Effortlessly Find Beta on Excel with These Simple Steps

How to Calculate Beta in Excel

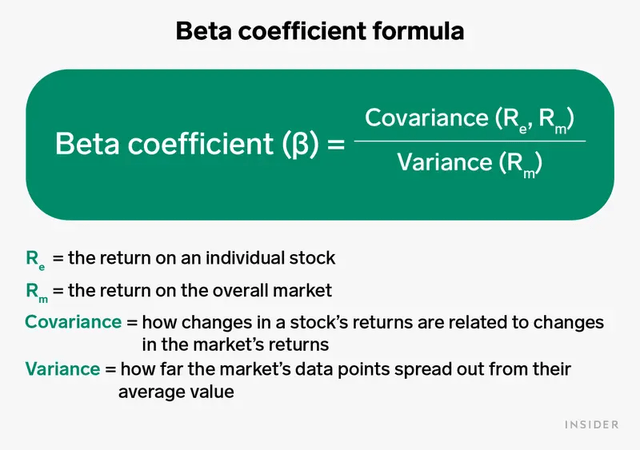

Calculating the beta of a stock or portfolio is crucial for investors and analysts who seek to understand the risk associated with their investments relative to the market. Beta measures the volatility, or systematic risk, of an asset in comparison to the market as a whole. In this guide, we will explore how to effortlessly find the beta using Microsoft Excel, one of the most popular tools for financial analysis.

Step-by-Step Guide to Finding Beta in Excel

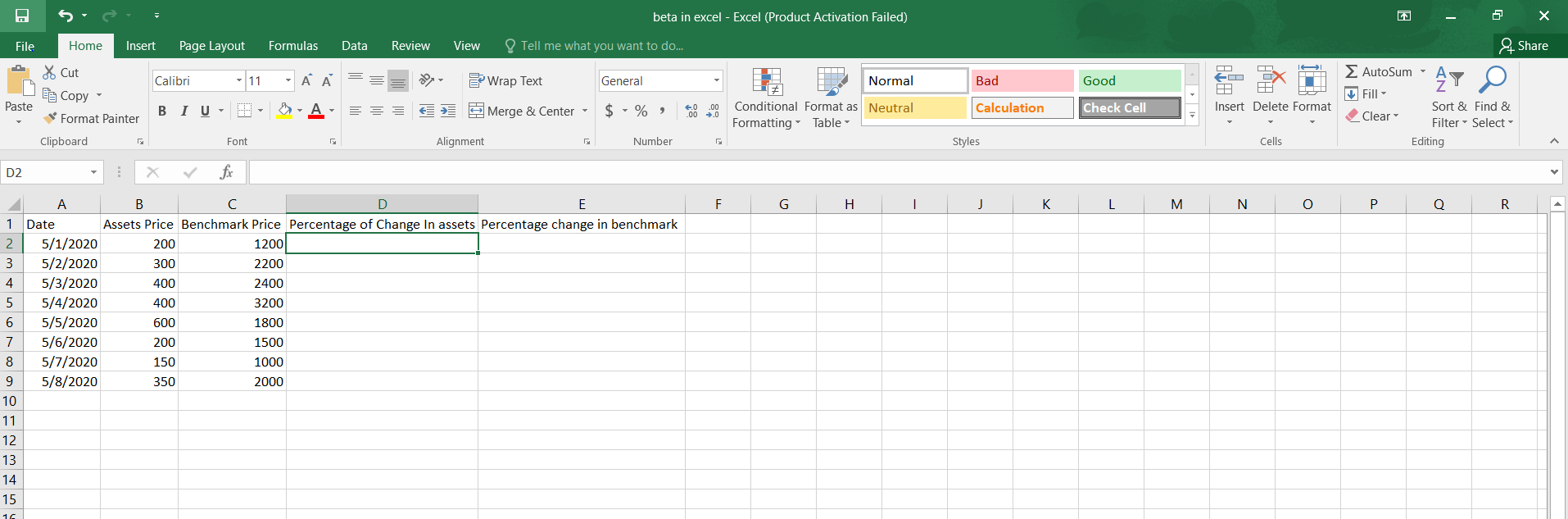

Collecting Data

- Stock Data: Gather daily or monthly closing prices of the stock or portfolio whose beta you want to calculate.

- Market Data: Obtain the same data for a benchmark index like the S&P 500, which will represent the market’s performance.

Once you have this data, you can proceed with the following steps:

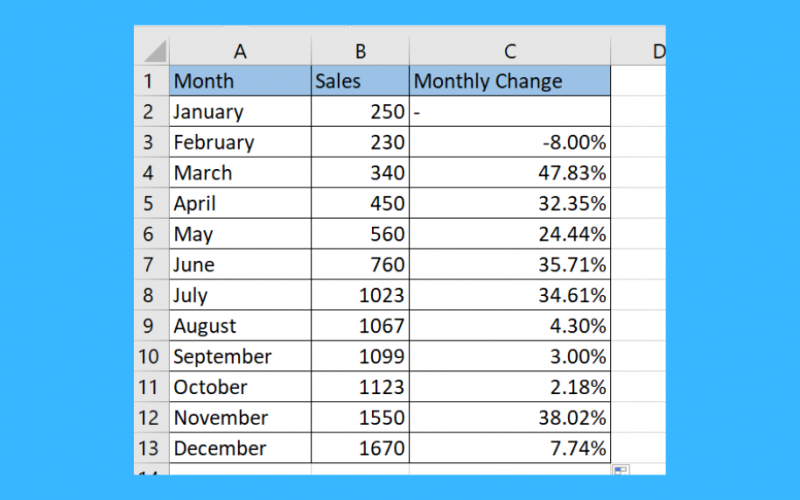

1. Calculate Returns

The next step is to calculate the daily or monthly returns for both the stock and the market index. Here’s how:

- In a new column, calculate the percentage change in stock prices:

=LN(A2/A1)

=LN(B2/B1)

Where A1, A2 represent your stock’s previous and current prices, and B1, B2 represent the market’s previous and current index values, respectively.

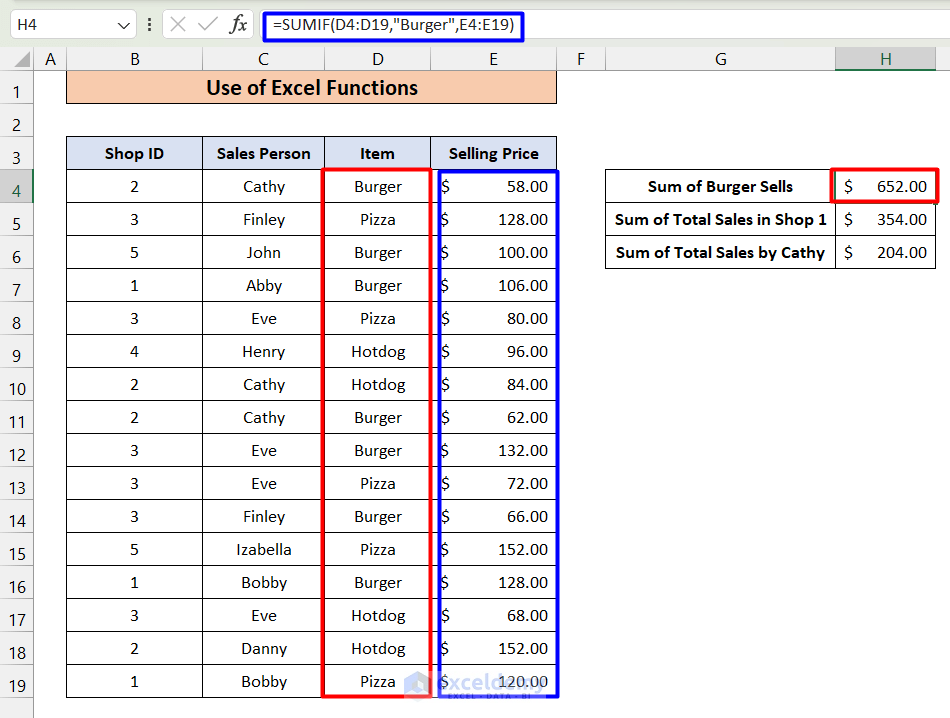

2. Perform a Regression Analysis

To calculate beta, you need to perform a regression analysis. Excel’s DATA ANALYSIS tool can be used for this purpose:

- Go to the Data tab.

- Click on Data Analysis and select Regression.

- Set up your regression:

- Y-Range: Select the column with your stock’s returns.

- X-Range: Select the column with the market’s returns.

- Ensure Labels is checked if your ranges include headers.

- Check Residuals for additional analysis if needed.

- Click OK to generate the output.

The beta will appear in the output table under Coefficients for the X Variable 1, which represents the market index.

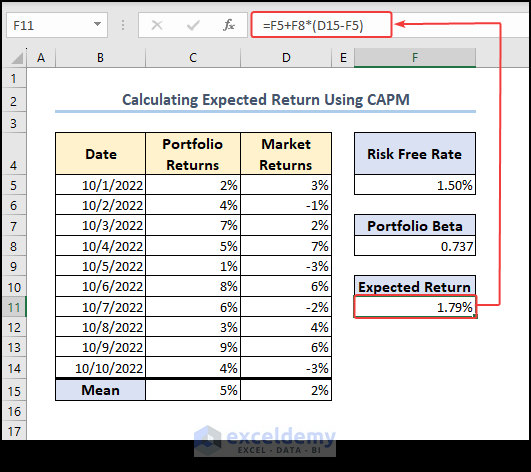

3. Interpret Your Results

The beta value will indicate:

- Beta < 1: The stock is less volatile than the market.

- Beta = 1: The stock’s volatility matches the market’s.

- Beta > 1: The stock is more volatile than the market.

Important Notes:

💡 Note: Ensure that your data for both the stock and the market cover the same period, with the same frequency of updates (daily or monthly).

Calculating beta using Excel not only provides a measure of risk but also gives insights into how your investment performs relative to the market. This information is invaluable when constructing a diversified portfolio or assessing investment risk. By following these steps, you can harness the power of Excel to make informed investment decisions based on empirical data.

Key Takeaways:

- Excel simplifies beta calculation with its regression tool.

- Accurate and reliable data collection is crucial for valid results.

- Interpretation of beta gives insights into stock volatility relative to the market.

Remember, while beta provides a snapshot of risk, it should be one of many tools in your financial analysis toolkit. Keep in mind the limitations of historical data and market changes when making investment decisions.

What does a negative beta indicate?

+

A negative beta indicates that the stock moves in the opposite direction of the market. This can sometimes be due to sector-specific factors or unique business risks.

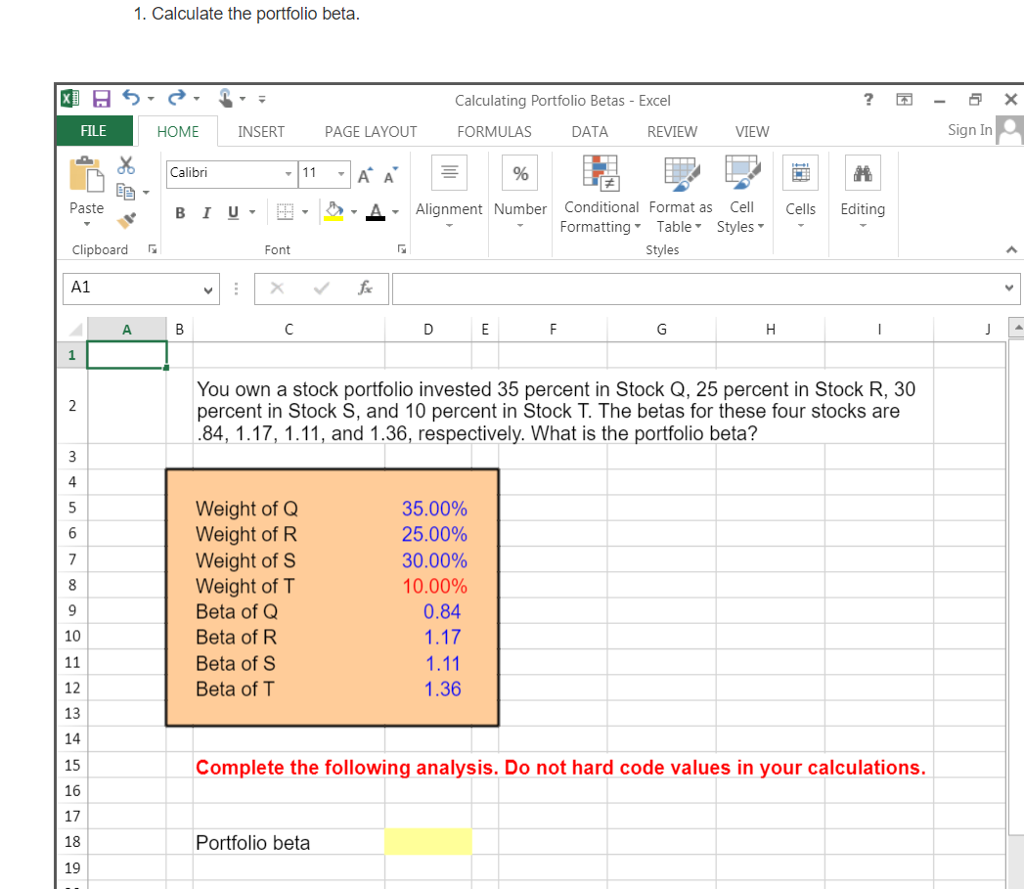

Can I calculate beta for a portfolio using this method?

+

Yes, you can calculate the beta for a portfolio. You would need to gather the returns of all the stocks in your portfolio and then use these in conjunction with market returns to compute an overall portfolio beta.

How frequently should I update my beta calculations?

+

Updating your beta calculations at least quarterly, or more frequently if there are significant market changes, can help keep your risk assessment current.