5 Simple Steps to Calculate Sharpe Ratio in Excel

The Sharpe Ratio is a widely used tool among investors to measure the performance of an investment compared to a risk-free asset, after adjusting for its risk. Calculating this ratio in Excel is straightforward once you understand the components involved. Here are five simple steps to compute the Sharpe Ratio for any investment portfolio using Excel.

Step 1: Gather the Necessary Data

Before you can calculate the Sharpe Ratio, you need to collect specific data:

- Average Return of the Investment: This is typically the mean of the returns over a specific period.

- Risk-Free Rate: The return of an investment with zero risk, often represented by government bond yields.

- Standard Deviation of the Investment: A measure of the investment’s volatility or risk.

Step 2: Calculate the Average Return

To get the average return:

- Enter your investment’s periodic returns into a column in Excel.

- Use the AVERAGE function:

=AVERAGE(B2:B100), assuming your returns are in cells B2 to B100. - Place this formula in an empty cell to calculate the average return.

Step 3: Determine the Risk-Free Rate

Find the current risk-free rate:

- Enter this rate in a separate cell, or if it’s a fixed rate, you can simply use it in your calculations.

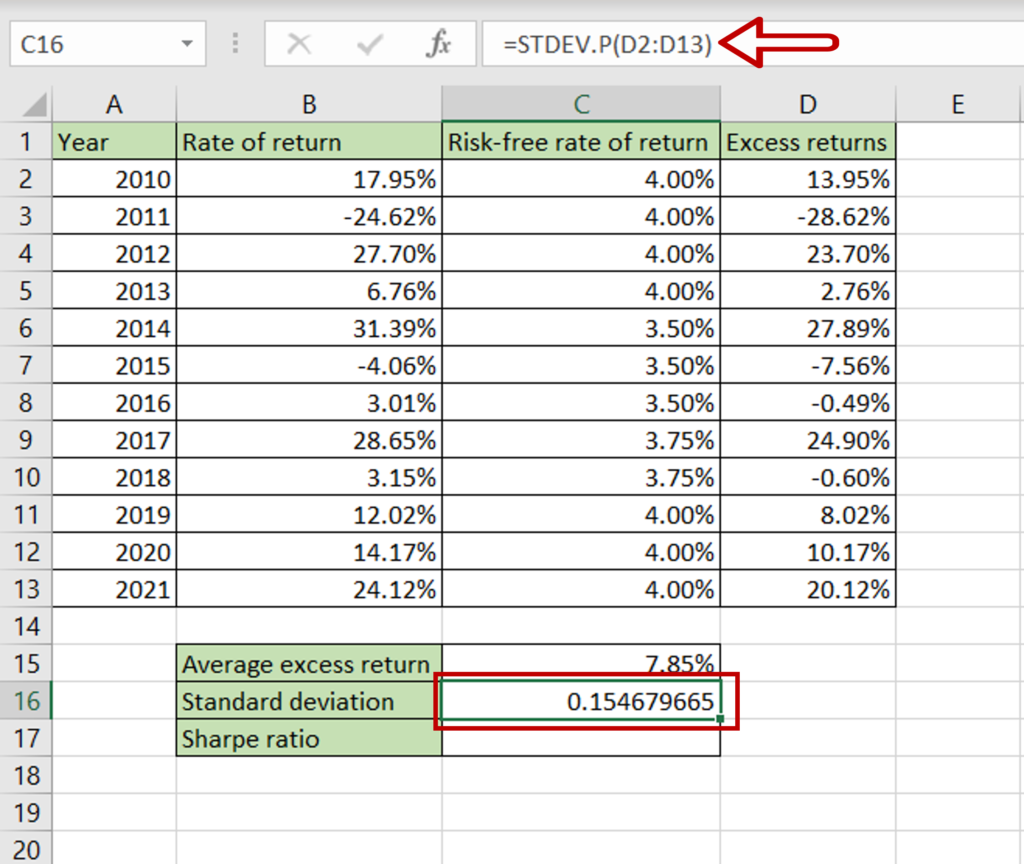

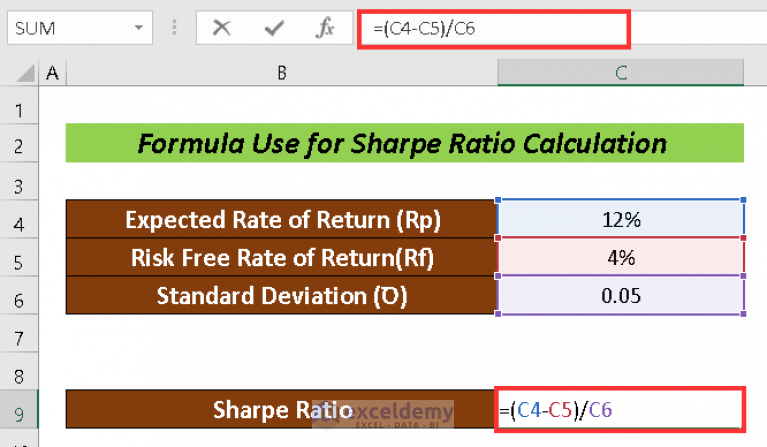

Step 4: Compute the Standard Deviation

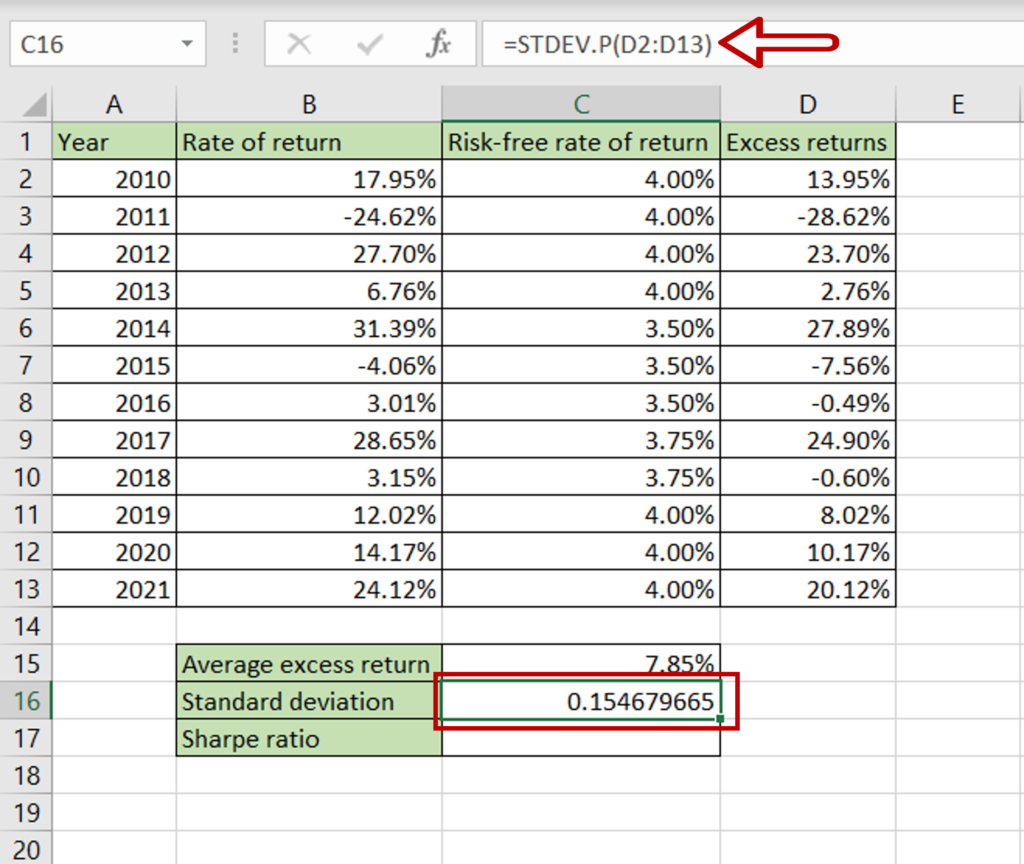

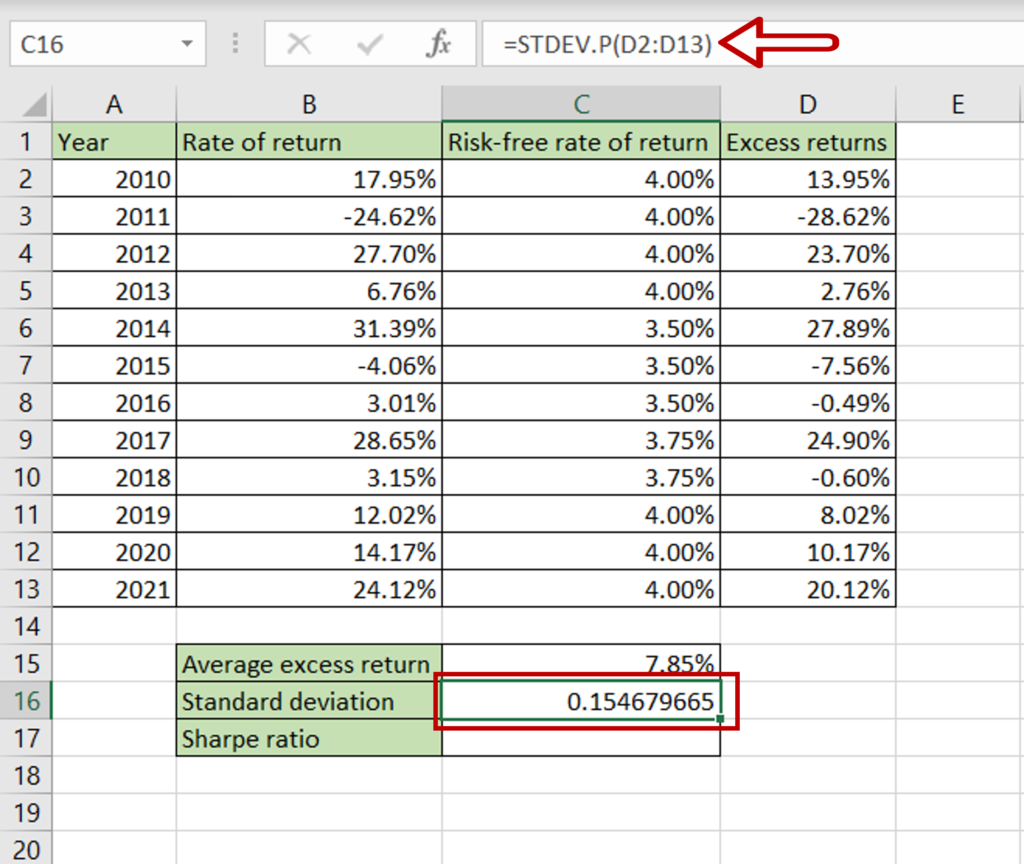

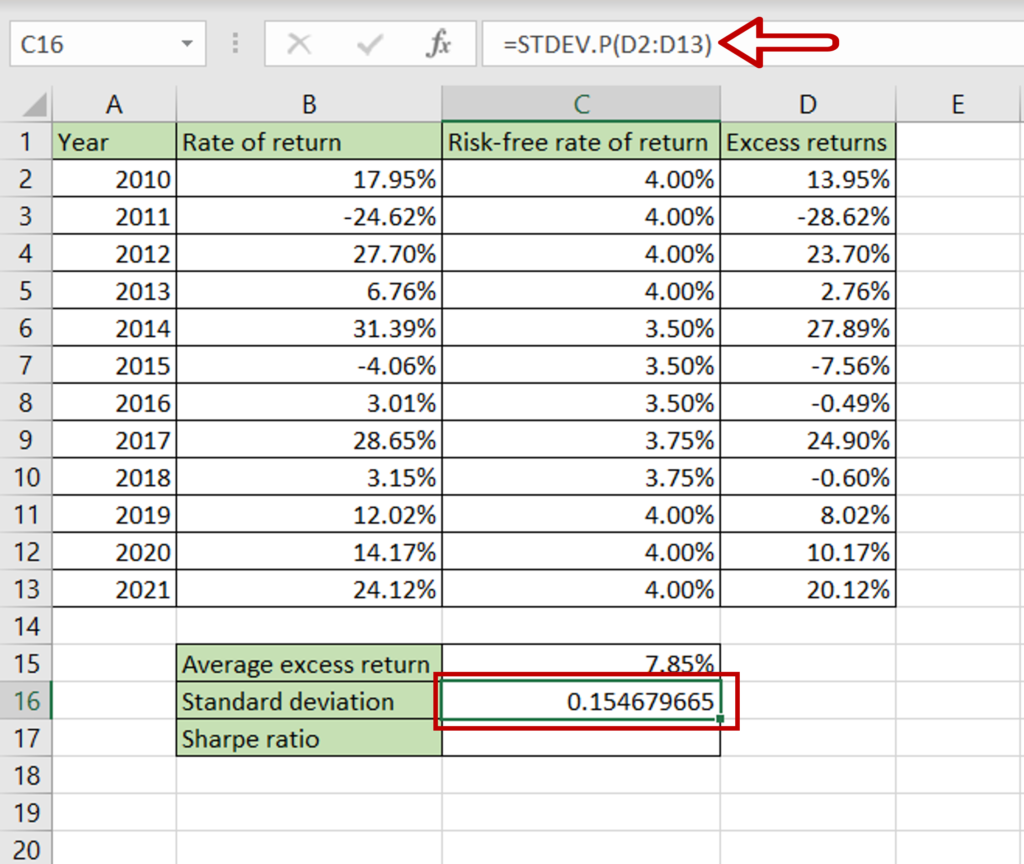

Standard deviation reflects the amount of variability or dispersion around the average:

- Select the same column where you’ve entered your returns.

- Apply the STDEV.P function for population standard deviation:

=STDEV.P(B2:B100). - Enter this into another cell to display the standard deviation.

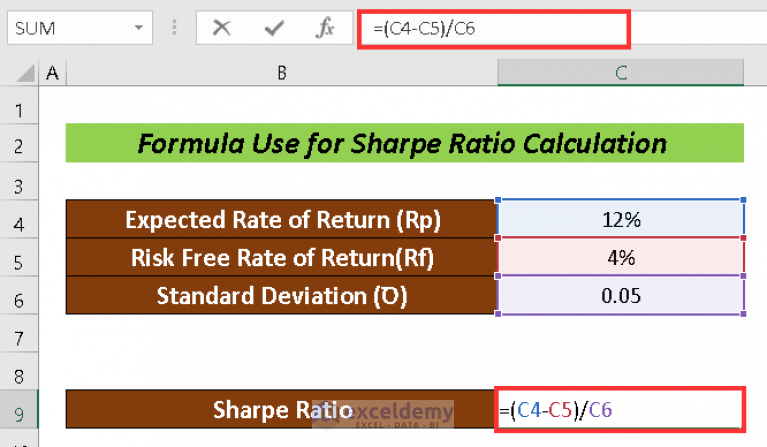

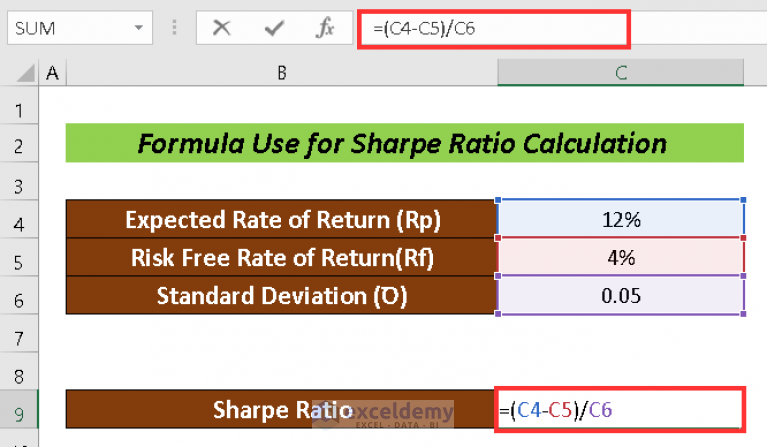

Step 5: Calculate the Sharpe Ratio

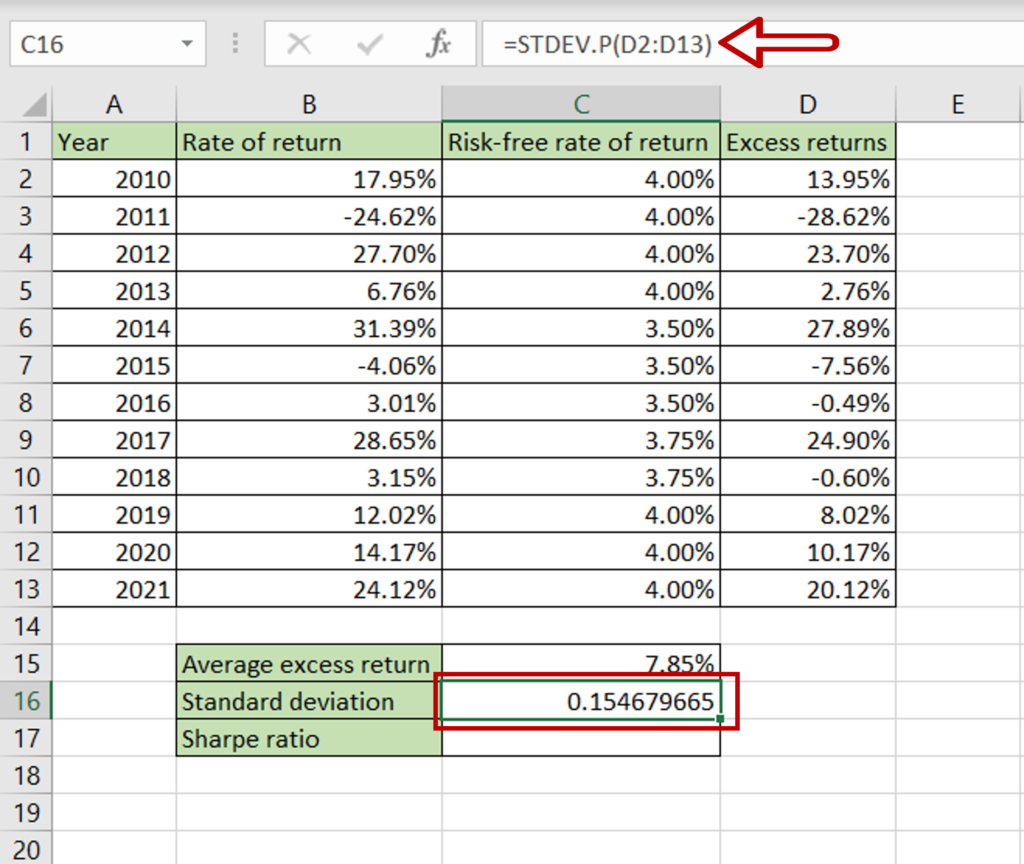

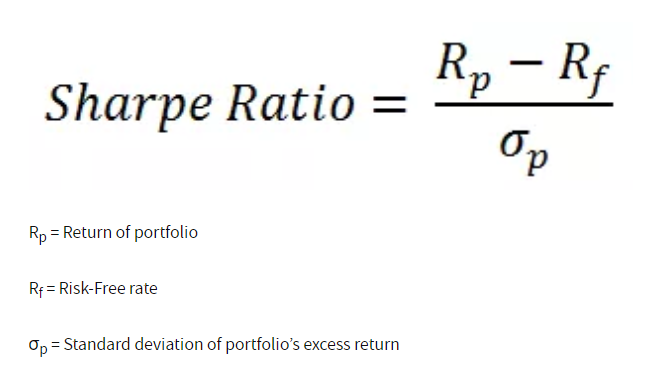

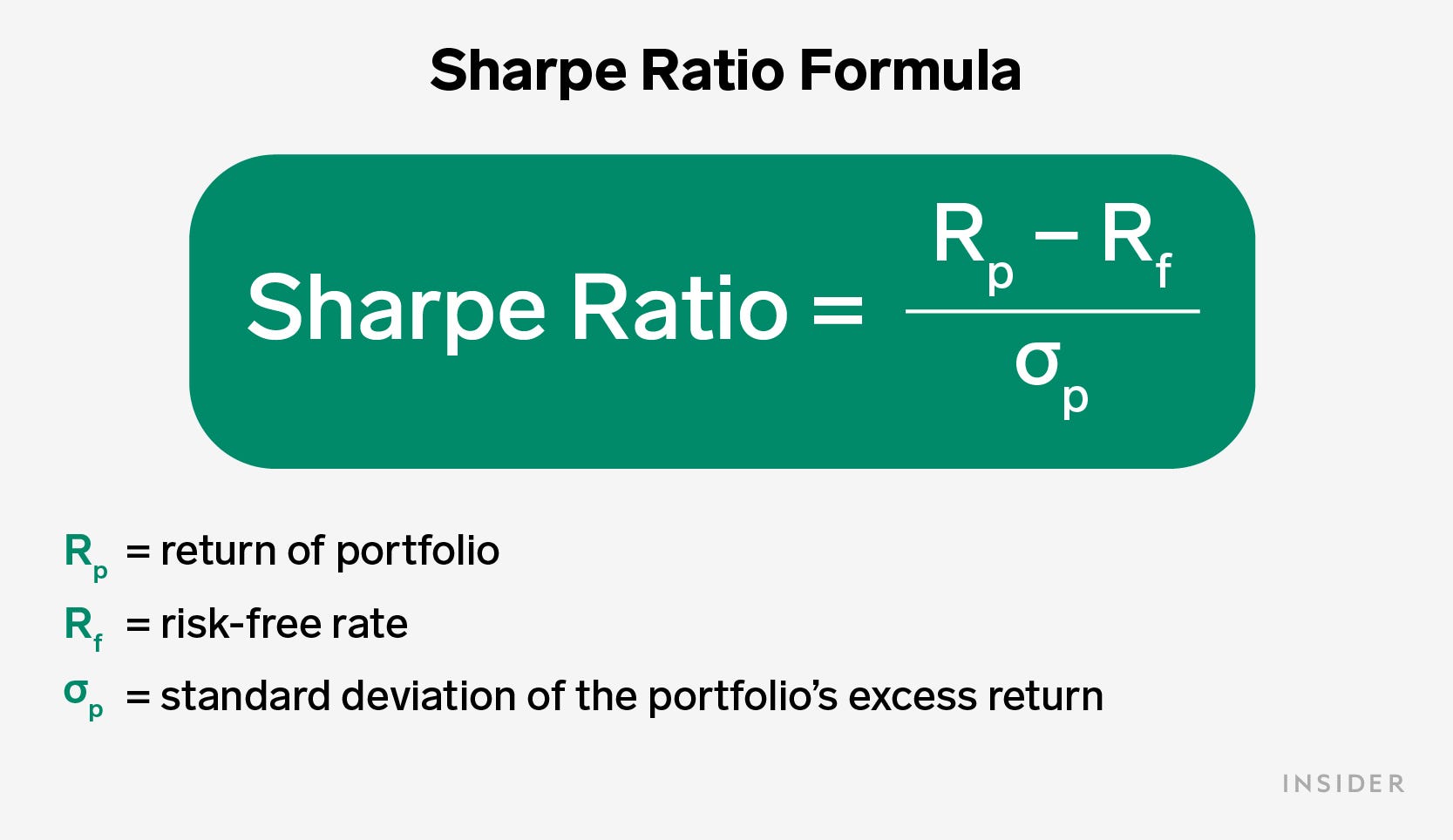

With all components ready, the formula for the Sharpe Ratio is:

Sharpe Ratio = (Average Return - Risk-Free Rate) / Standard Deviation

Follow these steps to calculate:

- Subtract the risk-free rate from the average return. This difference represents the risk-adjusted return.

- Divide this result by the standard deviation to normalize the risk-adjusted return by the volatility of the investment.

- The formula in Excel might look like this:

=(C2-D2)/E2, where C2 is the average return, D2 is the risk-free rate, and E2 is the standard deviation.

📌 Note: Ensure the data for returns are consistent (e.g., all annualized) and align with the time period of your risk-free rate to avoid discrepancies in the calculation.

Understanding the Sharpe Ratio allows investors to make more informed decisions by comparing the risk-adjusted performance of different investments. It's an excellent metric for evaluating the efficiency of adding risk to a portfolio to achieve higher returns.

With these steps, you now have a practical method to measure and compare the performance of your investments against their inherent risks. Remember, a higher Sharpe Ratio indicates a more attractive risk-adjusted return.

What does a negative Sharpe Ratio imply?

+

A negative Sharpe Ratio suggests that the investment has performed worse than the risk-free rate after accounting for its risk, indicating an unfavorable risk-return profile.

Can the Sharpe Ratio be used for any investment?

+

Yes, the Sharpe Ratio can be applied to any investment or portfolio with measurable returns and volatility, although it’s most effective for diversified portfolios.

What’s a good Sharpe Ratio value?

+

While a good Sharpe Ratio varies by context, generally, a ratio of 1 or higher is considered excellent, indicating that the investment returns are adequately compensating for the risk taken.

How does the choice of risk-free rate impact the Sharpe Ratio?

+

Using a higher risk-free rate will decrease the Sharpe Ratio, whereas a lower risk-free rate will increase it. The choice of rate should align with the investment horizon.

What are the limitations of the Sharpe Ratio?

+

The Sharpe Ratio has limitations, such as assuming returns are normally distributed and not accounting for the potential for significant losses (left tail risk).