5 Simple Ways to Calculate APR in Excel

When dealing with financial management or investment decisions, understanding Annual Percentage Rate (APR) is crucial. It helps borrowers and investors compare different loan offers or investment opportunities on a like-for-like basis. Calculating APR can be simplified with tools like Microsoft Excel, providing an easy way to make these important financial decisions. Here, we'll explore five simple methods to calculate APR using Excel, helping you navigate through the complexities of financial data with ease.

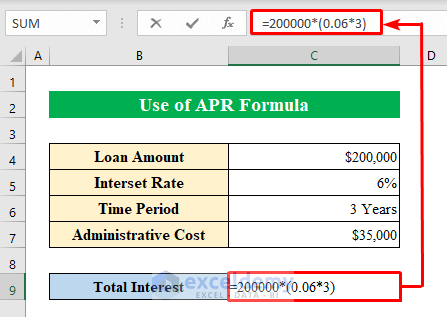

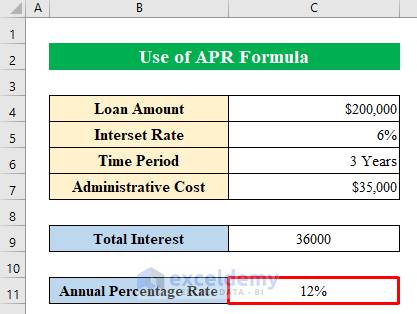

The Basic Formula for APR

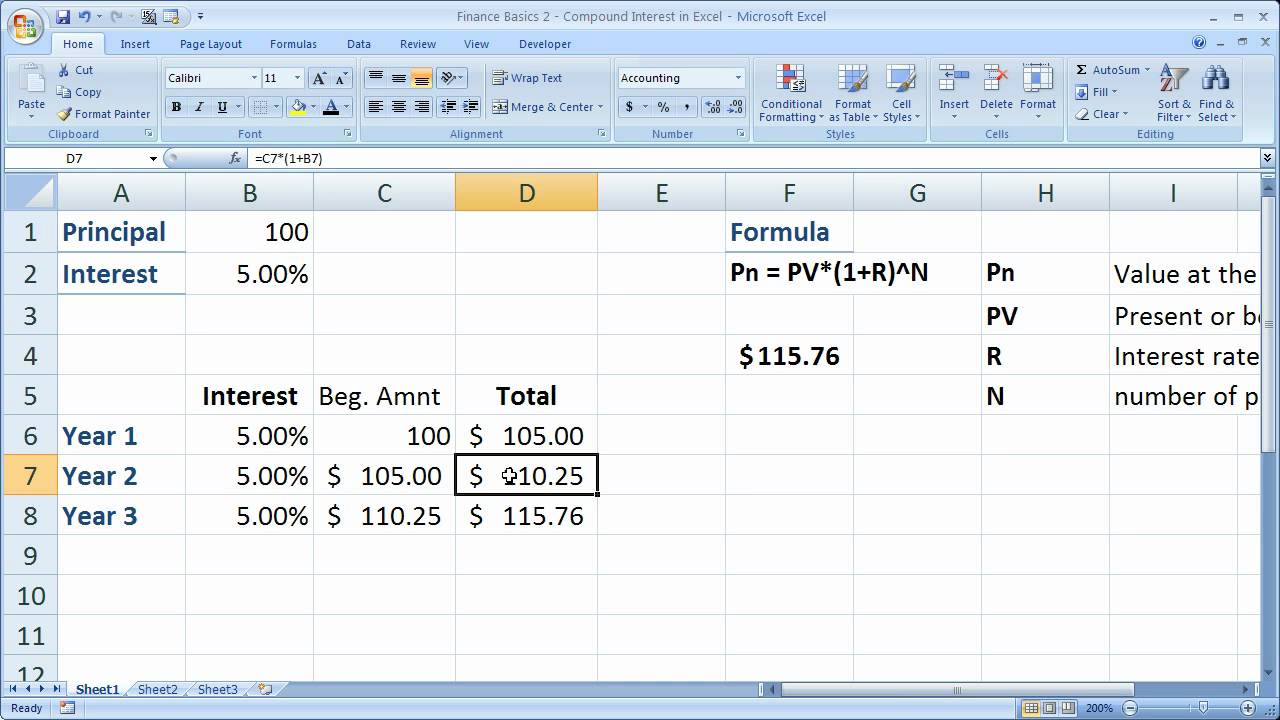

To kick things off, let’s dive into the basic formula for calculating APR in Excel.

- The general formula is: APR = (Interest + Fees) / Principal x (365 / Term in Days) x 100

- This formula accounts for interest rates, additional fees, and the compounding effects over time.

💡 Note: Ensure your cell references in Excel correspond to where you’ve placed your data.

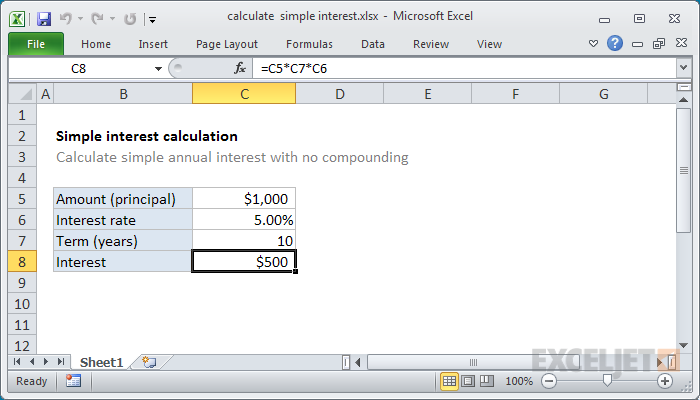

Using Excel’s Formulas

To calculate APR in Excel using this formula:

- Set up your spreadsheet with columns for principal, interest, fees, and term in days.

- Use the formula mentioned above to calculate the APR.

- You can also use Excel’s FV or PV functions if you have periodic payments.

| Loan | Principal | Interest | Fees | Term (Days) | APR (%) |

|---|---|---|---|---|---|

| Loan A | 10,000</td> <td>1,000 | $200 | 365 | =((B2+C2+D2)/B2)*365/E2 |

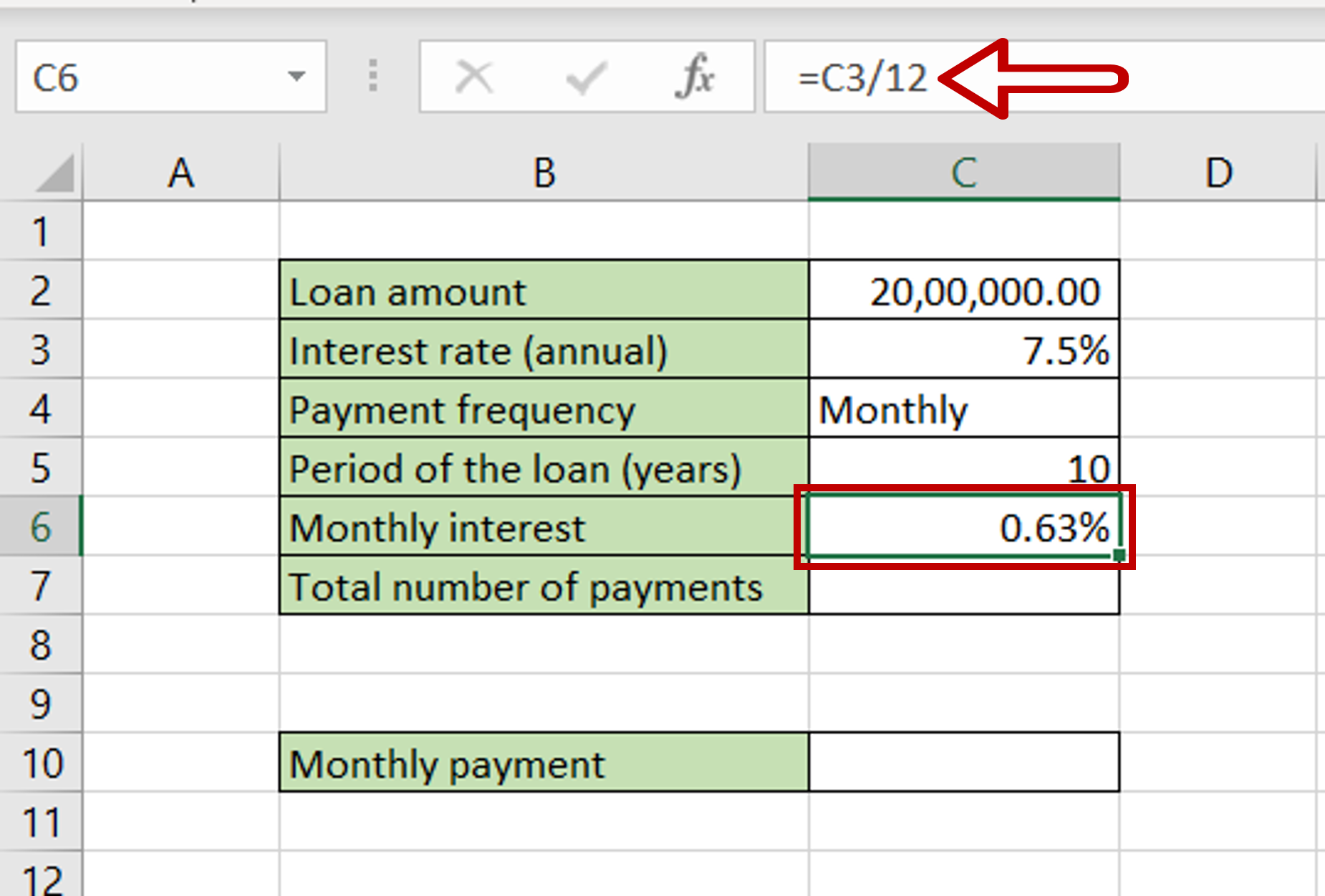

Method 1: Using Excel’s RATE Function

If you’re dealing with regular payments and you want a straightforward approach, Excel’s RATE function is your ally.

- Set up your data with the number of periods, payment per period, present value (loan amount), and future value.

- Use the RATE function like this: =RATE(nper, pmt, pv, [fv])

- Multiply the result by 100 to get the percentage.

Here’s a simple example:

=RATE(12, -100, 10000, 0)*12*100

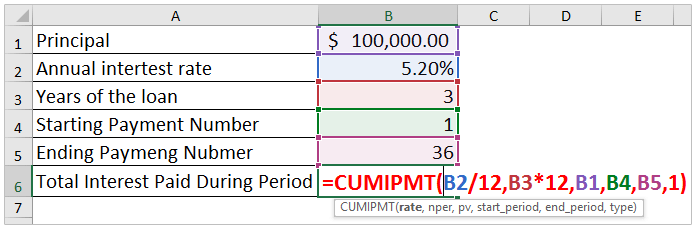

Method 2: The EFFECT Function

The EFFECT function helps you calculate the effective annual rate when compounding occurs more than once per year.

- To use EFFECT, you need to know the nominal annual rate and the number of compounding periods per year.

- The formula would be: =EFFECT(nominal_rate, npery) - 1

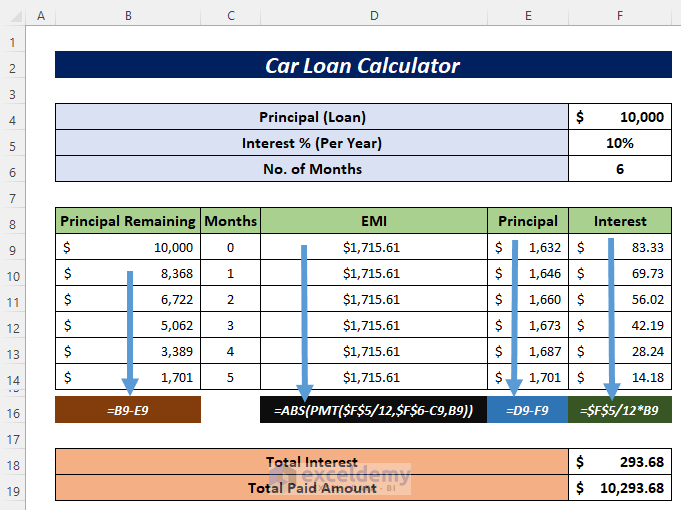

Method 3: Excel Goal Seek

If you know your payments but want to determine the APR, you can use Excel’s Goal Seek feature.

- Set up your loan amortization schedule in Excel.

- Use Goal Seek to adjust the interest rate until the present value of payments equals the loan amount.

This method doesn’t involve a specific formula but uses Excel’s tools to find the answer through iteration.

Method 4: Cash Flow Analysis

For complex loans with multiple payments or variable rates, use Excel’s cash flow functions:

- Set up cash flow periods and payments.

- Use the NPV or IRR function to calculate the interest rate that makes the Net Present Value equal to zero.

- IRR finds the interest rate when cash flows occur at regular intervals.

This method allows for a more detailed and dynamic APR calculation.

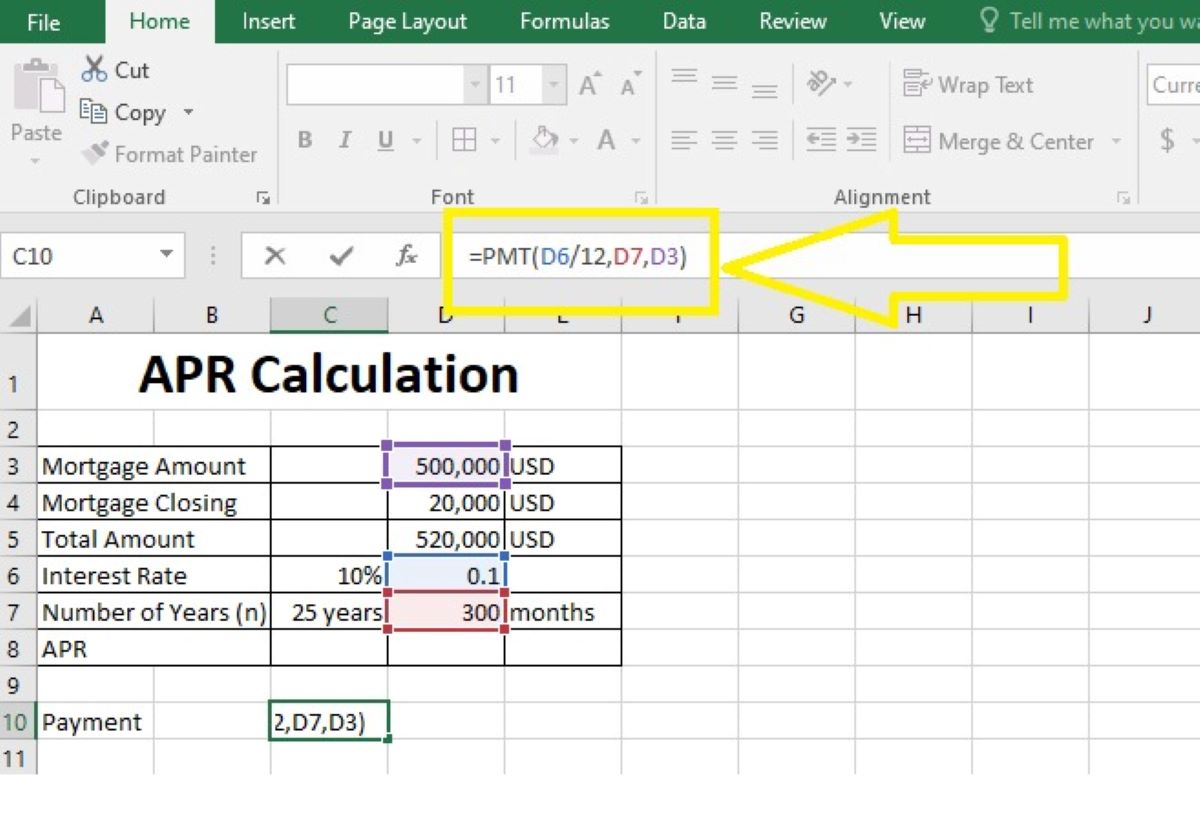

Method 5: Using the PV Function

The PV function in Excel can help you back-solve to find the APR:

- Set up your loan data with known values.

- Use the PV function to find the present value of payments, and adjust the rate until it matches the principal.

=PV(rate, nper, pmt, [fv])

Here, rate would be your guessed APR, nper is the number of periods, pmt is the regular payment, and fv is the future value (0 if there is no residual value).

Final Thoughts

Calculating APR in Excel can range from simple to complex depending on the loan structure or investment scenario. By using these five methods, you can effectively compare financial products, ensuring you’re making informed decisions. Whether you’re dealing with fixed payments or variable rates, Excel’s powerful functions like RATE, EFFECT, NPV, and IRR, along with tools like Goal Seek, equip you with the tools to calculate APR with precision. Remember, understanding your loan’s or investment’s APR is key to evaluating its cost or return over time.

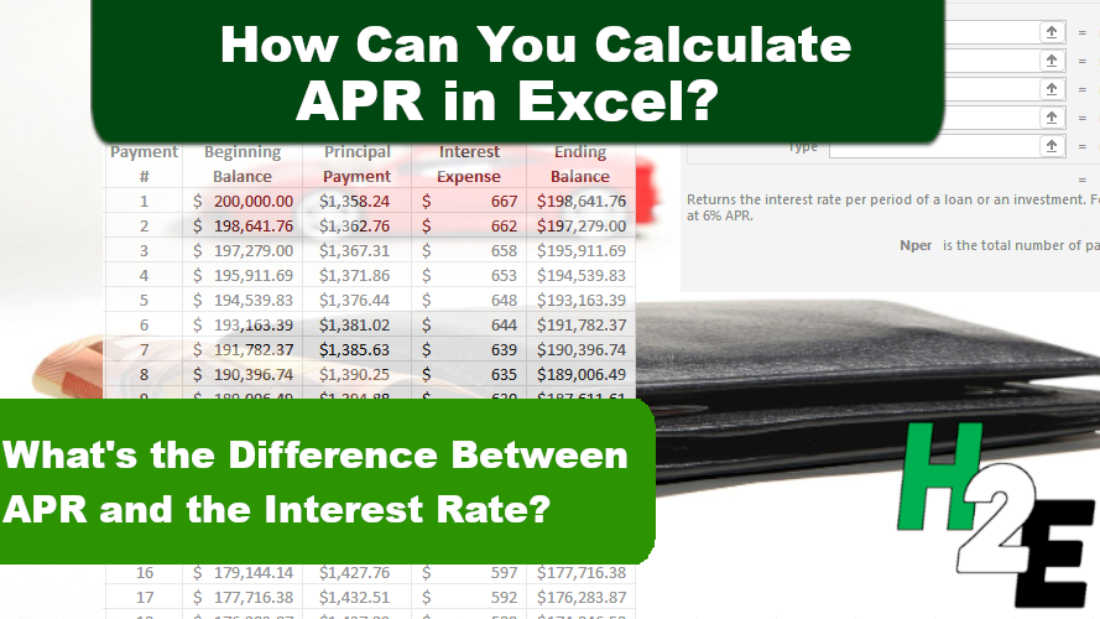

What is the difference between APR and APY?

+

APR (Annual Percentage Rate) accounts for interest and fees charged on a loan but does not consider compound interest. APY (Annual Percentage Yield), on the other hand, takes into account the effects of compounding, giving you a better estimate of the real cost of borrowing or the actual return on an investment.

Why is it important to calculate APR?

+

Calculating APR helps you compare different financial products on a standardized basis. It reveals the total cost of a loan or the effective return on an investment, enabling better financial decision-making.

Can APR change over the life of a loan?

+

Yes, for variable rate loans, the APR can change based on market conditions or the terms of the loan. Fixed rate loans, however, will have the same APR throughout their term.