Mastering Payback Period Calculation in Excel Simply

When it comes to investment decisions, understanding the payback period is crucial for businesses and investors alike. This financial metric helps determine how long it will take to recover the initial investment in a project or investment. Excel, with its powerful calculation capabilities, serves as an excellent tool for calculating the payback period. In this detailed guide, we'll delve into the intricacies of the payback period calculation, offering step-by-step guidance to master this technique in Excel.

Understanding the Payback Period

The payback period is the time it takes for an investment to generate enough cash flow to cover its initial cost. While not the most comprehensive measure of profitability, it provides a quick gauge of investment liquidity and risk, which can be particularly useful for small businesses or projects where cash flow is critical.

Why Calculate the Payback Period?

- Assess Investment Risk: A shorter payback period typically indicates lower risk.

- Liquidity Insight: Knowing when investments start returning cash can aid in better financial planning.

- Decision Making: It helps in comparing different investment options swiftly.

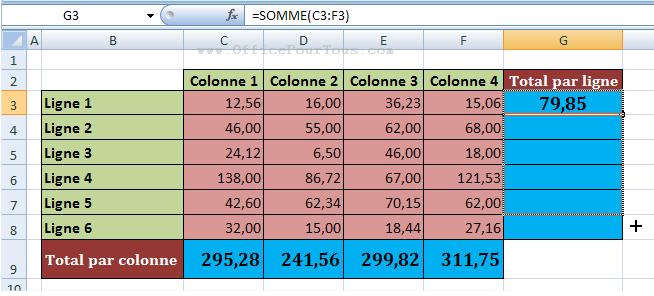

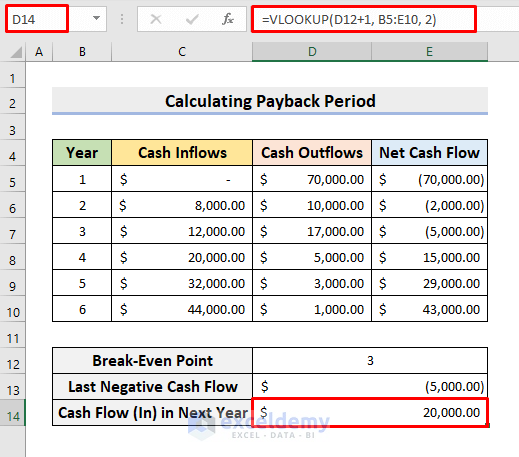

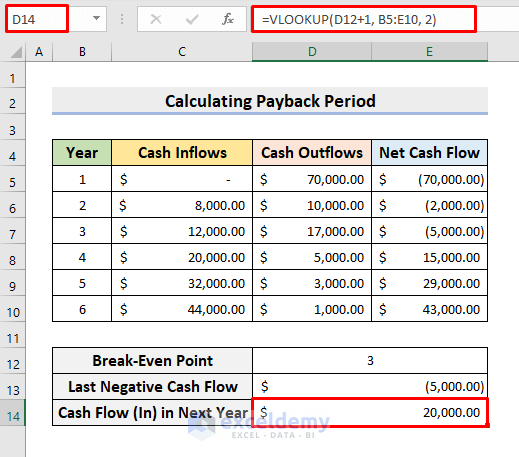

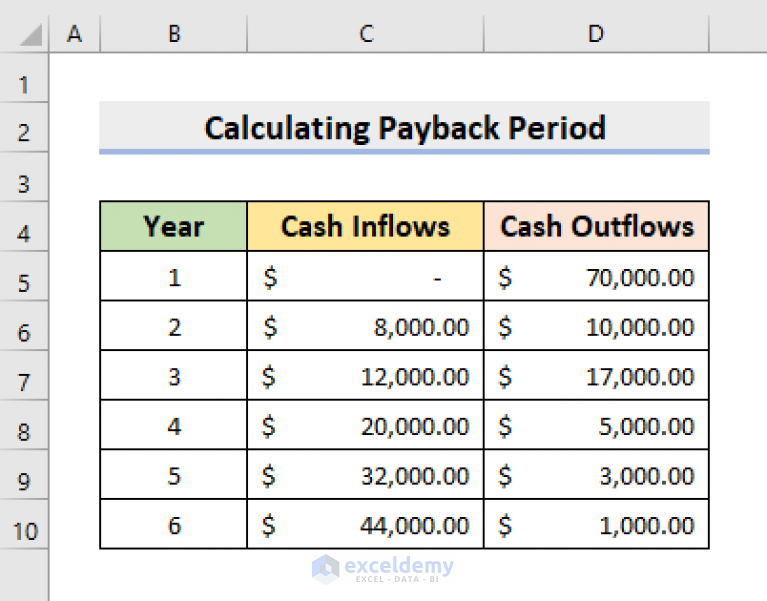

Setting Up Excel for Payback Period Calculation

To calculate the payback period in Excel, you need to set up a simple spreadsheet. Here’s how you can do it:

- Open a new Excel workbook.

- Create headers for columns: 'Year', 'Cash Flow', 'Cumulative Cash Flow'.

- Enter the years in which the cash flows are expected to occur in the 'Year' column.

- In the 'Cash Flow' column, list the expected cash inflows and outflows. (Note: Negative values indicate outflows).

- Calculate cumulative cash flow by summing each period's cash flow to the previous total. Use this formula in the 'Cumulative Cash Flow' column: =B2 (for the first year) and for subsequent years use =C2+B3, where B2 and B3 are the cash flows for year 1 and year 2 respectively.

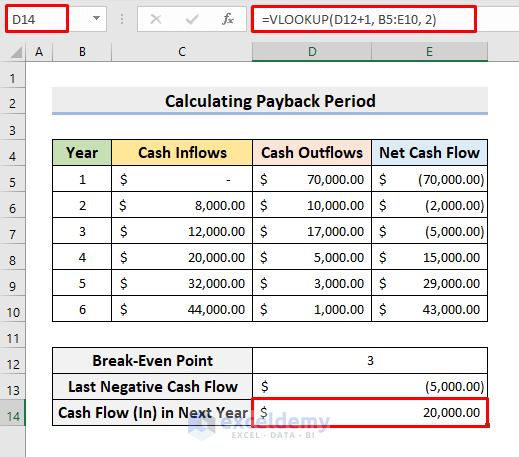

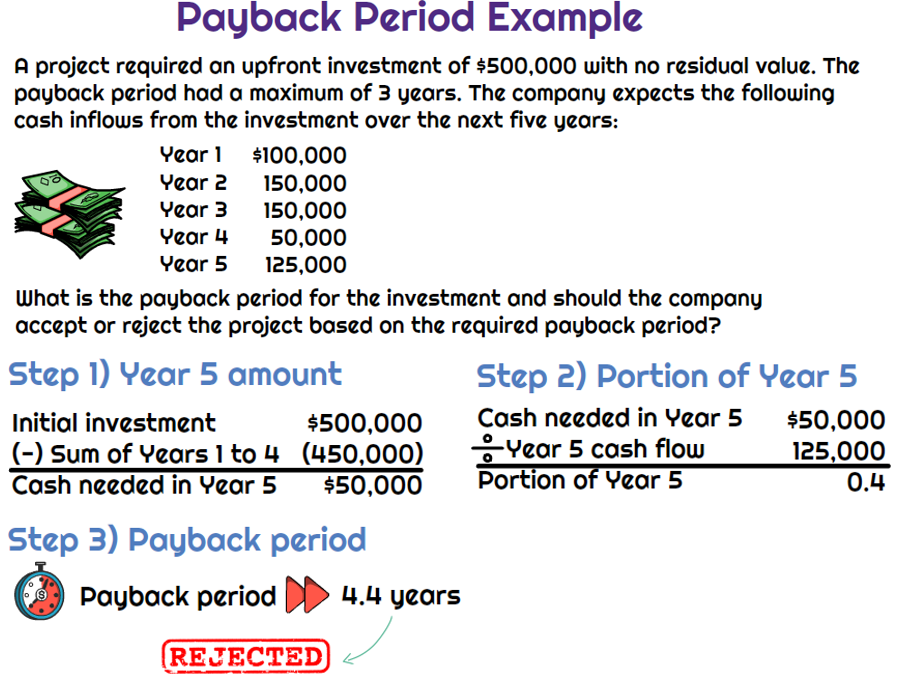

Basic Payback Period Calculation

Here’s how to calculate the basic payback period:

- Identify the year when the cumulative cash flow becomes positive for the first time.

- If the cumulative cash flow turns positive within a year, interpolate between the last negative cash flow year and the first positive year:

= (Initial Investment / (Cumulative Cash Flow at Positive Year - Last Negative Year's Cumulative Cash Flow)) * Year Length

📝 Note: This formula assumes cash flows occur at the end of each year. For quarterly or monthly cash flows, adjust the year length accordingly.

Advanced Calculation with Non-Uniform Cash Flows

For projects with variable cash flows:

- Extend your Excel table with additional columns for period length (e.g., quarterly, monthly).

- Use the formula below in the cell right after the last negative cumulative cash flow:

= (Initial Investment - ABS(Cumulative Cash Flow of Previous Period)) / Cash Flow of Current Period

This formula finds the fraction of the period after which the initial investment is paid back. Add this fraction to the previous periods to get the total payback period.

| Year | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | -10000 | -10000 |

| 2 | 2500 | -7500 |

| 3 | 5000 | -2500 |

| 4 | 3500 | 1000 |

📝 Note: Interpolation will help find the exact point within year 4 when the payback occurs.

Summary and Next Steps

In this comprehensive guide, we’ve covered how to calculate the payback period in Excel. Here’s a quick recap:

- Understanding the concept and importance of the payback period.

- Setting up a basic Excel worksheet for calculations.

- Calculating the basic payback period.

- Handling more complex cash flow scenarios.

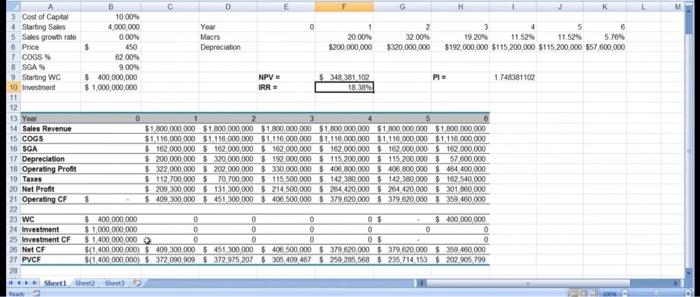

With these steps, you are now equipped to assess the payback periods of various investment options, helping in making informed decisions. Remember to:

- Regularly update your cash flow projections.

- Consider the time value of money for long-term investments.

- Use the payback period in conjunction with other metrics like NPV (Net Present Value) for a holistic view.

Why isn’t the payback period the only investment decision metric?

+

The payback period provides insight into how quickly an investment returns its cost, but it doesn’t account for the time value of money or future cash flows beyond the payback point. Therefore, it should be used alongside other metrics like NPV, IRR, and ROI for a comprehensive analysis.

How do I deal with negative cash flows after the payback period?

+

If a project generates negative cash flows after the payback period, it suggests potential issues. You’ll need to reassess the project’s overall viability, perhaps considering additional metrics like NPV or IRR to understand the long-term profitability and risk.

Can the payback period method handle variable cash flows?

+

Yes, the method can be adapted to account for variable cash flows. Use Excel’s interpolation formula for each period where cash flows change significantly to approximate when the initial investment is recovered.