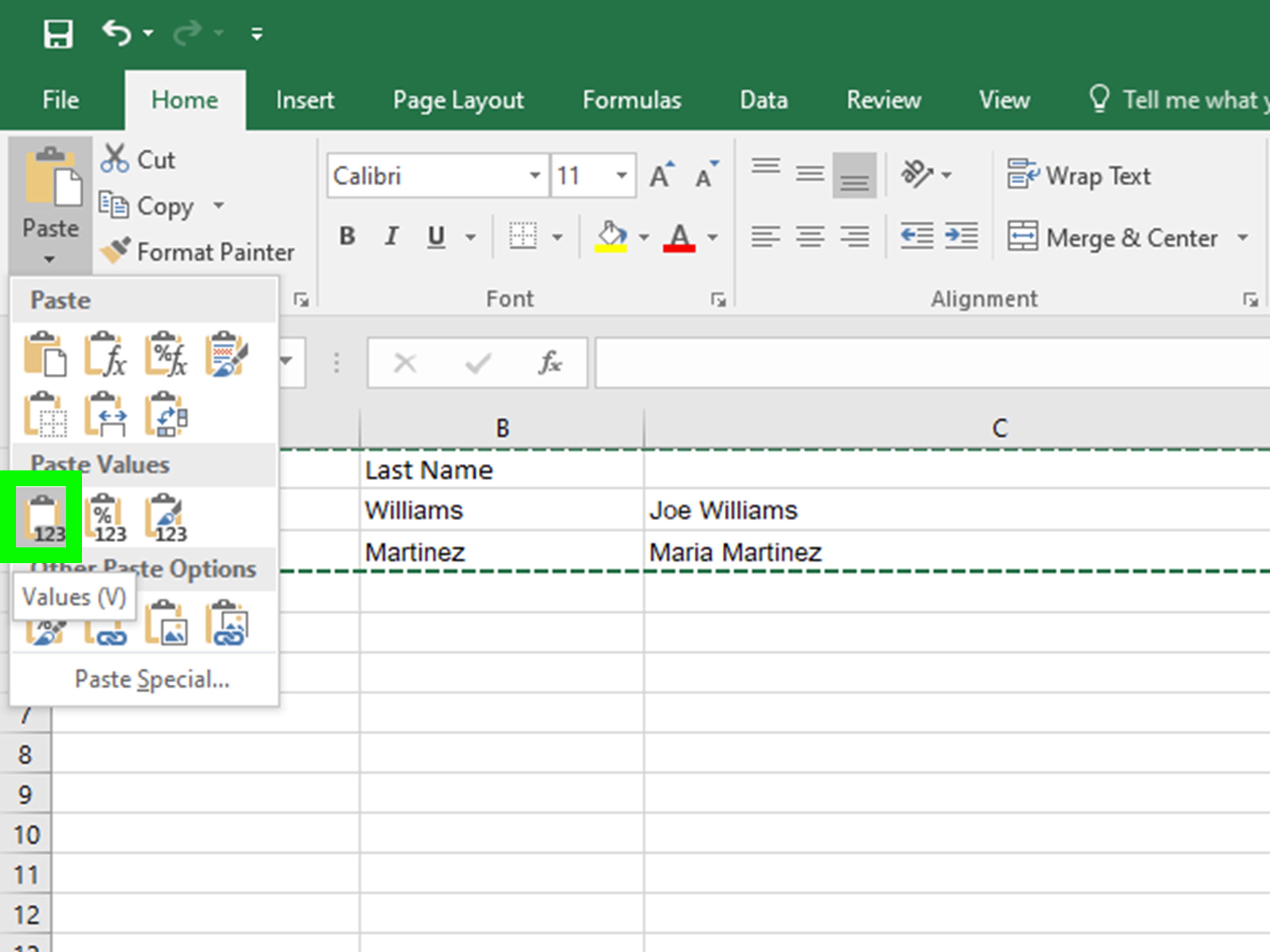

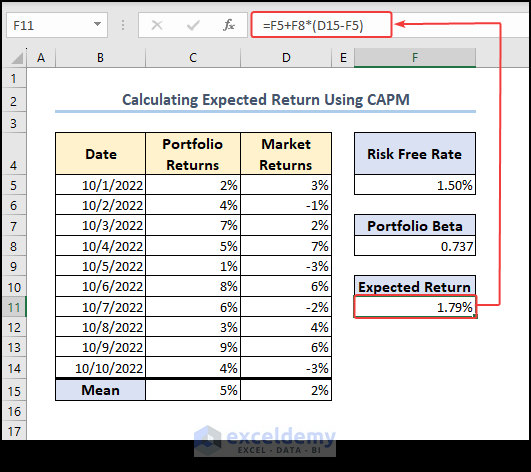

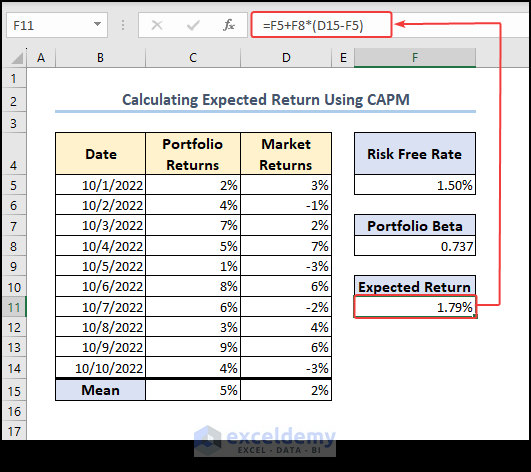

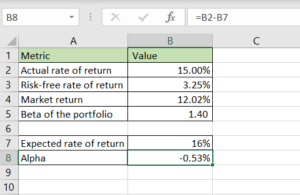

2. Input Data in Excel

| Cell | Data |

|---|---|

| A1 | Risk-Free Rate |

| A2 | Beta |

| A3 | Market Return |

| A4 | Actual Return of Security |

Enter the values in cells B1 through B4 respectively.

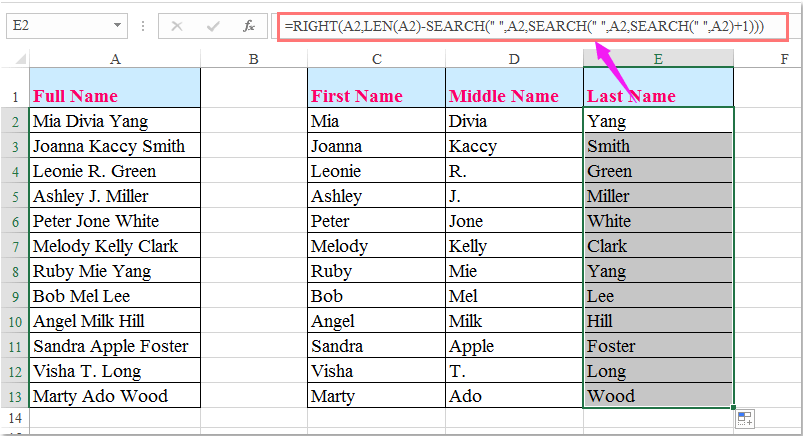

3. Calculate Expected Return Using CAPM

In cell C1, input the formula to calculate the expected return:

=B1 + (B2 * (B3 - B1))

This gives you E(Ri).

4. Calculate Alpha

Now, in cell C2, calculate alpha:

=B4 - C1

This will give you the Alpha (α) of your investment.

Interpreting Alpha

- Positive Alpha: Your investment has outperformed the expected return based on its risk.

- Negative Alpha: Your investment has underperformed.

- Zero Alpha: Performance exactly matches what was expected by CAPM.

💡 Note: Alpha alone does not provide a complete picture; it should be considered alongside beta and market conditions.

Advanced Analysis with Excel

If you’re interested in further analysis:

- Treynor Ratio: (Portfolio Return - Risk-Free Rate) / Beta. Enter this in cell C3:

=(B4 - B1) / B2

- Sharpe Ratio: (Portfolio Return - Risk-Free Rate) / Standard Deviation of Portfolio Returns. Although standard deviation isn’t directly part of the alpha calculation, it’s useful for assessing risk-adjusted performance.

Final Thoughts

Calculating CAPM alpha in Excel provides an in-depth look into how your investments are performing. It helps in identifying whether an investment’s returns are due to smart choices or just riding the market’s wave. Remember, while alpha is informative, it’s part of a larger financial analysis toolkit:

- Diversification: Understand the role of portfolio diversification in minimizing risk while seeking alpha.

- Investment Style: Assess whether your investment strategy aligns with your alpha goals.

- Risk Management: Use alpha in conjunction with other risk metrics to get a comprehensive view of your investment performance.

By following the steps outlined above, you can make informed decisions about your investments and potentially identify opportunities for better returns.

Here’s how you might address common queries about calculating CAPM alpha:

What is considered a good alpha?

+

A positive alpha indicates that the investment has performed better than expected. Generally, an alpha greater than 1% is considered good, but this can vary depending on the investment's risk profile and market conditions.

Can alpha be negative, and what does that mean?

+

Yes, alpha can be negative. This suggests that the investment has underperformed relative to its expected return for the level of risk it carries.

How often should I calculate alpha?

+

Alpha should be calculated periodically, at least annually or quarterly, to reflect changes in market conditions, portfolio performance, and investment strategies.

Does beta affect alpha?

+

Yes, beta influences alpha calculations because it measures a security's volatility relative to the market. A security with a high beta that beats market returns will show a higher alpha than a low beta stock that beats by the same amount.

In conclusion, calculating CAPM alpha in Excel is not just about understanding how your investments have fared but also about leveraging this information to make strategic decisions. Whether you’re a novice or a seasoned investor, mastering this calculation empowers you to better analyze and optimize your investment strategy. Remember, alpha is just one piece of the puzzle in the vast landscape of financial analysis.