Excel Payback Calculation: A Simple Guide

The concept of payback period is crucial for businesses and individuals alike when deciding on investments or evaluating project viability. By calculating how long it will take to recoup the costs of an investment, you can make better-informed decisions. In this guide, we'll delve into how you can perform a payback calculation using Microsoft Excel, making this seemingly complex task accessible even to those with minimal Excel experience.

Understanding the Payback Period

Before we dive into Excel specifics, let’s ensure you understand what the payback period is:

- Definition: The payback period is the time it takes for an investment to generate enough cash flow or savings to cover its initial cost.

- Importance: It provides a simple metric for risk assessment, especially useful for cash flow-focused businesses or for comparing different investment opportunities.

Setting Up Your Excel Sheet

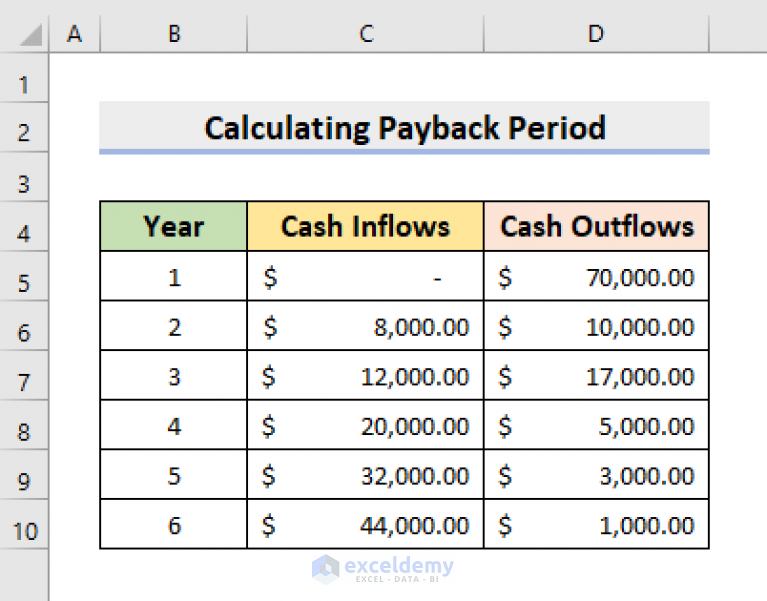

Here’s how to set up your Excel sheet for a payback calculation:

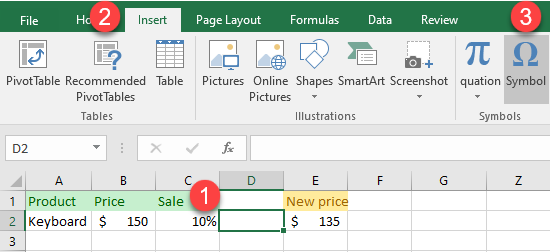

- Open a new Excel workbook.

- In cell A1, enter “Initial Investment” and input the cost in cell B1.

- From cell A2 downwards, list the years or periods (e.g., Year 1, Year 2, etc.).

- In column B, next to each year, input the expected cash flows or savings for that period.

💡 Note: Ensure the cash flows are positive figures. If you have a negative cash flow in any year, you'll need to adjust this figure for accurate calculations.

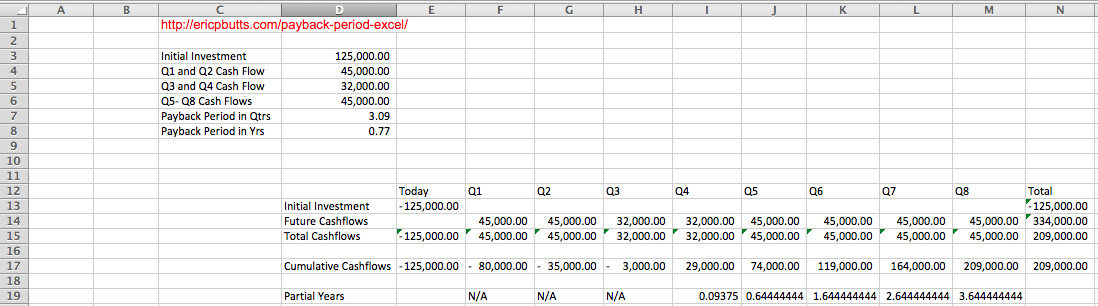

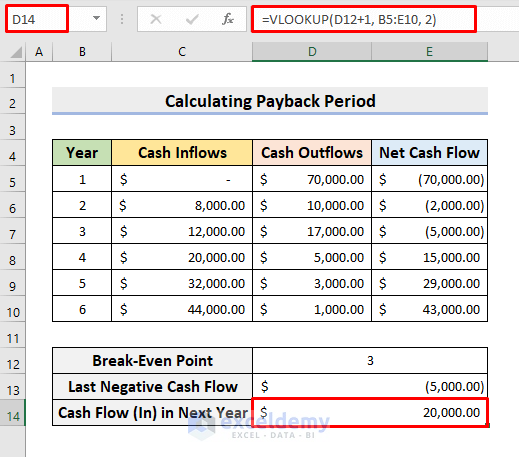

Calculating the Payback Period

Here’s how to calculate the payback period using Excel:

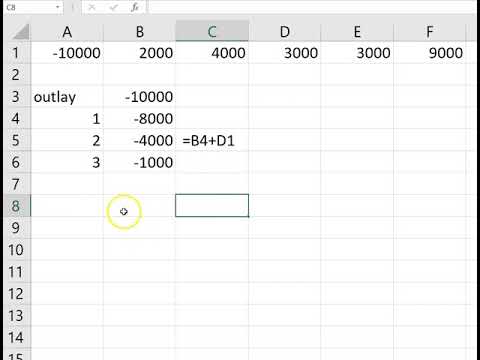

- In cell C1, enter “Cumulative Cash Flow”.

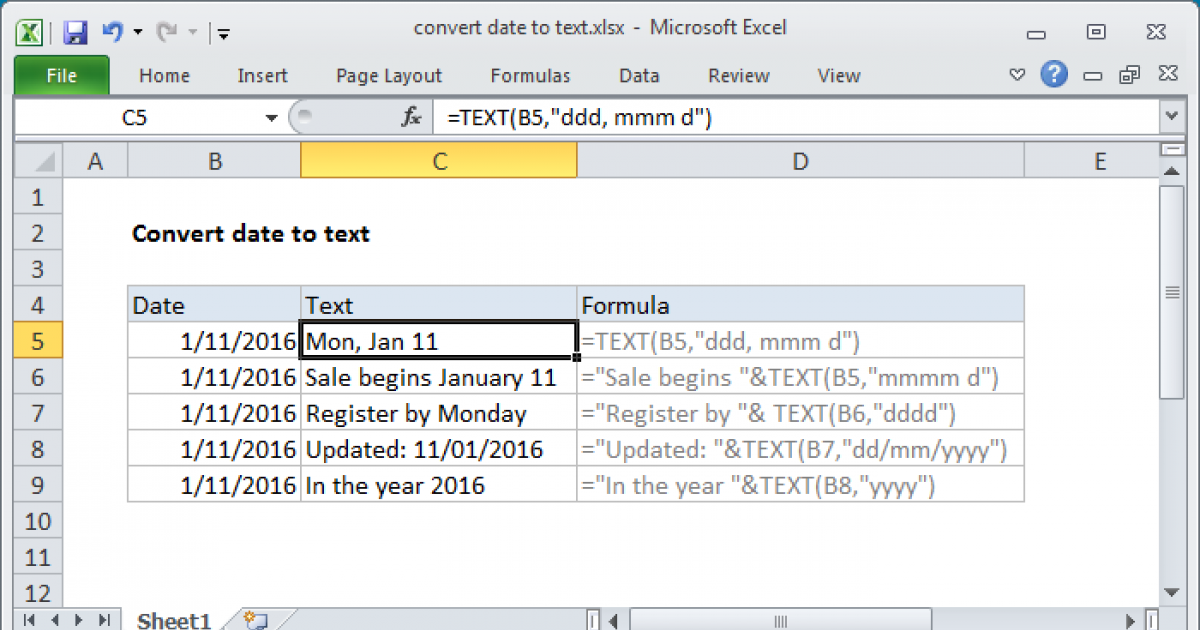

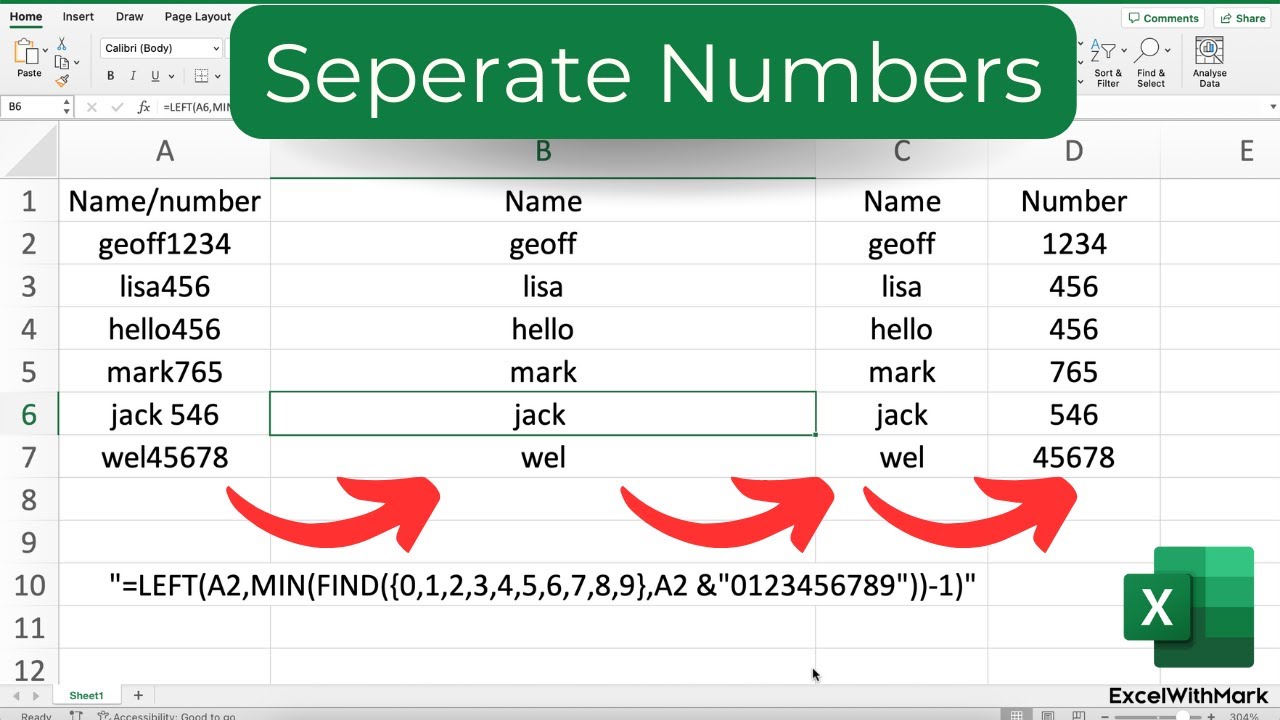

- Cell C2 should have the formula

=B2to start with the first year’s cash flow. - For C3 and beyond, use the formula

=C2 + B3. Drag this down to fill the column for as many years as you have cash flows. - Now, in cell E1, enter “Payback Period”. In cell E2, you’ll use a combination of formulas to find where the cumulative cash flow turns positive.

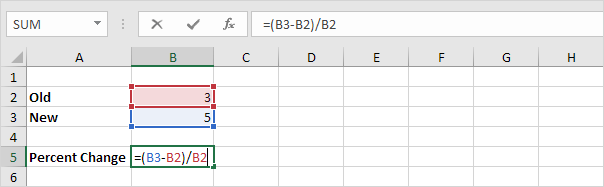

The formula in E2 would be something like:

=IF(C2 < $B$1, 1 + (B$1 - C2) / (C3 - C2), MATCH(TRUE, C$2:C$8 > $B$1, 0))

This formula does the following:

- Checks if the cumulative cash flow at the end of the first year is less than the initial investment. If so, it calculates a partial year for payback.

- If not, it finds the year where the cumulative cash flow exceeds the initial investment using the MATCH function.

Interpreting Your Results

Once your formulas are in place:

- If your payback period is a whole number, it means that by the end of that year, the investment will have paid back.

- If it's a decimal, say 2.7, it means that by the end of the 2nd year plus 70% of the 3rd year, the investment will be paid back.

| Example | Description |

|---|---|

| 1.0 | Payback in exactly 1 year |

| 3.5 | Payback by mid of the 4th year |

🧐 Note: The shorter the payback period, the less risk associated with the investment, as you'll recover your costs sooner.

Limitations of the Payback Period

While the payback period is a useful metric, it has limitations:

- It ignores the time value of money. Cash flows returned in later years are not discounted.

- It doesn’t account for returns after the payback period, potentially missing out on the full picture of investment profitability.

- It can favor projects with quicker returns but lower total profits over those with higher long-term profitability.

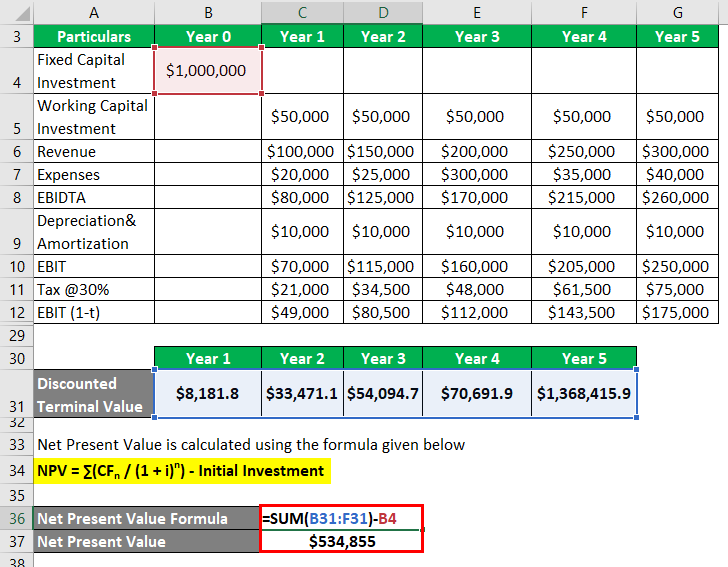

Enhancing Your Payback Analysis

To improve your payback analysis:

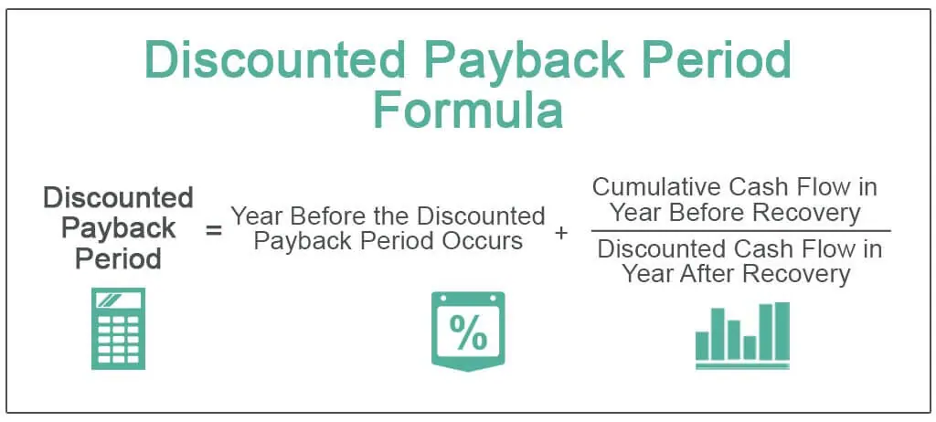

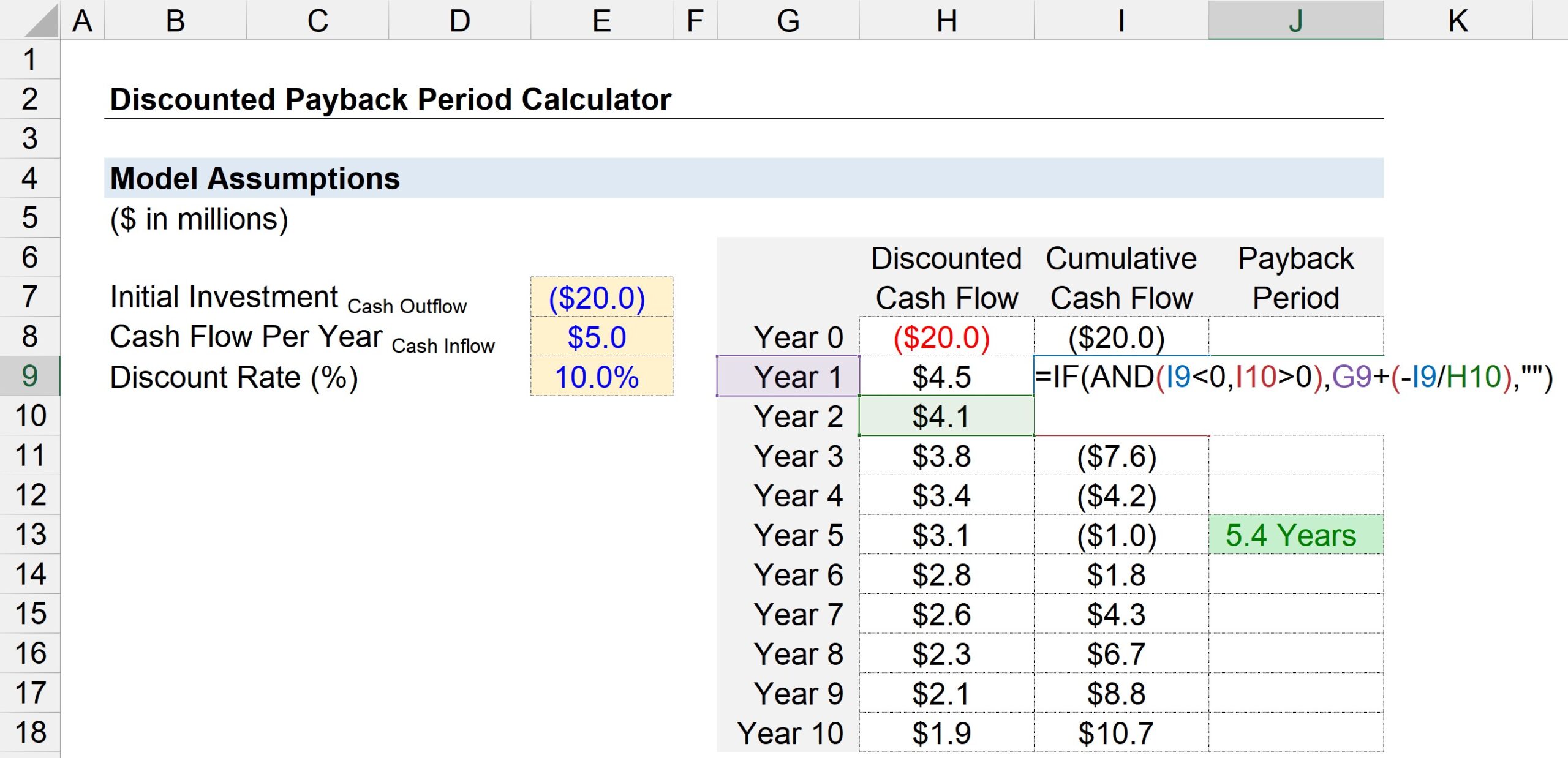

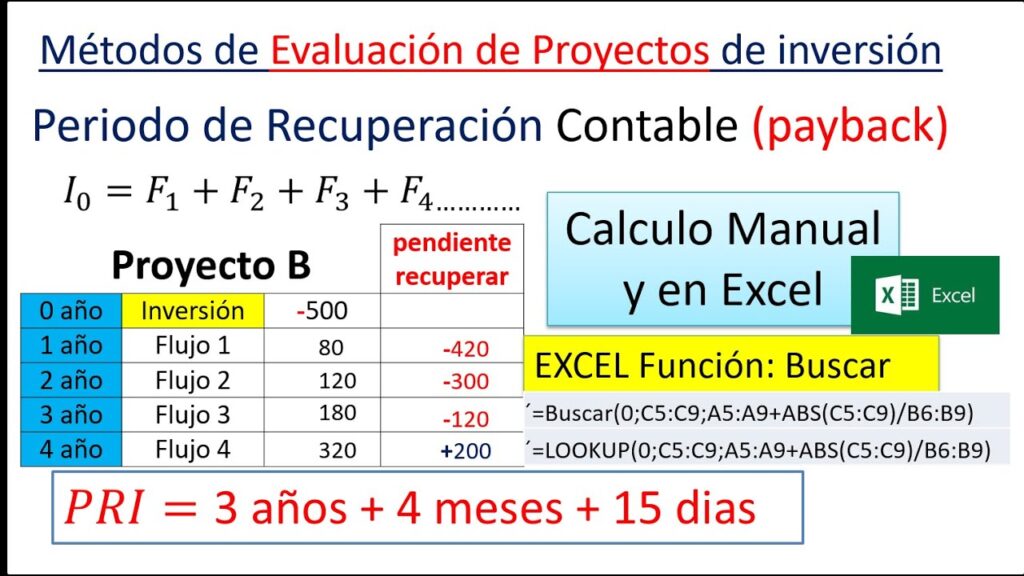

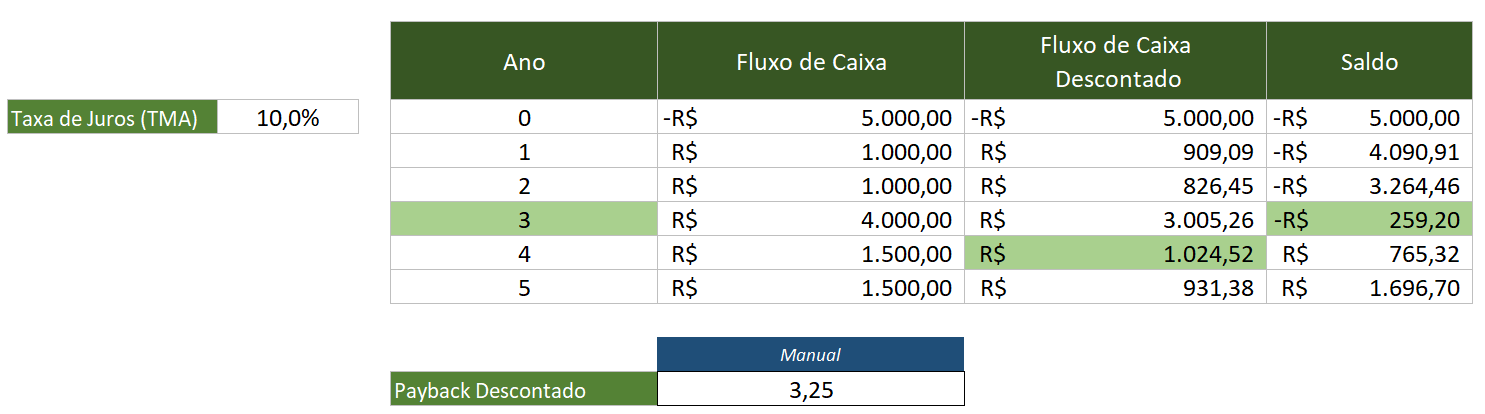

- Use the Discounted Payback Period if you want to factor in the time value of money.

- Combine with other metrics like Net Present Value (NPV) or Internal Rate of Return (IRR) for a more comprehensive analysis.

- Incorporate a break-even chart to visually represent when the investment breaks even.

In summing up, calculating the payback period in Excel is a straightforward process once you grasp the basics. By setting up your Excel sheet correctly and employing the right formulas, you can quickly determine how long it will take for your investment to become financially viable. This method isn’t without flaws, as it does not account for the time value of money or post-payback returns. Nevertheless, for initial assessments, it’s an effective tool to gauge investment risk and liquidity needs. If you delve deeper into financial analysis, consider using more advanced metrics in conjunction with the payback period for a thorough evaluation.

How do I account for uneven cash flows?

+

If your cash flows are not consistent annually, you can use the same formula structure but adjust for the year when the cumulative cash flow turns positive. The formula might become more complex as you’ll need to interpolate between periods.

Can I calculate discounted payback in Excel?

+

Yes, you can apply a discount rate to your cash flows using the NPV function or manually calculate discounted cash flows before computing the payback period. This gives you the discounted payback period, which accounts for the time value of money.

What if my investment has a variable or residual value at the end?

+

Incorporate the residual value into your cash flows in the year it’s realized. This will reduce your effective initial investment or increase the cash flow for that year, affecting the payback calculation.

How do I handle negative cash flows in the analysis?

+

If your project has negative cash flows after initial investment, you might need to calculate the payback period using a cumulative approach, considering the full cash flow cycle. Negative cash flows post-investment must be subtracted from positive cash flows to determine the net effect.