Calculate Indirect Cost Rate Easily with Excel Formula

Understanding Indirect Costs in Business

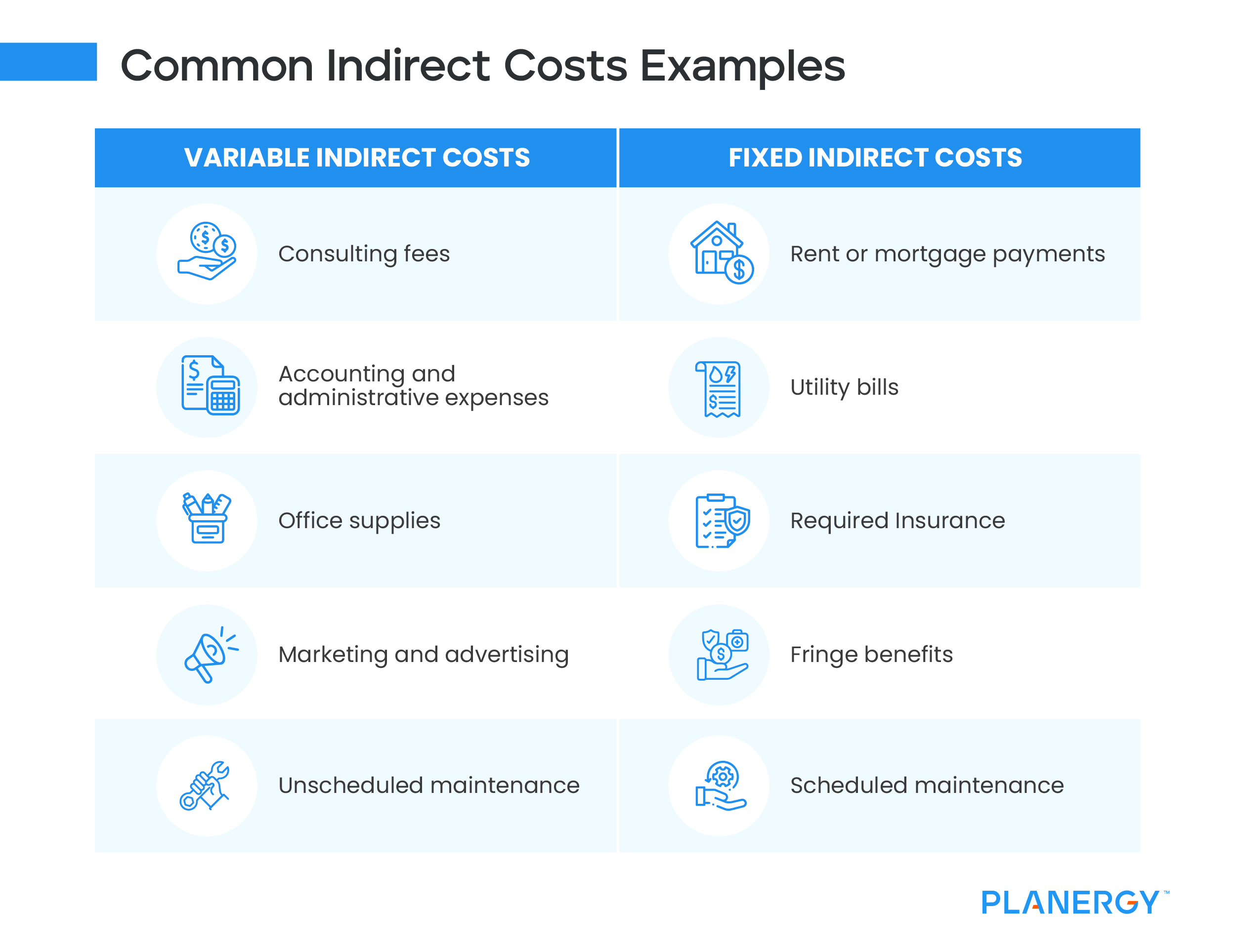

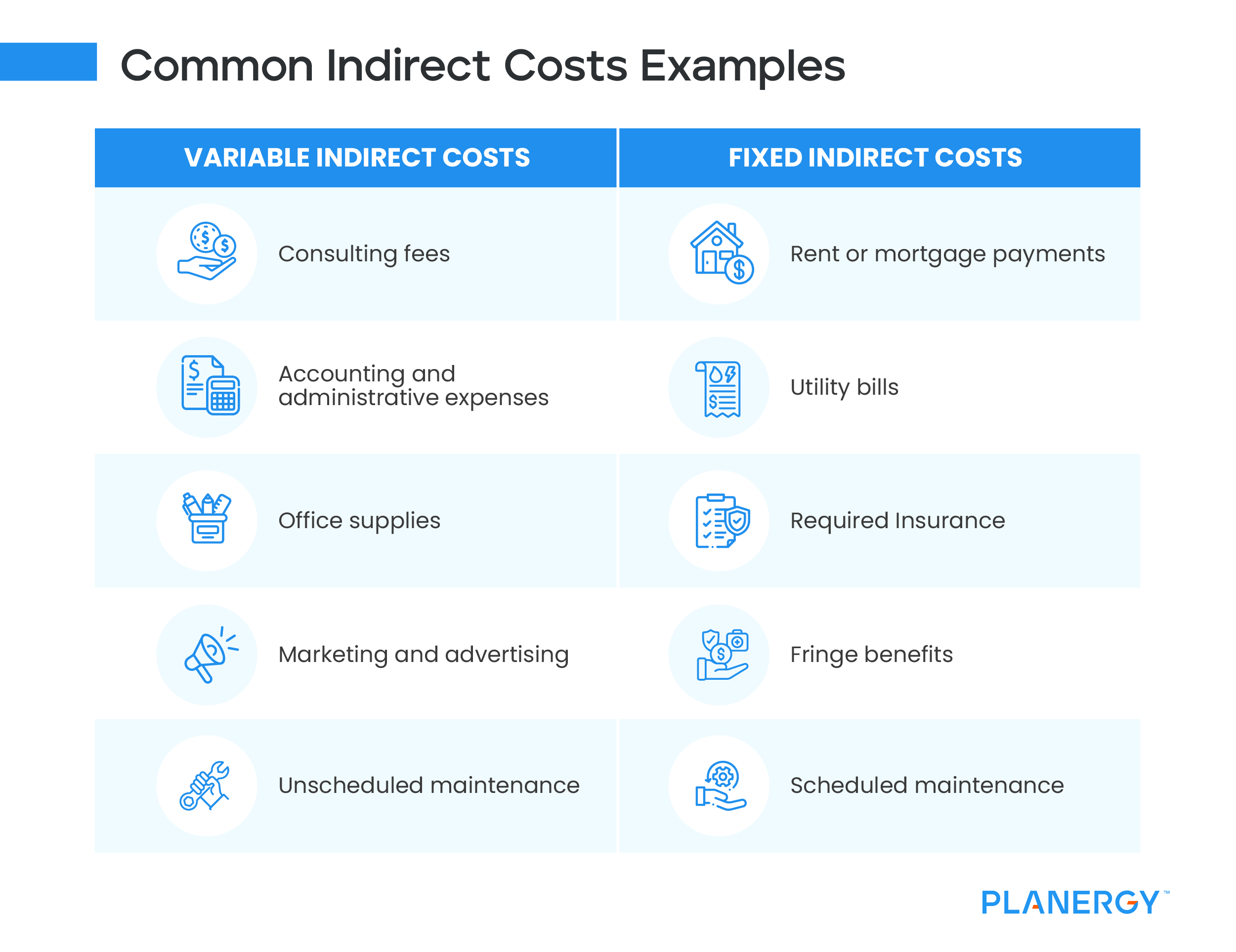

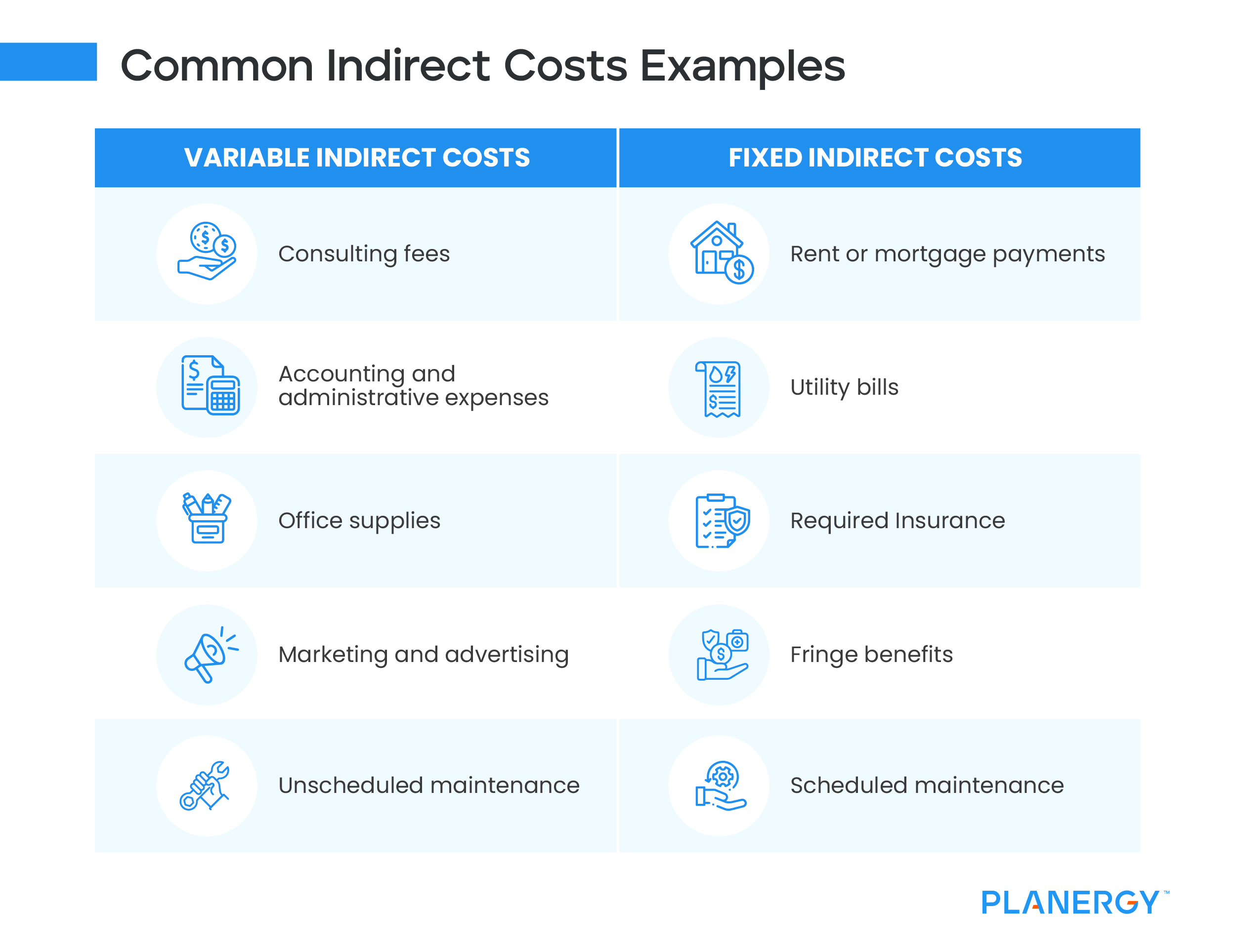

Indirect costs are an essential part of business financial management that are not directly tied to producing specific goods or services. These costs can include rent, utilities, insurance, administrative salaries, and more. Unlike direct costs, which can be easily allocated to a product or project, indirect costs benefit multiple activities and are often more challenging to manage.

The Significance of Calculating Indirect Cost Rates

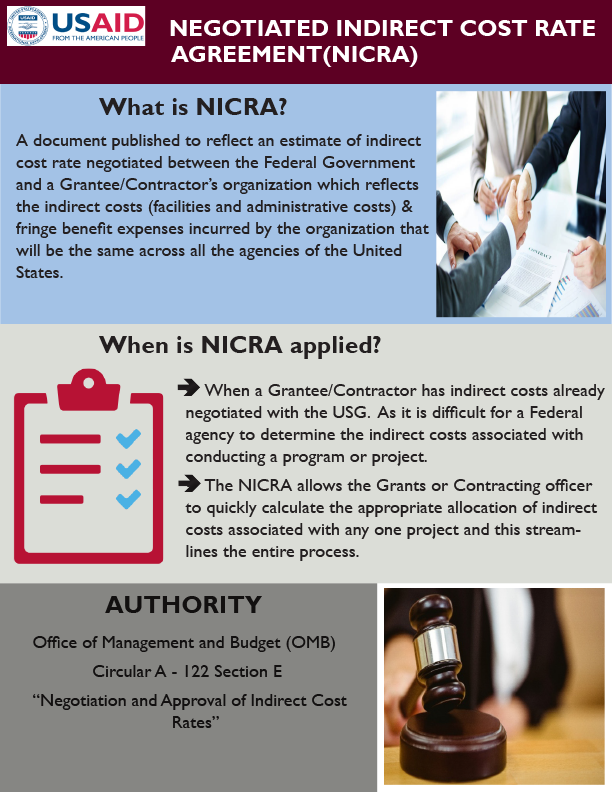

Calculating the indirect cost rate provides businesses with insights into their overall cost structure, helping in several ways:

- Improved Budgeting: Understanding the full cost of operations helps in creating more accurate budgets and forecasts.

- Pricing Strategy: Knowing your indirect costs allows for better pricing of products or services, ensuring profitability.

- Funding Requests: Accurate calculation is crucial when applying for grants or funding where indirect costs can be included.

- Operational Efficiency: Identifying how resources are utilized across the organization can lead to efficiency improvements.

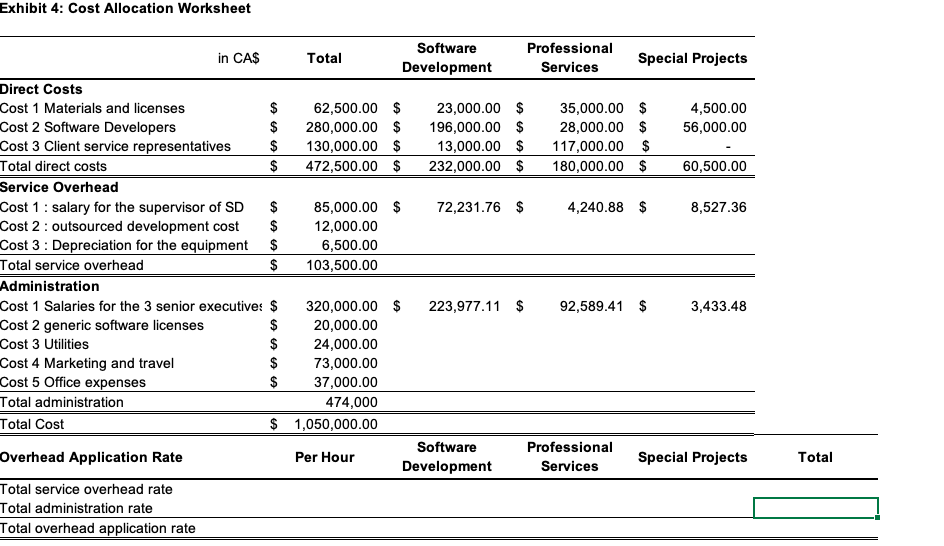

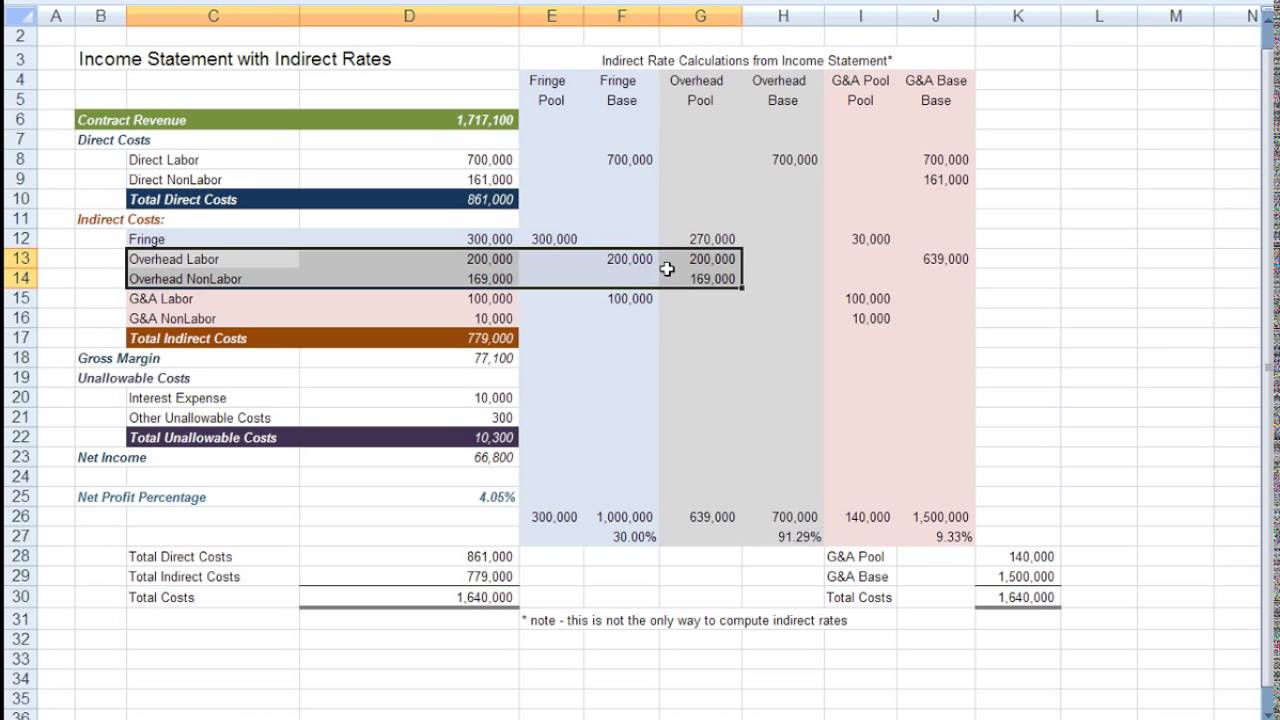

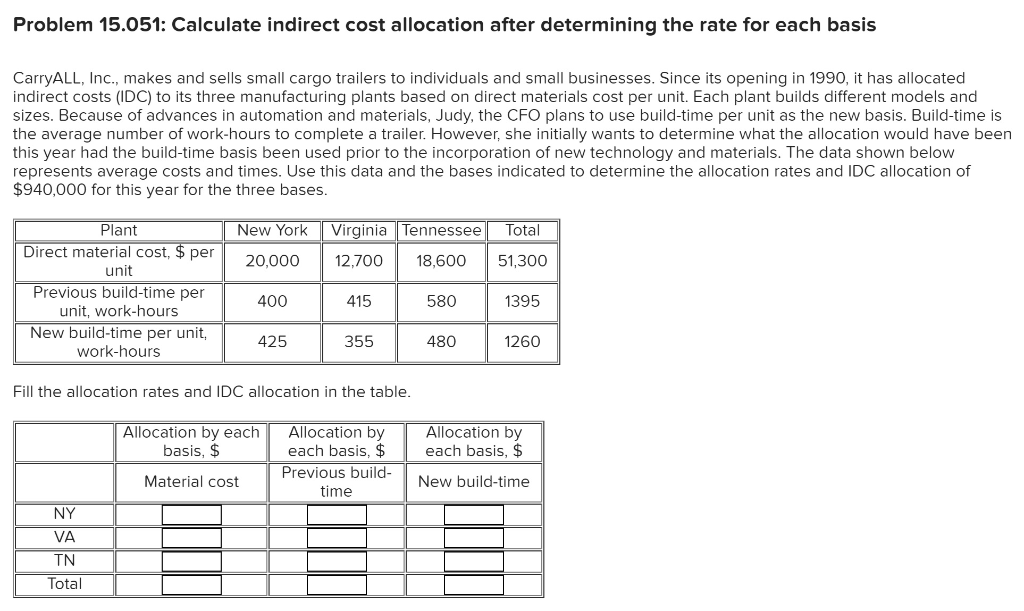

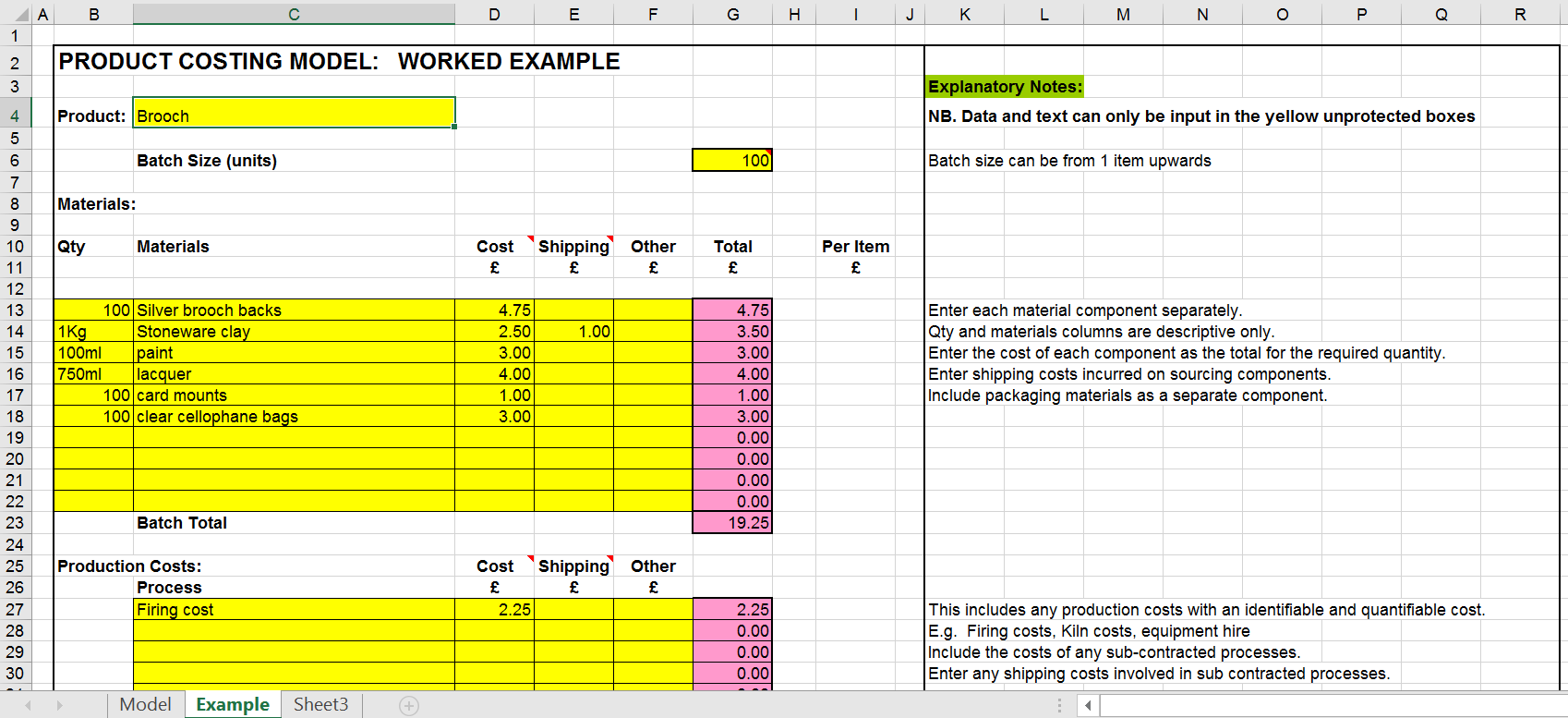

Setting Up Your Excel Spreadsheet for Calculation

Let's walk through how to set up an Excel spreadsheet to calculate your indirect cost rate:

- Open Excel: Start a new workbook or open an existing one if you're adding to previous data.

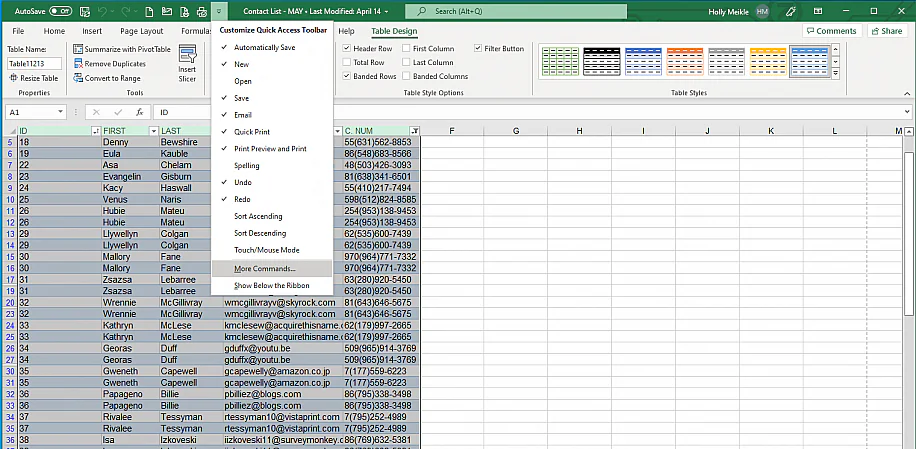

- Create Headers: In the first row, label your columns as follows:

Column A Column B Column C Column D Description Total Cost Direct Cost Indirect Cost

- Enter Data: Below the headers, list out your expenses, differentiating direct from indirect costs.

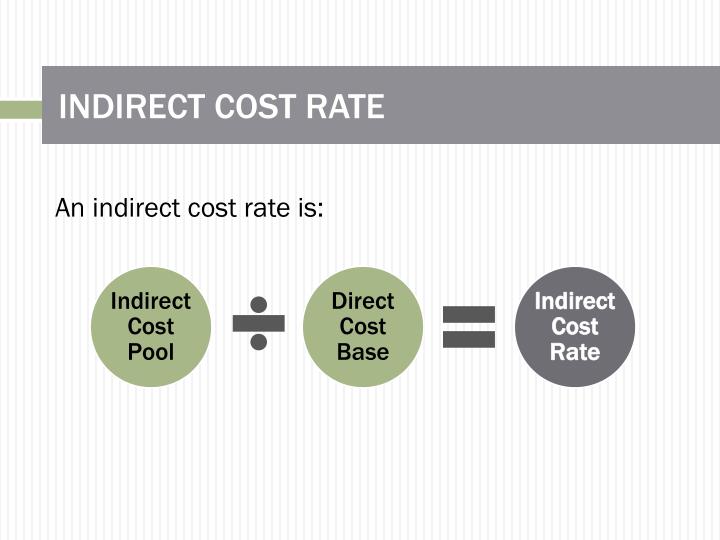

Formula for Calculating Indirect Cost Rate

The formula for calculating the indirect cost rate is straightforward:

Indirect Cost Rate = (Total Indirect Costs / Total Direct Costs) * 100

To set up this calculation in Excel:

- Sum Indirect Costs: Use the SUMIF function in Excel to total all indirect costs. Suppose your indirect costs are listed from row 2 to 10 in column D:

=SUM(D2:D10)

- Sum Direct Costs: Similarly, sum the direct costs in column C:

=SUM(C2:C10)

- Calculate the Rate: In another cell, input the formula:

=(Indirect_Costs_Sum / Direct_Costs_Sum) * 100

Make sure to replace "Indirect_Costs_Sum" and "Direct_Costs_Sum" with the actual cell references where you summed your indirect and direct costs respectively.

💡 Note: Using cell references in your formulas ensures that the calculations update automatically if you change any values.

Interpreting the Indirect Cost Rate

Once you've calculated your indirect cost rate:

- Over 100%: Indicates a heavy reliance on indirect costs, which might signal inefficiencies.

- Under 50%: Suggests lower overhead, but review to ensure all indirect costs are accounted for.

- Industry Benchmark: Compare your rate with industry standards to see if your indirect costs are typical or exceptional.

Strategies for Managing Indirect Costs

Here are some strategies to manage your indirect costs effectively:

- Regular Review: Continuously review indirect costs to ensure they are necessary and well managed.

- Negotiate Vendor Rates: Bulk purchasing or contract negotiations can reduce these costs.

- Automate and Outsource: Consider automation or outsourcing administrative tasks to reduce overhead.

- Optimize Office Space: Adjust office space usage to match current needs, potentially reducing rent or utility expenses.

By effectively managing indirect costs, businesses can:

- Reduce operational inefficiencies.

- Enhance profitability by ensuring that indirect costs are not disproportionately high.

- Be better prepared for economic changes that might affect indirect expenses.

Final Words

In summary, understanding and calculating the indirect cost rate is crucial for businesses to get a clearer picture of their financial health. Using an Excel formula to compute this rate provides a quantifiable measure of how much indirect costs are impacting the overall operation. This knowledge empowers business owners and managers to make informed decisions about pricing, budgeting, and strategic planning. By keeping indirect costs in check and optimizing where possible, companies can improve their competitive position and profitability.

Why is the Indirect Cost Rate important?

+

The Indirect Cost Rate helps businesses understand the full cost of their operations, aiding in pricing, budgeting, and operational efficiency.

Can indirect costs be reduced?

+

Yes, by reviewing and optimizing overheads, automating or outsourcing tasks, negotiating with vendors, and adjusting space usage, businesses can reduce their indirect costs.

What if the indirect cost rate is unusually high?

+

If the rate is high, it might indicate inefficiencies or misclassification of costs. Businesses should analyze the cost structure to identify potential savings or process improvements.